Volume Analysis Flash Update – 12.15.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Divergent Orders at the Front

The market spent much of the week in a holding pattern, awaiting direction from the Federal Reserve. With the Christmas backdrop encouraging a temporary stand down, price action appeared orderly on the surface. Beneath that calm, however, the flanks clearly received different marching orders.

For the week, Capital Weighted Volume leaned defensively, with roughly 65% of activity to the downside. Weekly upside volume was exceptionally light, running nearly 40% below normal, while weekly downside volume finished above average. Meanwhile, 5/8th of the weekly Capital Flows were outflows on average weekly Capital Weighted $ Volume flows. These imbalances may suggest selling pressure was deliberate rather than indiscriminate.

Thursday delivered one of the more revealing sessions of the week. The S&P 500 advanced and briefly pushed above 6900, yet over 85% of Capital Weighted Volume was to the downside on light total volume. That price and volume divergence quickly resolved. On Friday, the S&P 500 fell -1.07% on average volume, with 77% of the day’s activity weighted to the downside. Despite the pressure, the index managed to hold 6800 support.

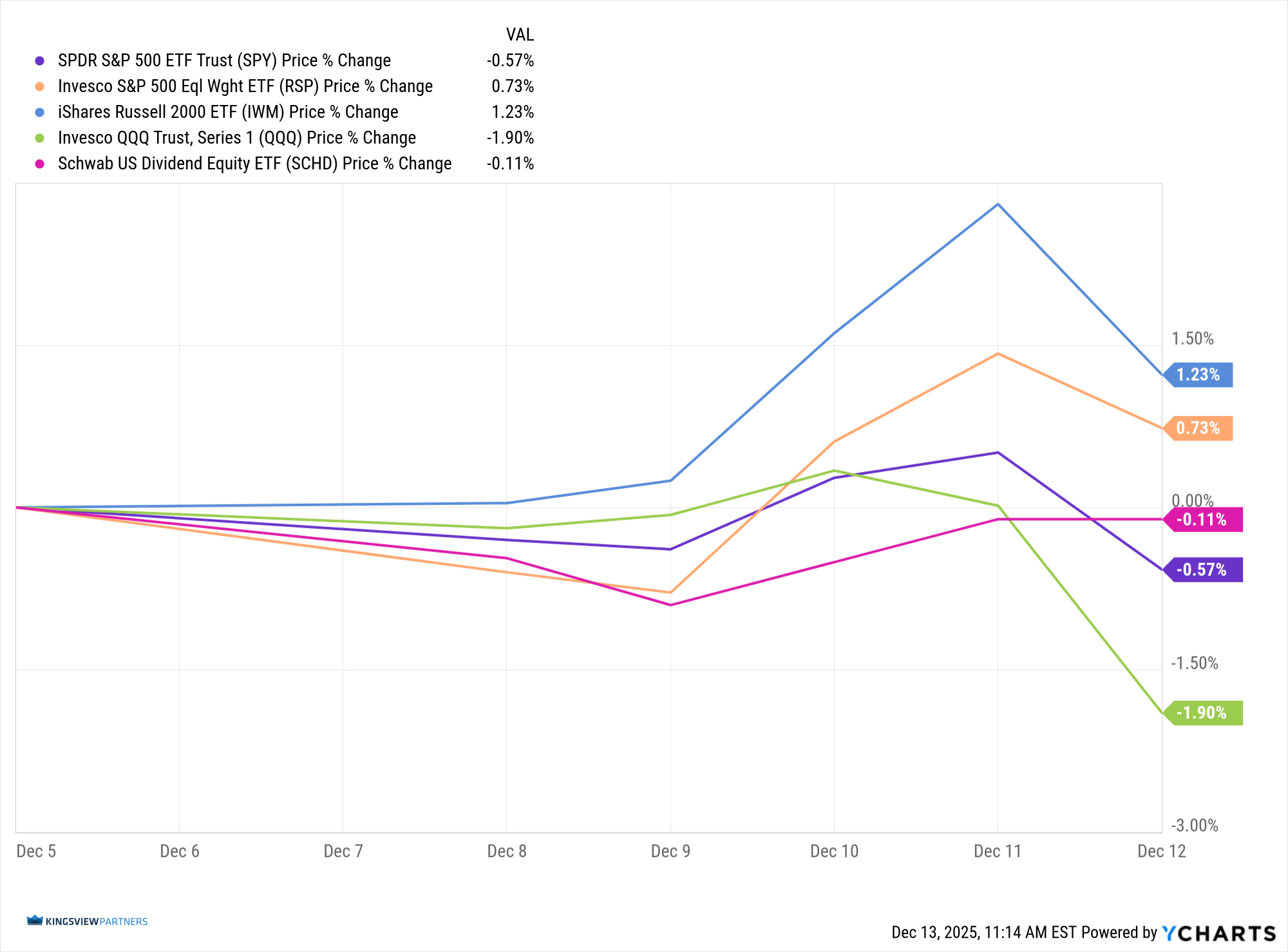

Performance across the field reflected this internal divergence. The SPDR S&P 500 ETF Trust declined -0.57% on the week. The Invesco S&P 500 Equal Weight ETF advanced 0.73%, while the iShares Russell 2000 ETF led the broader ranks higher with a gain of 1.23%. In contrast, the Invesco QQQ Trust fell -1.90%, showing relative weakness of the generals. The Schwab U.S. Dividend Equity ETF was nearly flat, slipping just -0.11%.

Market breadth offered a more constructive signal. The NYSE Advance–Decline Line continued to expand, breaking through the prior week’s persistent resistance and rallying toward its September ceiling. This suggests the ranks remain active even as leadership and capital flows diverge.

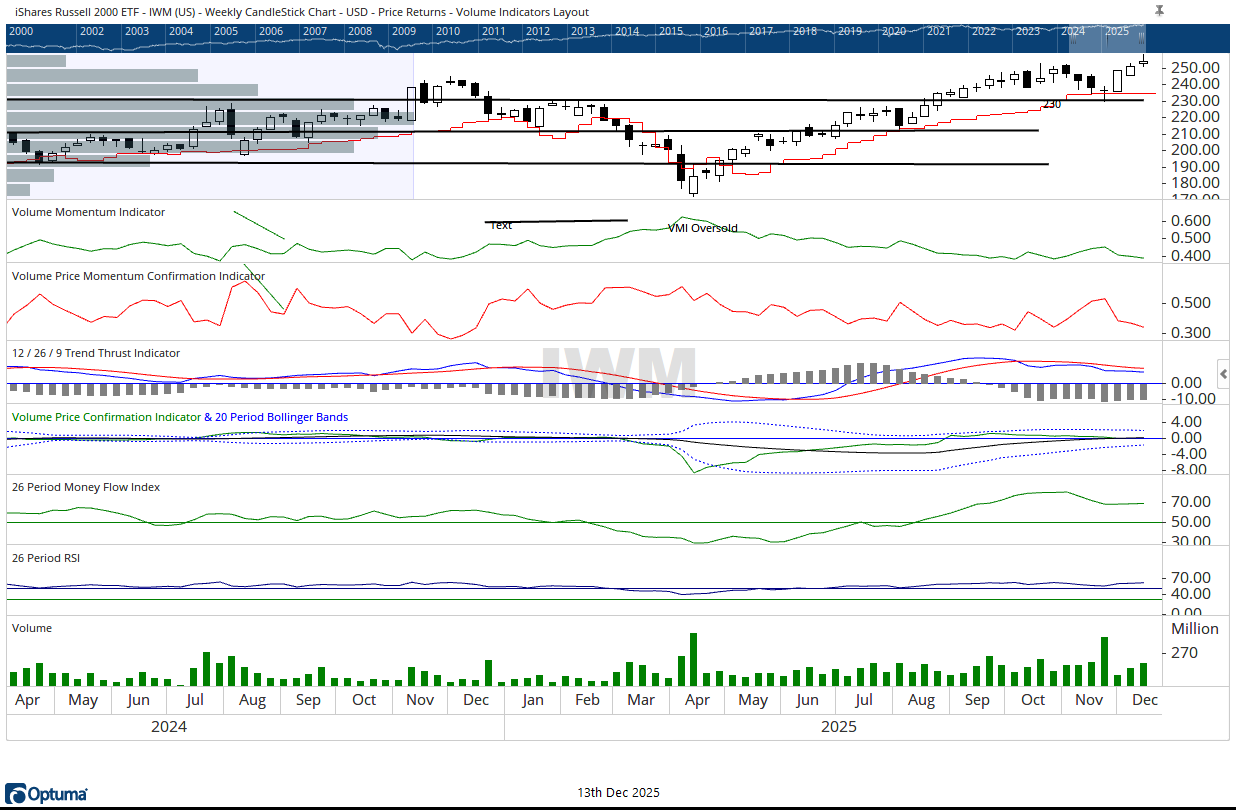

Technically, the generals, represented by the Invesco QQQ Trust, largely remained confined within last week’s range, closing near the midpoint of both weeks. A decisive close below 610 would mark a breakdown, with next support near 575. Any renewed advance would require a breakout above the two-week upper boundary near 630. Meanwhile, the troops, represented by the iShares Russell 2000 ETF, broke decisively above long-term resistance and surged to new all-time highs, advancing in a direction clearly at odds with the generals. Such divergences rarely persist for long, as one force typically reins in the other, with volume illuminating the path.

This week highlighted a market at an inflection point. Price held key support, breadth expanded, and the troops advanced, yet capital flows and volume trends leaned defensively and leadership weakened. These crosscurrents suggest neither a clear retreat nor a confirmed advance.

In such conditions, discipline is paramount. Investors should respect support levels, remain attentive to capital flow signals, and avoid overextension while leadership and participation remain misaligned. Risk management through position sizing, diversification, and predefined exit levels remains essential. Markets, like military campaigns, often pause before decisive action. Those prepared to adapt endure. And then there were none left without a plan.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 12/15/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.