Volume Analysis Flash Update – 12.08.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

The Christmas March: Awaiting the Santa Orders

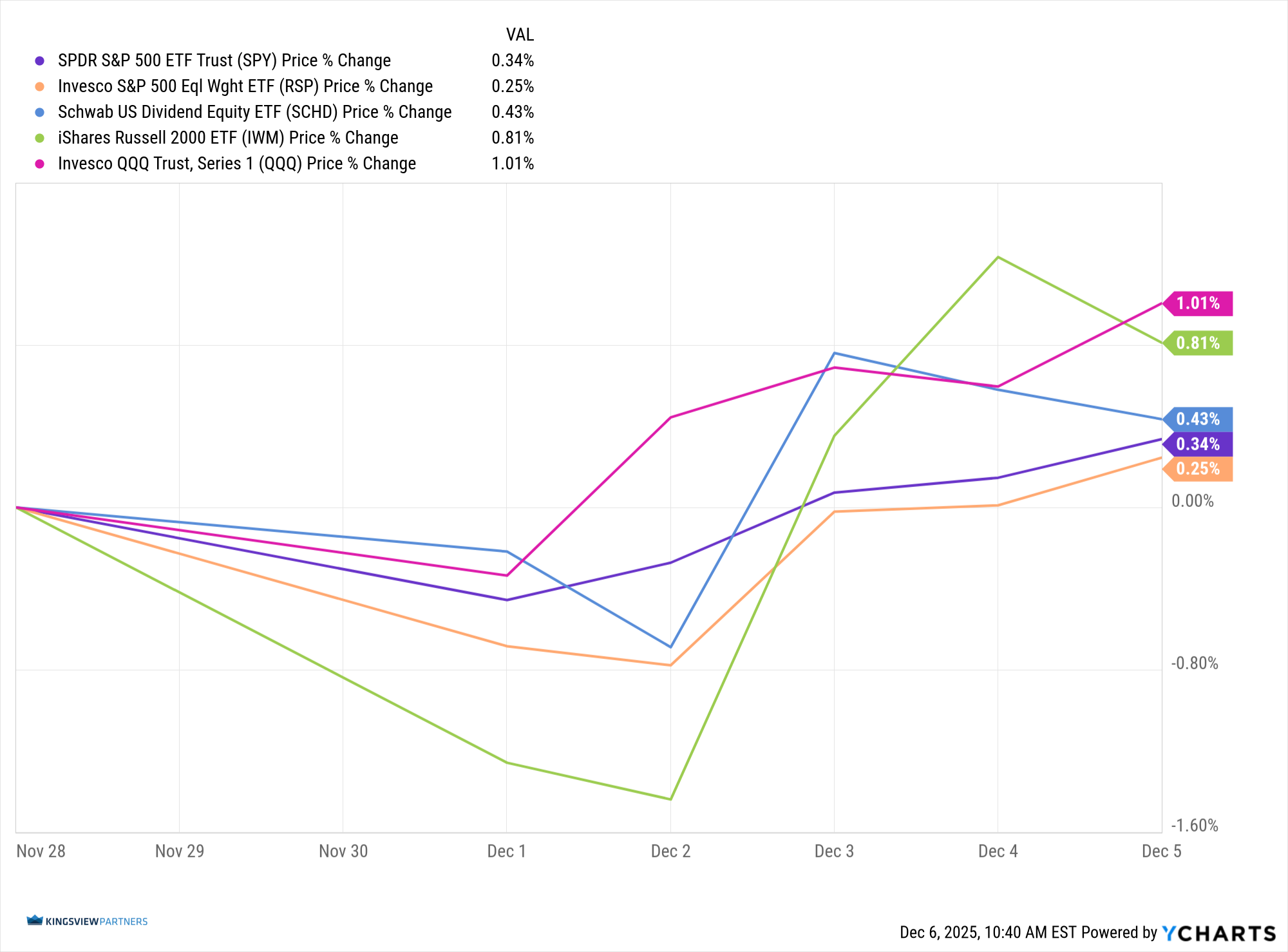

After weeks of heavy conflict and spirited counterattacks, the market grew noticeably quiet — as if troops and commanders alike were awaiting their next set of orders. The battlefield tone this week felt more like tactical repositioning than outright engagement.

The generals, represented by the Invesco QQQ Trust (QQQ), took point with a 1.01% advance. The troops, represented by the iShares Russell 2000 ETF (IWM), followed close behind at 0.81%. The remaining ranks, the SPDR S&P 500 ETF Trust (SPY), Invesco S&P 500 Equal Weight ETF (RSP), and Schwab U.S. Dividend Equity ETF (SCHD), moved in formation albeit at a slower pace, consistent with a market pausing to gauge its next strategic opportunity.

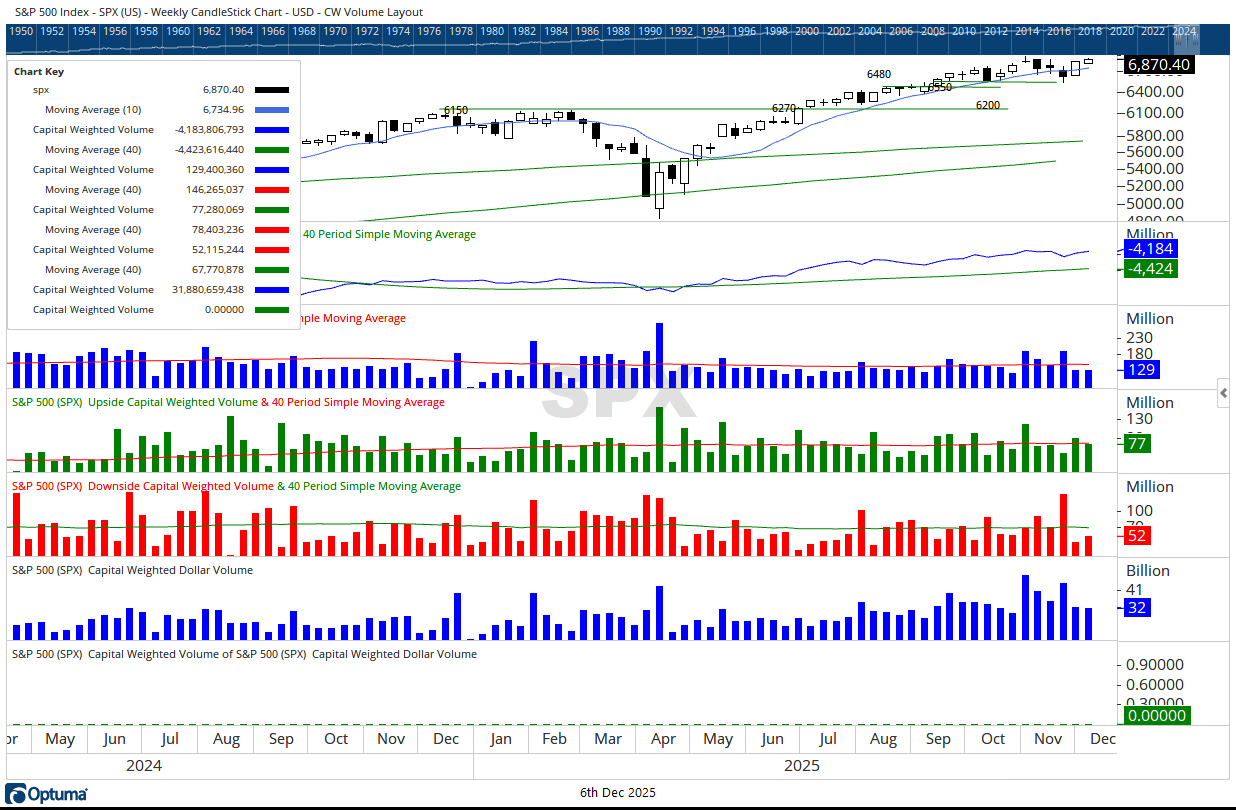

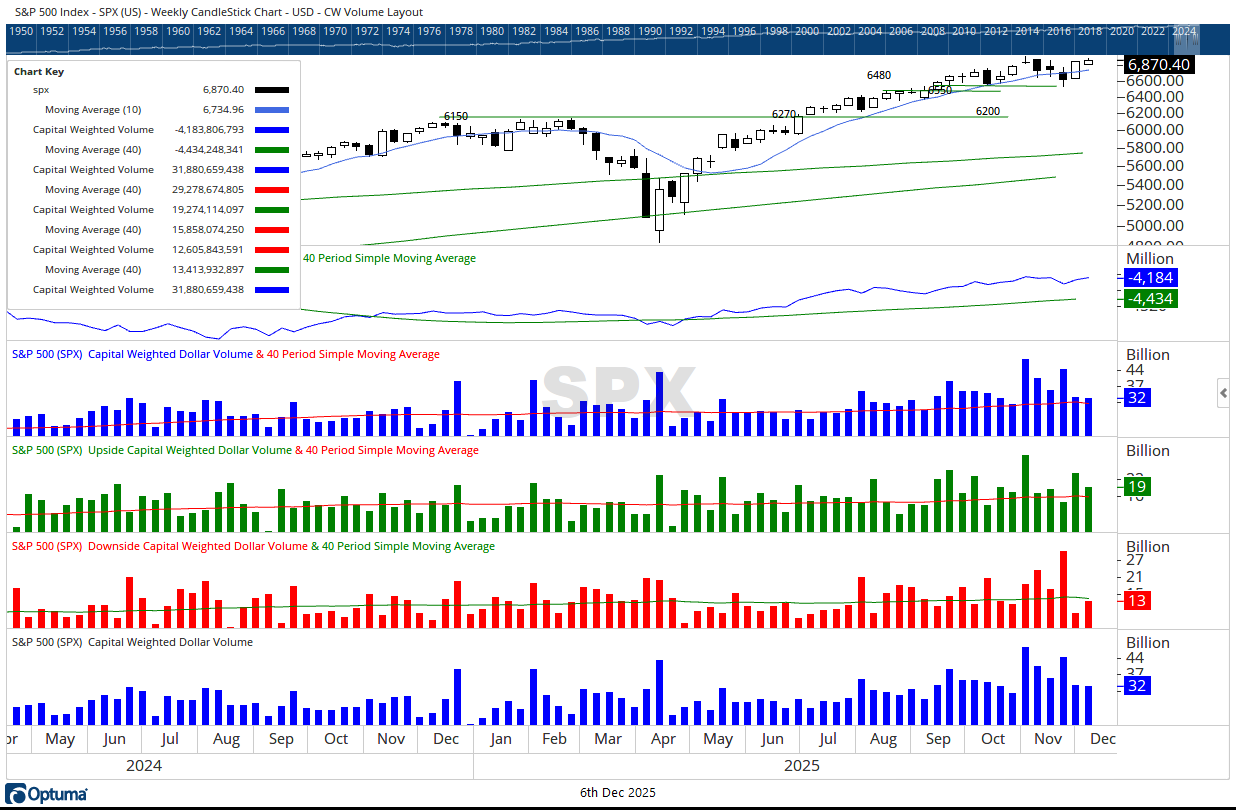

Capital flows reflected the same restrained but steady advance. Overall flows were average, though the composition leaned constructive: inflows were above average, outflows ran slightly below trend, as 60% of capital movement favored inflows. Capital-weighted volume was light. Upside volume printed near average while downside volume fell below average, a possible sign investors are waiting for clarity from the Federal Reserve. Roughly 60% of total volume pointed to the upside, reinforcing the market’s cautiously optimistic stance.

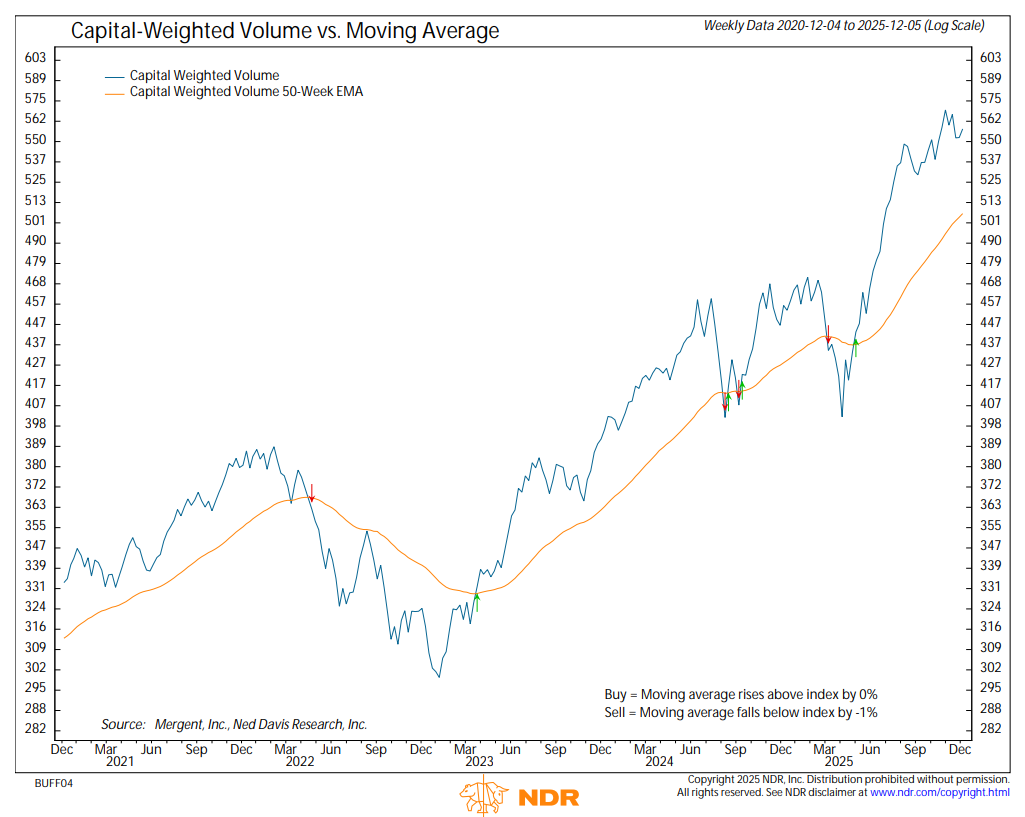

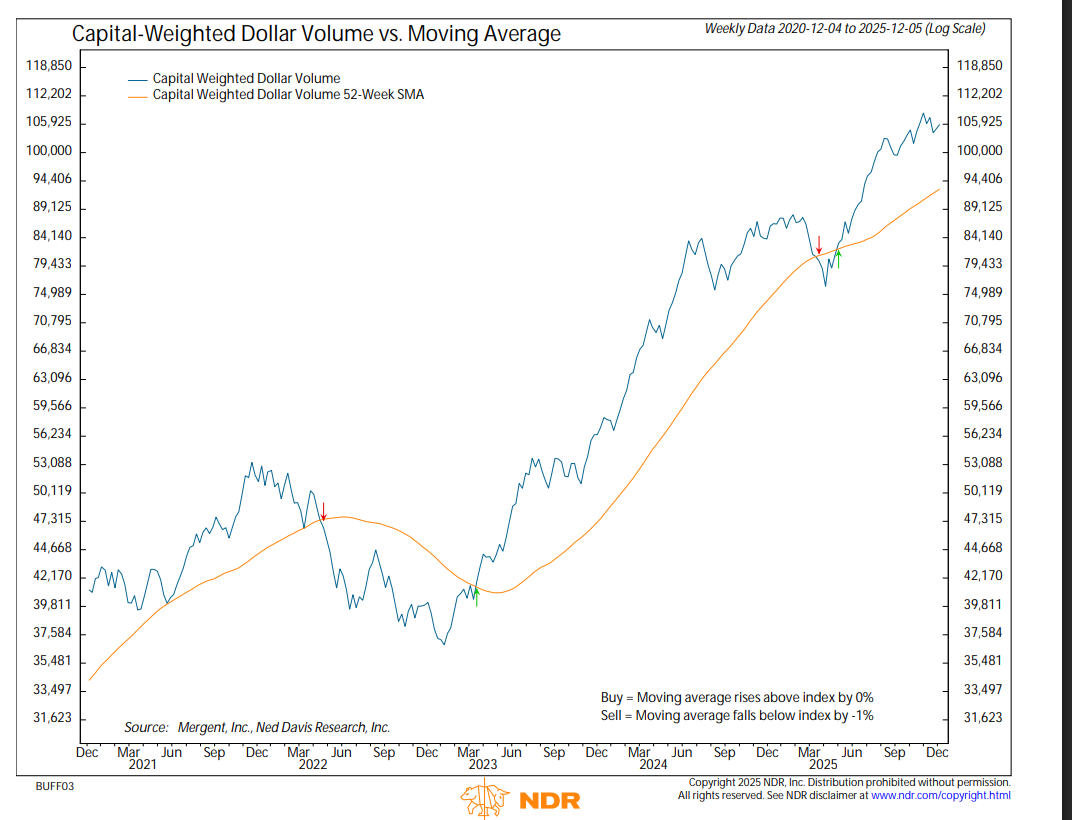

Despite the quiet trading, the deeper indicators showed subtle strengthening. The accumulated trends of both capital-weighted volume and capital-weighted dollar volume have fish-hooked upward, reasserting their positive direction. Both remain comfortably above long-term moving averages, though still slightly lagging the sharp advances seen over the prior two weeks. Liquidity is present, but by no means surging.

Last week’s powerful breadth thrust found its equilibrium. The NYSE Advance-Decline Line held steady, finishing the week flat but maintaining its reclaimed uptrend. The stabilization after a surge could be a constructive sign: the troops have advanced, secured ground, and are holding it.

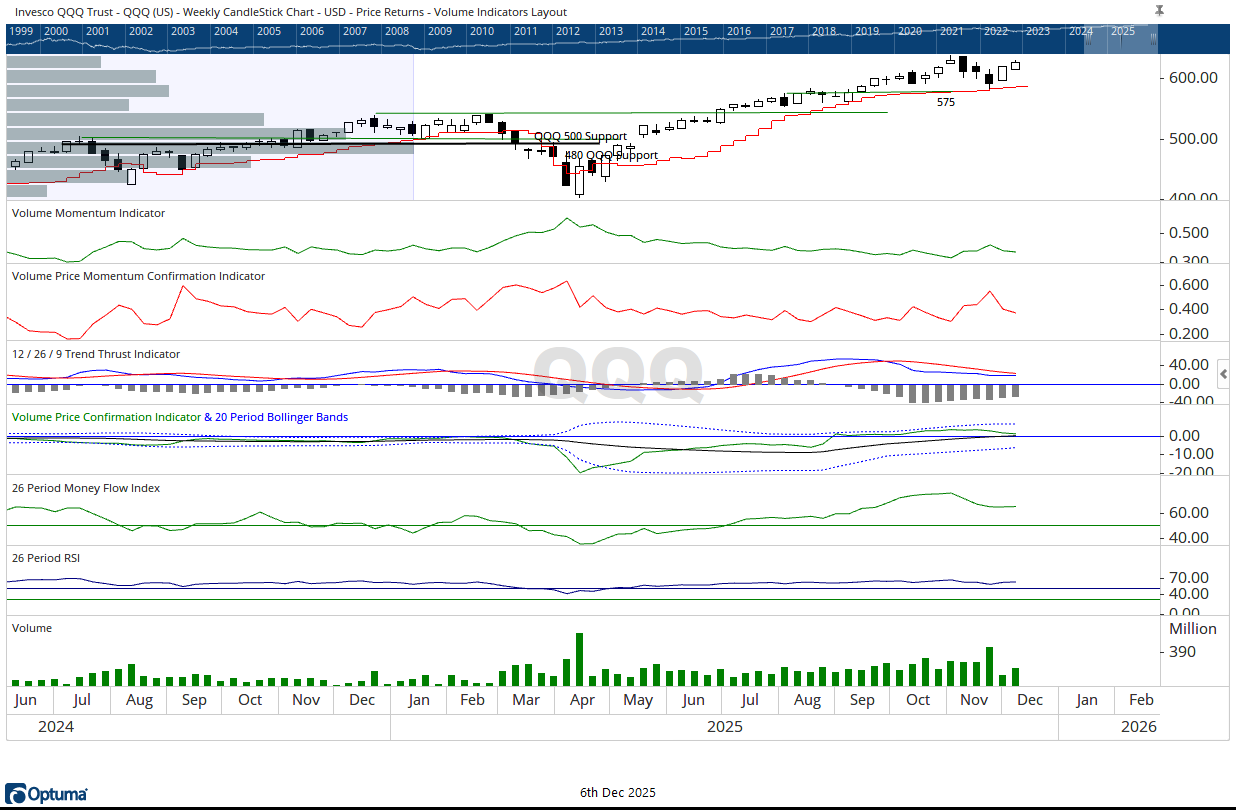

The generals, broke out of last week’s range and are closing in on the next October resistance near 630. Their steady ascent continues to lead the broader campaign. Meanwhile, the troops briefly touched their all-time highs and appear poised to push deeper into uncharted territory, perhaps an encouraging sign for those watching for leadership broadening.

Meanwhile, the S&P 500 remains above its 10-week moving average, holding the higher ground reclaimed during the Thanksgiving counteroffensive. The index is edging toward the seasonal period where historically the market has tended to receive “Santa Claus orders”, a final bullish push of the year. Whether the long-awaited Santa Claus Rally arrives will depend on three fronts:

• the generals’ ability to clear their next resistance band,

• the troops following through on new-high attempts,

• and capital flows continuing their upward hook.

But through it all, one principle remains unchanged: disciplined risk management. As any seasoned commander knows, the calm before a campaign can be as dangerous as the battle itself. Investors should remain vigilant, maintain defensive positions where warranted, and advance only with calculated intent. The gravestone of Halloween and the gratitude of Thanksgiving have passed. In anticipation, the markets await this season’s holiday message, whether delivered by Santa or the Grinch.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 12/08/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.