Volume Analysis Flash Update – 12.01.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

From Gravestone to Gratitude: Thanksgiving Counteroffensive Sets Stage for Santa

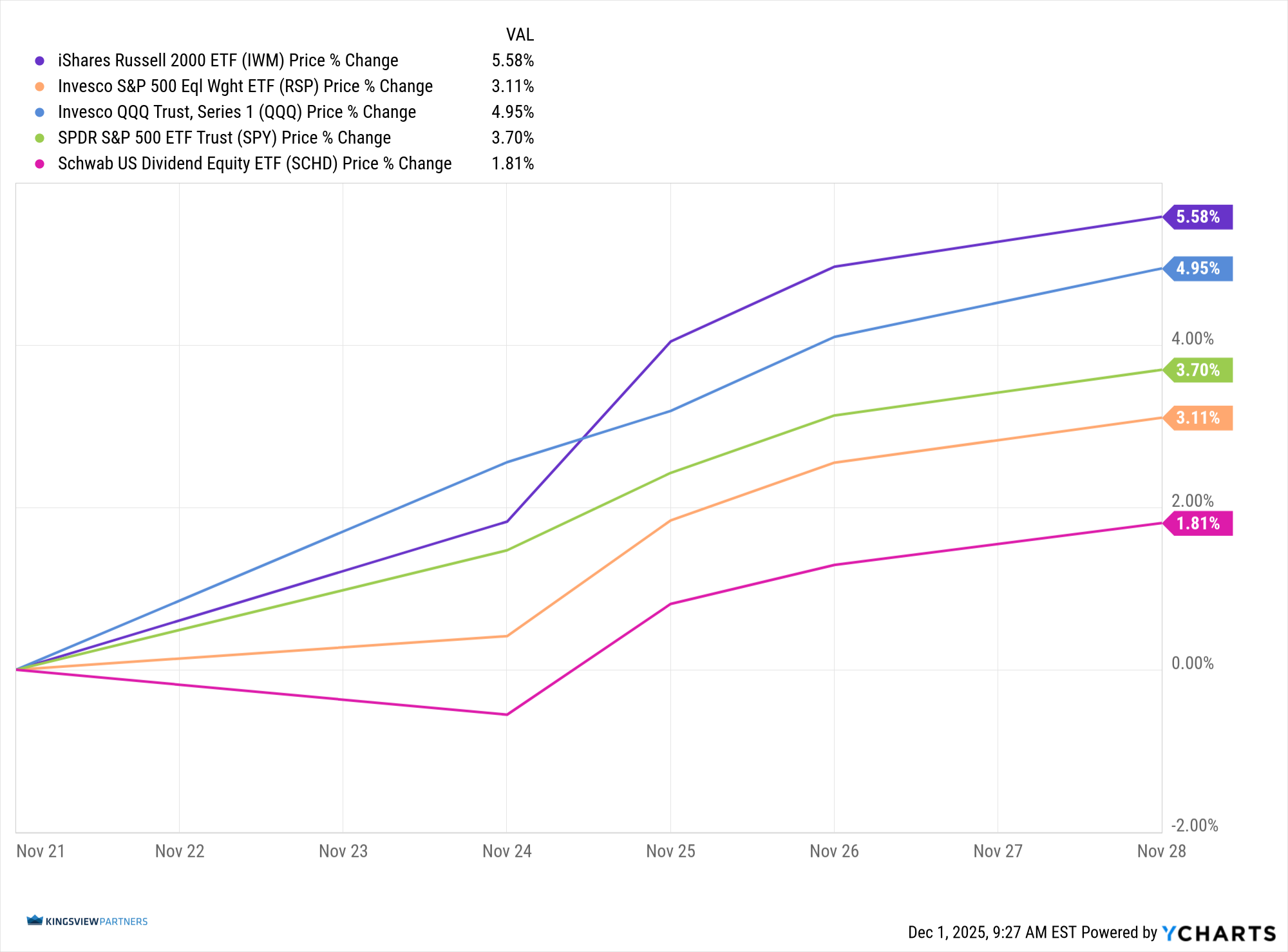

After several weeks under the long shadow of Halloween’s gravestone doji, the market finally mounted a full-scale Thanksgiving counteroffensive. What began as defensive skirmishes turned into an organized advance, led not by the generals but this time by the troops.

The iShares Russell 2000 ETF (IWM) troops launched the strongest assault, surging 5.58% for the week. The Invesco QQQ Trust, Series 1 (QQQ) generals followed with a 4.95% gain. Even the quality-focused brass commanders, represented by the Schwab U.S. Dividend Equity ETF (SCHD), joined the push with a 1.81% advance. The broader ranks also participated climbing steadily throughout the holiday shortened week, adding depth to the market’s charge.

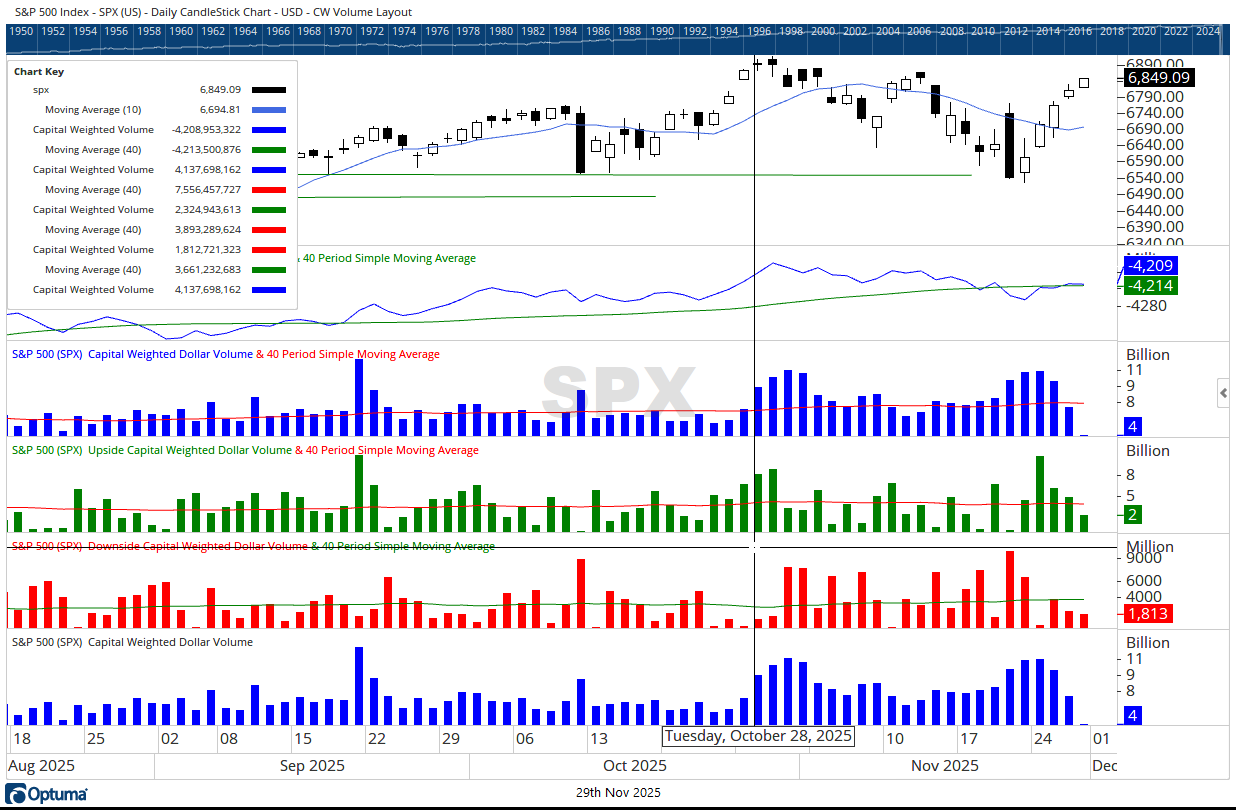

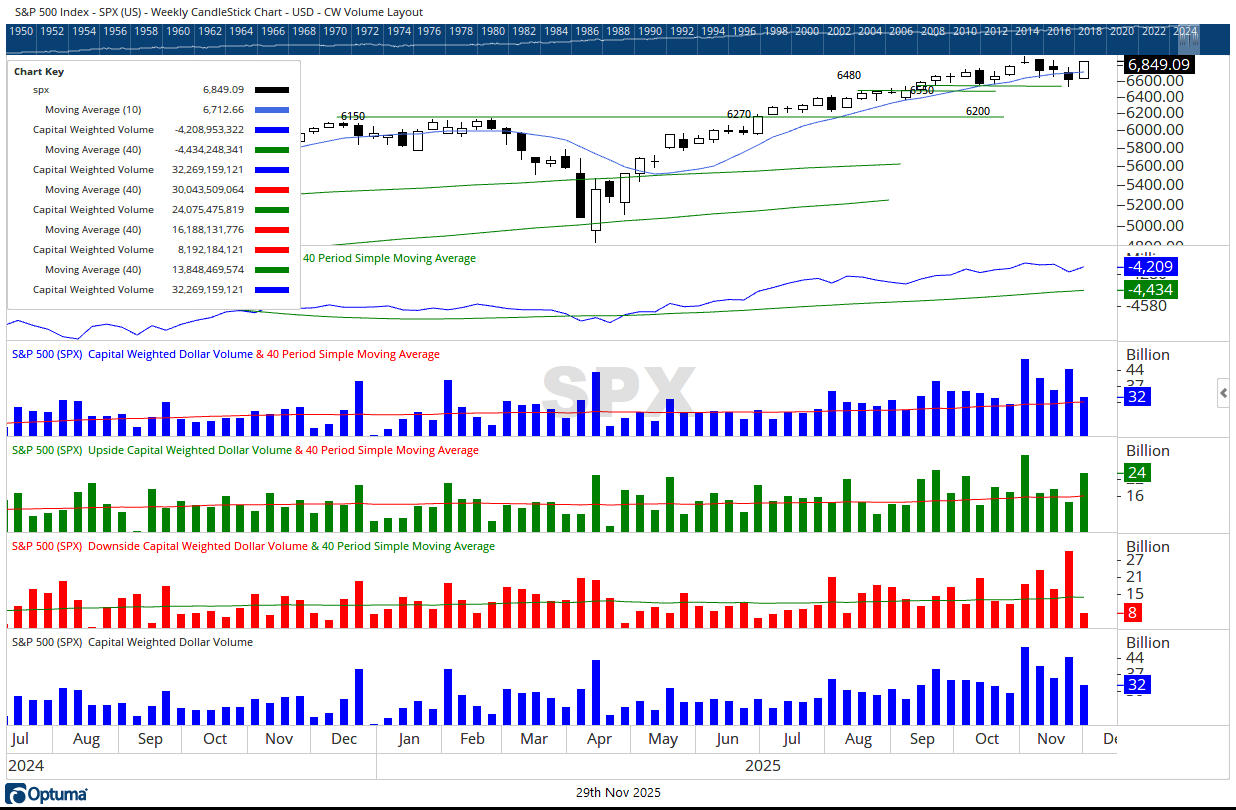

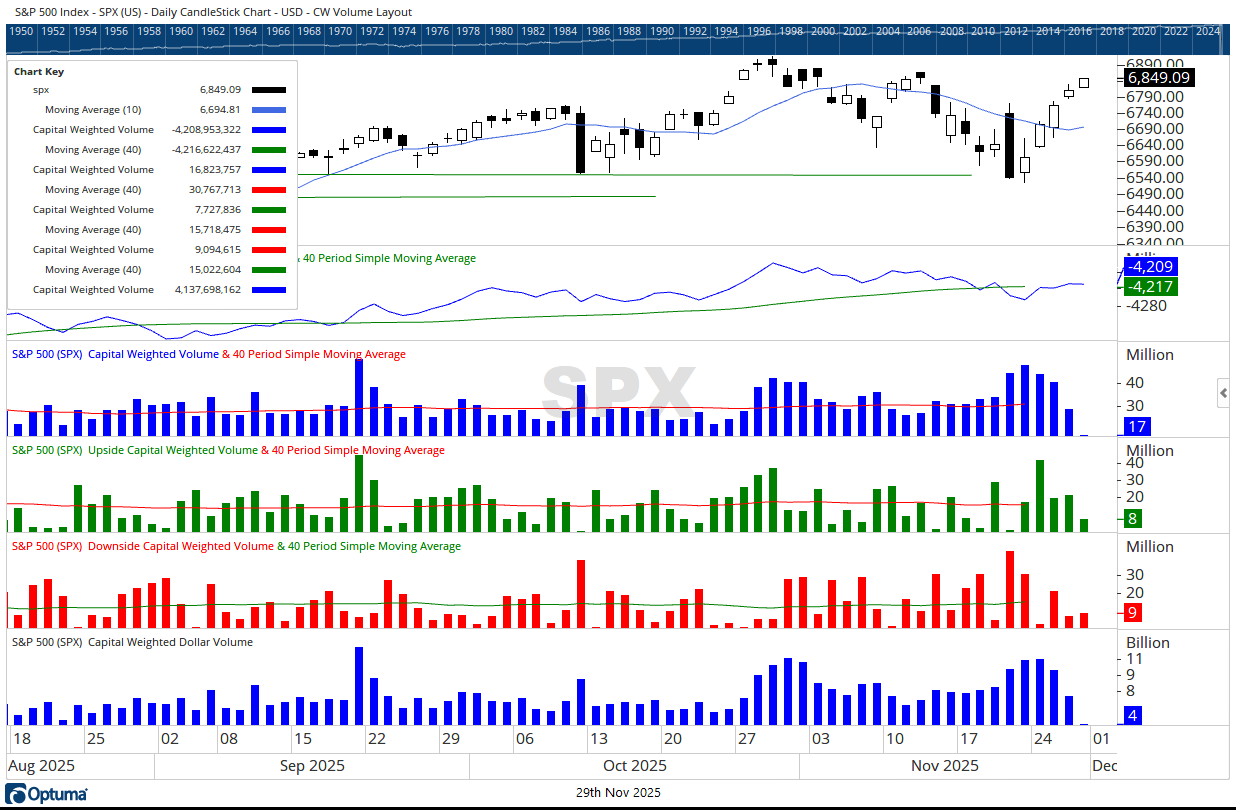

Thanksgiving week started with force. Monday, November 24th registered a powerful 94% upside volume day, marking the highest trading activity since September 19th. An impressive 69% of the week’s volume flowed to the upside. Capital-weighted dollar volume (capital flows) came in slightly above average, despite a day-and-a-half holiday break, indicating that buying conviction held firm even as trading hours thinned.

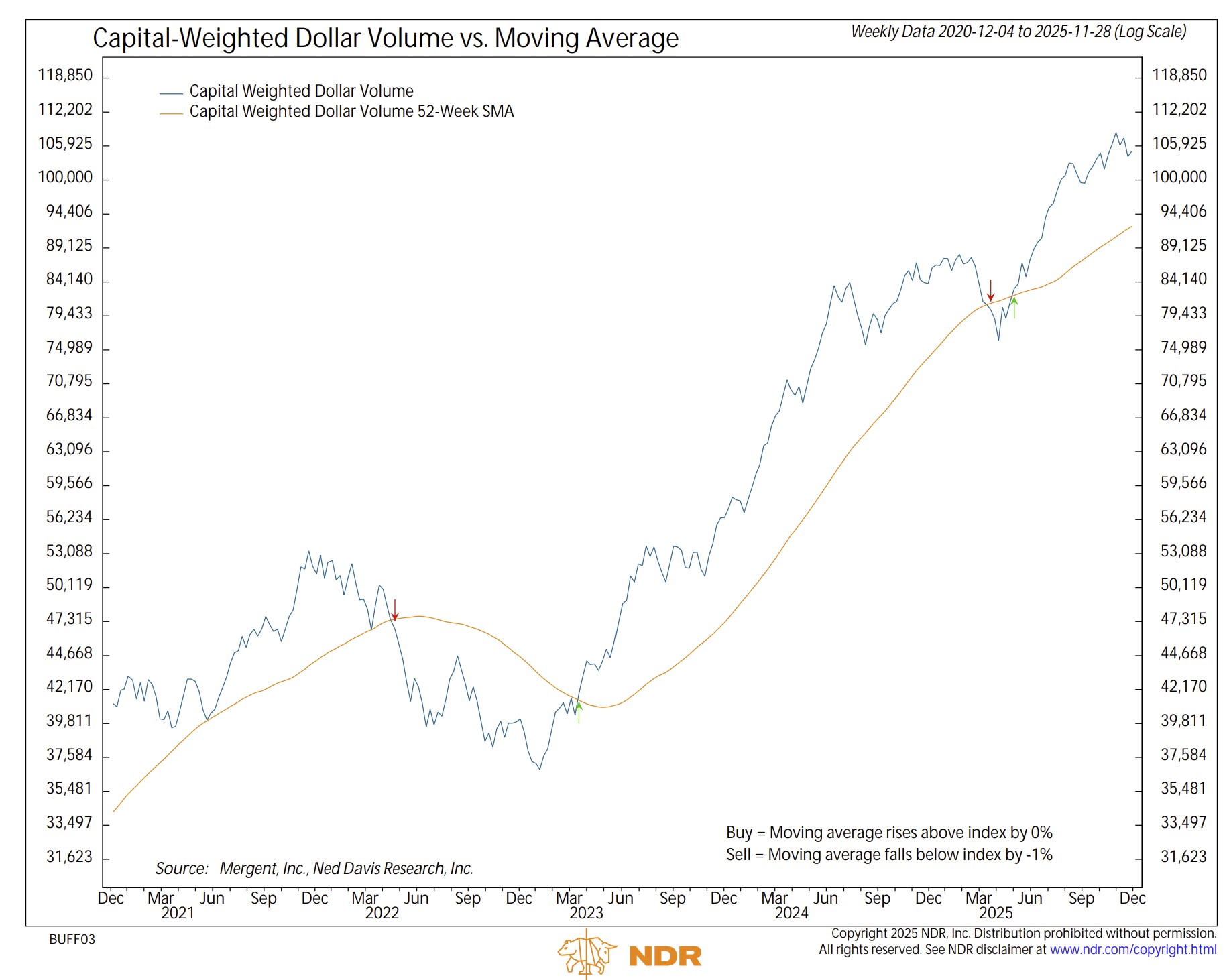

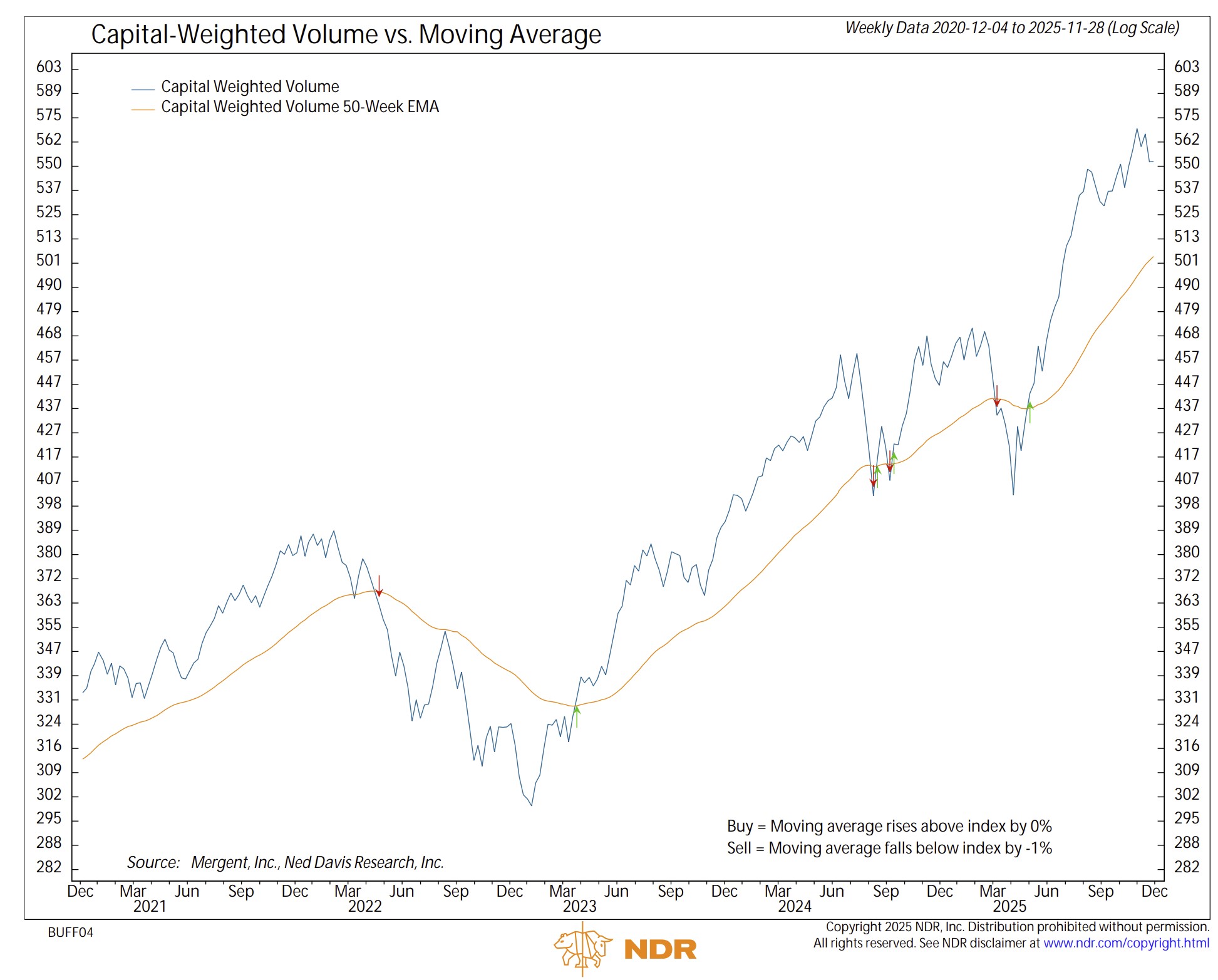

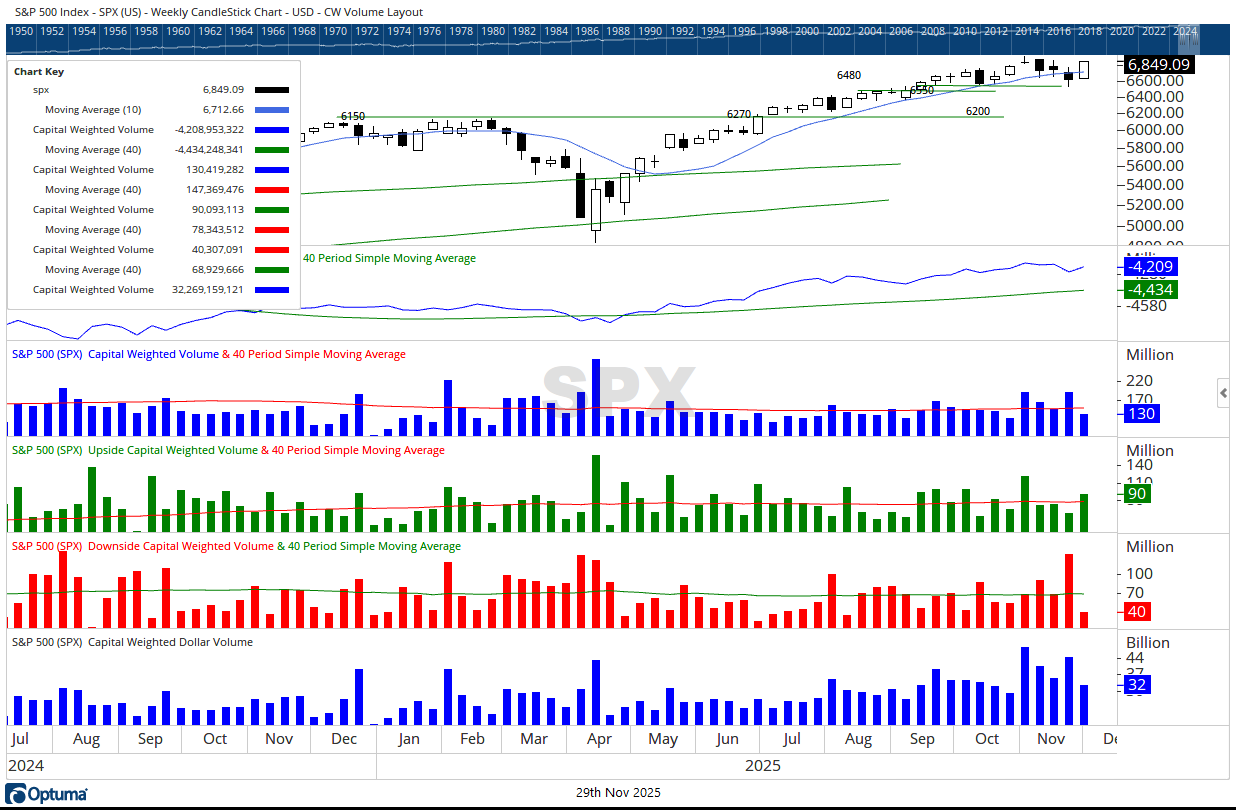

Curiously, despite a one-sided week to the upside, capital-weighted volume was not able to turn up, instead flattening out. Meanwhile, capital-weighted dollar volume “fish-hooked” higher, though only modestly. Liquidity remains abundant, but the hesitation in volume trends suggests buyers pushed hard but just not hard enough to trigger a full momentum breakout in the internals.

Market breadth delivered the clearest holiday message. After breaking below trend last week, the NYSE Advance-Decline Line not only reclaimed trend but exploded higher and now is nearly approaching breadth thrust conditions. This is a bullish development worthy of close monitoring as hopes for a Santa rally anxiously approach.

Although not leading this week’s charge, the generals heavily participated too. QQQ broke out of last week’s range, bouncing sharply off 575 support. The next resistance levels sit at 625 and then 640, a breakout above those levels would take the generals into new all-time-high territory.

The troop’s surge was even more impressive. IWM catapulted off 230 support and closed the week at the doorstep of 249 resistance. A clean breakout there would confirm that leadership is broadening, a constructive sign for the overall campaign.

Meanwhile, the S&P 500 (SPX) reclaimed the high ground. SPX broke through 6800 resistance to close back above its 10-week moving average, restoring its positive intermediate trend. Short-term resistance now lies between 6870 and 6883, with the major battlement at 6920, the all-time high.

With breadth strengthening, support levels defended, and leadership expanding beyond the generals, the market may be shifting from the fear of Halloween to the gratitude of Thanksgiving. Now, the question becomes whether the troops and generals can carry this momentum to grease the skids for a Santa Claus rally or will investors be disappointed with coal in their stockings.

Yet even amid seasonal cheer, disciplined investors should remember that markets, like campaigns, are won through risk management, not optimism alone. Momentum now once again favors the bulls, but as always, capital preservation remains the commander’s compass.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 12/01/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.