Volume Analysis Flash Update – 11.24.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Halloween Gravestone Doji IV

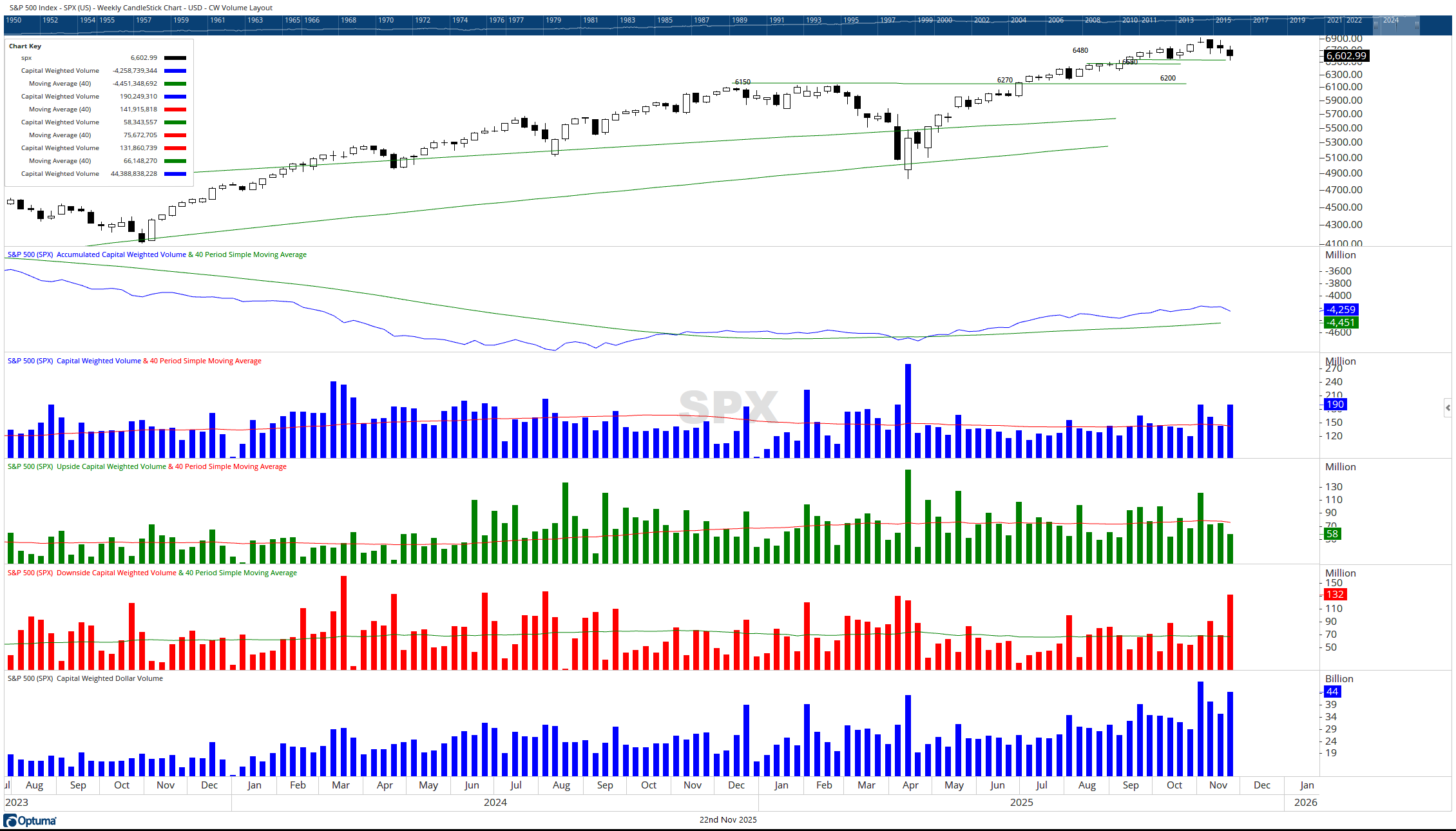

Despite the ray of hope revealed in last week’s outlook, Halloween’s gravestone doji on the S&P 500 continues to haunt the battlefield as the S&P 500 closed below its 10-week moving average for the first time since early May. Midweek, the index fell beneath 6,550 support but found footing at minor 6,520 support before rallying to close the week just above 6,600. The next resistance level stands at 6,800 with intermediate support at 6,475 and major support at 6,200.

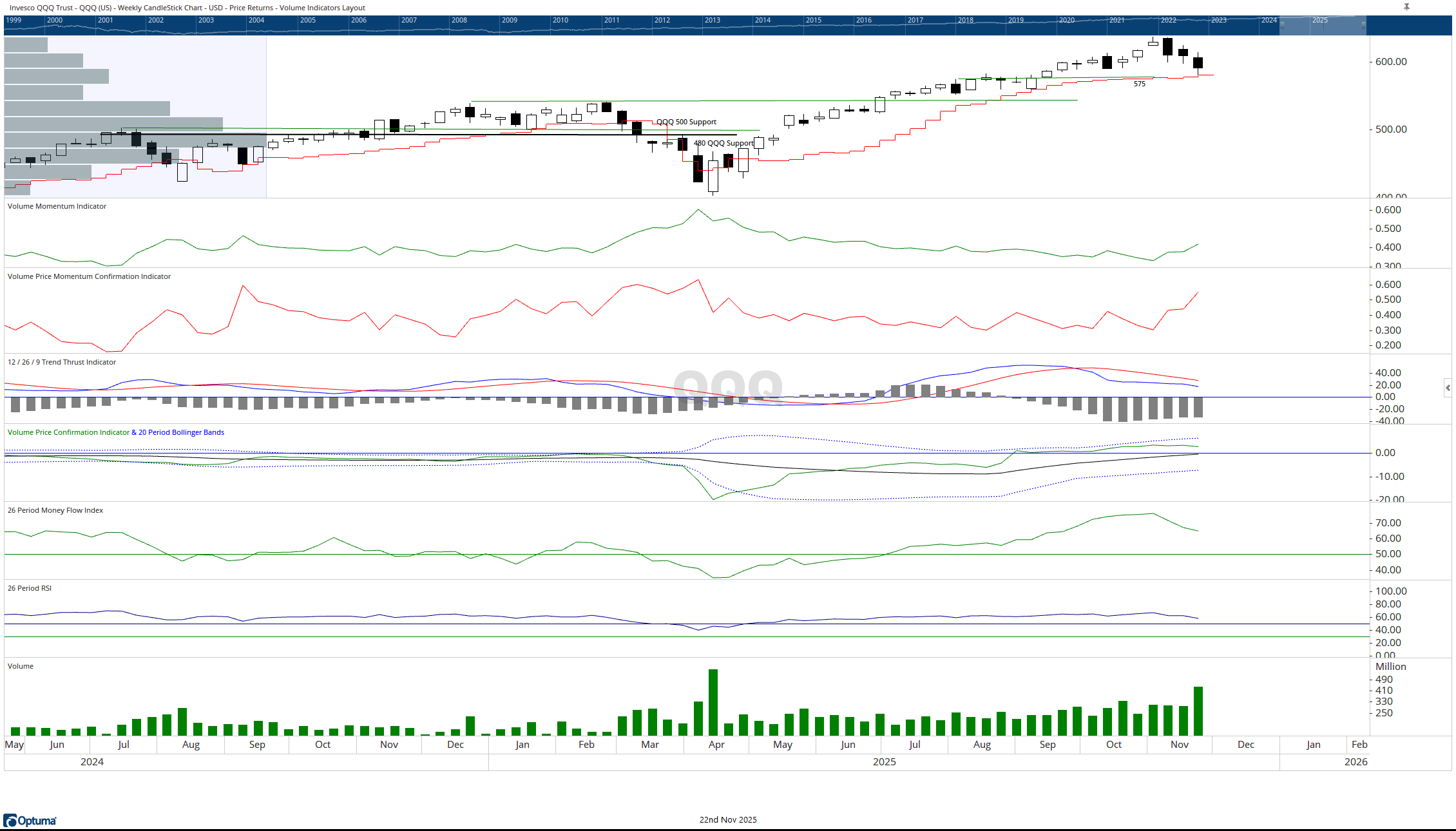

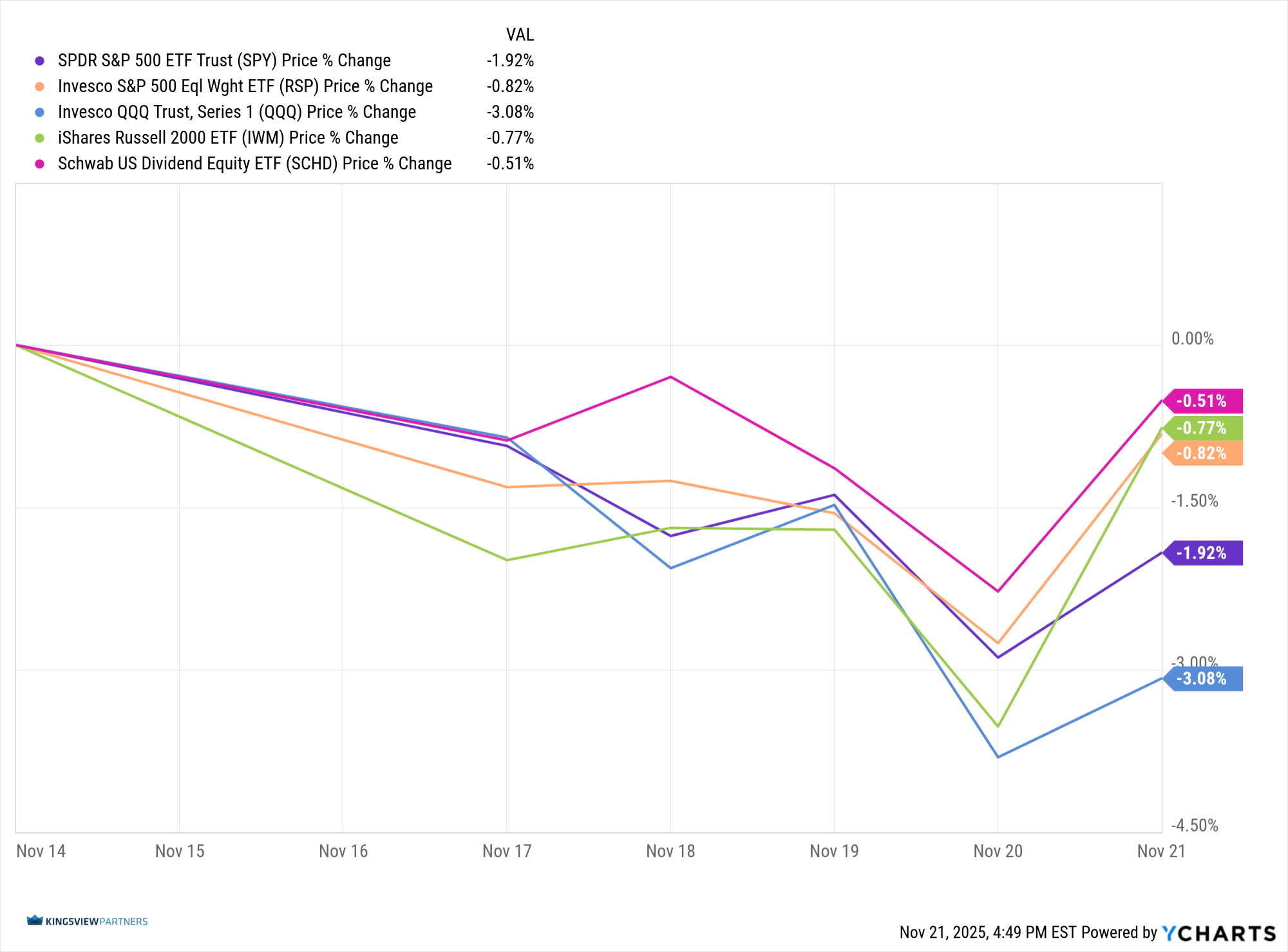

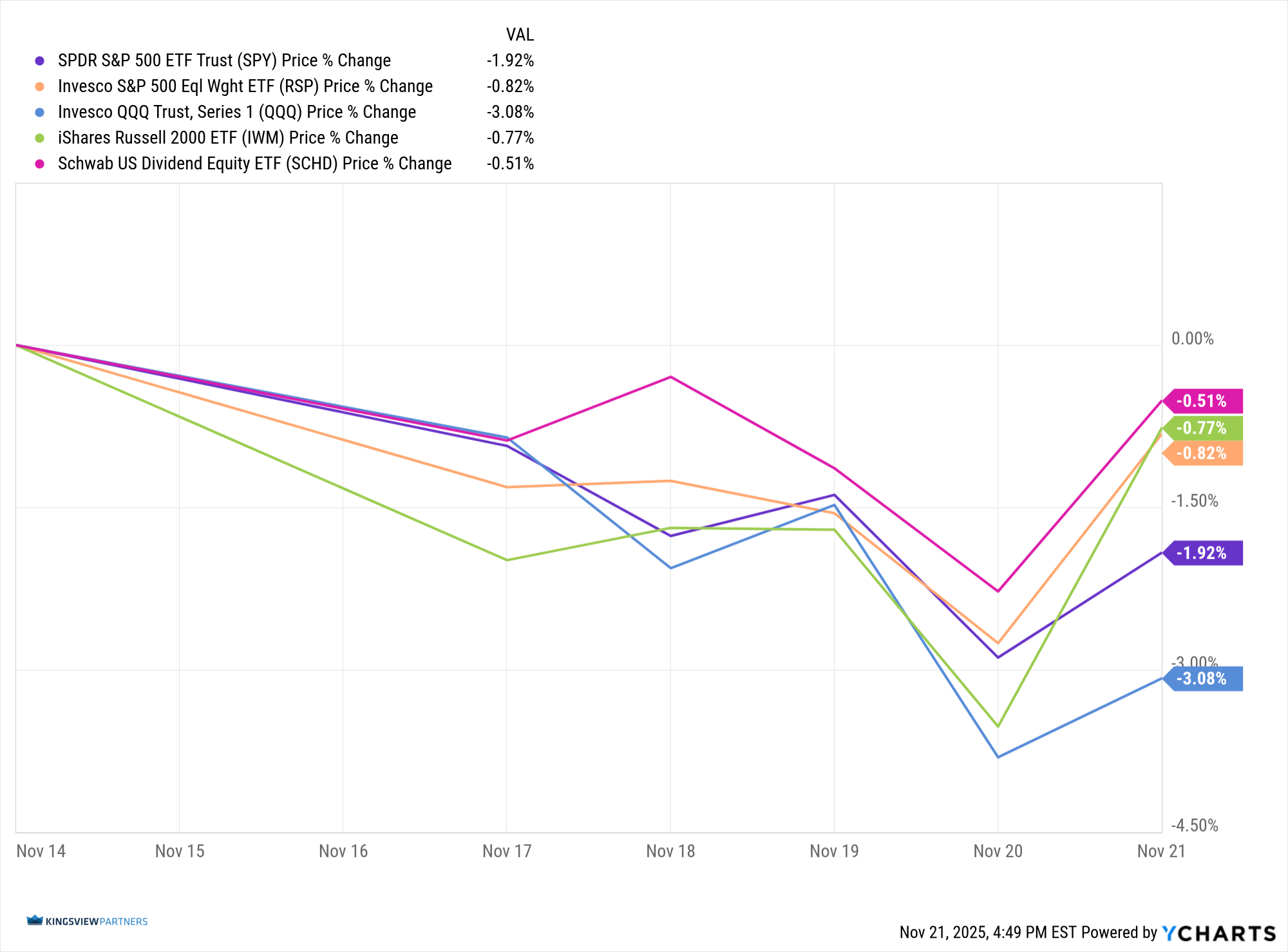

Once again, the generals led the retreat. The Invesco QQQ Trust (QQQ) fell -3.08%, dragging its lieutenants SPDR S&P 500 ETF Trust (SPY) down -1.92%. Still, outside the generals’ ranks, most sectors held their losses below 1%, reflecting selective, rather than systemic, selling pressure. The Invesco S&P 500 Equal Weight ETF (RSP) commanders retreated -0.82%, while the iShares Russell 2000 ETF (IWM) troops fell -0.77%, and the “brass“, Schwab U.S. Dividend Equity ETF (SCHD) slipped a modest -0.51%. This more measured weakness, in contrast to the general’s heavy retreat, suggests the market may be using the sell-off to broaden its participation base.

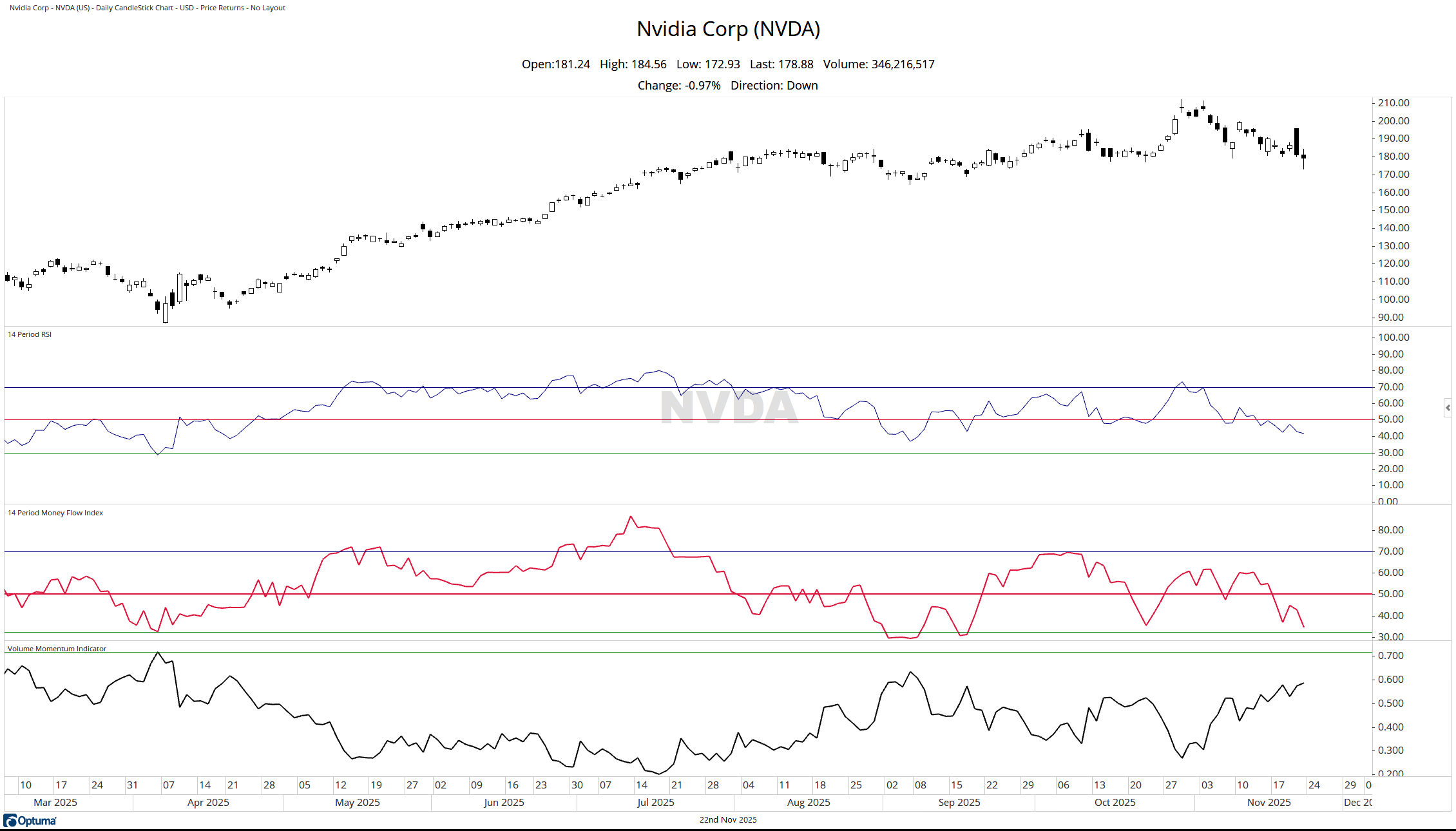

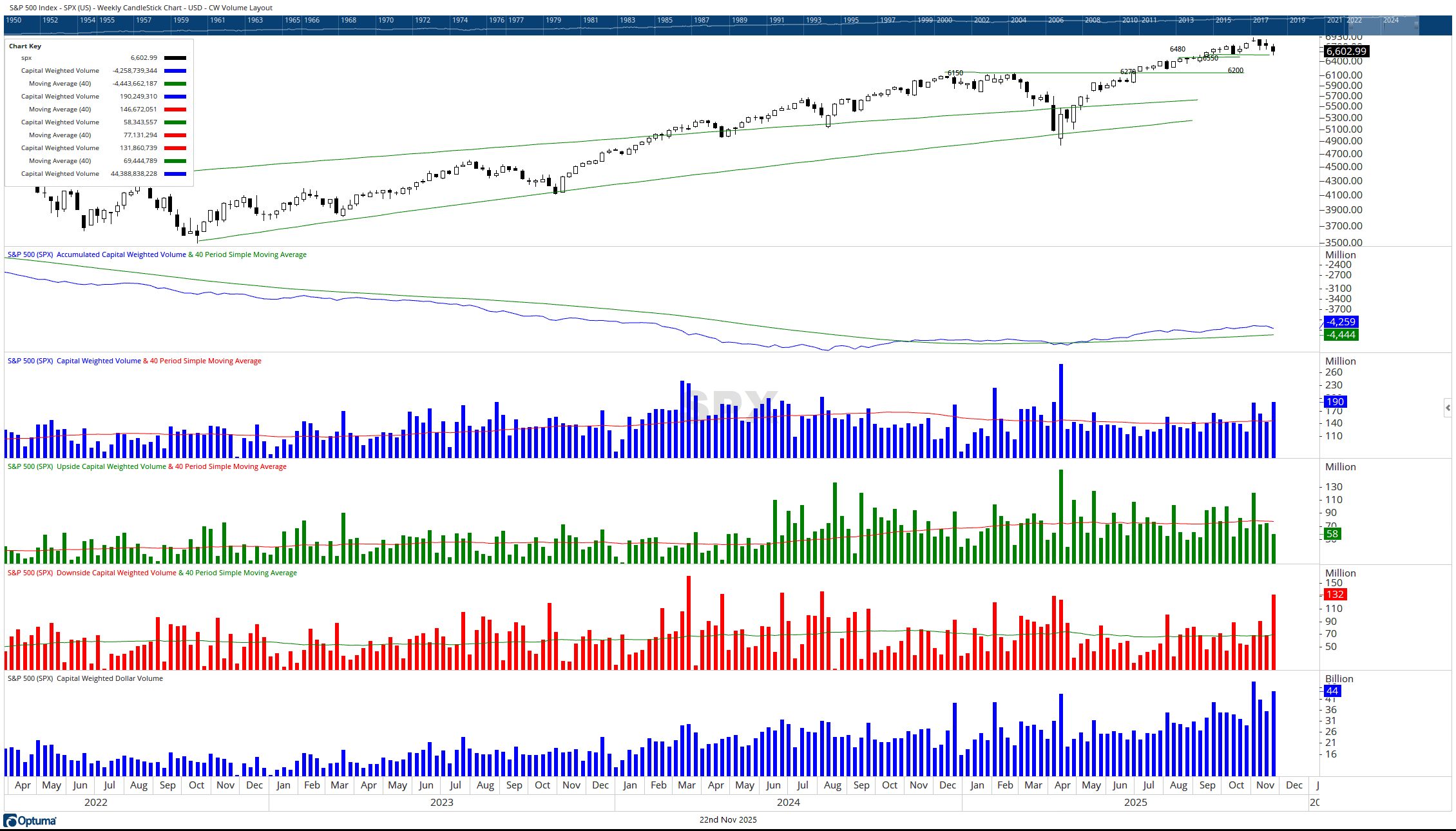

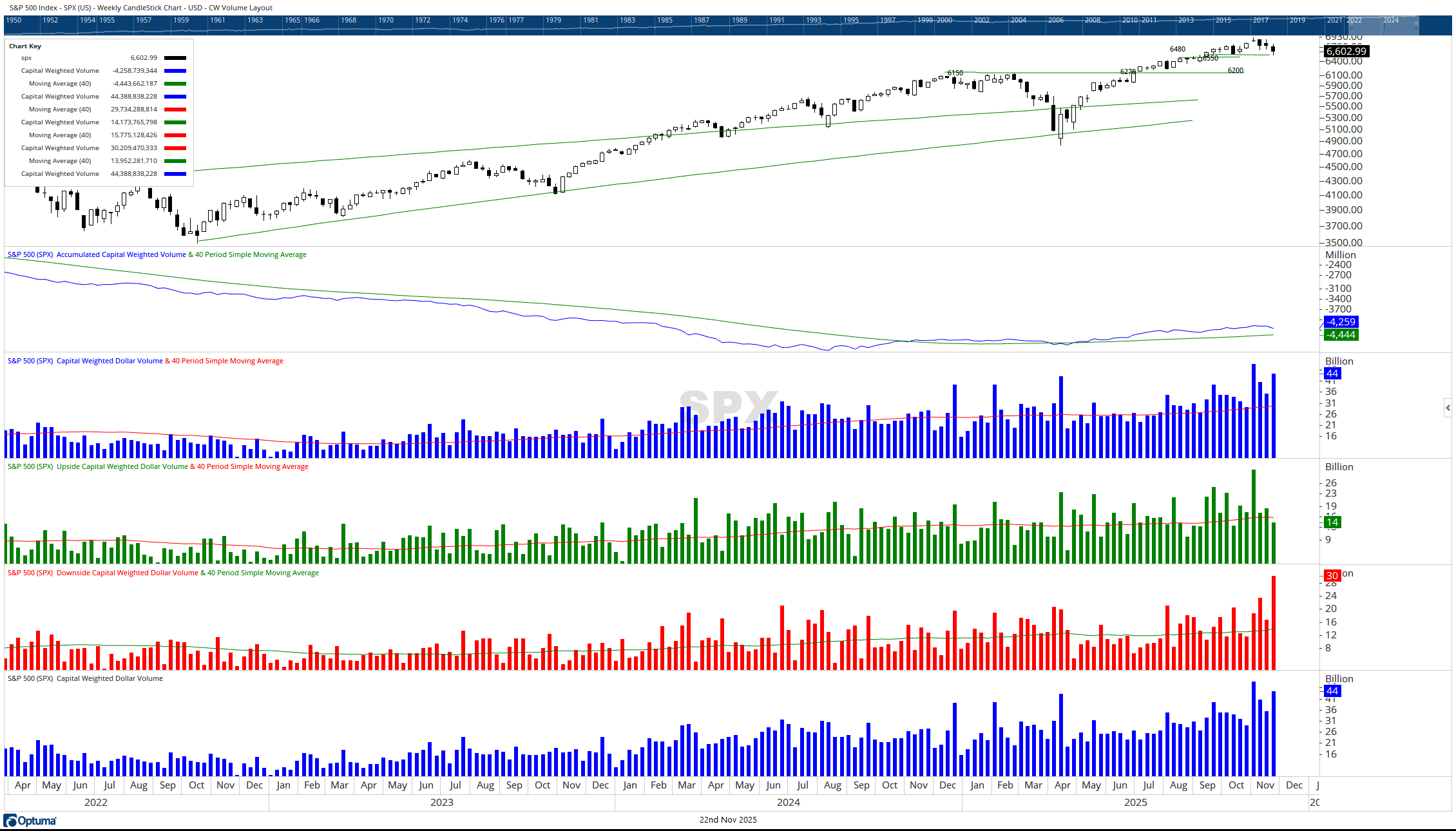

Looking back on the week, Wednesday offered a brief reprieve, posting 85% upside CW volume on above-average activity. Thursday’s post-earnings reaction to the general’s champion, NVIDIA (NVDA), flipped the tone sharply, delivering a staggering 96% downside CW volume on the highest downside reading since the tariff tantrum period. The 90% upside day marked the highest single-day total CW volume since September 19th, and by week’s end, 69% of total CW volume had flowed to the downside. Friday, the 21st, the selling pressure escalated further, registering CW downside volume twice its daily average, despite the S&P 500 closing up on the day.

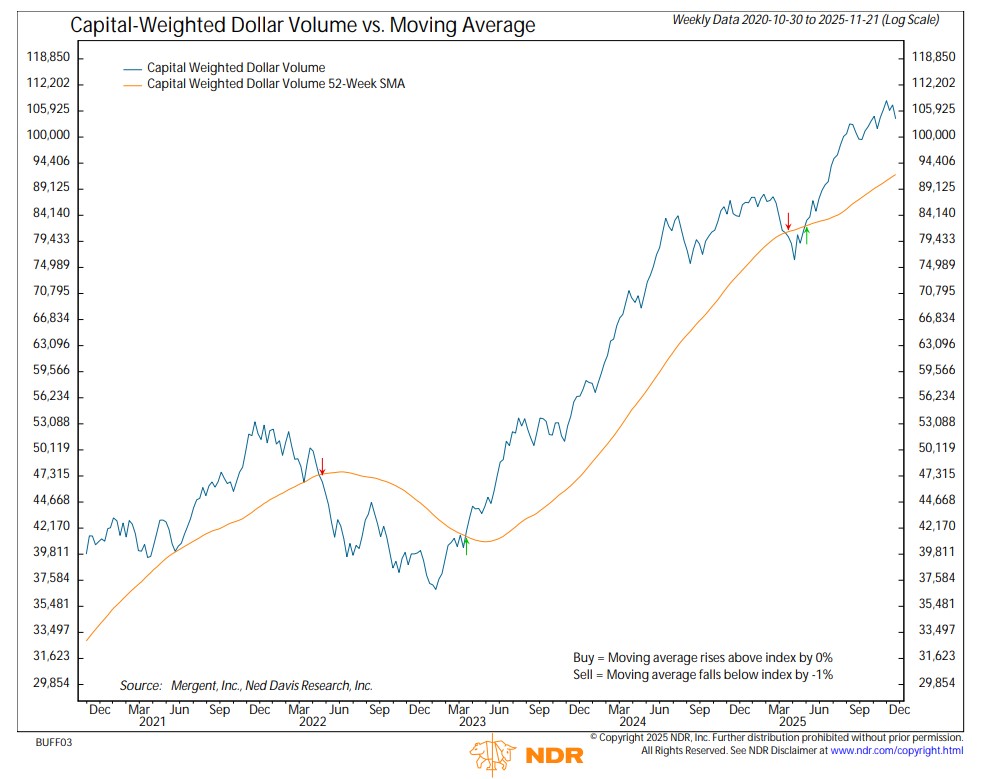

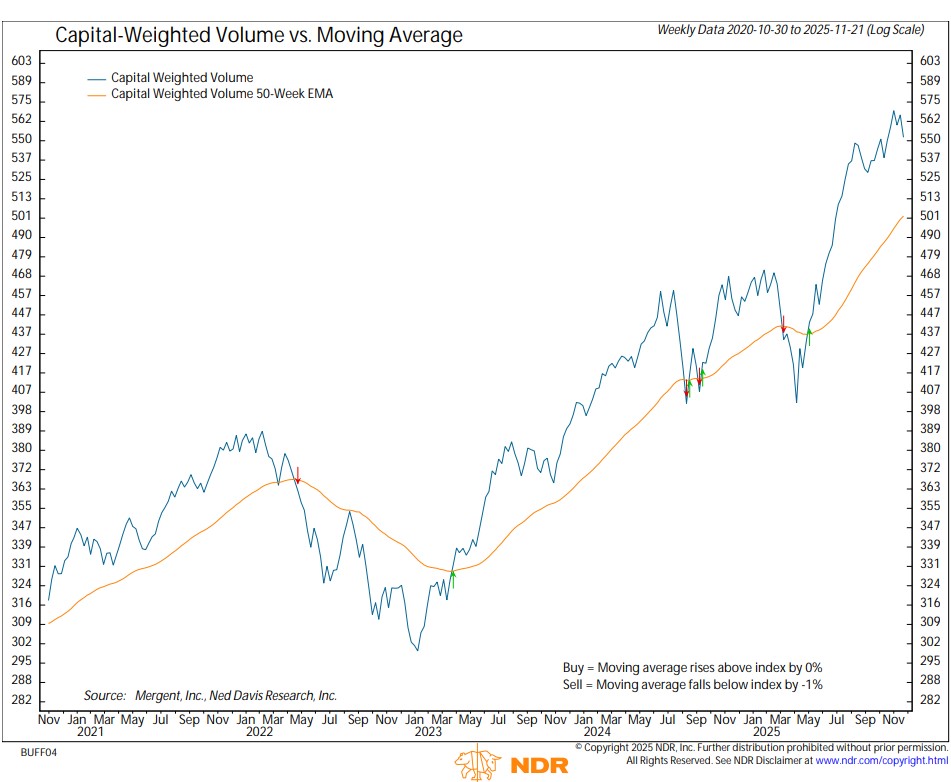

Weekly capital-weighted volume was well above average, with upside volume well below average and downside volume mirroring the extremes of the tariff tantrum period. Weekly capital flows also surged well above average — inflows were slightly below norm, but outflows reached record levels, exceeding even those of the tariff tantrum. In total, 72% of capital flows were outflows. Despite the selling surge, both capital-weighted volume and capital-weighted dollar volume trends remain firmly positive and above their near-term support lines, showing that liquidity remains abundant, not withdrawn.

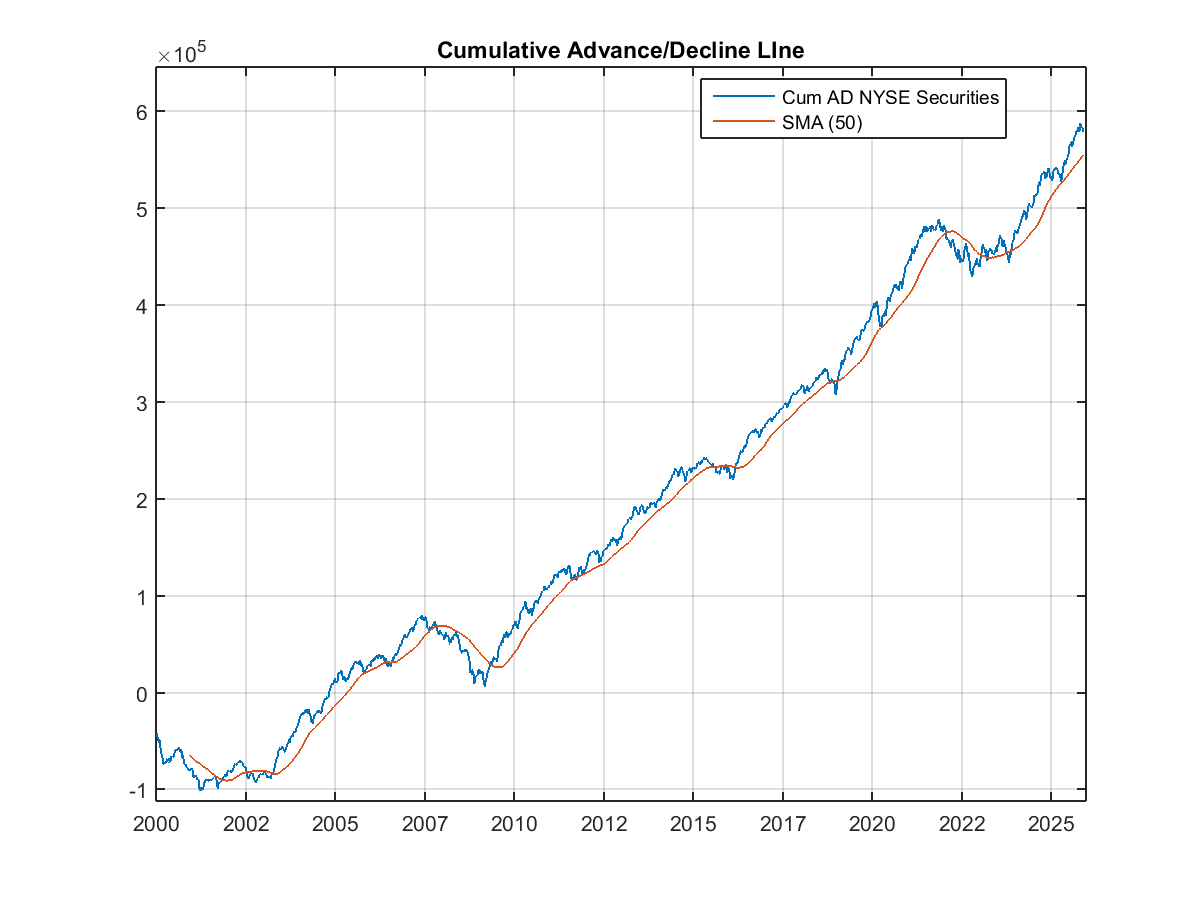

Market breadth weakened as the NYSE Advance-Decline Line broke below trend for the first time since March 28, though it managed to close near its weekly high. Meanwhile, the NYSE Operating Companies Advance-Decline Line remains well above its trend, a sign that internal participation hasn’t fully deteriorated.

Volatility also reemerged, with the CBOE Volatility Index (VIX) rising to its highest level since April’s tariff scare. The negative spread between the VIX and its futures, however, may suggest fear is becoming overdone, a potential contrarian tell.

From a tactical standpoint, the generals (QQQ) successfully defended the critical 575 support. The troops (IWM) briefly breached 230 intraday but closed back above that crucial level, and closed holding Monday’s opening ground. As for market leader NVIDIA, its daily relative strength index broke below 50 and now approaches oversold territory near 30, while its money flow index rises, a potentially bullish divergence. To lead the Nephilim, it should hold the 175 level on a weekly closing basis, with major support residing at 150.

In summary, the bears may take heart from Thursday’s record downside volume. Yet the bulls still retain the strategic ground. The generals, troops, and S&P 500 all closed above key support levels, and capital-weighted trends remain flush with liquidity. Halloween’s gravestone may still loom, but its bearish candies are growing stale. As we enter Thanksgiving season, perhaps focus shifts from fear to gratitude. For disciplined investors, managing risk with patience and poise over panic.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 11/24/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.