Volume Analysis Flash Update – 11.17.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

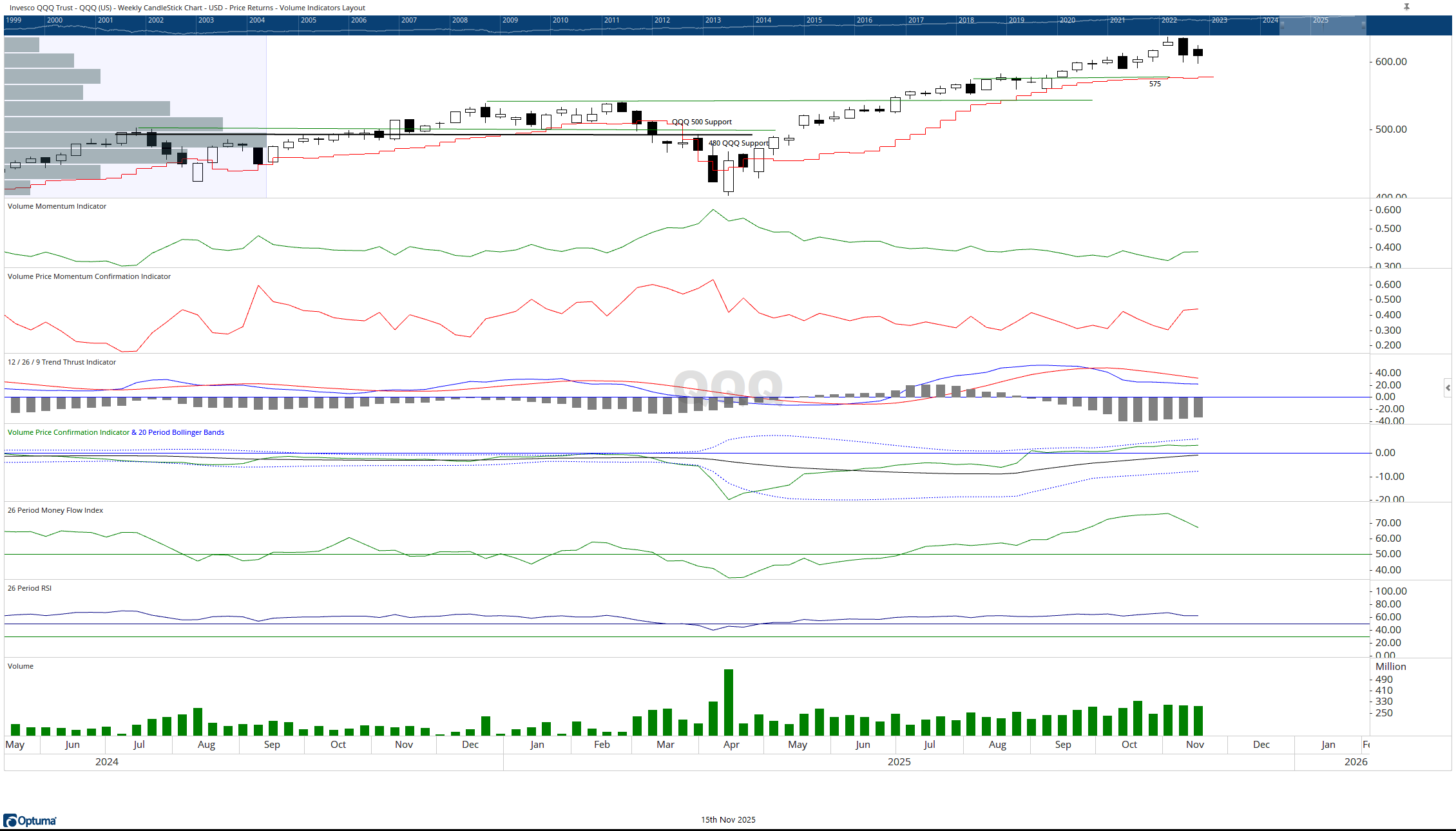

Gravestone Part III: Setting The Stage

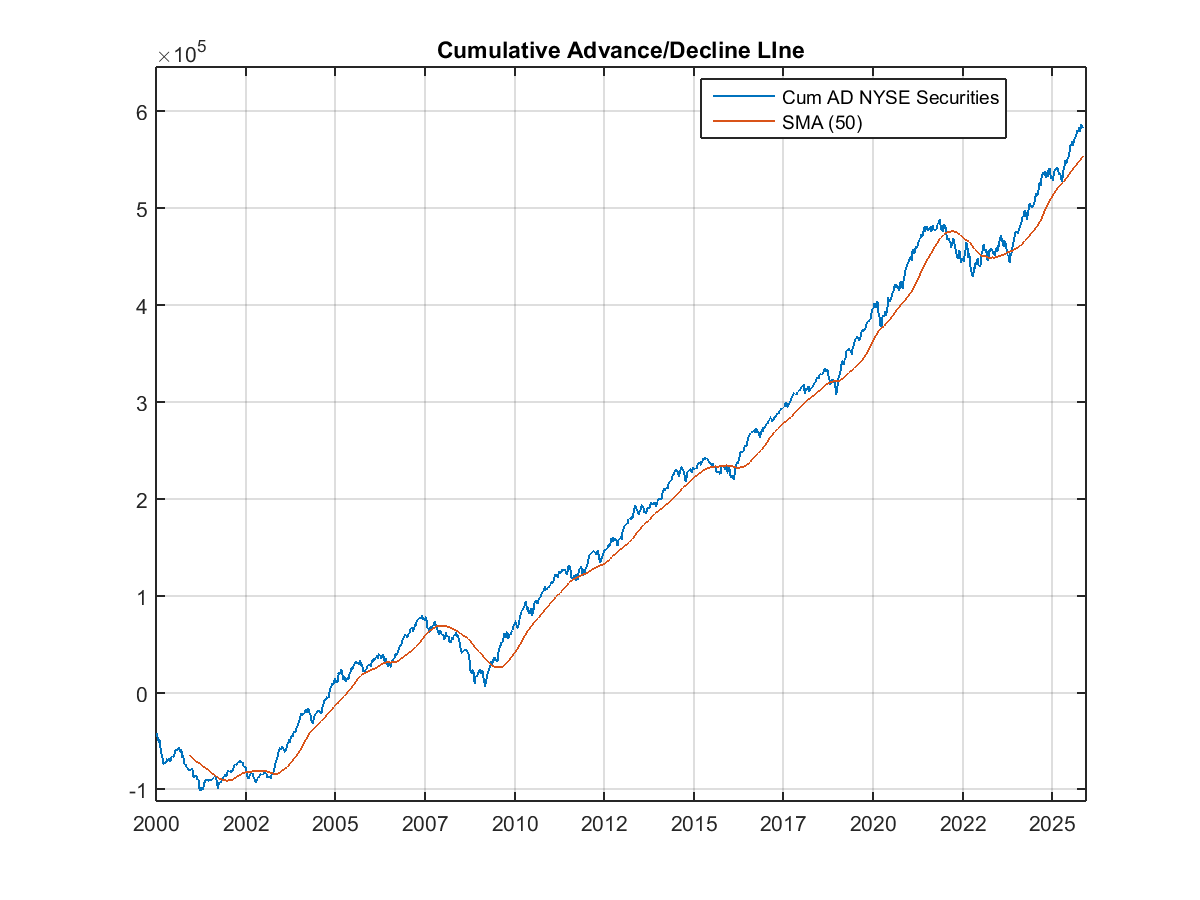

Two weeks ago, on Halloween, the S&P 500 closed the week forming a gravestone doji—a candle historically known for its ominous reputation. True to form, the market heeded that warning, delivering a bearish follow-through the following week. Yet just as the tombstone cast its shadow, a new pattern emerged last week, a potential shift in morale led by a dragonfly doji forming on the NYSE Advance-Decline Line, signaling the possibility of a broader based counterattack.

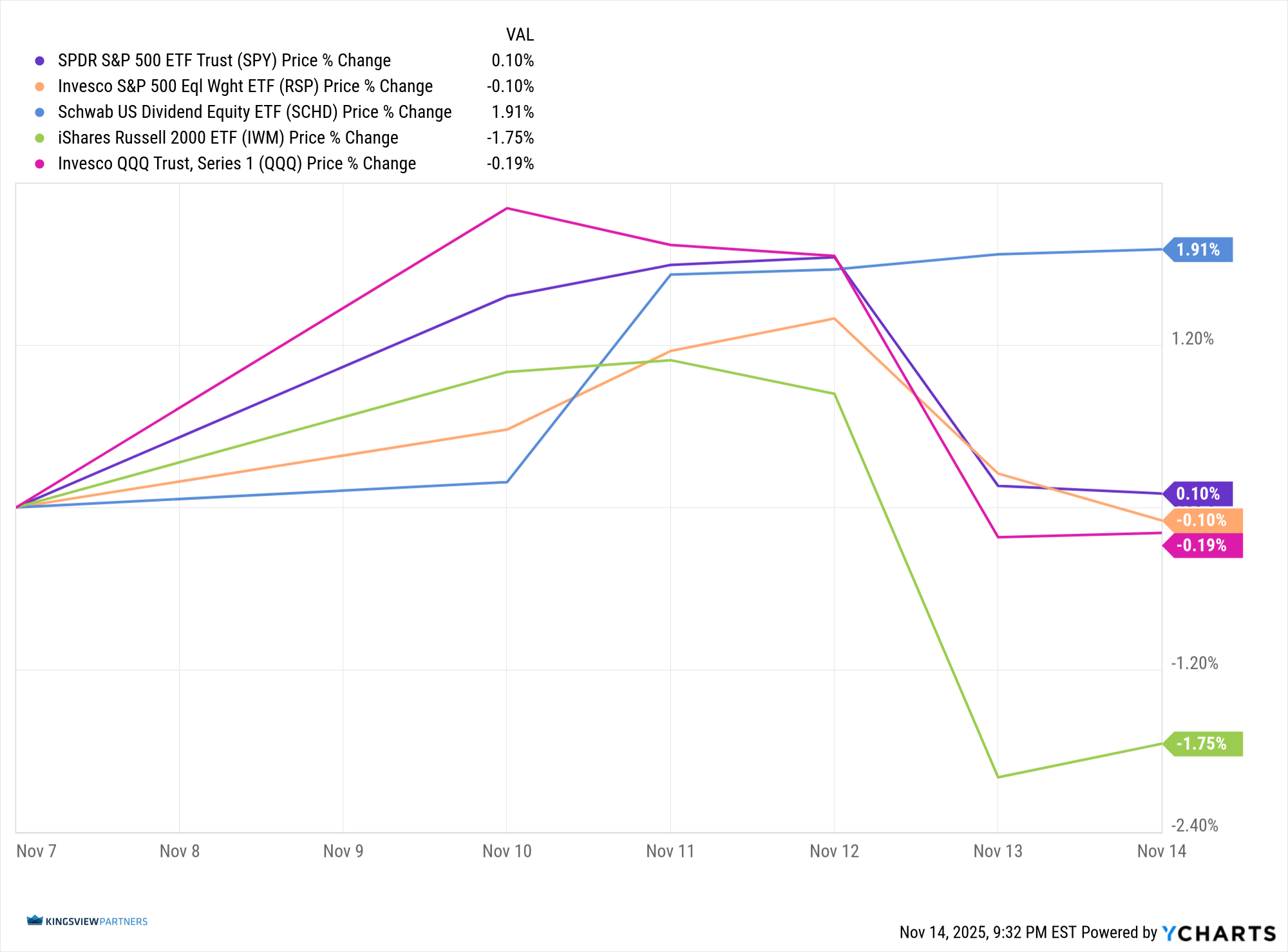

Despite the week’s turbulence, the SPDR S&P 500 ETF Trust (SPY) finished marginally higher, closing up 0.10%. The Invesco QQQ Trust (QQQ), representing the generals, lost only -0.19%. The Invesco S&P 500 Equal Weight ETF (RSP) lieutenants fell -0.10%, while the iShares Russell 2000 ETF (IWM) troops retreated more sharply at -1.75%. Amid the mixed battlefront, the Schwab U.S. Dividend Equity ETF (SCHD) brass commanders, rooted in quality and discipline, advanced 1.91%, proving again their defensive prowess.

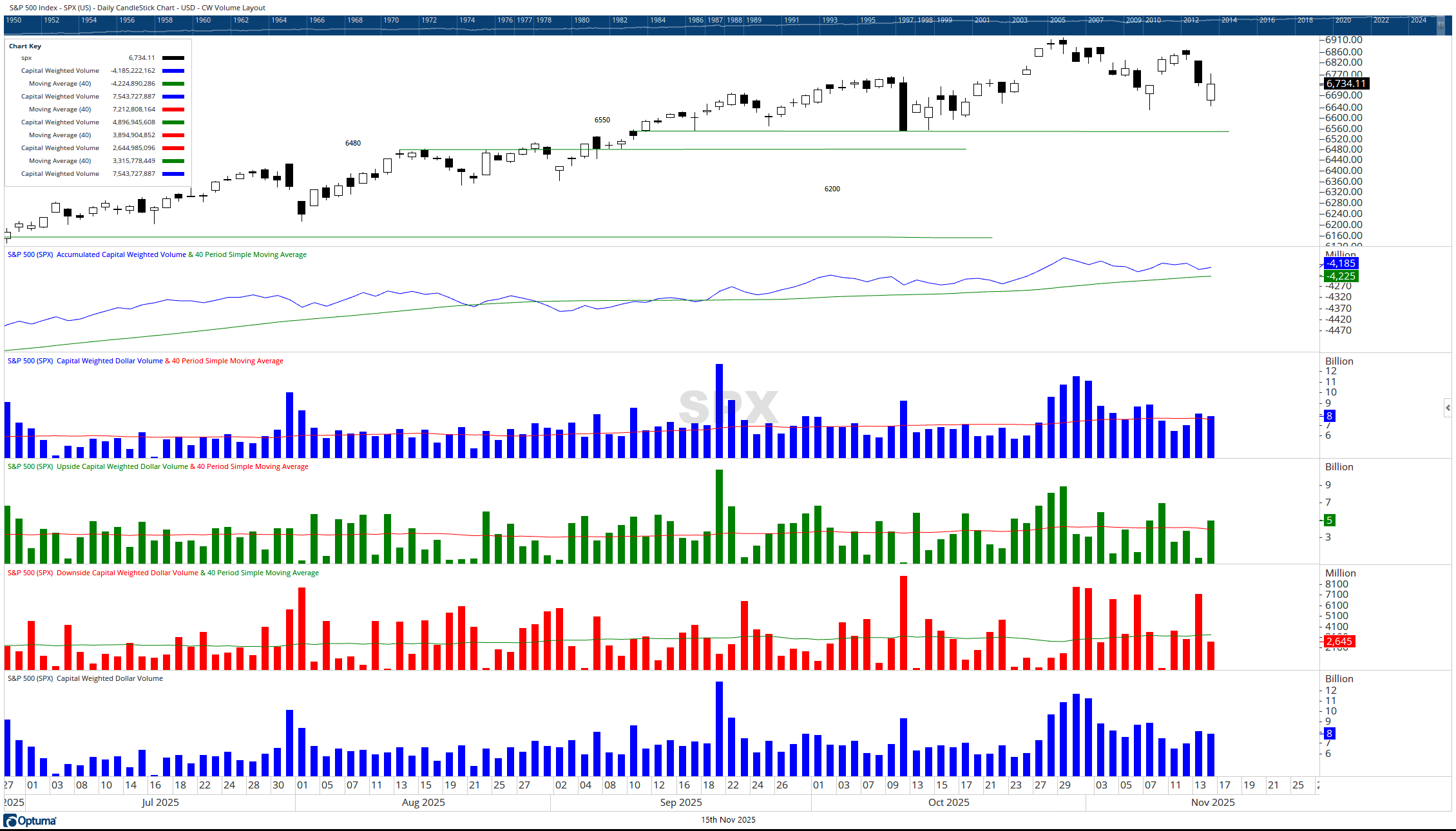

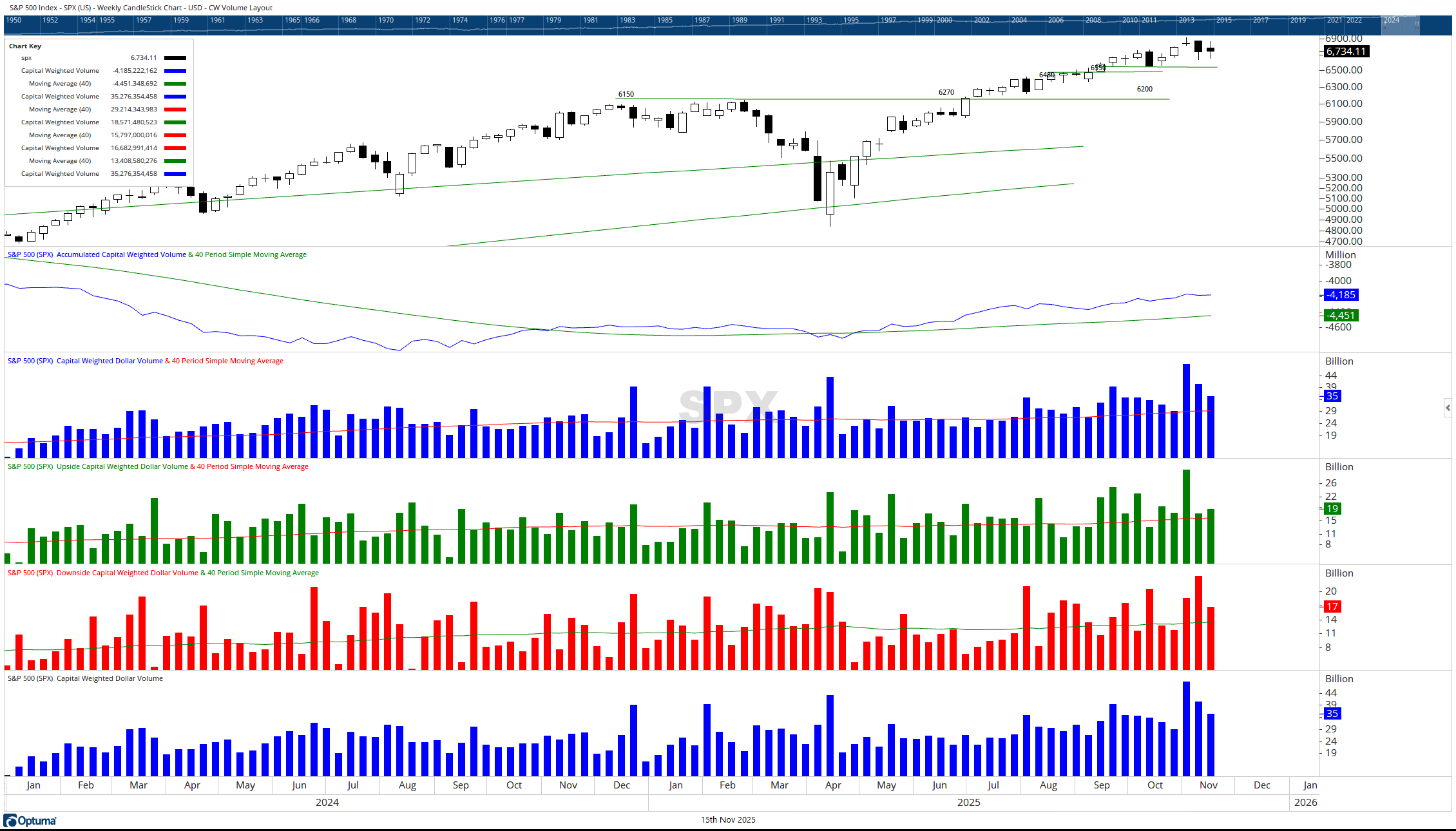

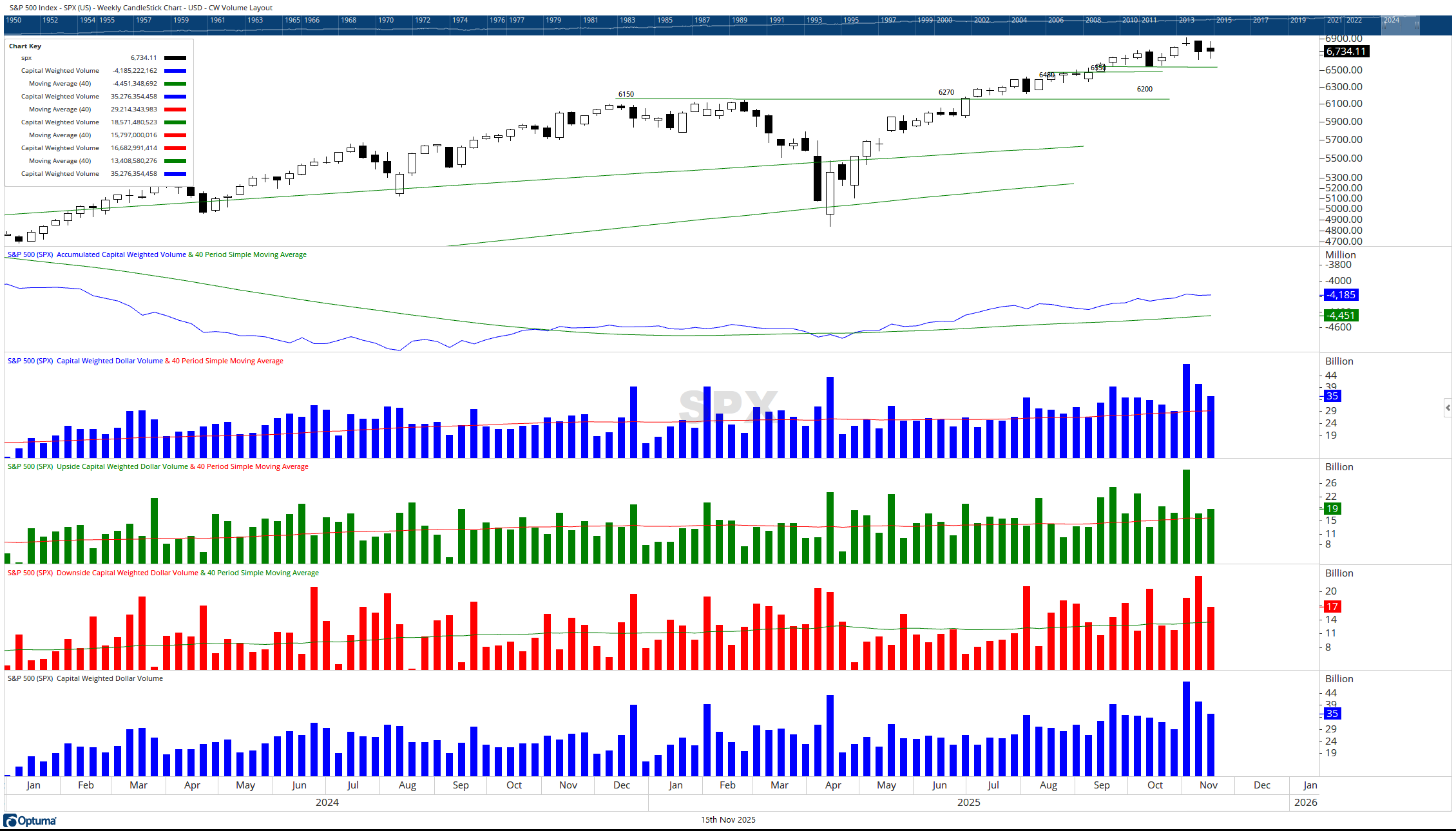

The S&P 500 traded entirely within the prior week’s range—a tactical pause between major offensives. A breakout above 6,883 or breakdown below 6,630 could mark the next decisive move. Nearby support lies at 6,475, with intermediate support near 6,200 and resistance at 6,920.

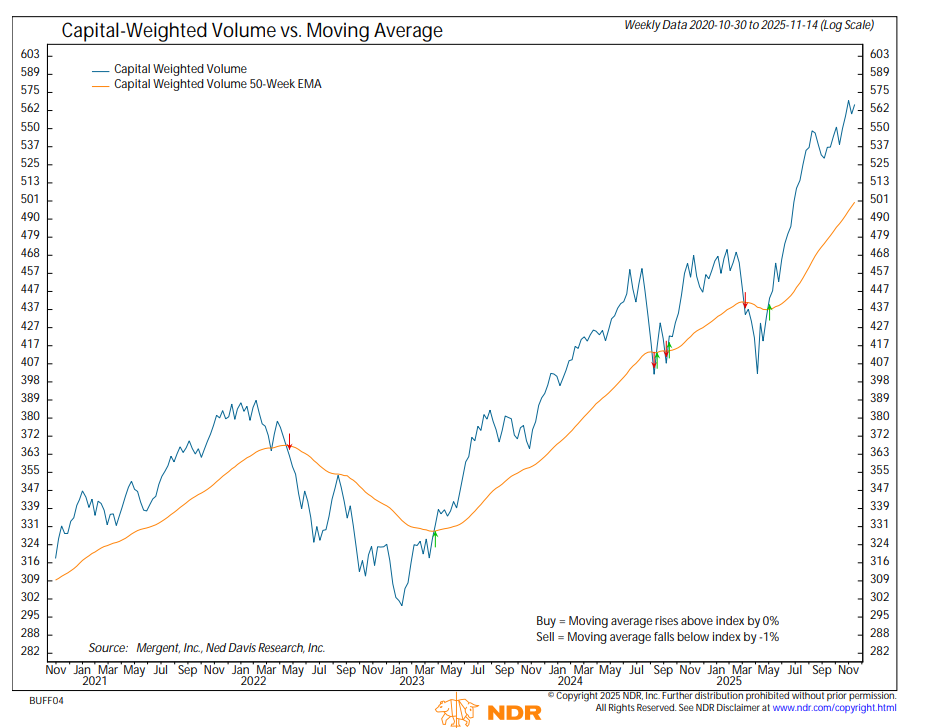

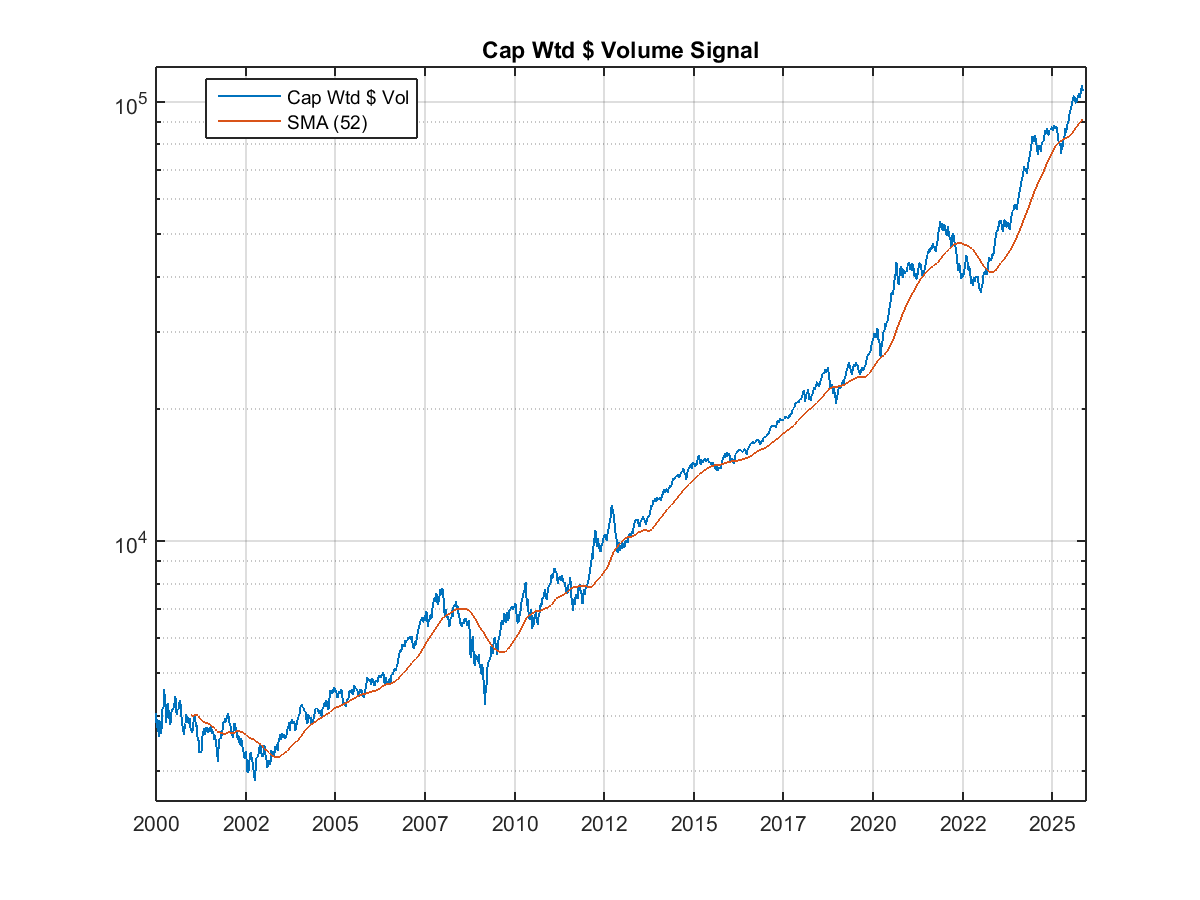

From a capital flow perspective, both inflows and outflows were above average on the week. The ratio of 53% inflows to 47% outflows suggests that, while the front lines remain contested, buying pressure continues to overmatch selling intensity. Meanwhile, both upside and downside capital-weighted volumes tracked near their typical averages, consistent with the theme of consolidation. The trend of both capital flows and capital weighted volume continue steadily higher.

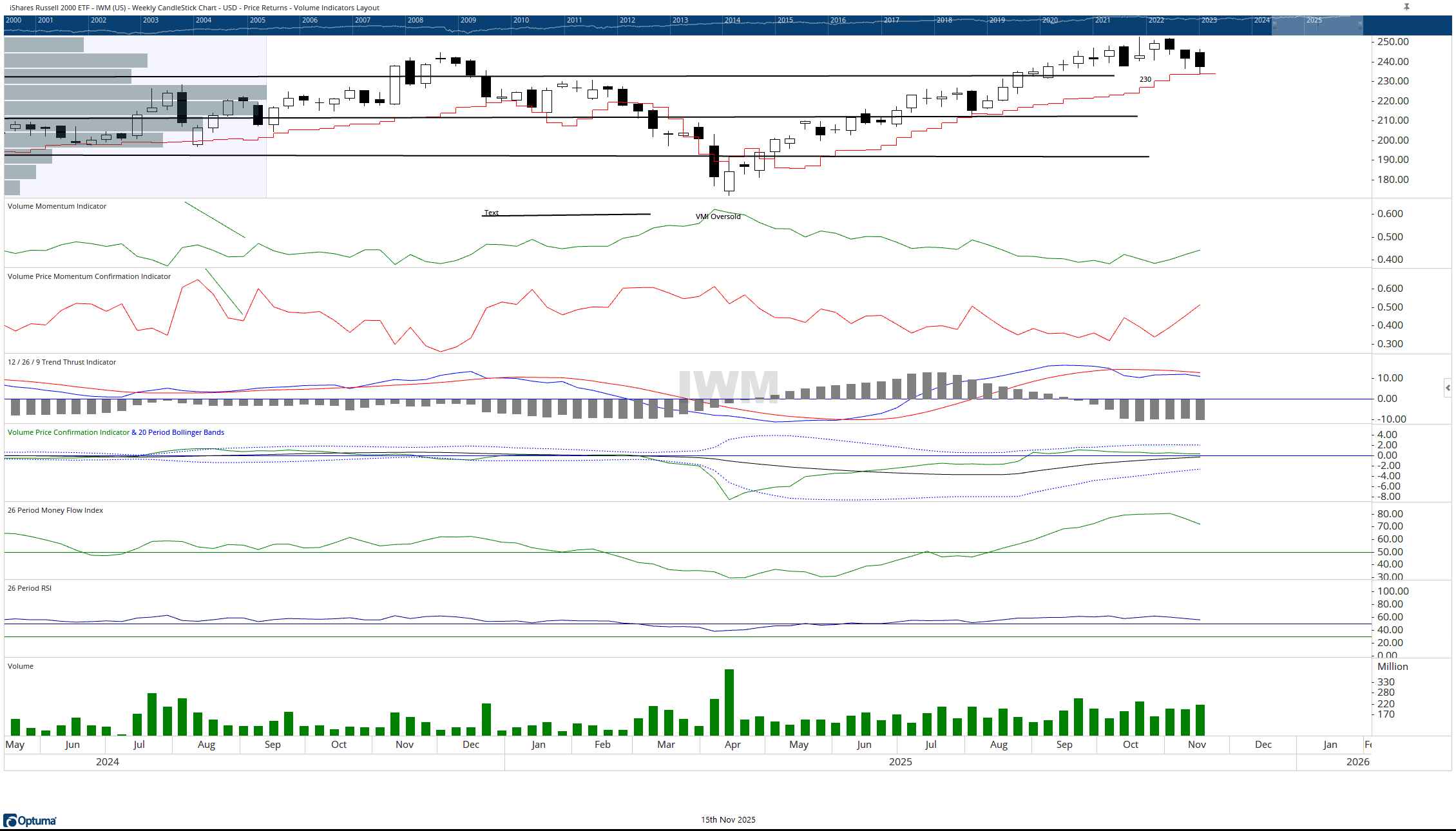

The NYSE Advance-Decline Line closed down on the week but remains above key support. The Invesco QQQ Trust held its lows, maintaining support around 575. The iShares Russell 2000 ETF likewise defended the 230 level, with its Money Flow Index at 72 and corresponding Relative Strength Index at 55, signaling a healthy fueled market.

Leadership may well hinge on the generals’ largest “Nephilim” — NVIDIA (NVDA) due to post earnings on the 19th. During its previous earnings report, short-term volume momentum appeared slightly weak while intermediate momentum remained strongly robust. This time, the landscape looks different. Short-term volume momentum now leads price momentum (55 vs. 50), while intermediate money flow has slipped from the high 90’s to just 50, trailing relative strength at 62. The balance of intermediate money flow and short relative strength, both at the mid-point level of 50, reflects an uneasy truce between buyers and sellers, adding intrigue to the powder keg. A break above resistance near 205 or below 183 could determine NVDA’s next advance, with intermediate support at 175 and major support at 149 marking critical inflection points for the supreme leader of the generals.

The current theater suggests neither total victory nor defeat. The gravestone’s warning was heeded, yet the dragonfly’s wings hint at resilience. In military terms, the front has stabilized creating an uneasy ceasefire before the bull’s champion takes center stage this week.

For disciplined investors, the message remains unchanged: manage risk as commander of their forces, protecting capital first, advancing as conditions favor success. Markets, like battlefields, reward those who combine courage with caution, patience with preparation, and strategy with discipline.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 11/17/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.