Volume Analysis Flash Update – 11.10.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

“From Gravestone to Dragonfly: Hope Arises from the Battlefield”

Halloween’s gravestone doji was true to its reputation serving as an early epitaph for the recent rally. The tombstone trade proved fatal for the generals of the advance, while the brass commanders once again demonstrated their resilience when under heavy fire. Yet, even in the aftermath of heavy shelling, a new sign appears on the horizon. This time, one not of doom, but of potential deliverance.

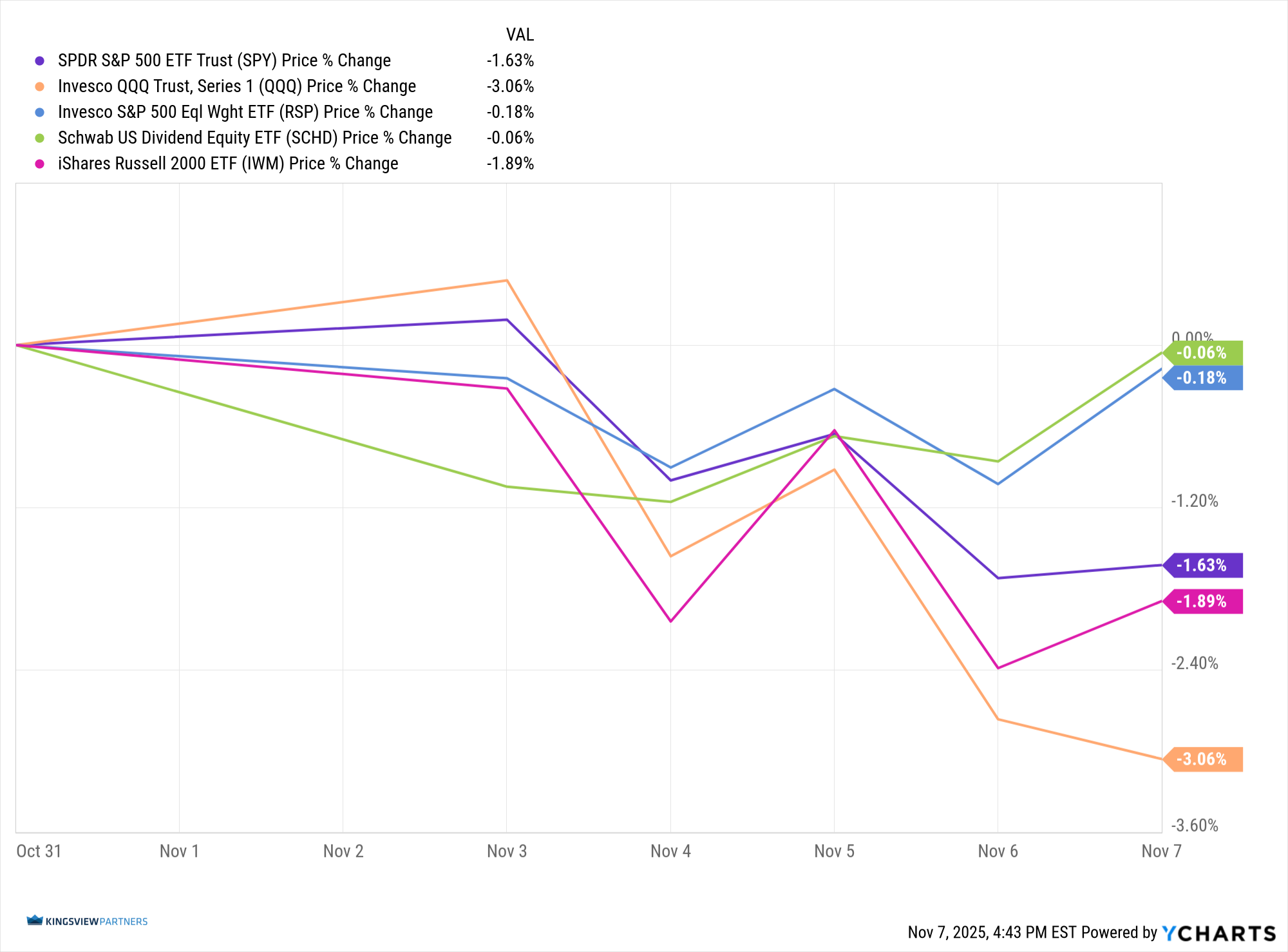

Last week, the Invesco QQQ Trust, Series 1 (QQQ), representing our generals, led the retreat, falling -3.06%. The iShares Russell 2000 ETF (IWM) troops followed, down -1.89%. Yet the brass commanders of dividend discipline, the Schwab U.S. Dividend Equity ETF (SCHD), stood their ground nearly unscathed at -0.06%, joined by the Invesco S&P 500 Equal Weight ETF (RSP) lieutenants, off a modest -0.18%. Even the flagship SPDR S&P 500 ETF Trust (SPY), though retreating -1.63%, managed to preserve some of its prior gains.

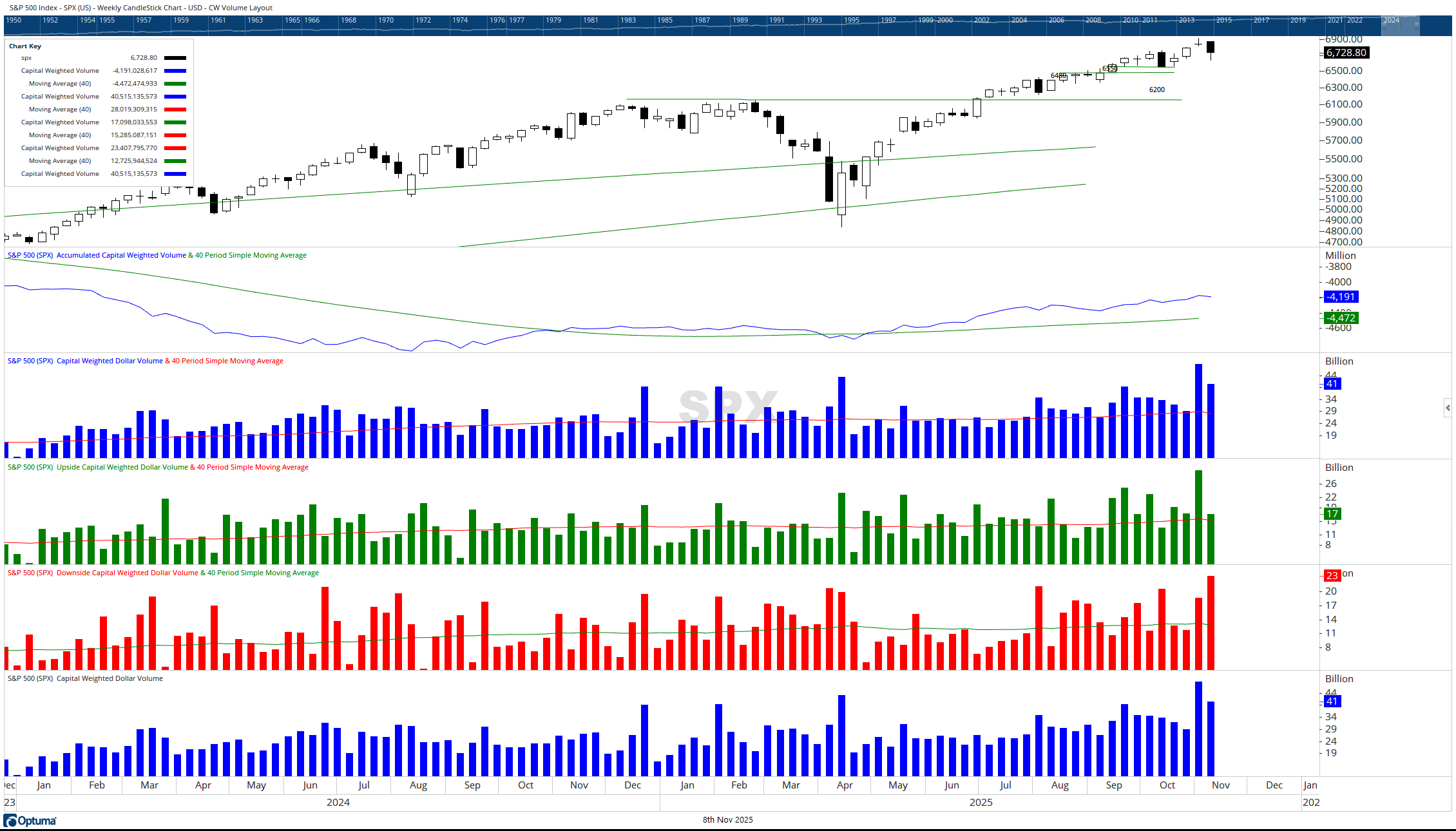

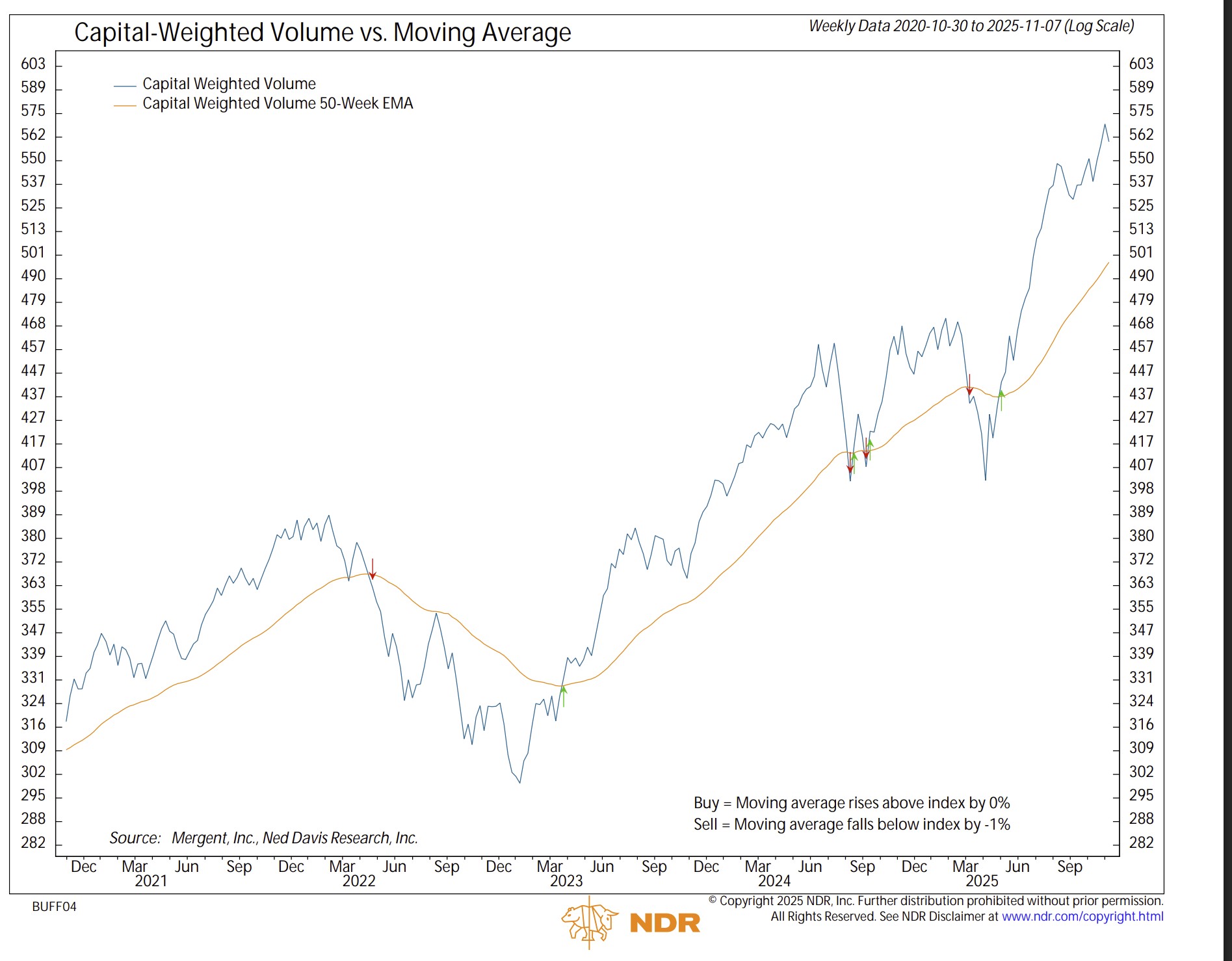

Despite the losses, some of the campaign’s undercurrents tell a more nuanced story. Capital-weighted dollar volume remained exceptionally high but fell short of last week’s record-setting barrage. Highlighting the bearish campaign, downside capital flows registered the strongest on record, even surpassing June 21, 2024—the week that inspired our “And Then There Were None” series. Yet, amidst the carnage, not all was lost. S&P 500 inflows stayed above average, and notably, no 90% outflow days emerged. Thursday came close at 85%, a figure mirrored in downside volume metrics earlier on Tuesday. Despite heavy capital flow, weekly upside and downside capital weighted volume both tracked closer to trend, perhaps implying that the gravestone’s grip may already be loosening.

Even with accumulated capital-weighted volume and capital-weighted dollar volume both turning sharply lower, each continues to make higher highs and higher lows, remaining well above trend and signaling the underlying strength of this bull market’s longer-term logistics.

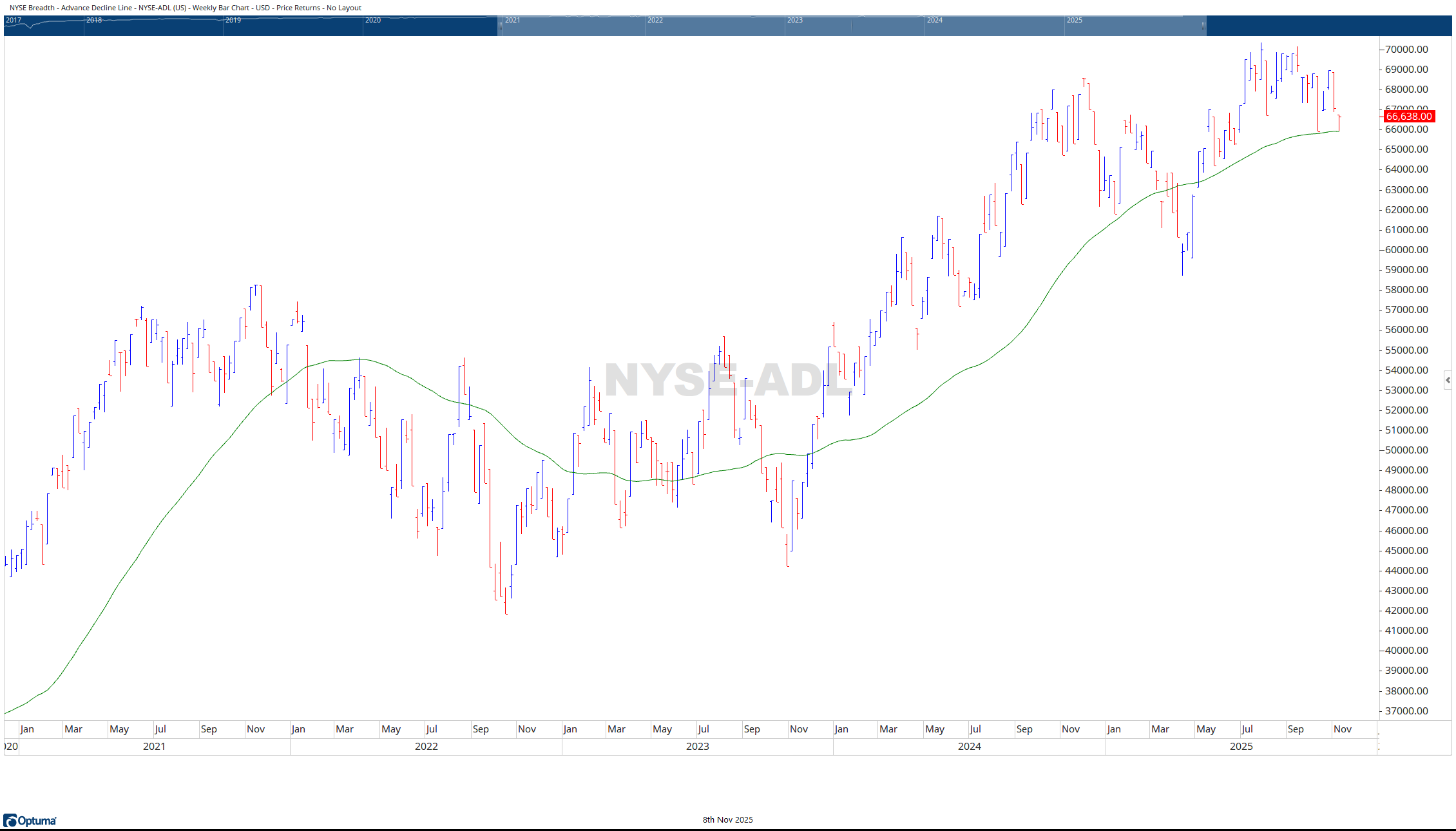

On the front lines of market breadth, the NYSE Advance-Decline line fell early in the week, only to mount a comeback by Friday to close near the week’s open. The resulting pattern forms a dragonfly doji, the mirror inverse image of last week’s gravestone. In Japanese candlestick terms, where the gravestone warns of endings, the dragonfly whispers of new beginnings. It suggests that, even after the selloff, buyers returned to the field, perhaps signaling a tactical reversal in the broader campaign.

The generals (QQQ), though wounded, remain positioned above key support near 575. The troops (IWM) likewise regrouped, upholding the critical 230 support line. Holding these levels may be crucial to maintaining a bullish battlefront in the weeks ahead.

In summary, last week’s gravestone fulfilled its grim prophecy, but this week’s dragonfly offers a glimmer of hope, a sign that what was intended to be buried may not yet be dead. As always, risk management remains the commander’s compass. Successful investing, like warfare, is not about avoiding every ambush, but surviving them, emerging disciplined, deliberate, and ready for the next engagement.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 11/10/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.