Volume Analysis Flash Update – 11.3.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Trend or Trick - Gravestone on Halloween

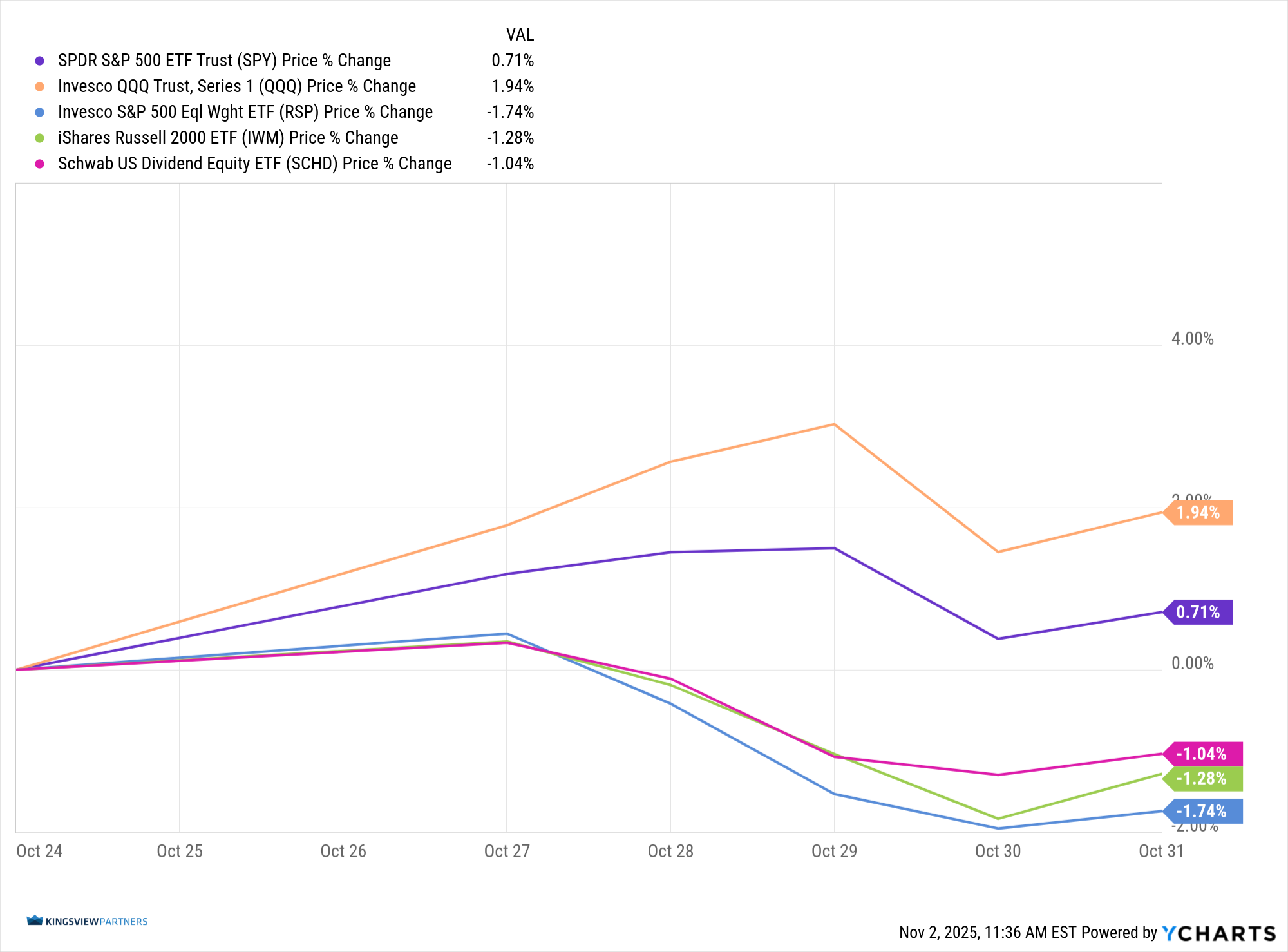

The generals (Invesco QQQ Trust, QQQ) led a strong charge this past week, advancing 1.94%, but most other units failed to follow, instead falling into retreat. The surging troops (iShares Russell 2000 ETF. IWM) closed negative, down -1.28%, while the dividend commanders (Schwab U.S. Dividend Equity ETF, SCHD) lost -1.04% on the week.

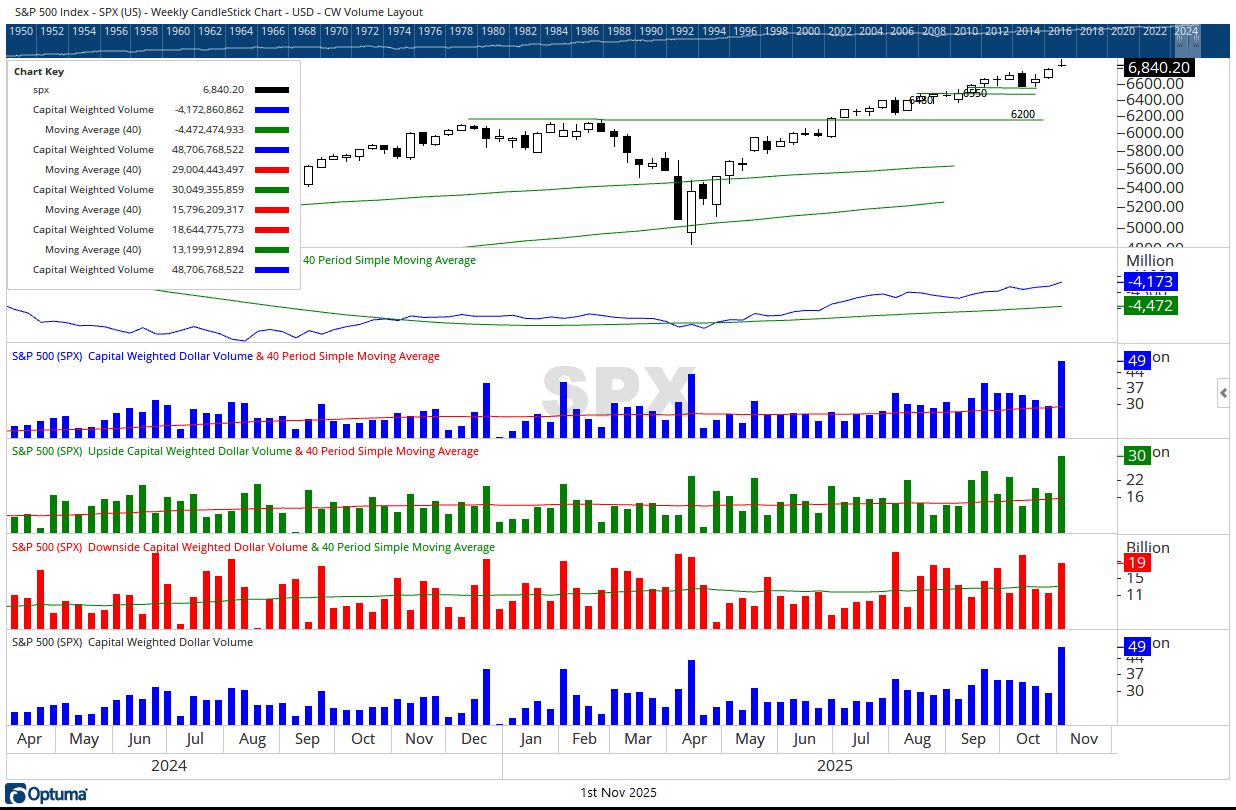

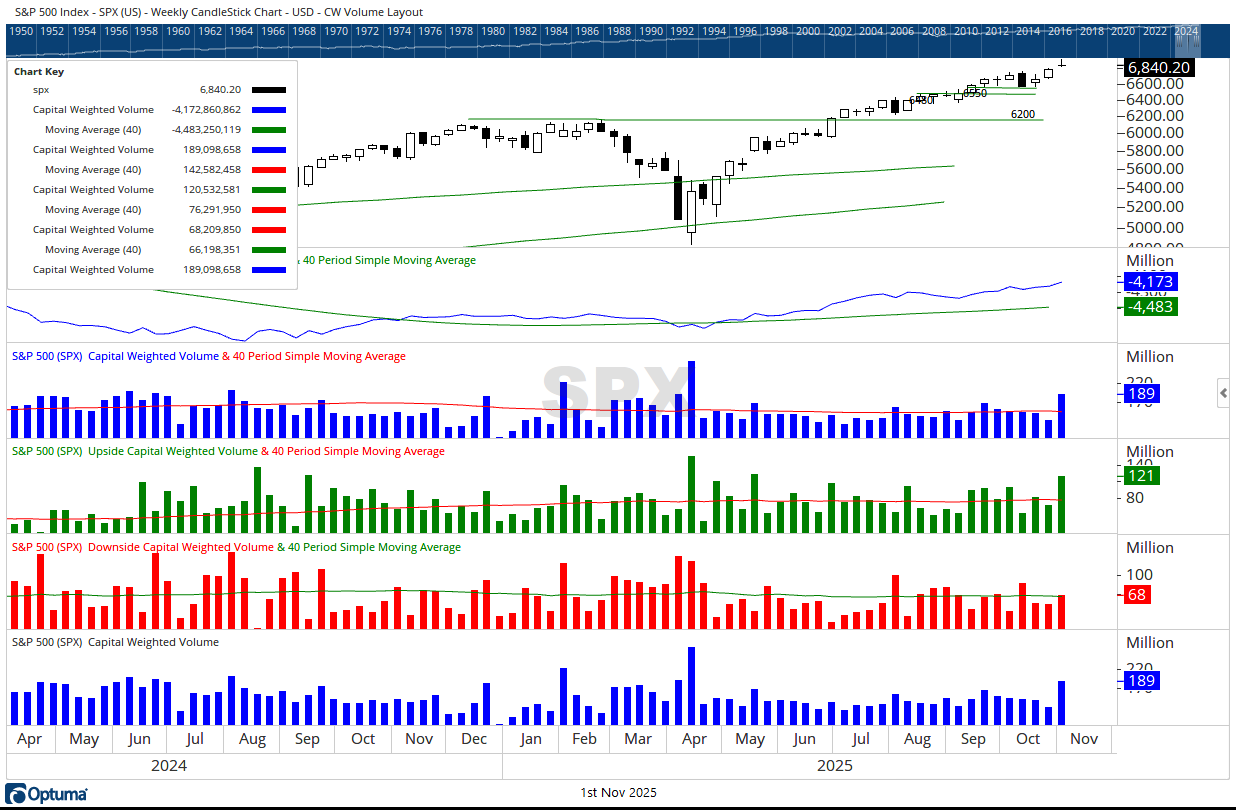

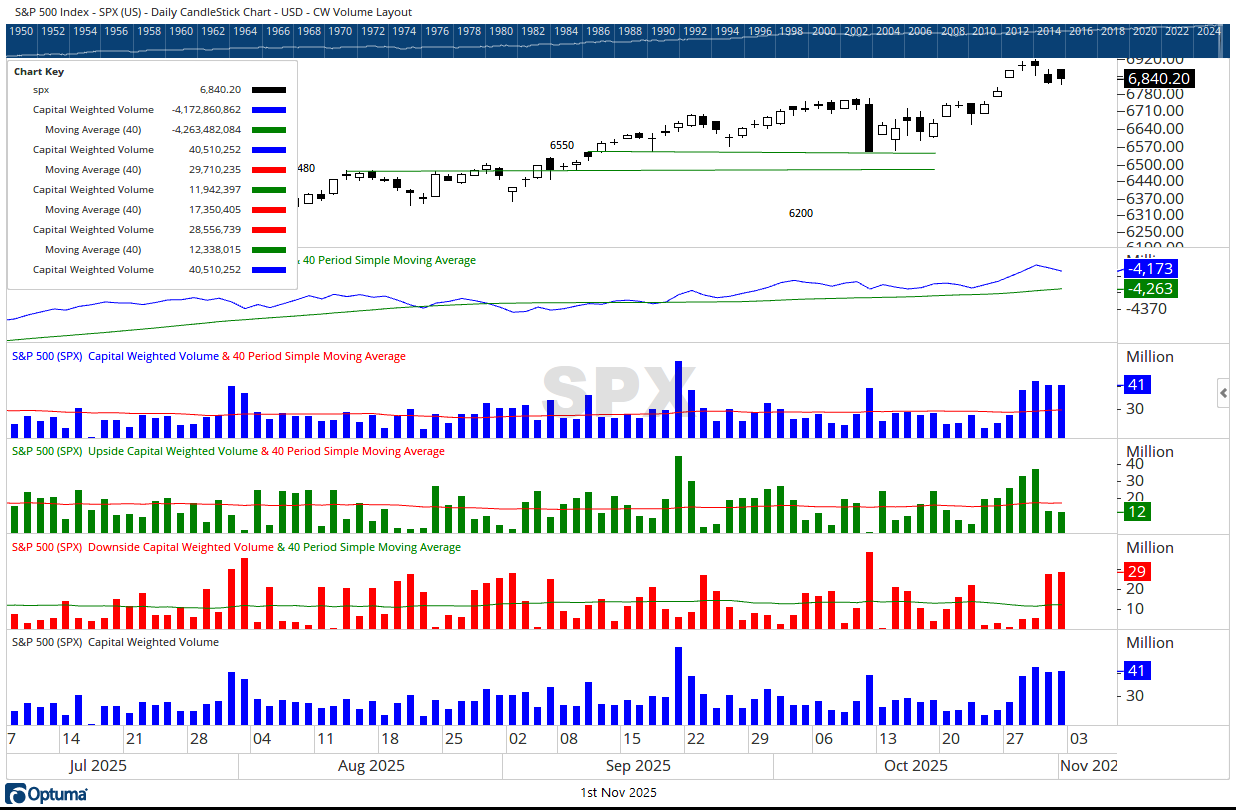

Monday began the week opening with an upside gap on light volume on a strong 96% upside capital weighted volume day. Tuesday brought heavy trading just shy of a 90% upside day (86%). Wednesday delivered the full package: a 93% upside capital-weighted volume day on high participation across most sectors. However, Invesco QQQ Trust (QQQ) printed a doji star – an early warning of fatigue. By Thursday and Friday, the bears took the field with the highest capital flows of the week. Trading remained balanced, but approximately 70% of those end-of-week flows were attributed to the downside.

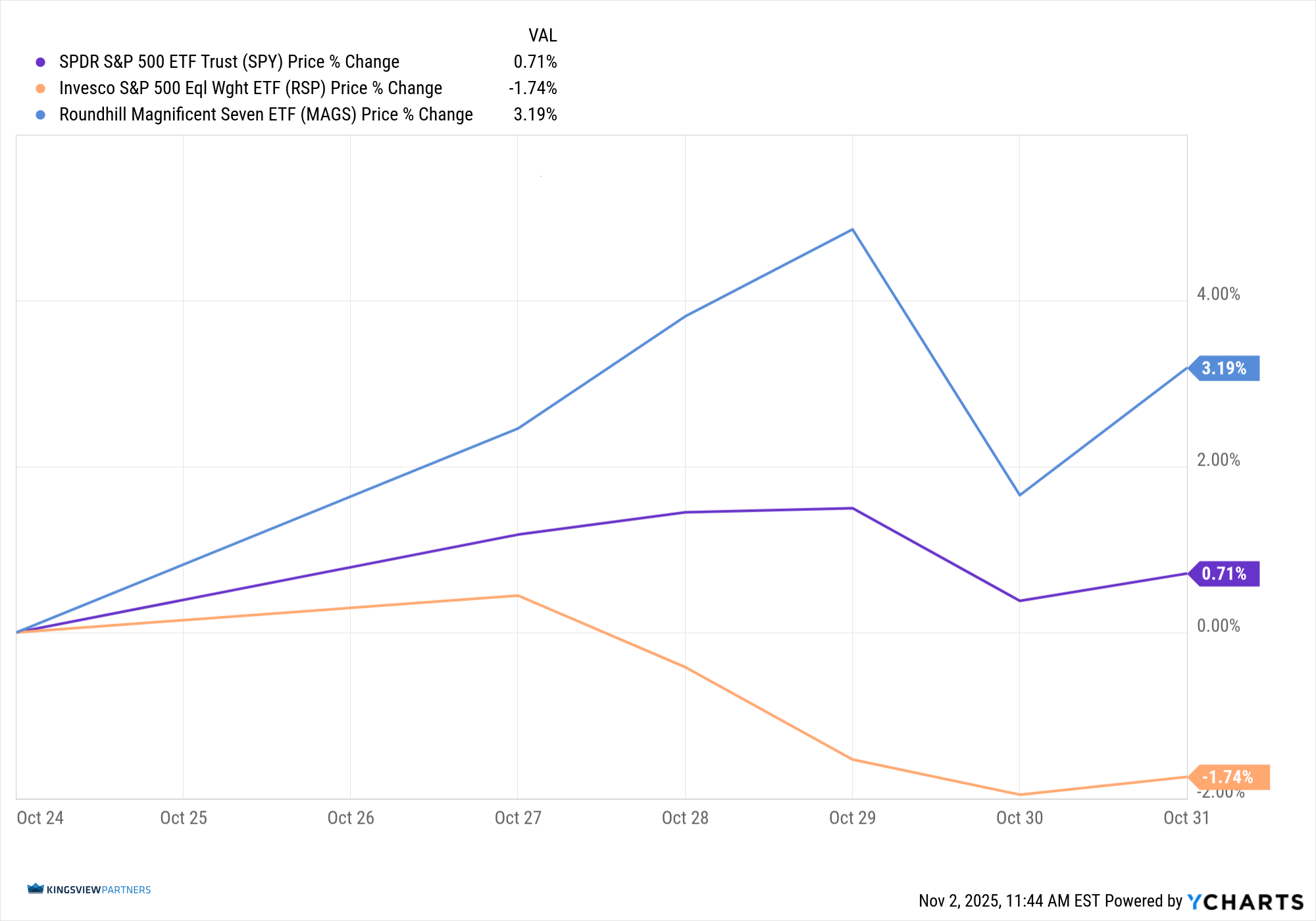

It was the mighty Nephilim of old leading the general’s charge, with five of the Magnificent Seven reporting earnings. Their advance carried the Roundhill Magnificent Seven ETF (MAGS) up 3.19% on the week. In stark contrast, the equal-weighted brass commanders, Invesco S&P 500 Equal Weight ETF (RSP), retreated -1.74%. This divergence of nearly 5% between equal-weight and concentrated leadership reflects a narrowing advance. The generals are marching ahead with the troops digging in, while the middle ranks, under heavy clouds, went into retreat.

More Candlestick Formations: Gravestone Doji at All-Time Highs

For the week, the S&P 500 closed with a rare Gravestone Doji, In Japanese candlestick analysis, the Gravestone Doji represents a failed rally and the potential “death” of an uptrend. It is a potential warning that buyers lost their grip and that selling pressure may soon overtake demand. This rare formation occurred even as the price index made new all-time weekly and intraday highs on high trading volume creating a strangely wrapped nugget for trick or treaters to consider.

Gravestone Structure:

The market opened with an upside gap above prior highs, surged intraday to fresh records, then reversed lower, closing near the weekly open as well as the low. Volume was exceptionally high, suggesting emotional participation from both breakout buyers and profit-taking sellers.

Gravestone Psychology:

The S&P 500’s upside gap reflected strong bullish conviction, possibly even a degree of panic buying. Yet by the close, those ghostly gains mostly evaporated, perhaps revealing institutional distribution. The long upper wick reflected exhaustion, where early demand was eventually mostly absorbed by supply.

Considering capital-weighted volume, upside volume dominated early in the week even as prices later weakened. This could be a sign of mild institutional distribution. Should net capital flows turn negative, this gravestone doji may signal a potential exhaustion marker. However, if capital inflows persist, demonstrating follow-through resumed buying, this rare candle could prove to be a mere test of breakout conviction rather than a temporary top.

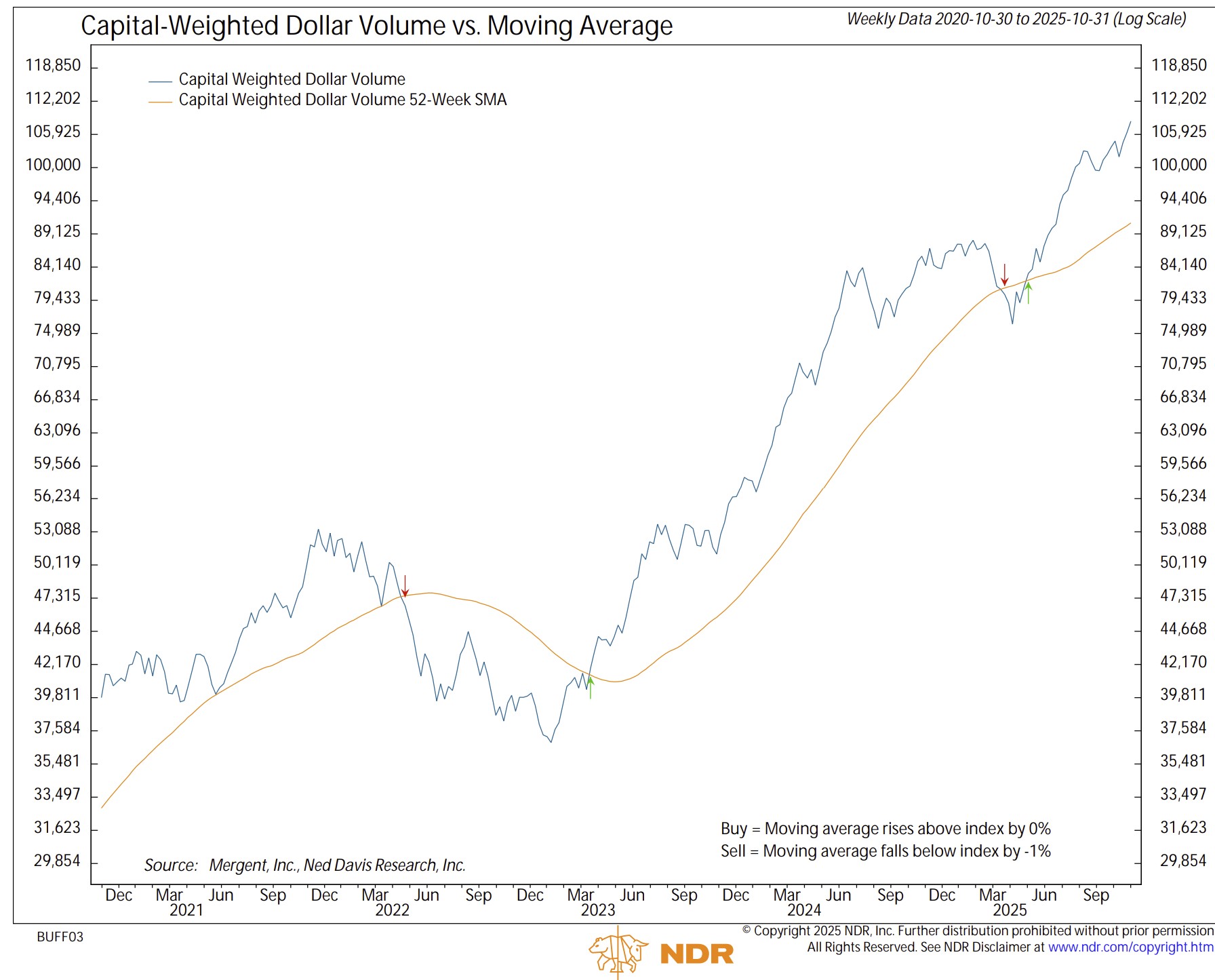

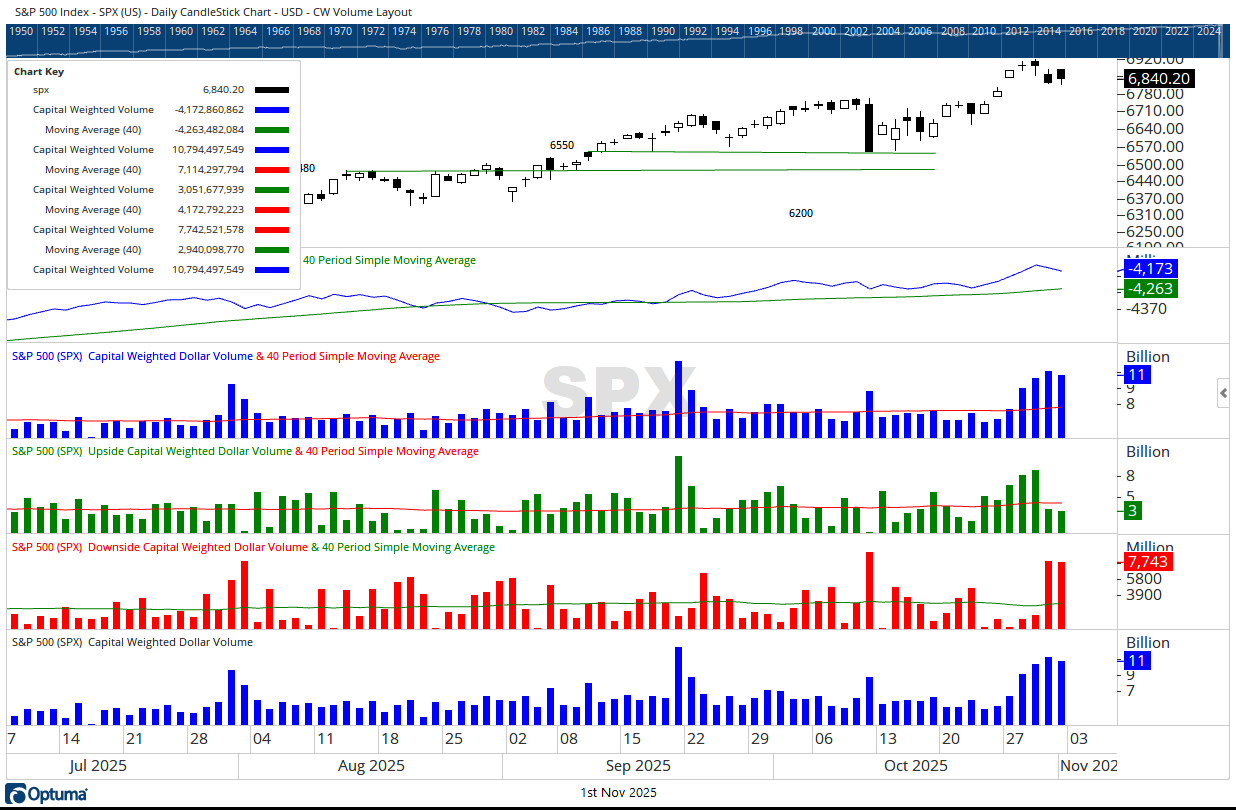

Meanwhile, volume continues to rise, even from the grave. On the week, capital-weighted volume was highly elevated, with 64% of capital-weighted activity to the upside. Dollar-weighted volume was an historic standout. More capital traded hands this week than in any prior week on record, even surpassing the high-volume rebound of April 11th. Total and capital inflows were exceedingly strong, while downside flows rose back to average levels.

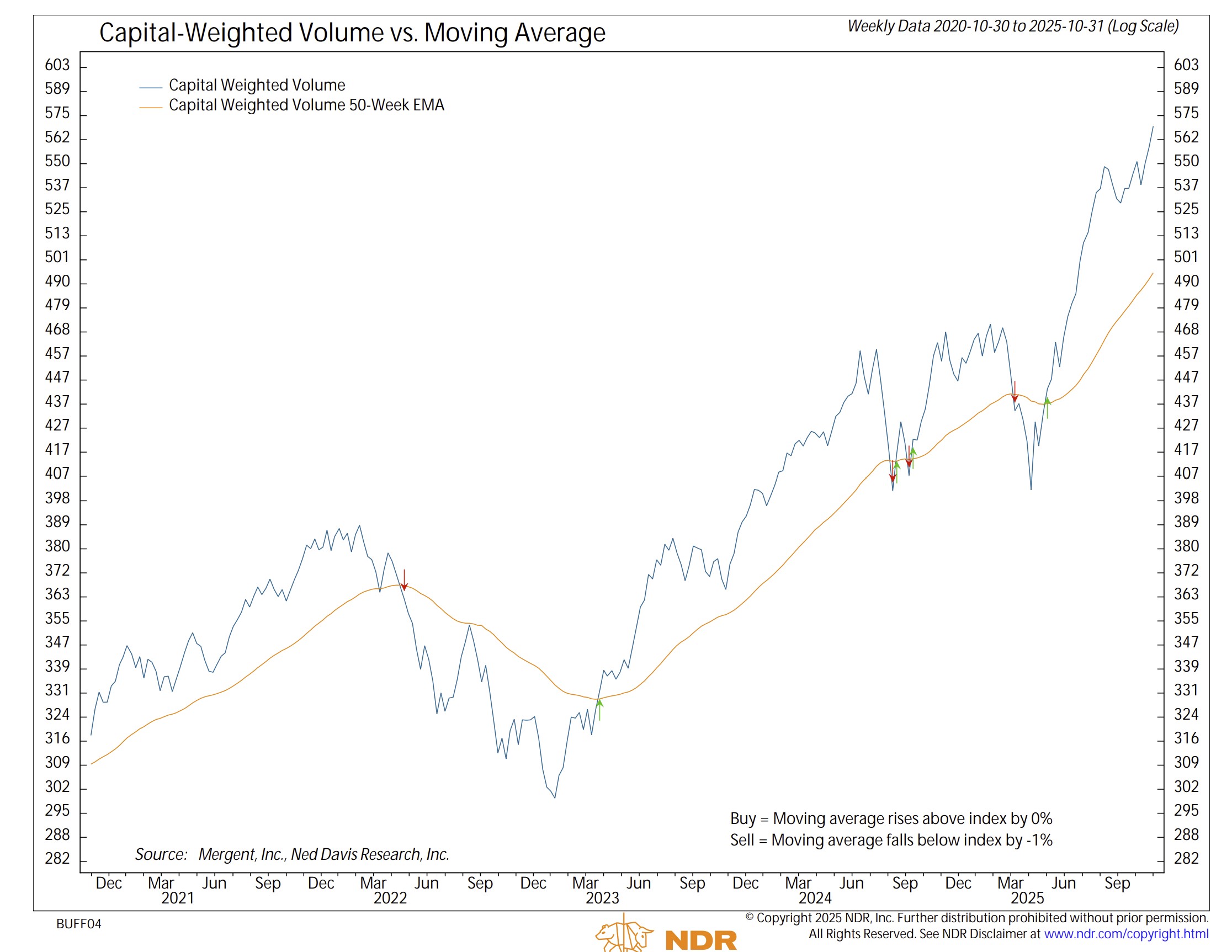

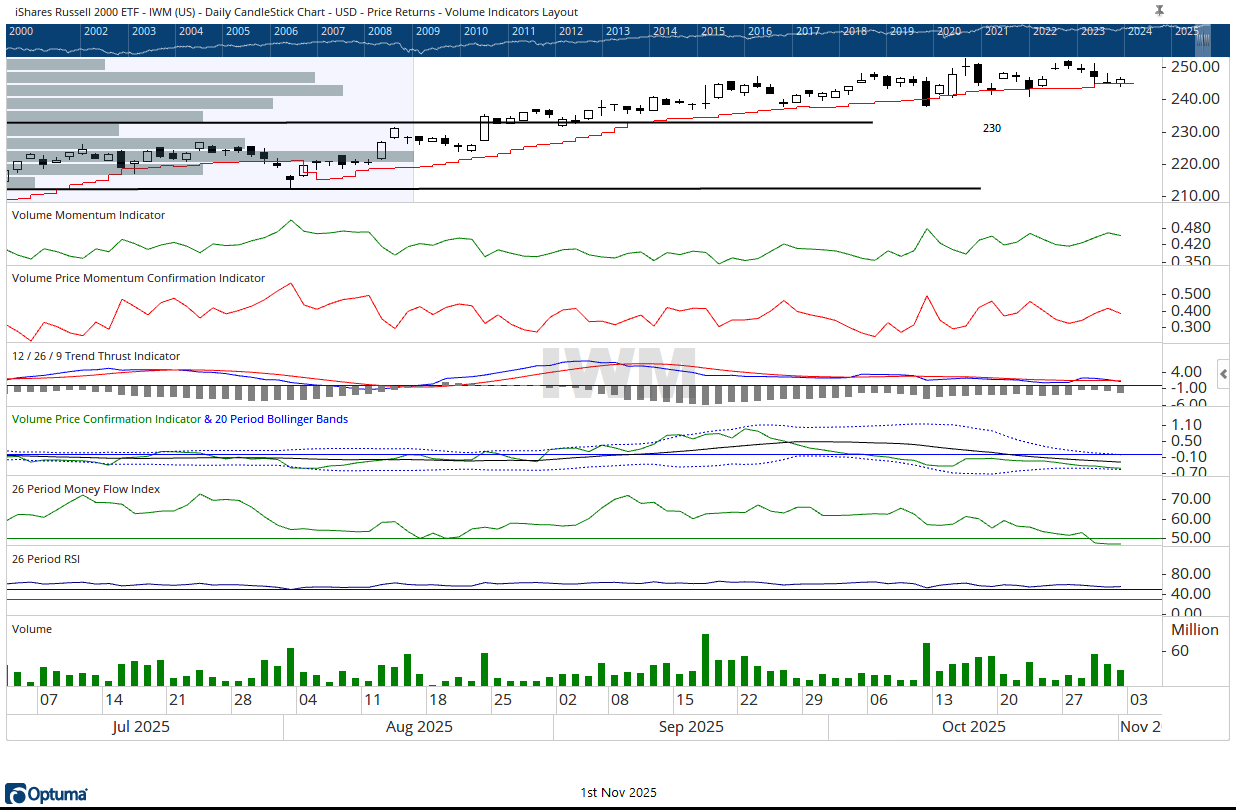

For the week, both the accumulated trends of capital weighted volume and dollar volume continue to march to all-time highs. Market breadth, however, weakened, falling back into its previous range and nearing trend support. The iShares Russell 2000 ETF (IWM) money flow index slipped below 50, signaling a shift from positive to negative internal volume-weighted momentum. The 240 level now represents IWM’s critical short-term support level. Counting the previous Friday, the generals (QQQ), recorded three consecutive upside gaps followed by a fourth which turned into a doji star on Wednesday. A doji star is known as a classic sign of short-term exhaustion or indecision at altitude. So far so good, as Wednesday’s top has become the weekly and all-time QQQ highs.

Haunted Highs? Clouds Gather, but Hopeful Rays Remain

The S&P 500 closed this week at record weekly highs, with doji formations summoning fatigue with capital surging through narrow leadership channels. In this way, the market appears caught between confidence and caution. The clouds forming at these elevations may not yet signal a storm, but foggy outlooks may suggest a call for vigilance.

For investors, this might be a time to tighten formations, reaffirm risk parameters, rebalance exposure, and ensure a disciplined defense remains in place. As in any campaign, victories are preserved not by unchecked advance, but by prudent management of position, terrain, and supply lines. In investing terms: position sizing, diversification, and adaptive risk management are our lines of defense when gaps and ghosts may haunt the market’s summit.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 11/3/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.