Volume Analysis Flash Update – 10.27.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Clouds Clearing as Market Forces Advance

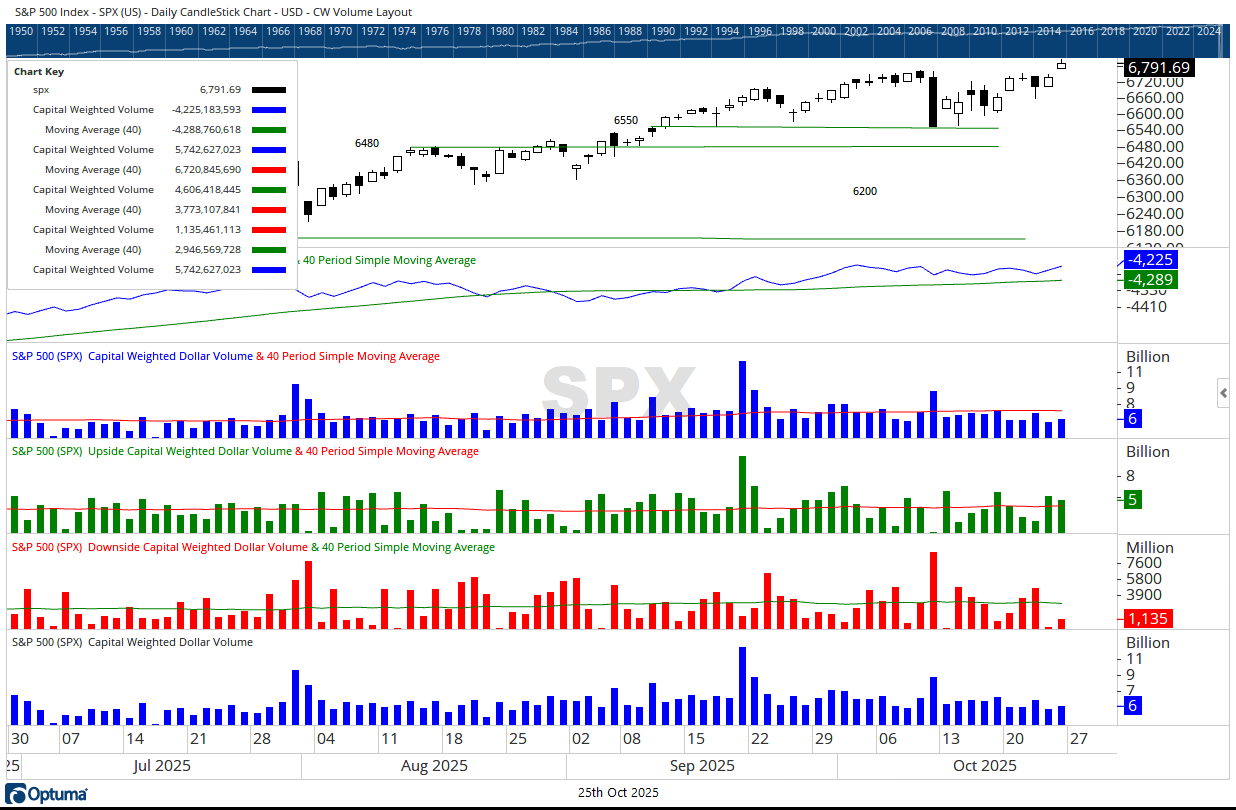

The S&P 500 Index broke above last week’s outside bar’s resistance to record a new all-time high. Although Thursday’s narrow inside session may have appeared unremarkable on the surface, the underlying dynamics told a more powerful story: upside volume overwhelmed downside volume by roughly 9-to-1, and capital inflows accounting for 94% of total activity creating the fuel propelling Friday’s breakout.

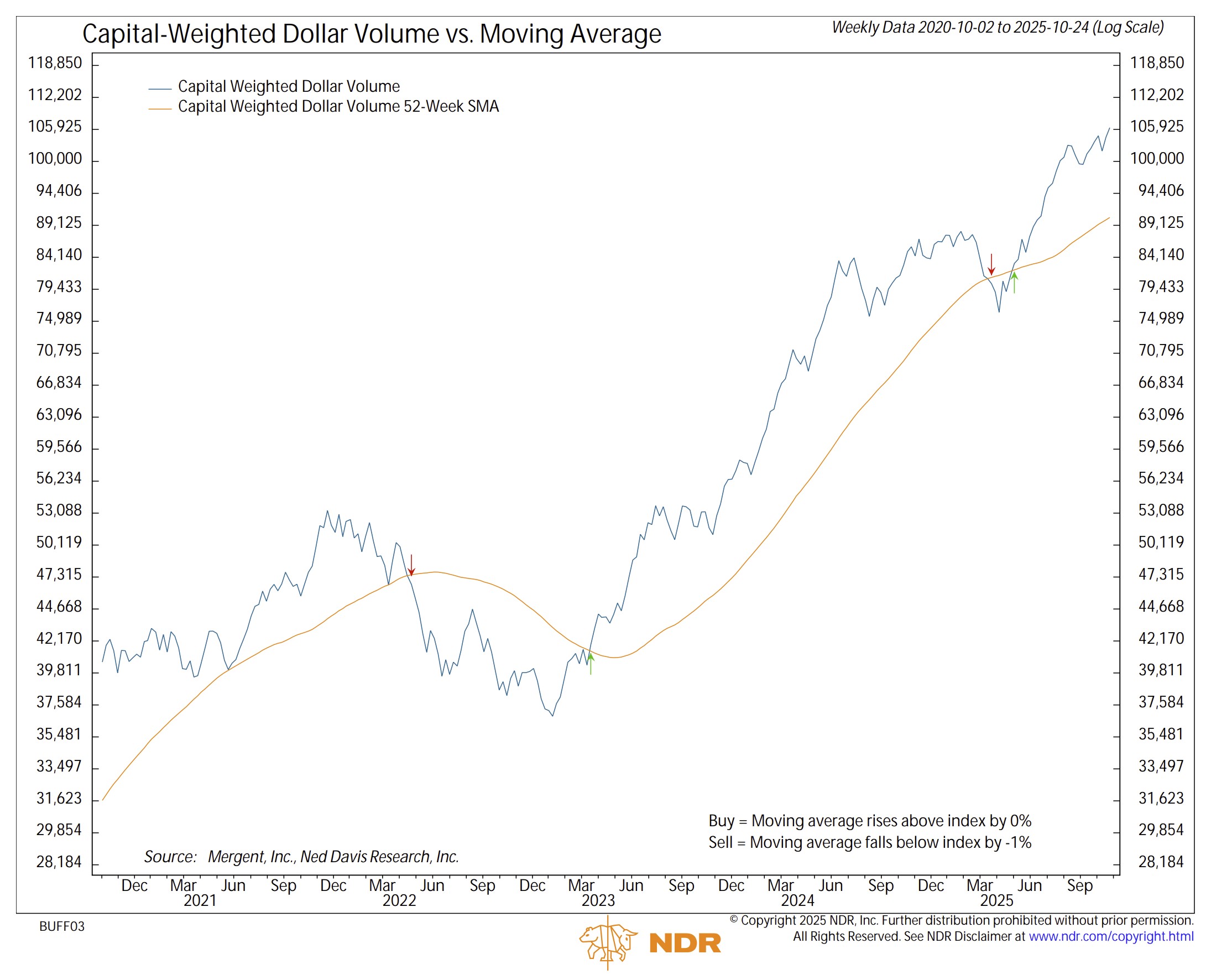

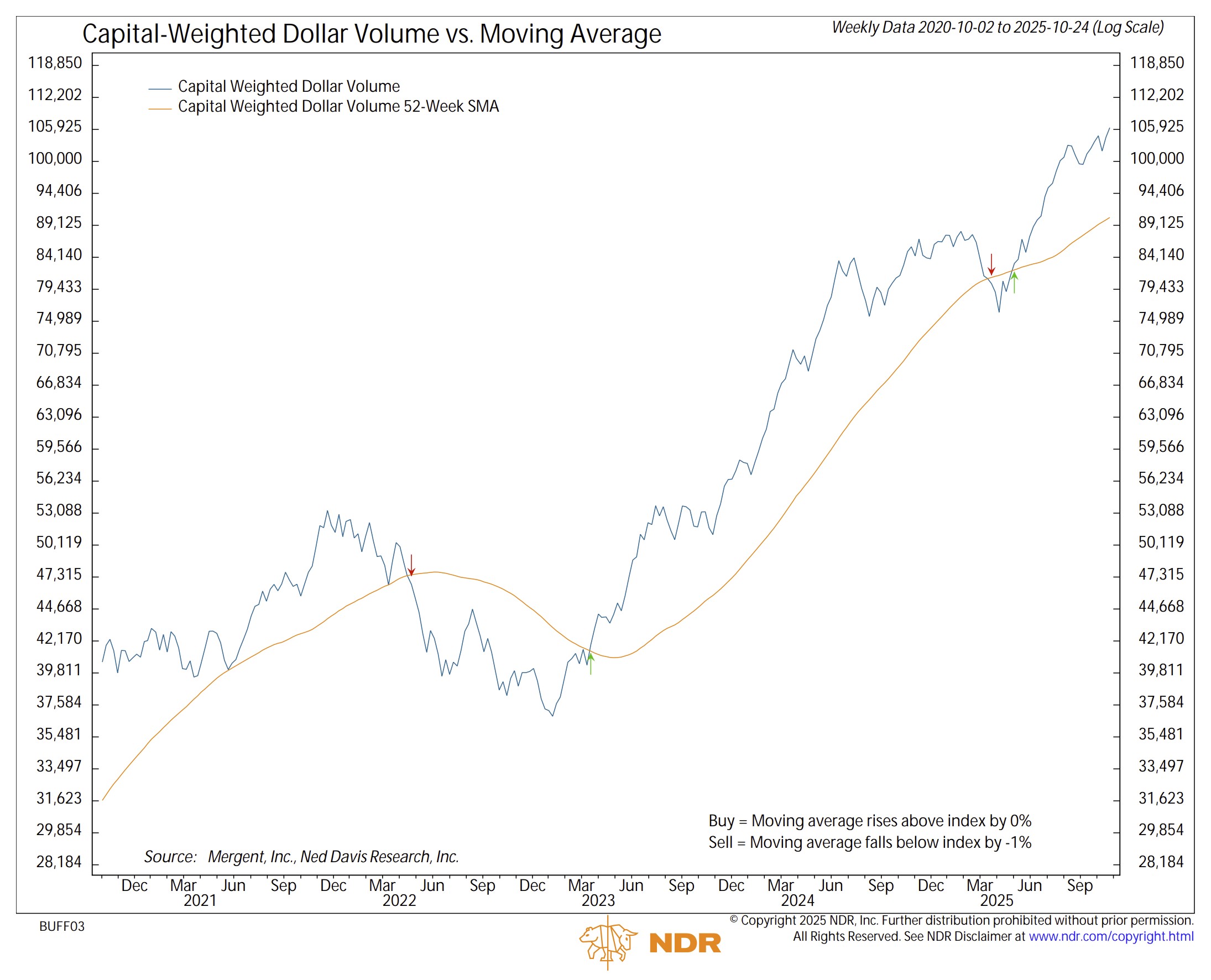

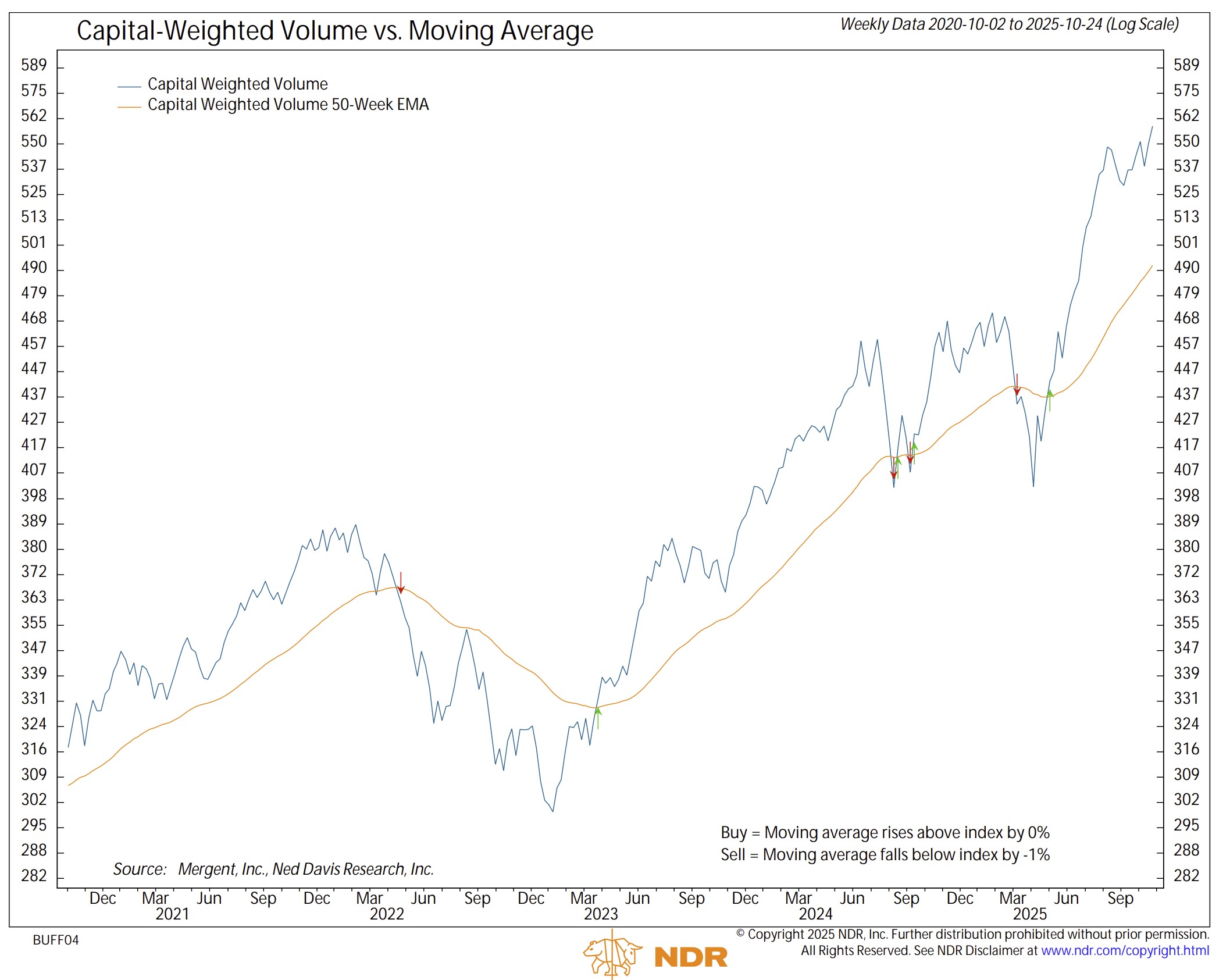

On the week, total capital flows were just average, with inflows slightly above trend and outflows modestly below. Roughly 60% of dollar volume was inflow. One small blemish was that capital-weighted volume during the breakout came in below average, with only 55% of total volume on the upside. Even so, the accumulated trends for both Capital-Weighted Volume and Capital-Weighted Dollar Volume rose to new all-time highs, bullishly confirming price leadership and strengthening the conviction behind the advance.

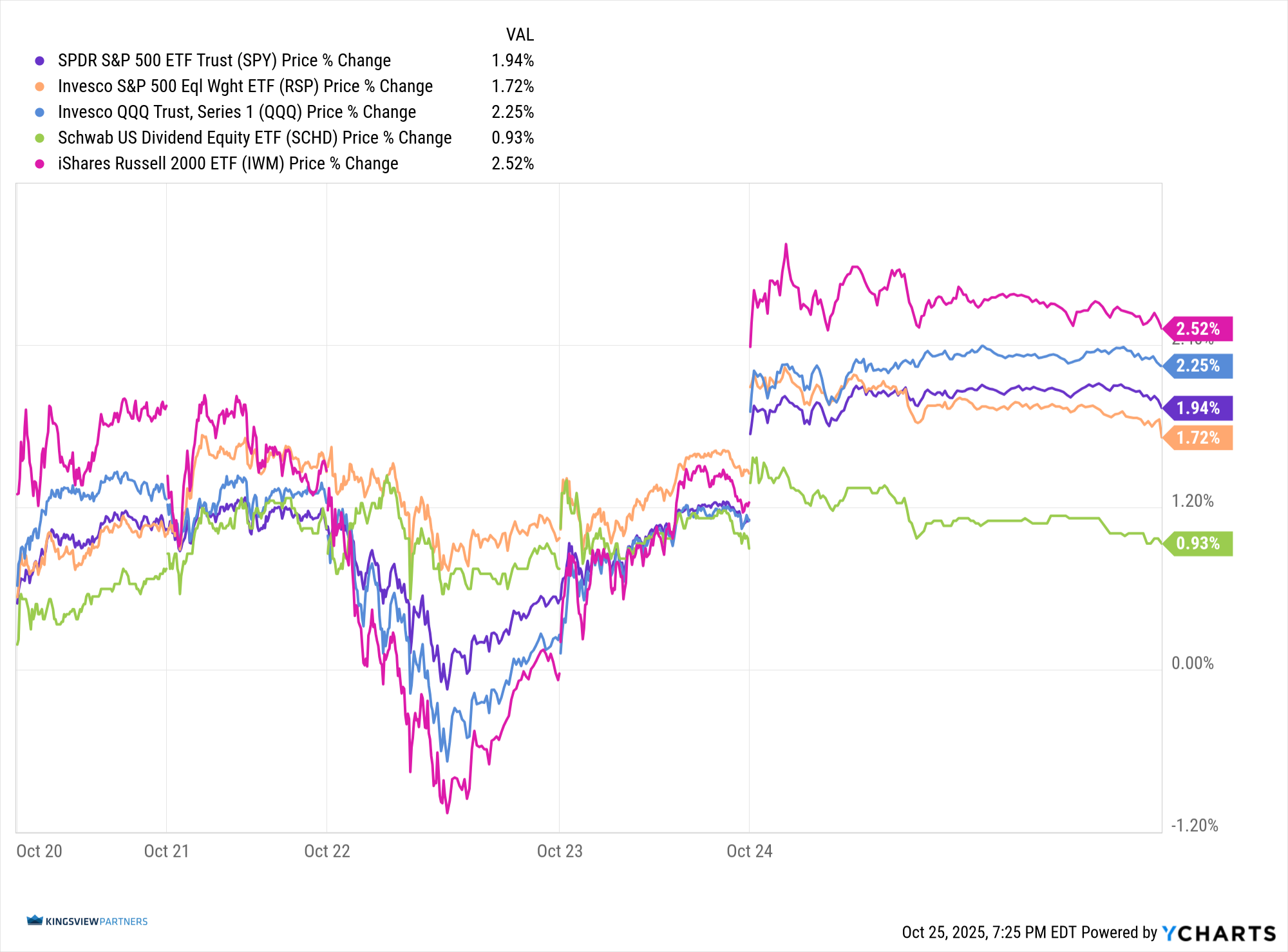

Among the tactical ranks, both the generals and the troops pressed forward. The Invesco QQQ Trust, Series 1 (ETF) gained 2.25% on the week, while the iShares Russell 2000 ETF (IWM) climbed 2.52%. The SPDR S&P 500 ETF Trust (SPY) and Invesco S&P 500 Equal Weight ETF (RSP) followed closely, up 1.94% and 1.72%, respectively. The brass commanders, represented by the Schwab U.S. Dividend Equity ETF (SCHD), advanced 0.93%, continuing to lag the broader force.

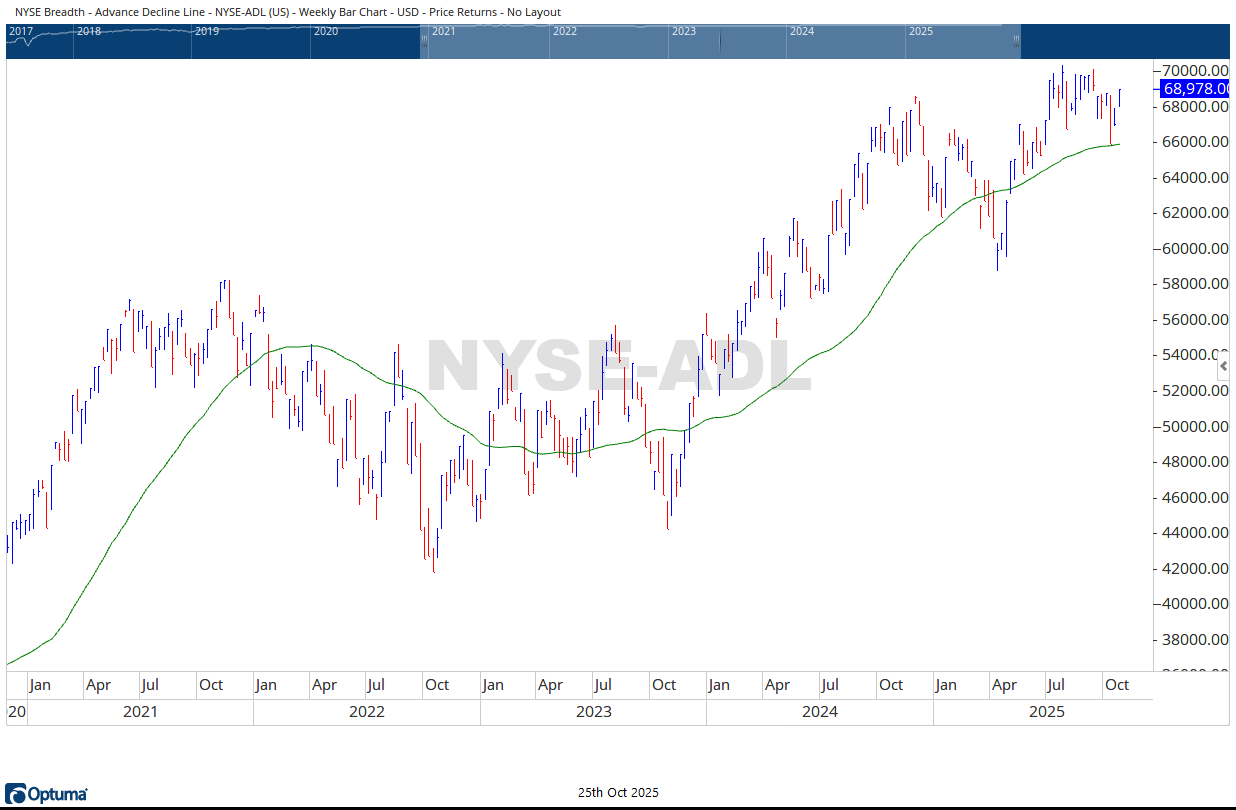

Market breadth strengthened in support of the breakout. The cumulative NYSE Advance-Decline Line pushed through near-term resistance, though it remains below its all-time peak. The NYSE Operating Companies subset, however, reached a new record closing high – an encouraging signal from the underlying corporate core.

The generals extended their leadership with both price and volume momentum maintaining strong alignment. Quarterly price momentum registered 65, while volume momentum remained higher at 75, strong evidence of sustained conviction behind the advance. The troops also pressed higher to close the week at new highs, though just shy of intra-week records set the previous week. Their strength remains notable, with price momentum at 61 and volume momentum notching 80, a signal of surging liquidity.

In summary, the front lines have advanced beyond resistance as both capital-weighted volume and dollar flows confirm and now lead once again the move. Liquidity remains strong, breadth is improving, and leadership persists across both large-cap generals and small-cap troops. Yet the lagging brass commanders remind investors that not all units share similar strength.

As the clouds lift, rays of hope shine across the field yet seasoned commanders know to keep defenses ready. Investors should maintain exposure to confirmed leadership while defining tactical support and resistance parameters. Risk-managed and option overlays may serve as protective perimeters, preserving strength for future campaigns when volatility returns.

In every market cycle, victory belongs not to those who forecast, but to those who prepare, balancing offense and defense reward and risk.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 10/27/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.