Volume Analysis Flash Update – 10.20.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Clouds Gathering, Rays Breaking Through

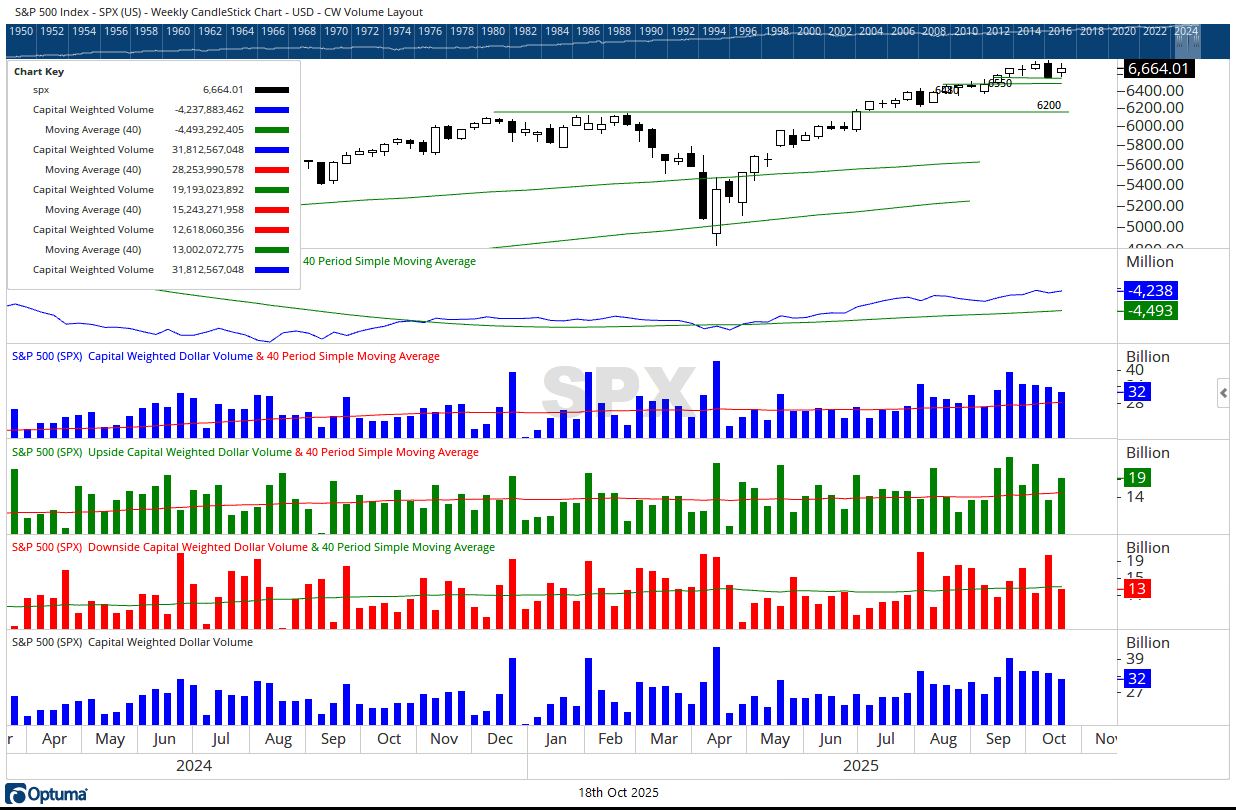

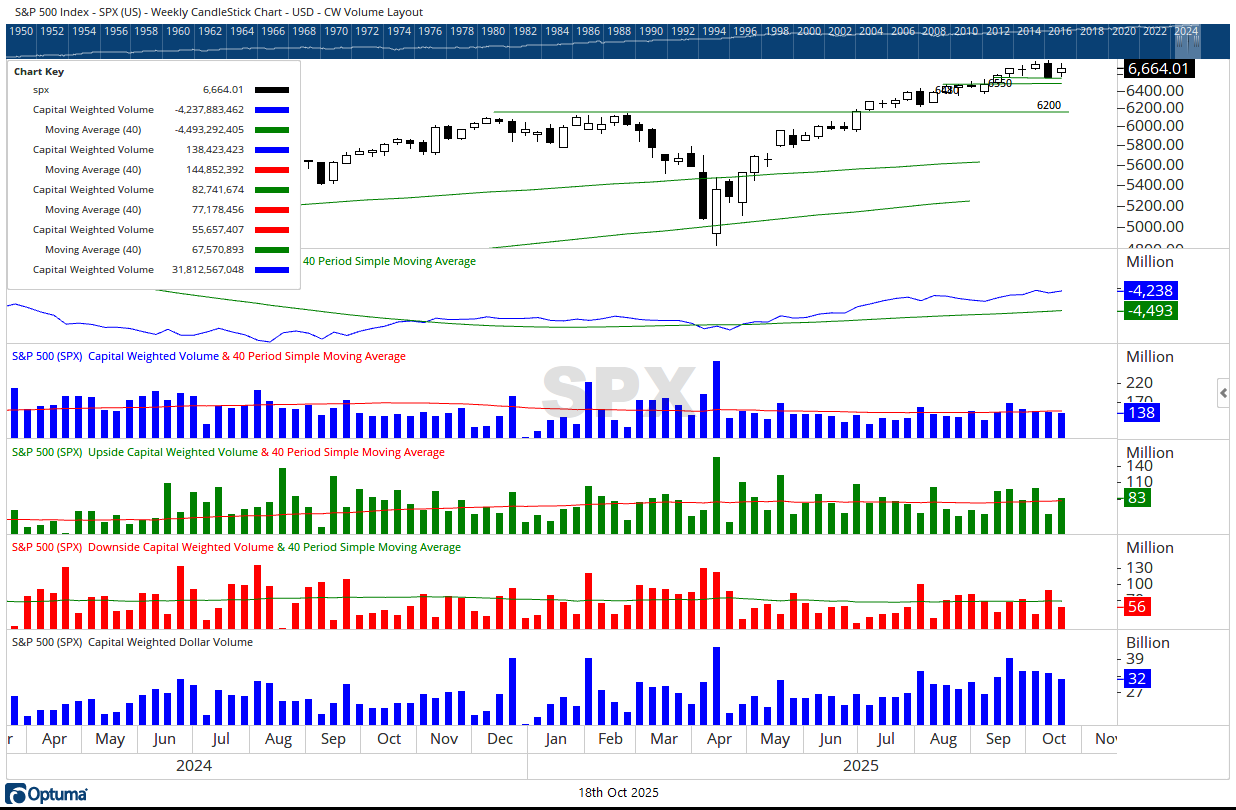

This week our market “army” repositioned under cover. The S&P 500® Index remained entirely inside last Friday’s (10/10/2025) long bar, a tactical inside-week formation at the rear of the frontline. The battlefield quieted, yet the under-surface currents show both risk and latent potential.

Volume & Capital Flows: Calm on the Surface, Engines Running Underneath

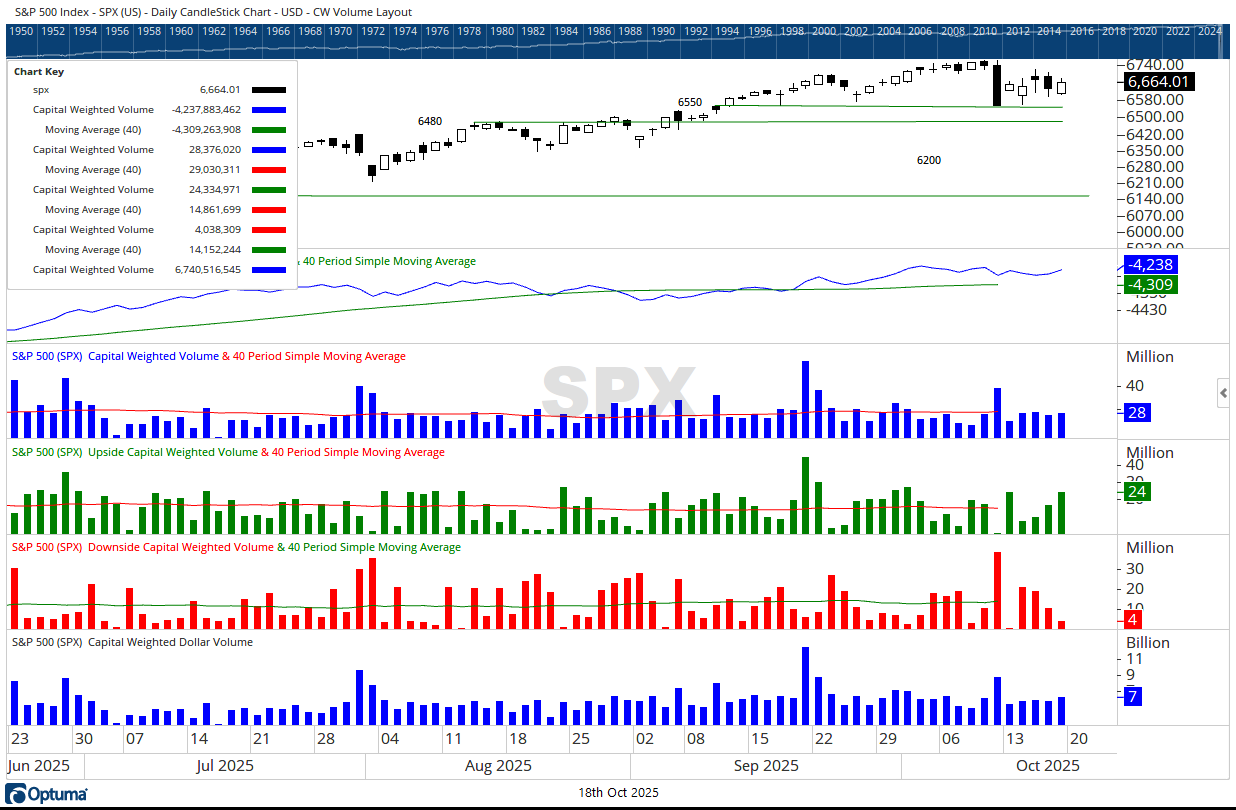

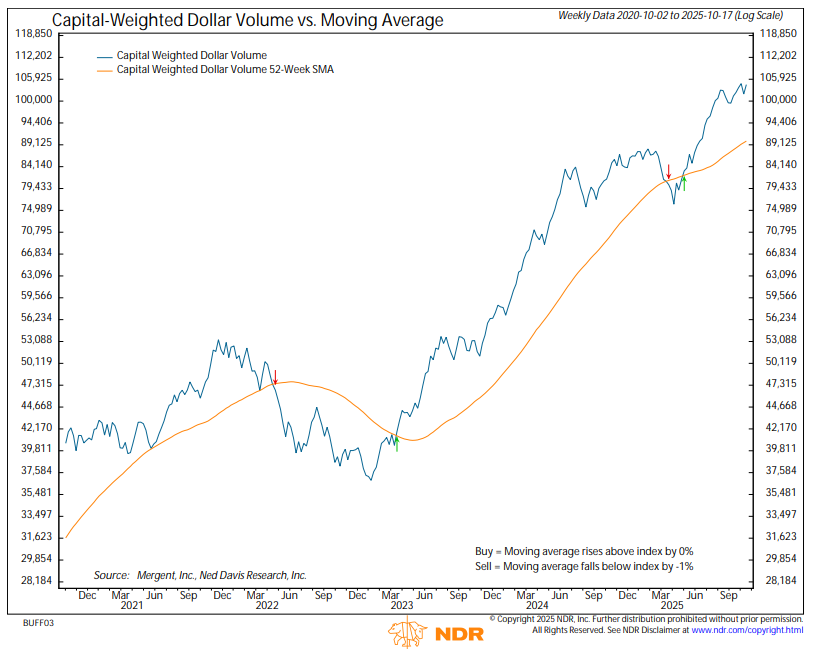

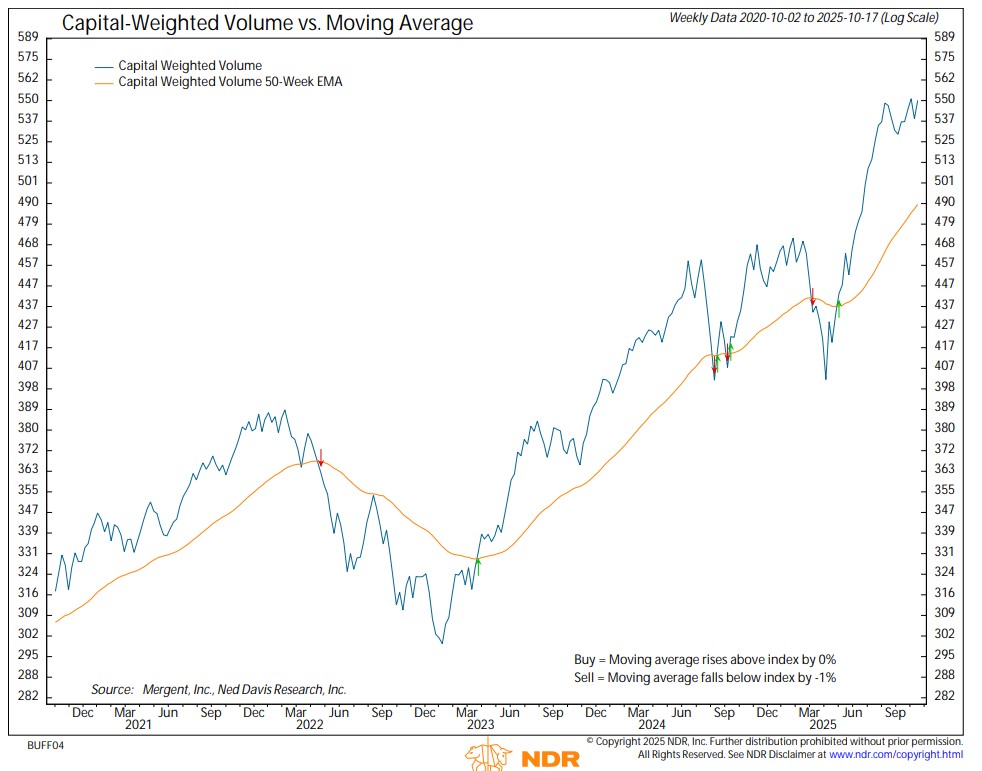

- The S&P 500’s capital-weighted volume was average, but 60 % of the volume favored the upside, a hint of cautious conviction.

- Capital flows were slightly above average: inflows were above trend, outflows slightly below, with 60% of flows being inbound.

- While price closed mid-bar of 10/10’s range, the trend lines for both CW volume and capital flows remain near their all-time highs, showing mild leadership beneath the surface.

Defensive Lines Set – Resistance & Support Locked In

- Resistance for the S&P 500 is pegged at 6765, support at 6550, defined by the 10/10 outside-day.

- A decisive close above 6765 or below 6550 may define the next short-term campaign. Until then the front remains range-bound, that is neither advancing nor retreating.

Breadth and Reinforcements: Mixed Good News

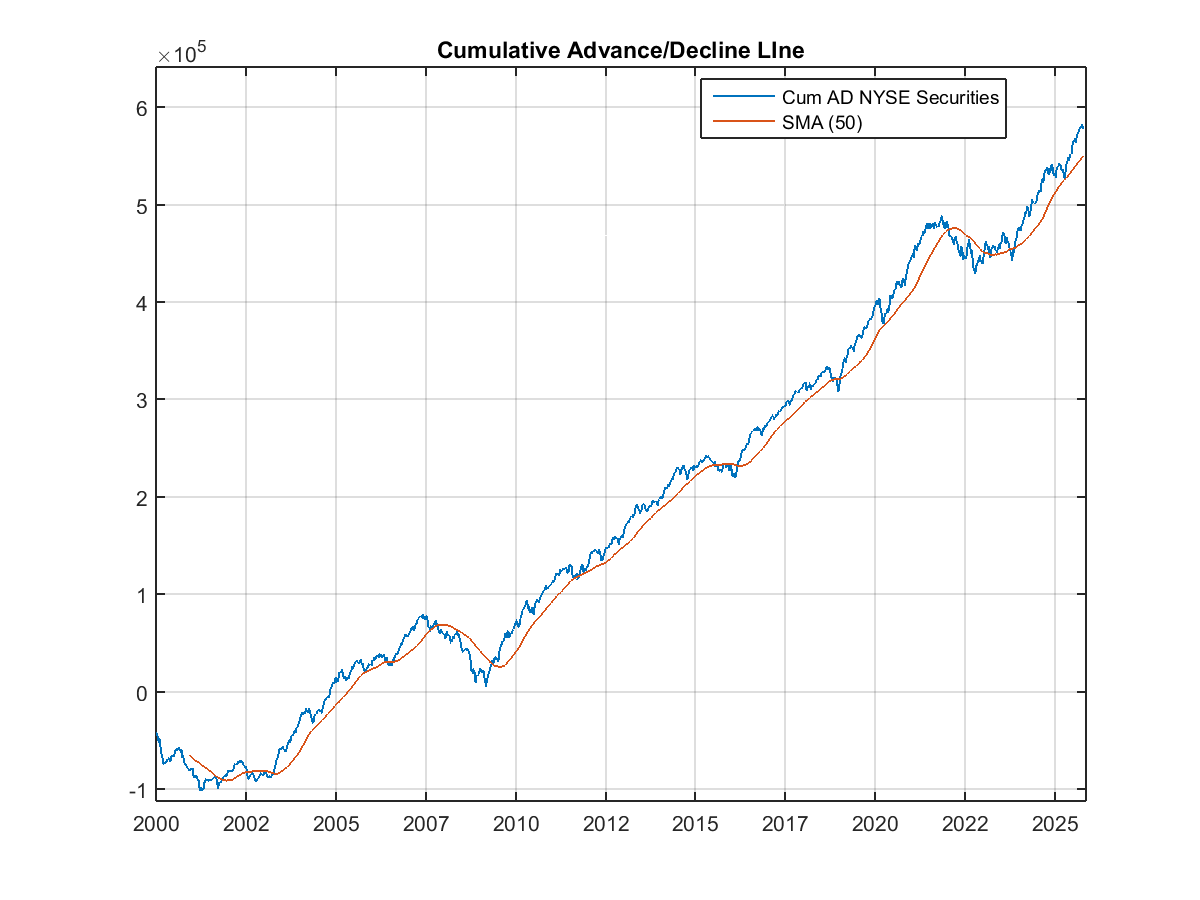

- The NYSE Advance‑Decline Line closed at trend-line support last week. Like the S&P itself, it traded within the prior week’s range, closing near the mid-point of the 10/10 outside bar.

- Operating-company breadth (NYSE operating companies only) shows relative strength, sitting just off its all-time highs suggesting a ray of hope amid the clouds.

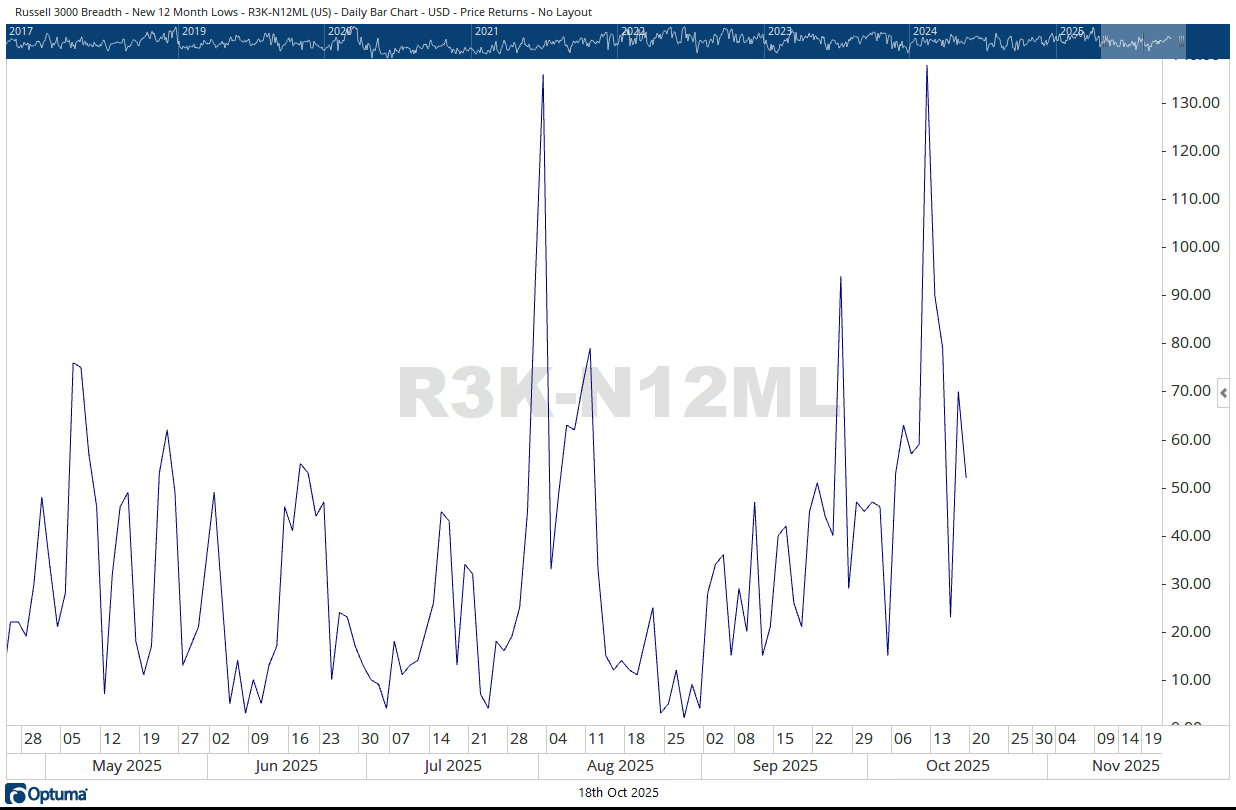

- Meanwhile, across the broader equity universe, the Russell 3000 is showing rising new-lows, which signals growing internal deterioration even if the surface advance remains intact. In other words: more stocks within that broad 3,000-stock basket are making fresh lows, which speaks to fragility beneath the façade of stability.

Generals and Troops: Leadership at Work

- The “generals”, represented by the Invesco QQQ Trust (QQQ) held their ground inside the 10/10 range, closing near the mid-point. Importantly, QQQ’s volume momentum (MFI ~75) exceeds its price momentum (RSI ~63). This suggests fuel remains in the tank.

- The “troops”, represented by the iShares Russell 2000 ETF (IWM), closed also in the mid-range but earlier in the week executed an intra-week breakout to a fresh all-time high. Momentum here is stronger still: MFI ~80 versus RSI ~59, showing vigorous underlying accumulation.

- Yet the “brass commanders”, the Schwab U.S. Dividend Equity ETF (SCHD), lagged — advancing only 0.98% for the week, while the generals rose 2.64% and the troops 2.48%. This underperformance in the dividend heavy-class may signal an erosion of defensive positioning in the center of the formation.

Key Summary: Range-Bound, But With Strategic Implications

The S&P is locked between the borders of one defining day (10/10) — neither charging forward nor falling back. While volume and liquidity suggest opportunistic potential, breadth may be brittle and rising new-lows in the Russell 3000 universe add a caution flag. In short: supply lines are thin.

Conclusion: Rays of Hope Amid the Clouds + Risk-Management Bow

Yes, there are rays of hope: volume and capital-flow leadership remain intact; key troops and generals are positioned with momentum behind them. But a few clouds are thickening, breadth deterioration, rising new-lows, lagging defensive sectors.

In this theatre of war, the wise commander (investor) does not charge blindly. Rather:

- Maintain exposure to leadership groups (generals and troops) while defining potential triggers near the 6550/6765 range for the S&P.

- Monitor the breadth indicators (including the Russell 3000 new-lows) as early warning systems.

- Retain reserves or hedges in case the clouds turn into storms, preserving the ability to act when the next advance opportunity emerges.

Markets advance in pulses: [Advance → Consolidate → Regroup]. Your mission: press when conviction is confirmed and preserve when the formation strains. The bow of discipline always precedes the arrow of opportunity.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 10/20/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.