Volume Analysis Flash Update – 9.22.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

A New Hope or a Gathering Storm?

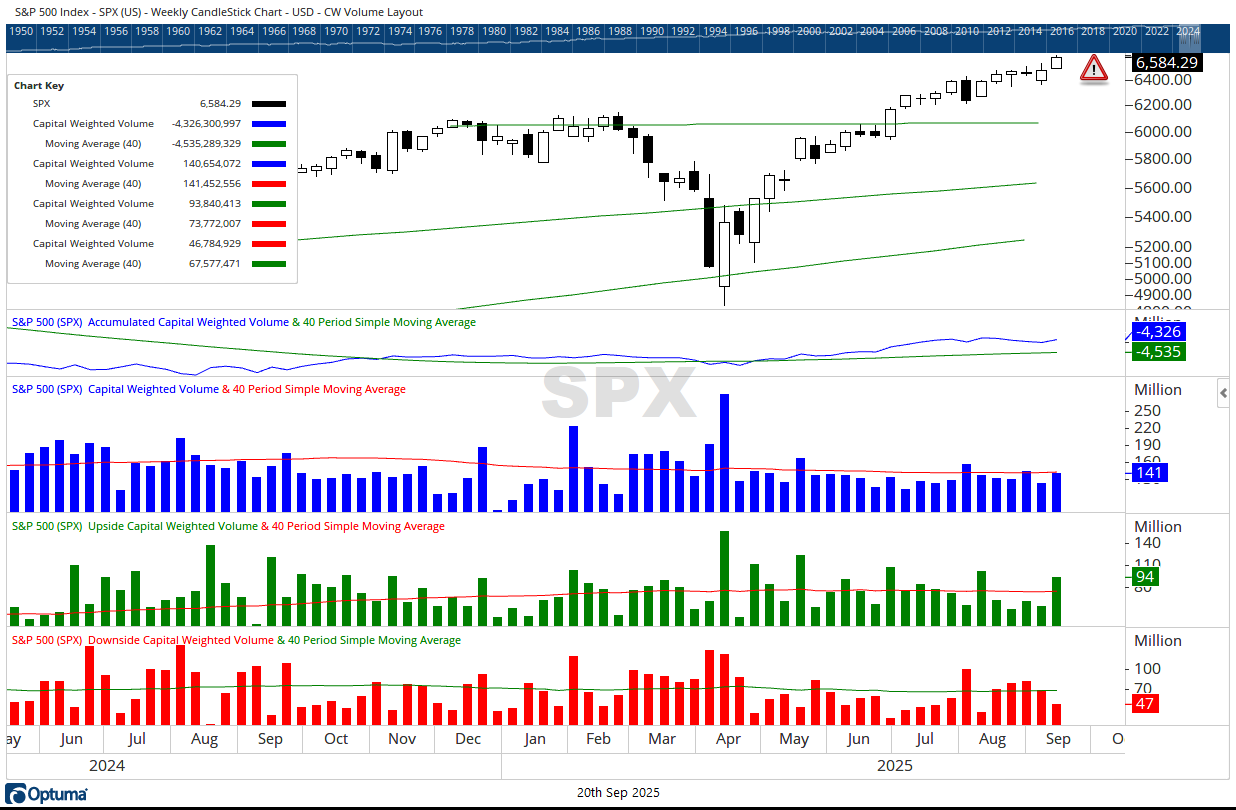

This past week, the market delivered another milestone with the S&P 500 closing at new weekly highs. Beneath the surface, however, the story is one of mixed conviction. Capital is flowing, but not yet at the same pace as price.

Volume and Flows

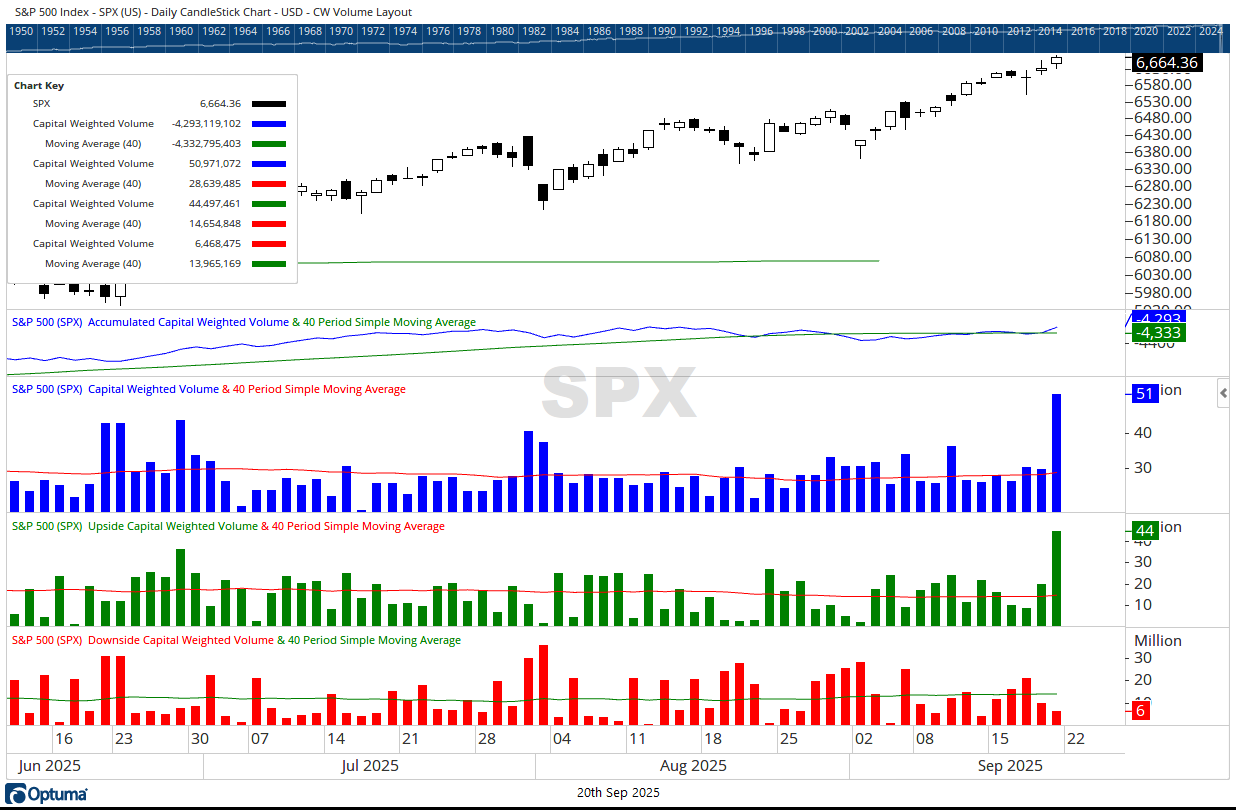

- On the week, 60% of volume was upside, with 40% to the downside.

- Friday, September 19th, stood out as a massive volume day: capital-weighted volume nearly doubled its daily average, with 87% of both flows and volume to the upside, just short of a 10% upside day.

- Weekly capital-weighted volume finished well above average, with inflows slightly above average and outflows holding steady near norms.

- Overall, 63% of flows were inflows versus 37% outflows, a constructive ratio.

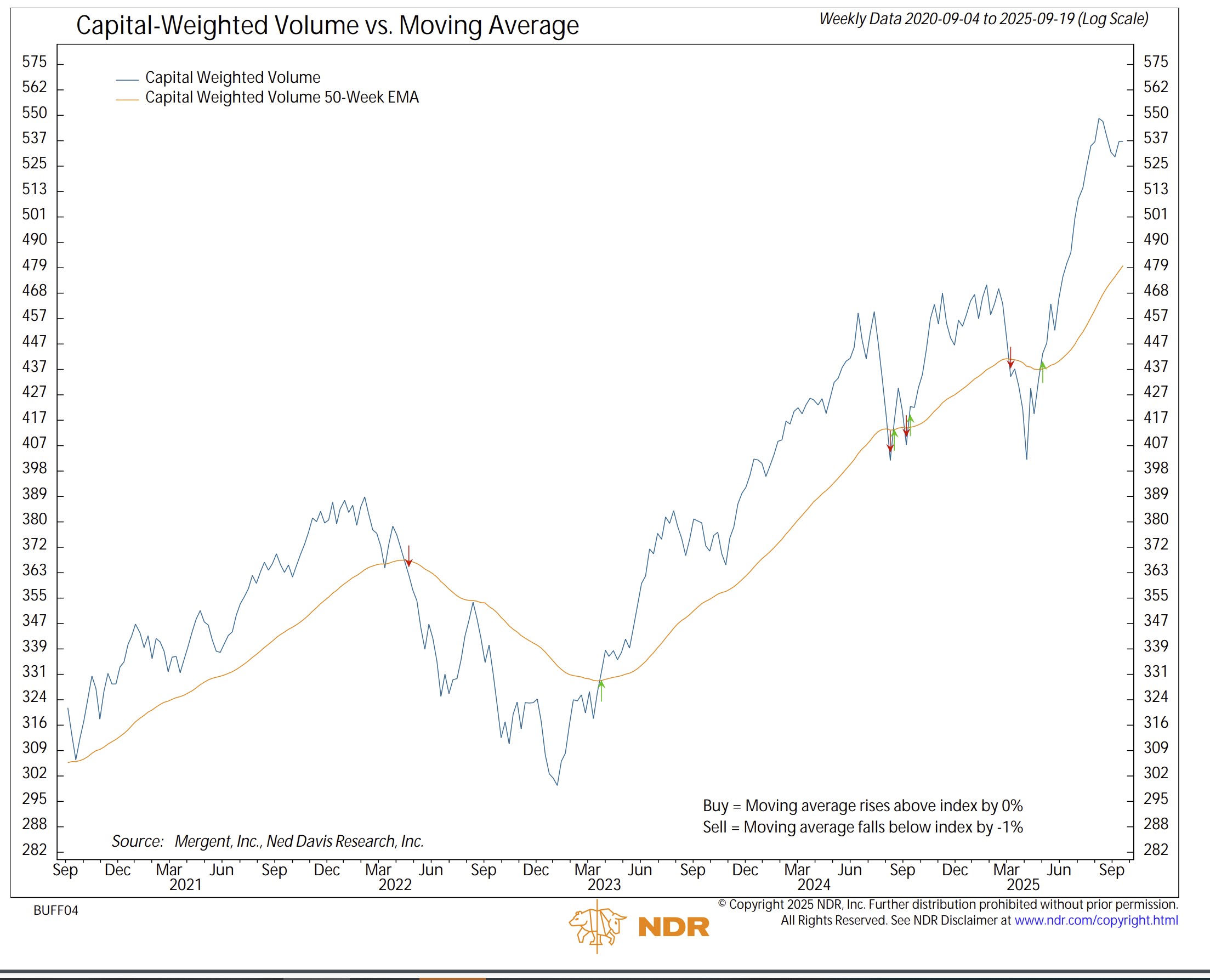

Capital-weighted dollar volume and to a much lesser extent capital-weighed volume extended their “fishhook” reversals higher but below all-time highs, still trailing and losing more ground to price action.

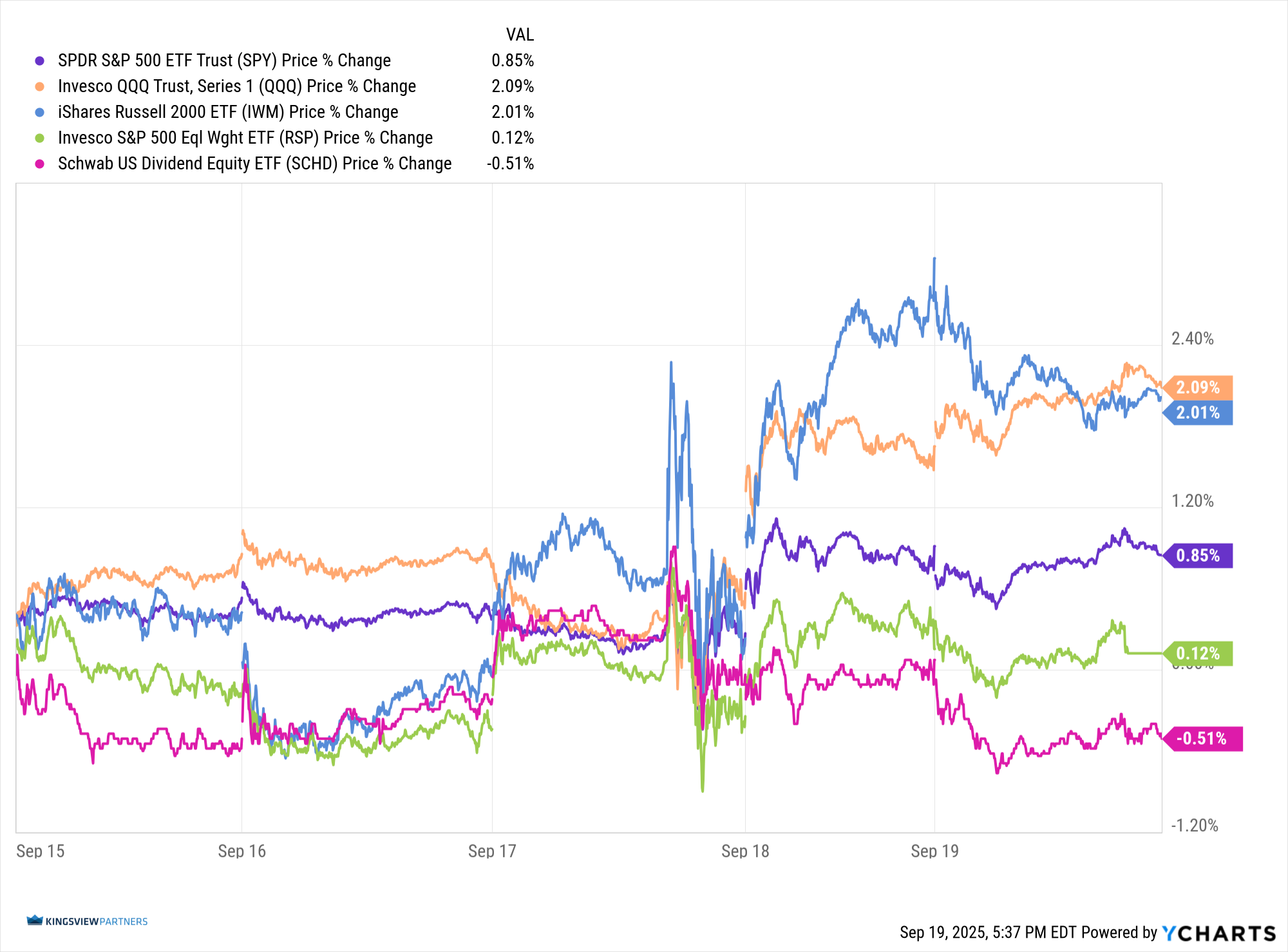

The generals, Invesco QQQ Trust (QQQ), led the charge, closing up +2.09% and posting new all-time highs. Their advance carried strong price momentum, even if volume remains noncommittal.

The troops, iShares Russell 2000 ETF (IWM), finally broke the seal of all-time highs intraday and scored a new weekly closing high, finishing +2.01%. Importantly, their volume momentum surged to 70 while price momentum lags at 60, producing a positive Delta Force, a bullish thrust divergence.

Meanwhile, the lieutenants, Invesco S&P 500 Equal Weight ETF (RSP), barely gained ground (+0.12%), while the brass commanders, Schwab U.S. Dividend Equity ETF (SCHD), retreated (-0.51%). This underperformance in equal weight and dividend stocks is disappointing, especially given the strong surge in mega caps and small caps. The head (generals) is leading, the legs (troops) are finally now churning, but the belly of the market (lieutenants) is reeling. Such a combination could hint exuberant exhaustion if not rectified.

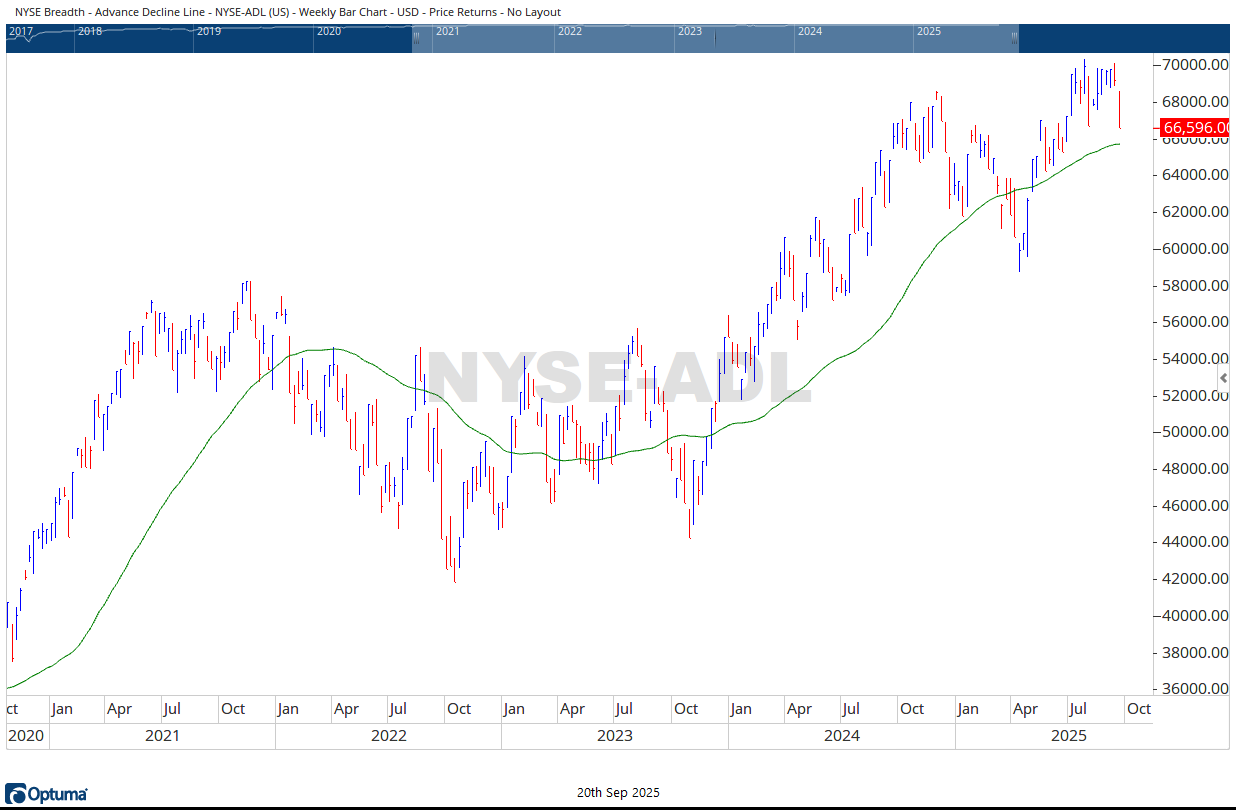

Moreover on the breadth side, NYSE Advance–Decline Line broke down from its August range, gapping lower on the week. This divergence between breadth and the troops stands as a contradiction: the troops advanced, but their “breadth tell” rolled over. It is a split message, one of renewed hope, but also producing shadows of doubt.

Overall, the flagship generals cut through the waves at full sail, setting a strong course. The crew of smaller vessels, the troops, are now beginning to catch the wind. Yet the support ships, the lieutenants and commanders, lag dead in the water. The fleet advances, but unevenly, with currents of volume and flows not fully matching the price’s tide. The question remains: are we watching the dawn of a new hope in a broadening rally, or the calm before a gathering storm where breadth fractures beneath the surface?

For investors, this is the time to stay tactical. Risk management remains the shield, there to help guard against renewed storm clouds while leaving room to potentially march forward should the rally broaden into a sustainable advance.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 9/22/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.