Volume Analysis Flash Update – 9.15.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

A New Hope or a Gathering Storm?

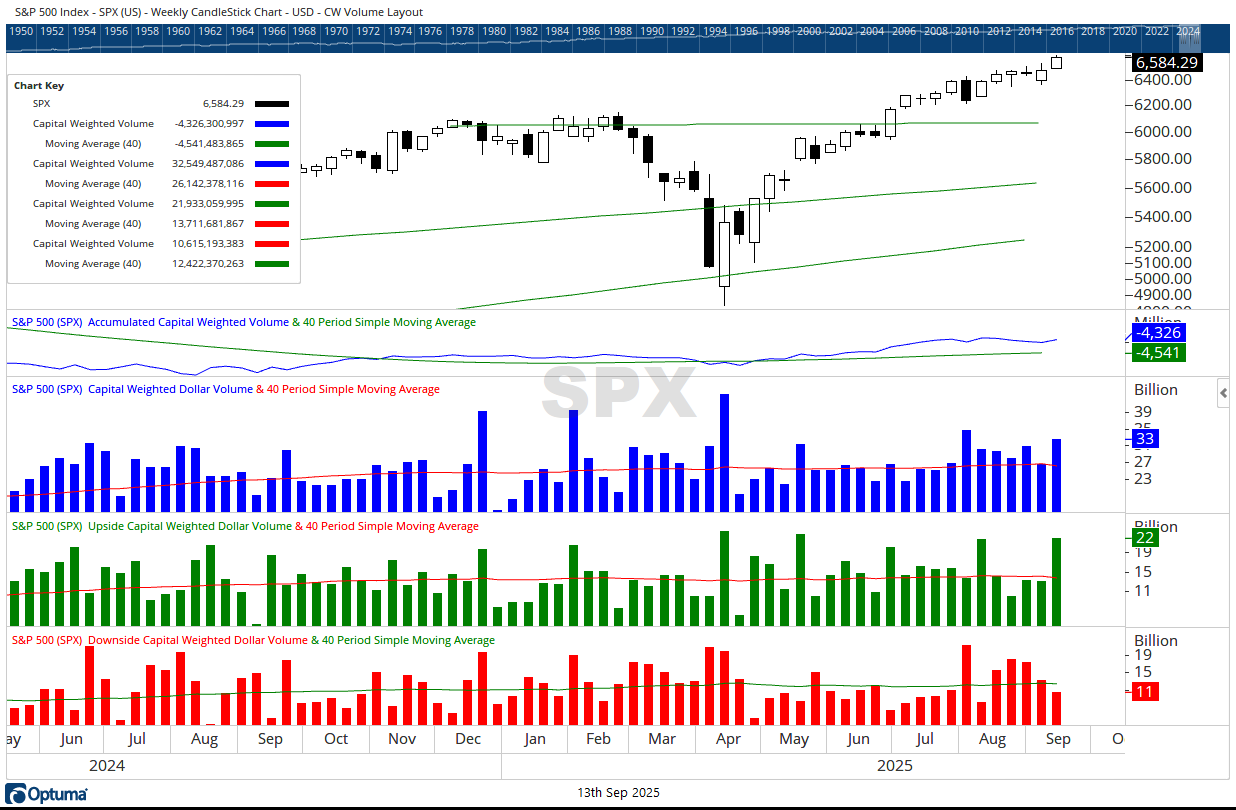

This past week the market delivered fresh records as the S&P 500 closed at new all-time weekly highs. Yet, while price pressed to new ground, volume revealed a more nuanced story.

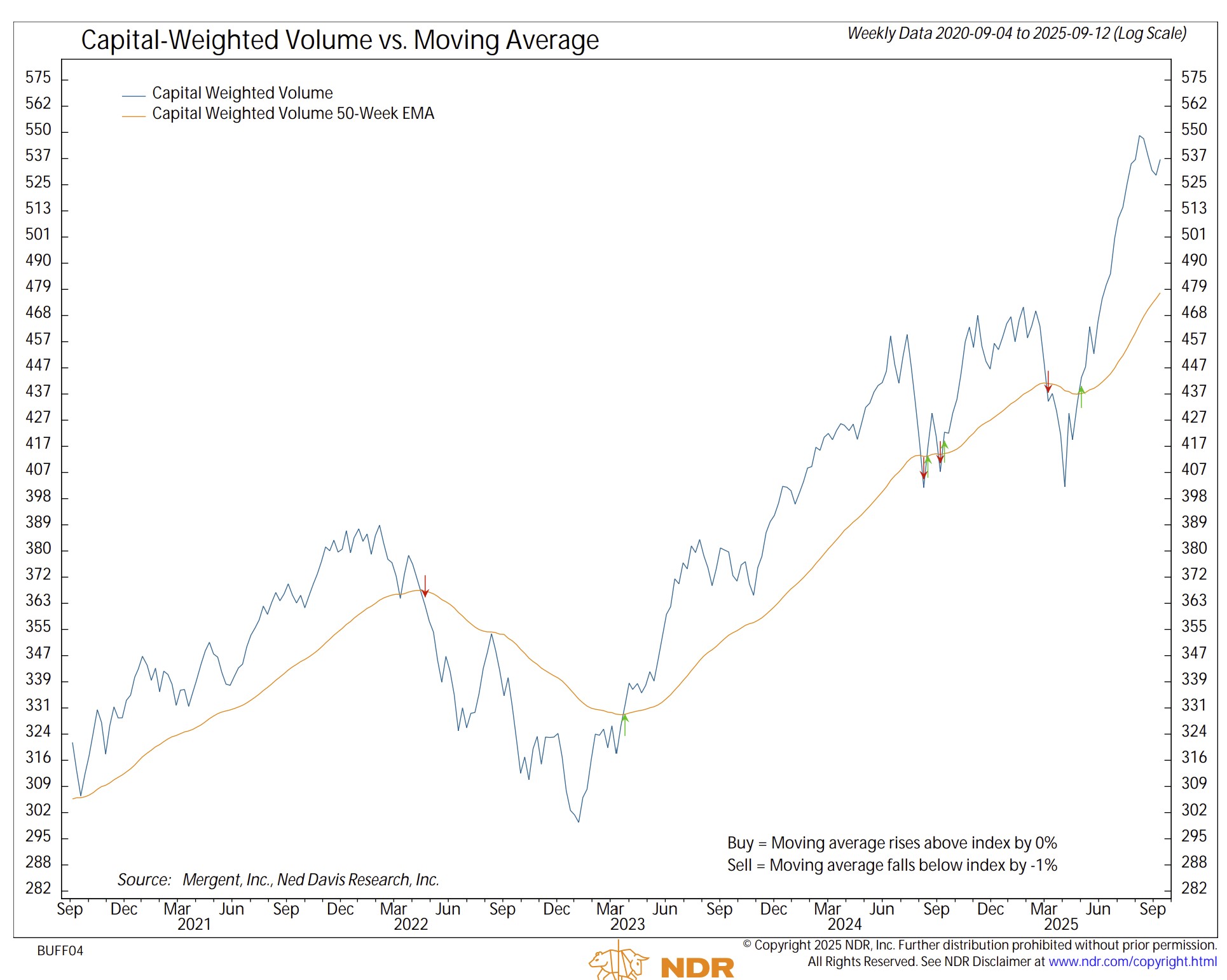

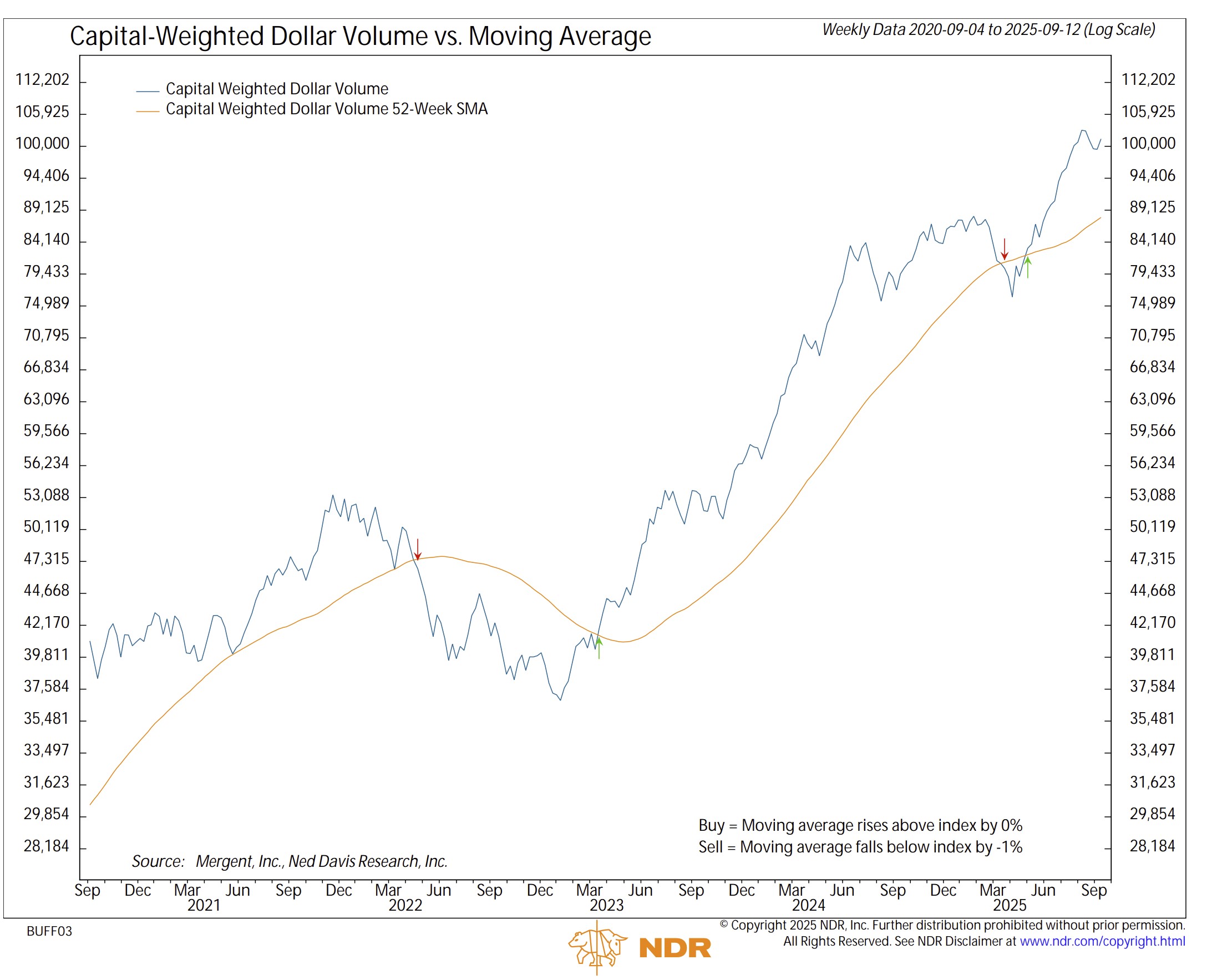

Both capital-weighted dollar volume and capital-weighted share volume turned slightly higher, each forming a subtle “fishhook” reversal. Their direction is encouraging, but neither has reclaimed new highs, leaving them trailing the price index even as the S&P 500 price index sets new high records. This dynamic suggests the rally remains supported, but that the fuel driving it is no longer matching the thrust of price itself.

Overall, 68% of total capital flows were inflows, with 67% of capital-weighted volume to the upside. Volume was slightly above average, though liquid flow overall remained relatively in line with historic weekly norms. Notably, on Wednesday, September 10th, the S&P 500 broke intraday to new highs but closed the session lower, a pattern often viewed with concern. Yet even on that day, 67% of capital-weighted volume registered as upside, cushioning what might otherwise have been a more bearish signal.

On the bullish side, both capital-weighted flows and volume remain well above trend, with their upward fishhooks hinting at renewed strength. Yet on the bearish side, their failure to confirm price’s all-time highs leaves an important caveat: for now, volume is lagging price.

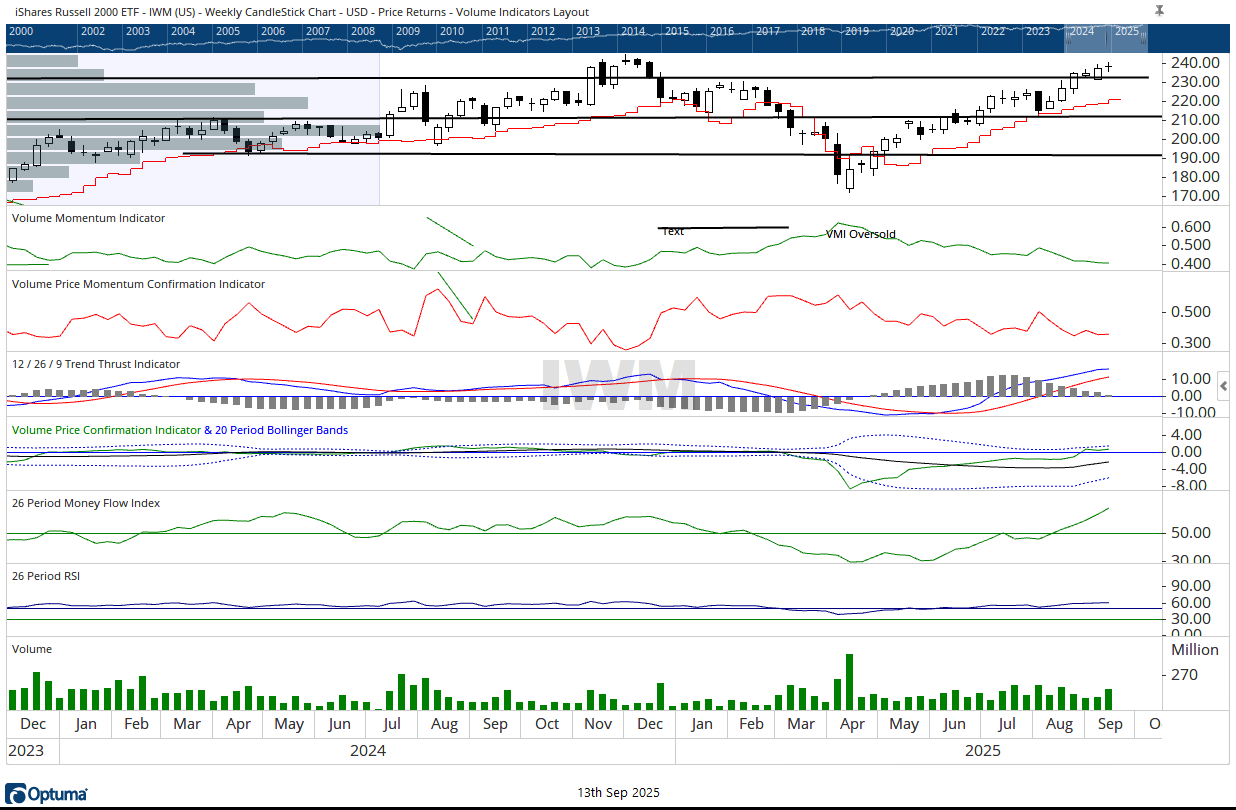

Among the ranks, the troops, iShares Russell 2000 ETF (IWM), reached new intraweek highs, only to fade and close near last week’s level, forming a small doji candle on the week. This suggests that despite rising odds of lower rates, normally favorable small cap conditions, buying pressure among small caps is beginning to lose its momentum. Their key tell, the NYSE Advance–Decline Line, broke out of its consolidation range midweek but ultimately retreated back inside, muting its signal softening new hopes.

By contrast, the generals, Invesco QQQ Trust (QQQ), marched forward with conviction, breaking out of their consolidation to close at new all-time highs. This decisive action suggests that what appeared to be the makings of a gathering storm may, for now, may be dissipating.

Performance confirmed the generals’ renewed command. The Invesco QQQ Trust (QQQ) advanced +1.86% on the week, outpacing their lieutenants – SPDR S&P 500 ETF Trust (SPY) up +0.27% and the equal-weight forces, Invesco S&P 500 Equal Weight ETF (RSP) up +0.22%. The brass commanders, Schwab U.S. Dividend Equity ETF (SCHD), slipped -0.43%, as the resurgence of mega-cap leadership retook center stage.

Conclusion:

The battlefield imagery remains divided. The troops are showing fatigue at resistance, and breadth measures are hesitant. But the generals have reasserted control, carrying the flag to new highs and reinvigorating the mega-cap trade. In times when rallies surge but undercurrents whisper caution, risk management is the essential discipline. It shields against storm clouds if they return, while still leaving room to advance alongside the generals should this broadening hope endure.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 9/15/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.