Volume Analysis Flash Update – 8.18.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Troops Bolster Momentum but Stall at Resistance

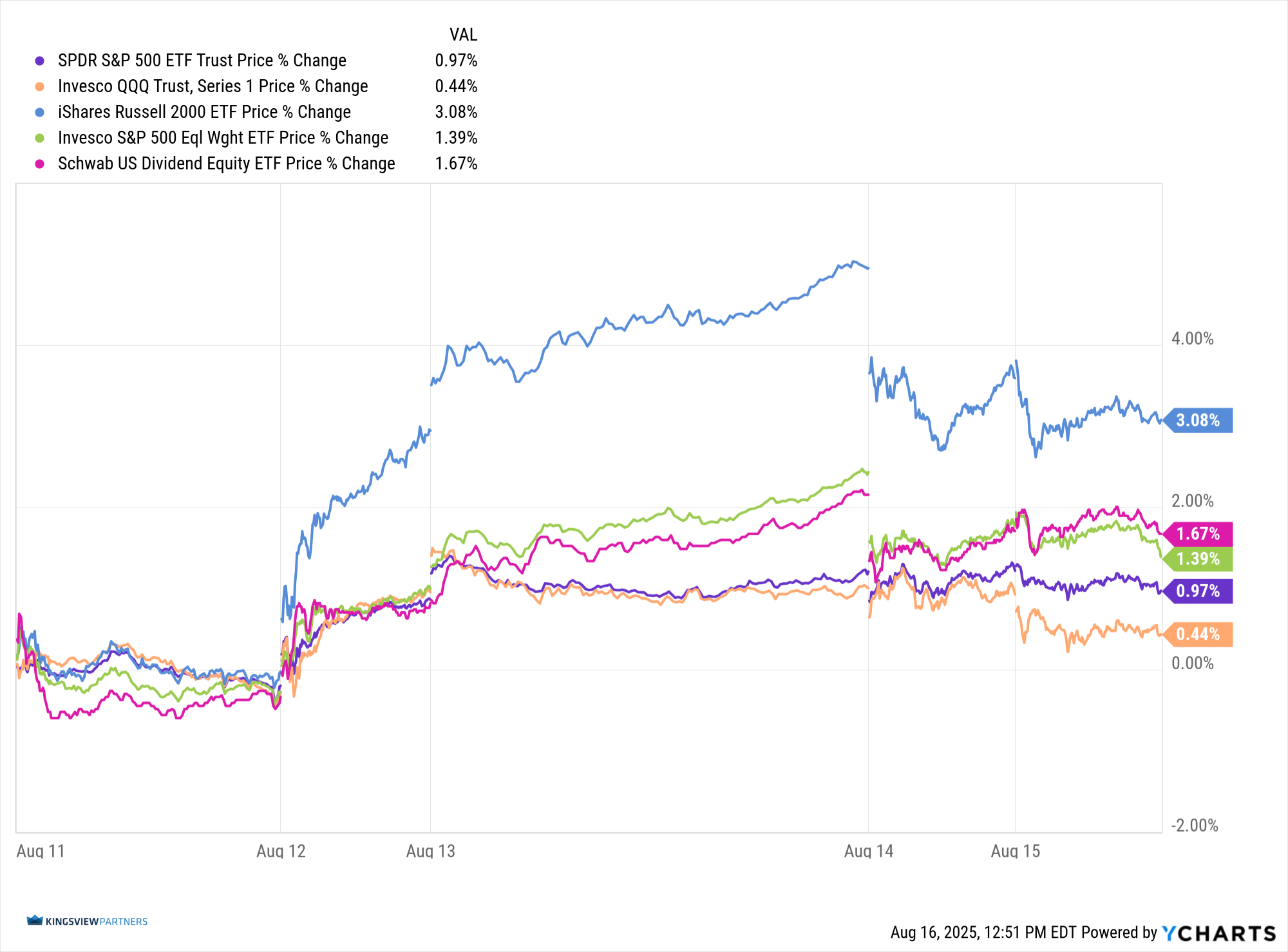

For the second consecutive week, the troops (IWM – iShares Russell 2000 ETF) strengthened its advance, gaining 3.08% and charging forward from their 210 support line. Their momentum, however, was checked at the 232 resistance post, where the rally faltered. A decisive break above this level would be one of only two remaining steps needed to move the troops fully out of consolidation and into a confirmed bullish alignment with their large-cap counterparts.

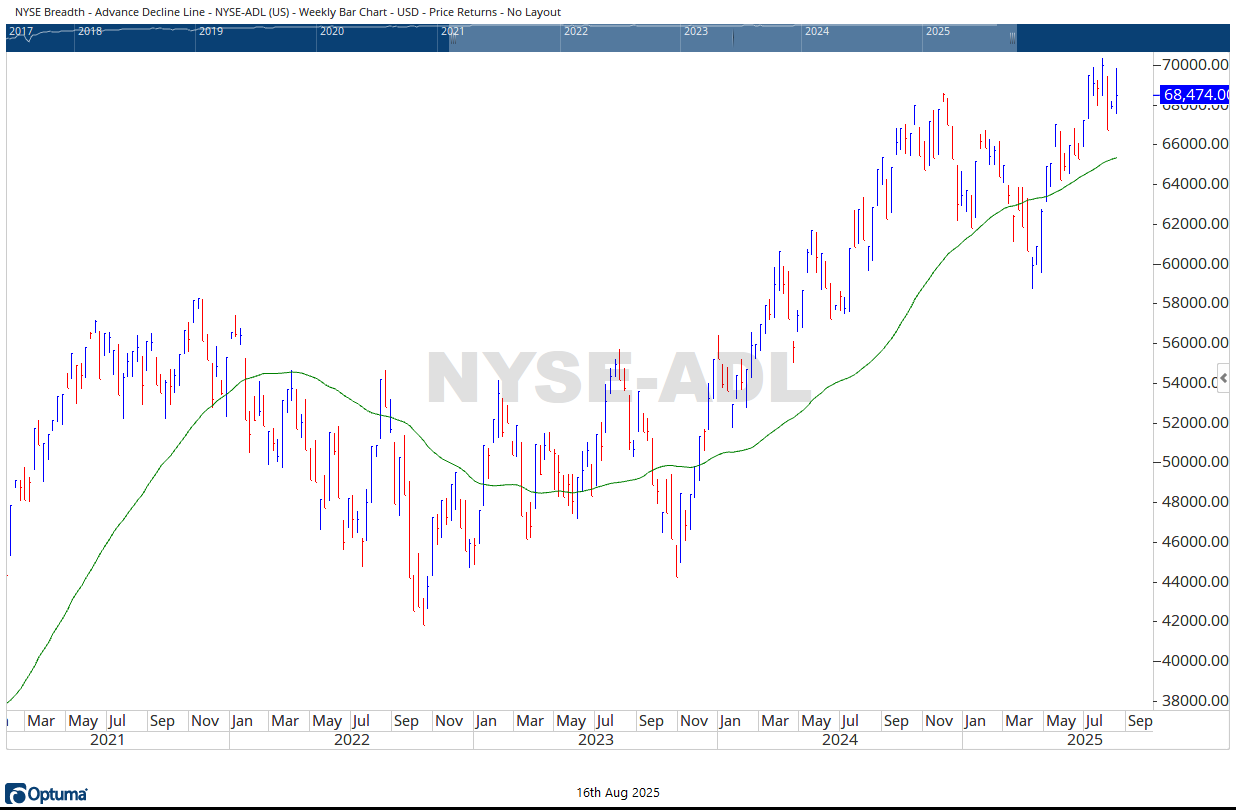

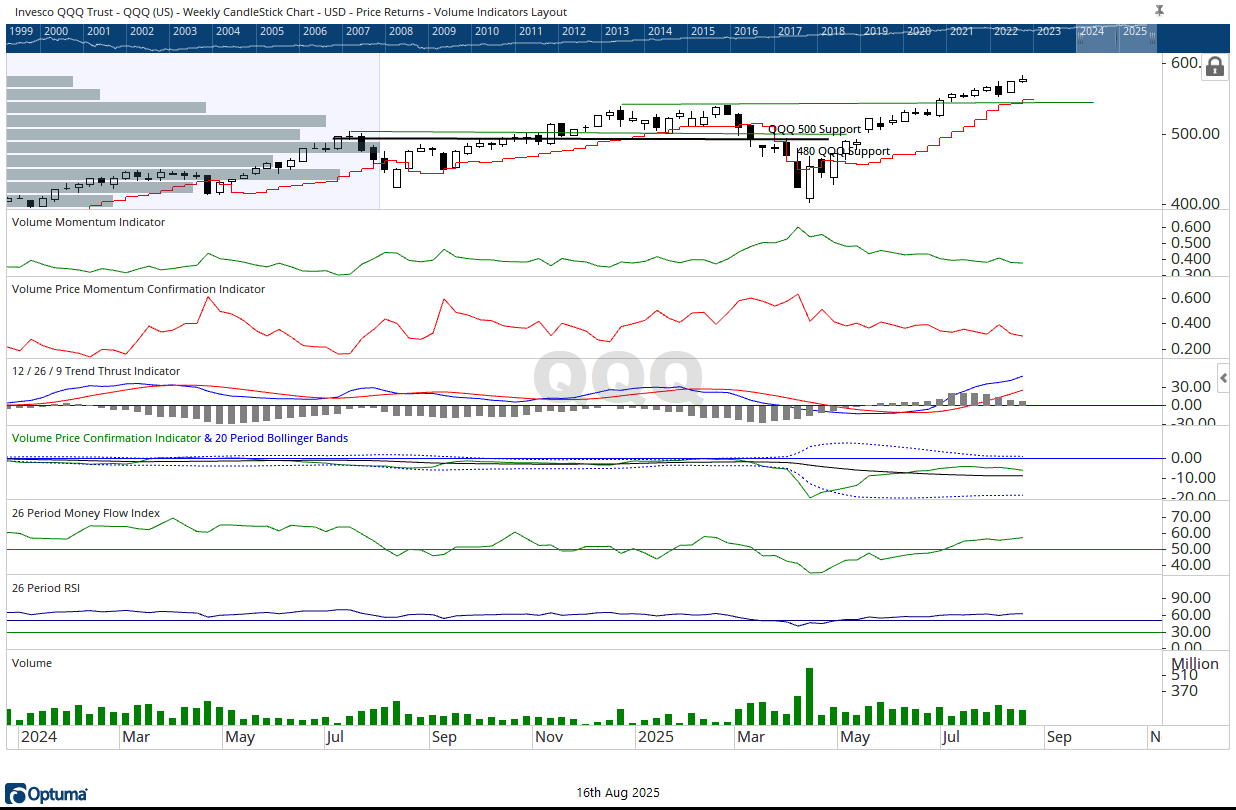

The generals (QQQ – Invesco QQQ Trust), though trailing their broader market piers, continued their march albeit at a slower pace than in prior weeks, adding just 0.44%. Yet despite their modest gain, they once again set both daily and weekly record highs, confirming their position as the vanguard of this campaign. The broader capital weighted S&P 500 Index likewise followed suit with new highs of its own.

Among the supporting forces, the brass commanders, represented by SCHD (Schwab U.S. Dividend Equity ETF) and RSP (Invesco S&P 500 Equal Weight ETF), advanced 1.67% and 1.39% respectively, surpassing the lieutenant SPY (SPDR S&P 500 ETF), which gained 0.98%. The participation of the brass commanders is notable, as their steady progress provides reinforcement to the generals’ leadership and offers greater balance to the advance.

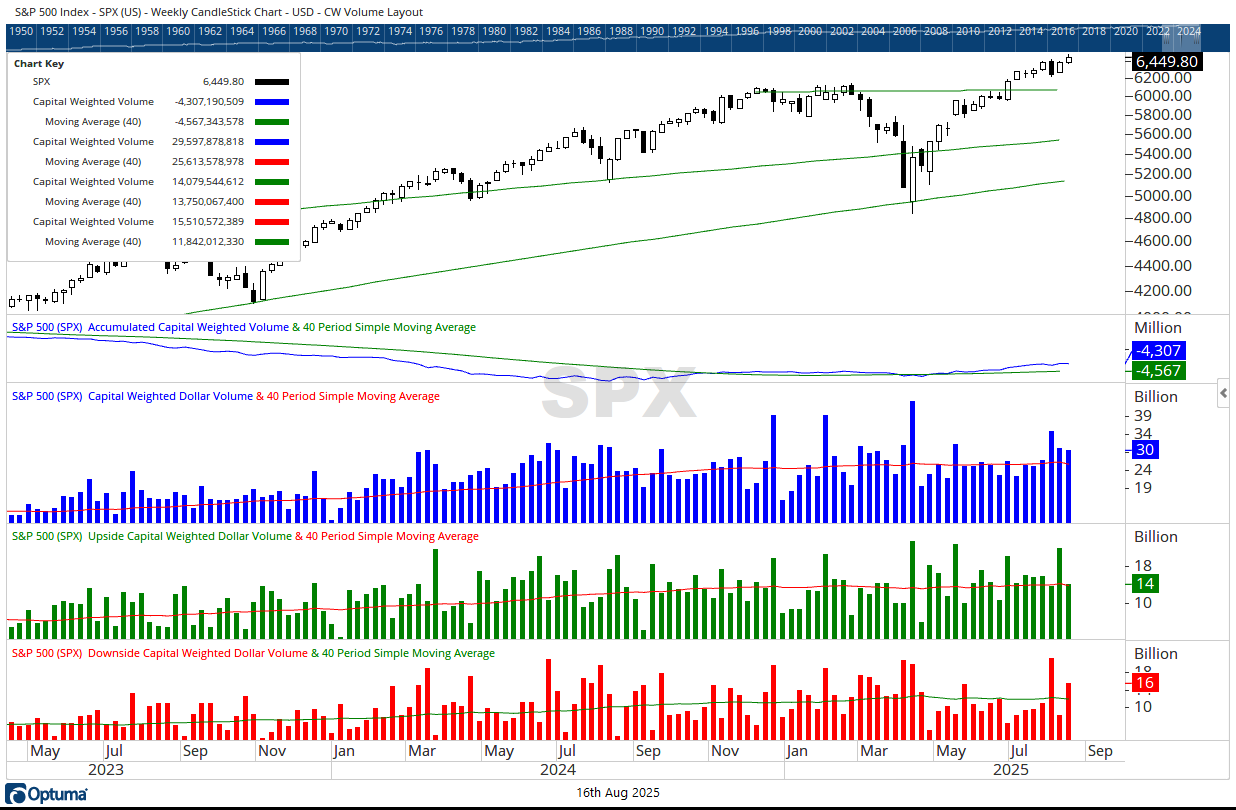

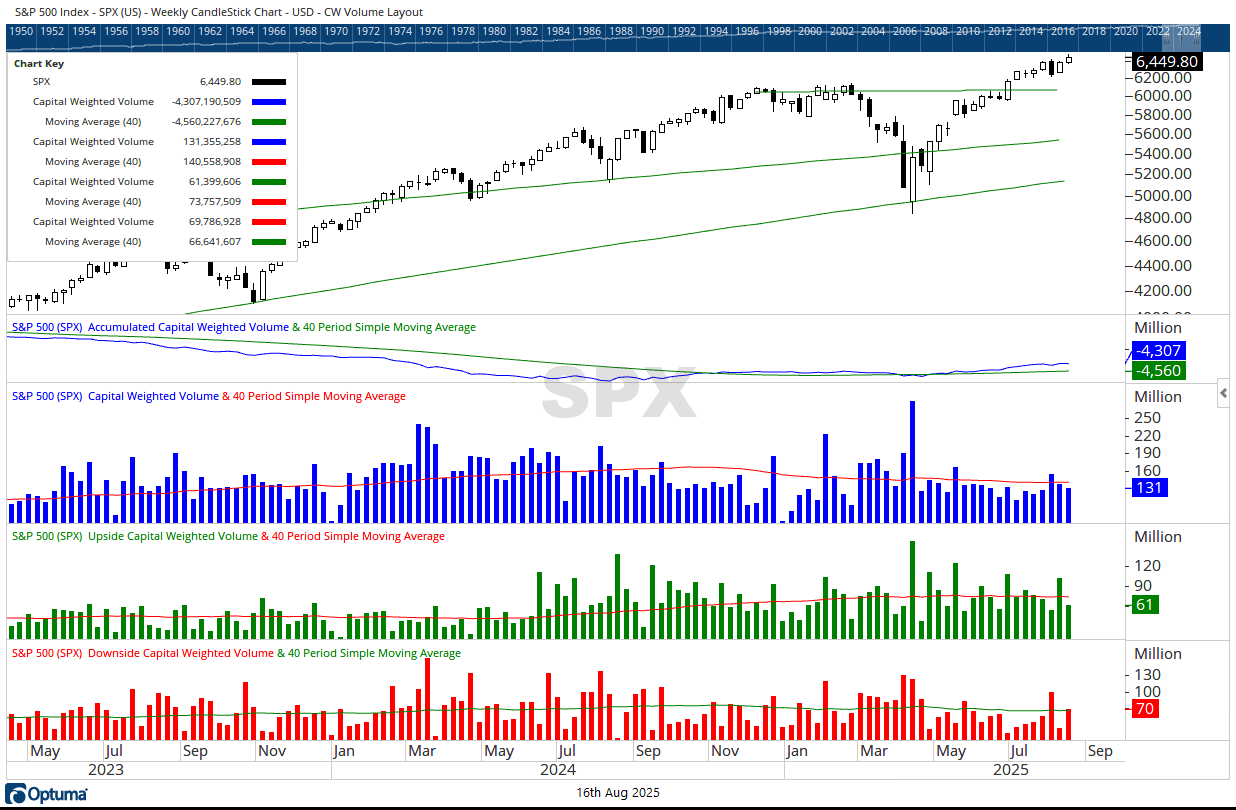

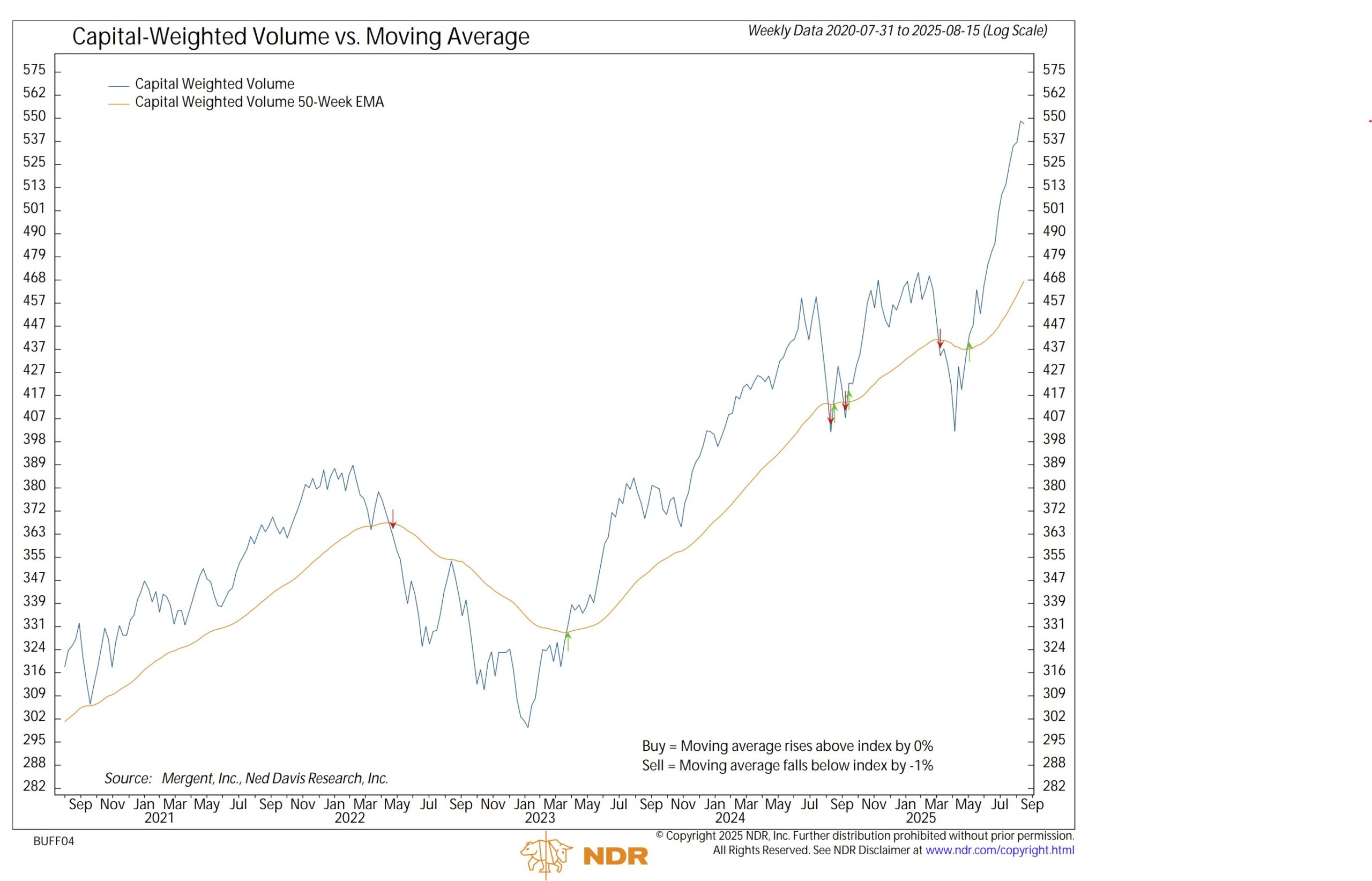

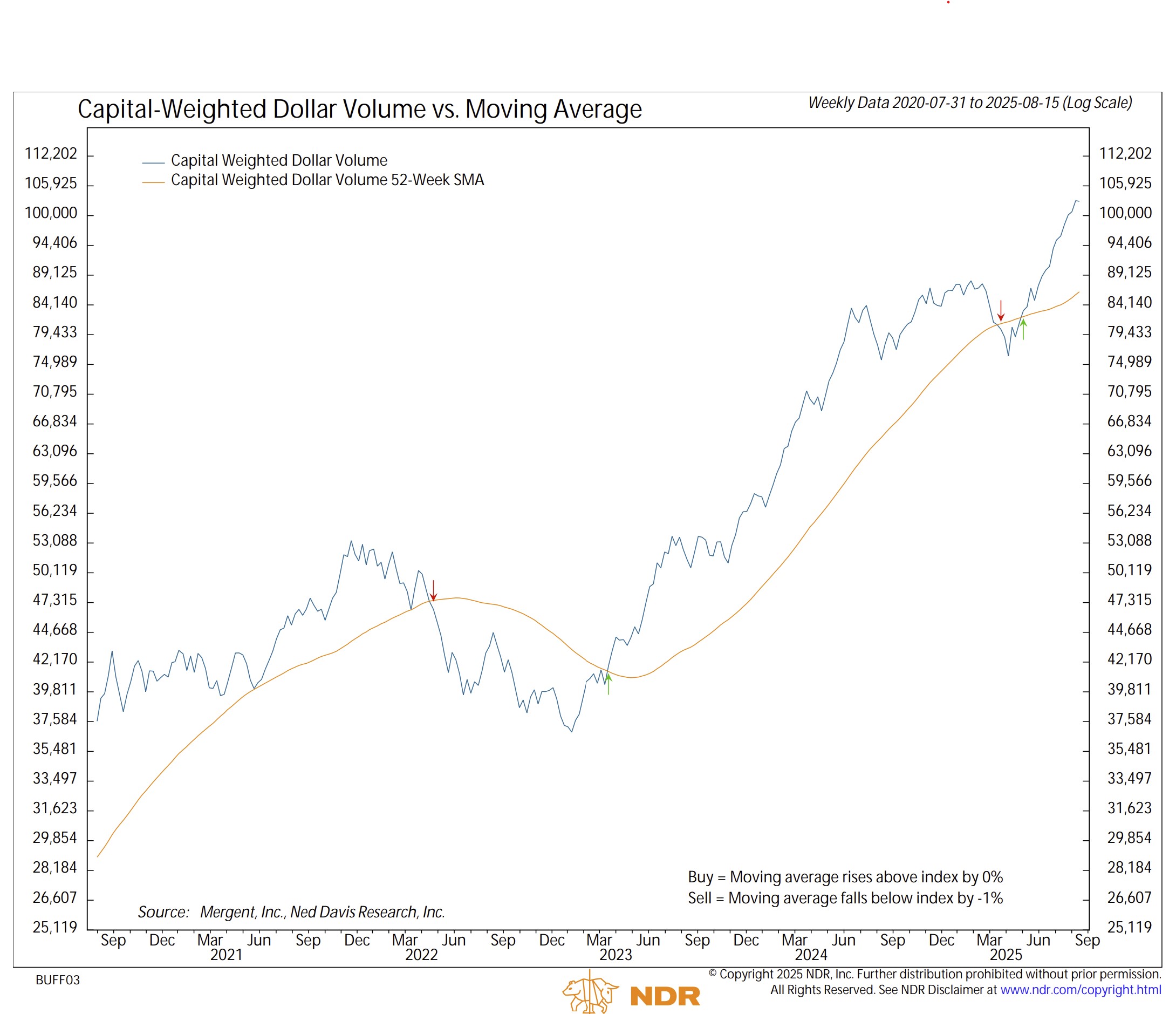

While the whole field advanced this week, supply lines painted a murkier picture. Capital Weighted Volume came in slightly below average, yet Capital Weighted Dollar Volume (Capital Flows) registered slightly above average. Inflows for the S&P 500 were only at average levels and were overrun by above-average outflows. Similarly, downside volume led upside volume by a seven-to-six ratio, though overall activity was muted on below-average total Capital Weighted Volume. Despite this week’s setback, the longer-term accumulated trends in both Capital Weighted Volume and Capital Weighted Dollar Volume remain significantly above their price counterparts, showing volume leadership is still pressing ahead of price action.

In summary, this week’s campaign remains intact with the generals pressing into new highs and the troops advancing with renewed energy, though stalled for now near resistance. The brass commanders also are on verge of joining the front lines, strengthening their formation. Yet this week’s supply lines reveal some early signs of stress, as capital inflows are only average while downside volume has gained ground. The bullish case remains supported by increasing volume trends, but the mixed signals beneath the surface caution against short term complacency.

Risk management is the discipline that keeps armies intact during uncertain campaigns. Investors should remain positioned with the trend but guard the flanks. Monitoring key support levels such as 210 for the troops, 540 for the generals, and 6200 for the S&P 500 is essential. Tactical stops, diversification, and readiness to rebalance remain critical. In war and in markets, the battle is rarely won on a single advance. Those who endure are those prepared to regroup. And then there were none left exposed.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 8/18/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.