Volume Analysis Flash Update – 8.11.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Generals Breach the Heights

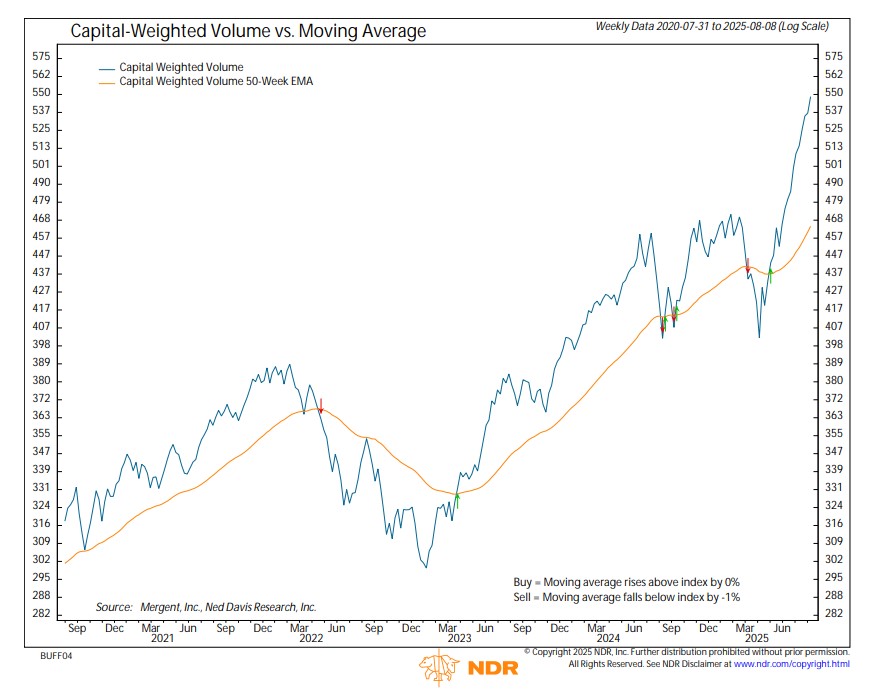

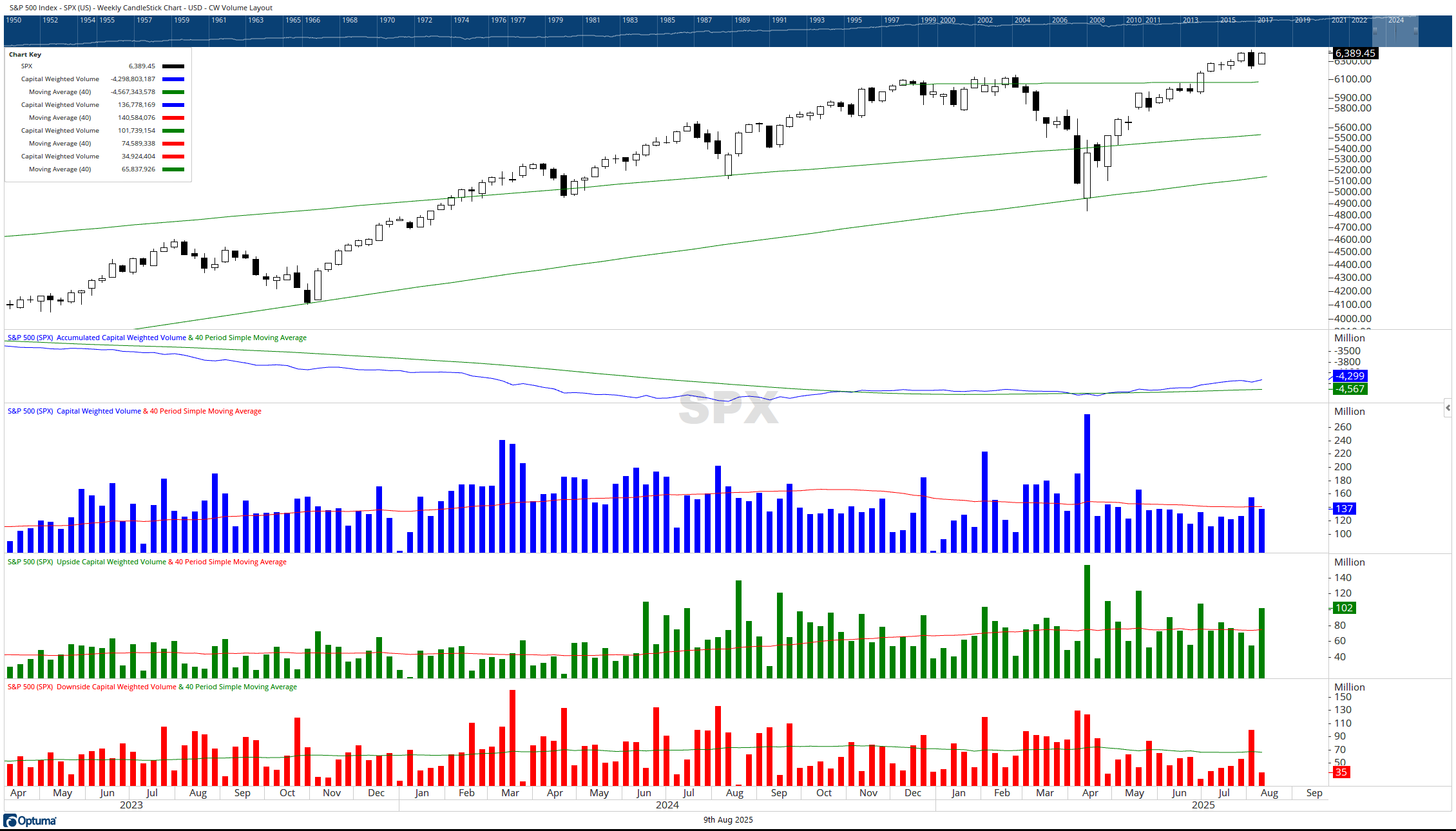

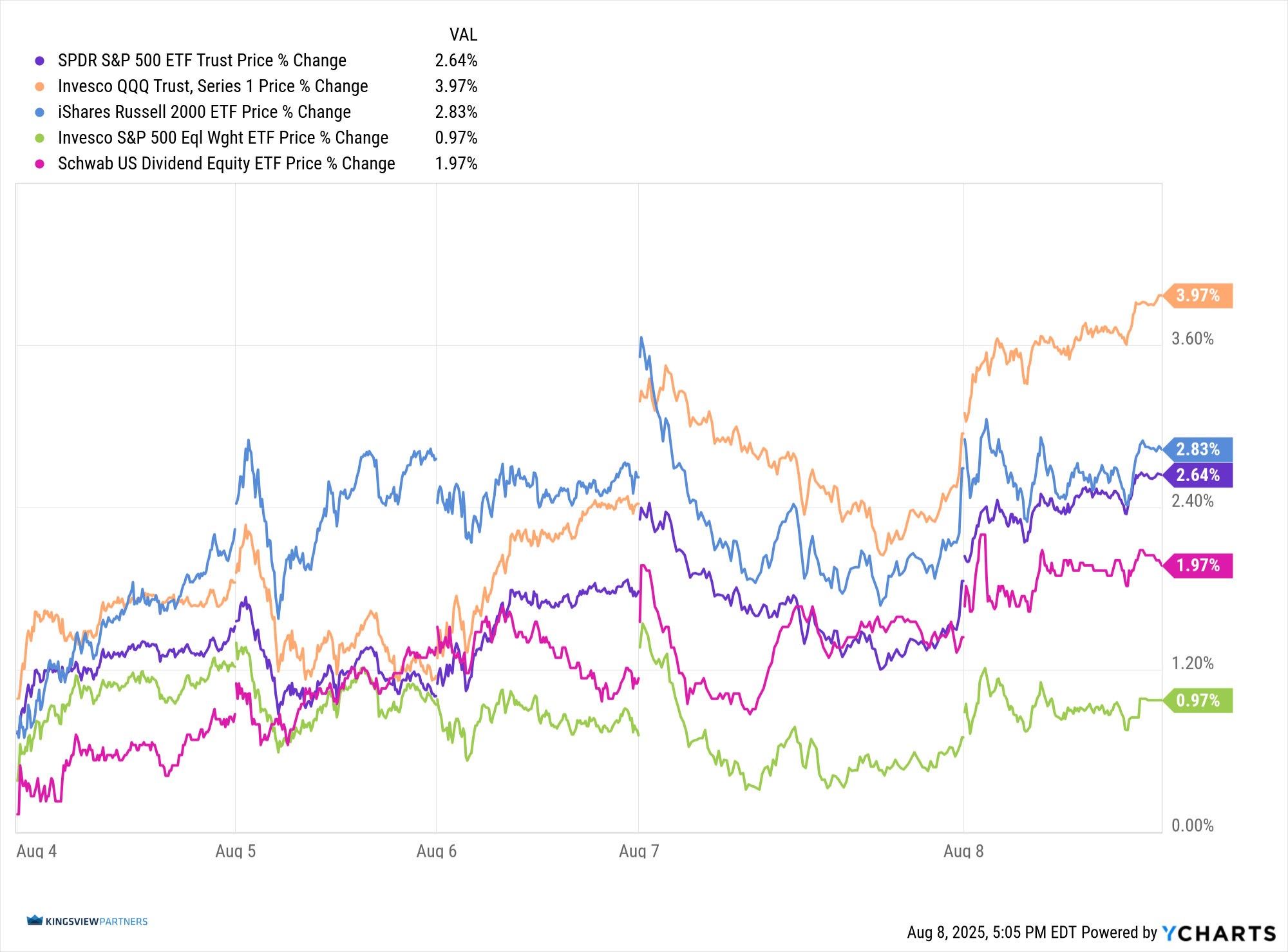

The generals (Invesco QQQ Trust) led from the front this past week, charging ahead with a 3.97% gain and breaking through to close at new all-time highs. While Capital Weighted Volume came in slightly below its weekly average, Capital Flows registered slightly above average, confirming that the advance was backed by committed capital.

All major units advanced, yet the equal-weighted forces (RSP – Invesco S&P 500 Equal Weight ETF) lagged their capital-weighted counterpart, managing only a 0.97% gain. The delta between the generals and the brass commanders revealed concerning depth of ranks between the mega caps and the broader market. Although the troops (IWM – iShares Russell 2000 ETF) rose 2.83%, they remain positioned within the previous week’s trading range, still bounded by 225 resistance overhead and 212 support beneath.

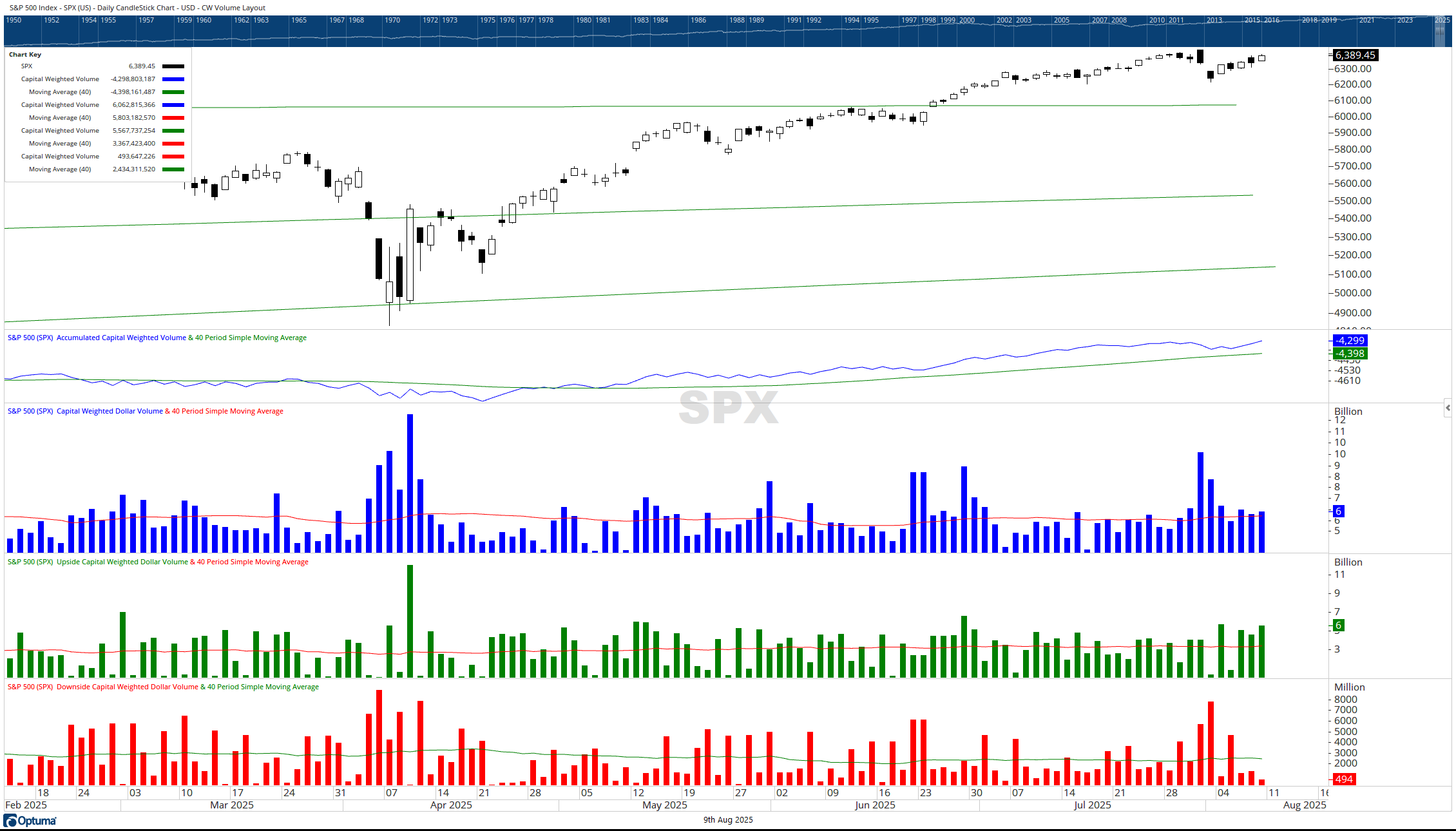

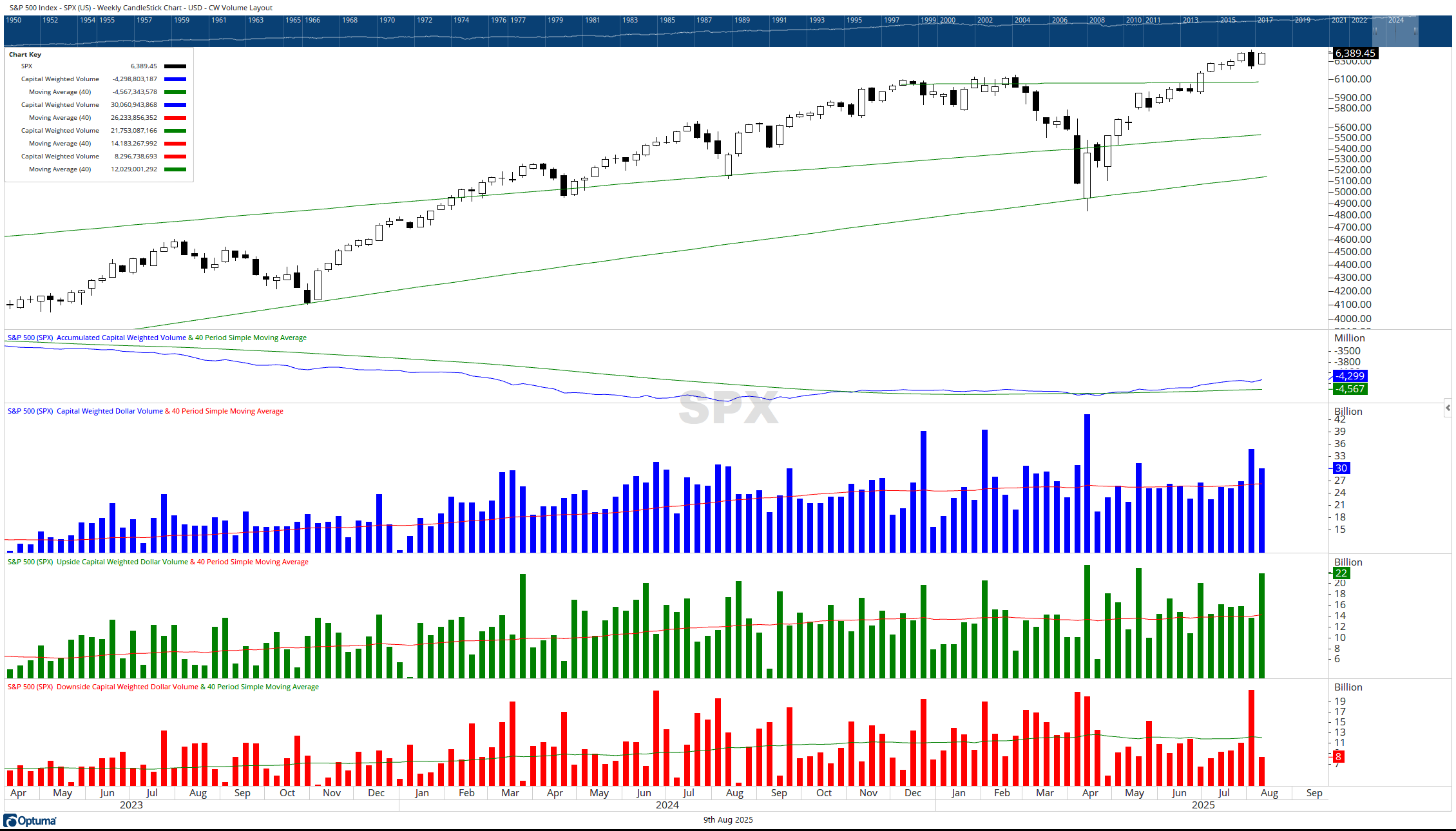

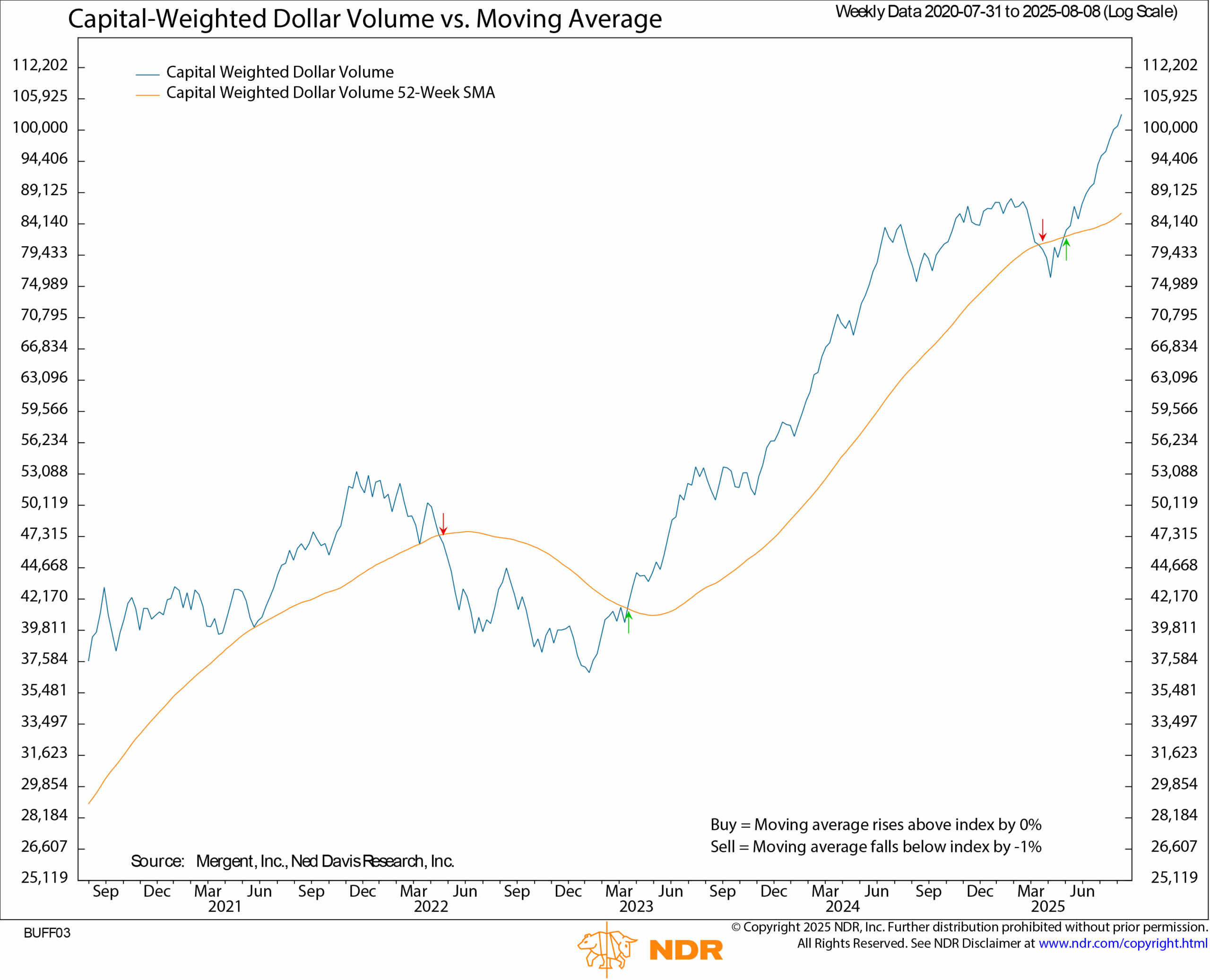

The campaign closed the week on a strong note. Friday’s session was a decisive 90 percent day, with 90% of Capital Weighted Volume advancing and 94% of Capital Flows moving into equities. For the week as a whole, 72% of flows were inflows, and an impressive 74% of Capital Weighted Volume was to the upside. The accumulated trends of Capital Weighted Volume and Capital Weighted Dollar Volume remain firmly above all-time highs, reinforcing the view that volume leadership is intact and extending well ahead of price.

Still, despite volume trends breaking new ground, the S&P 500 price index closed inside the previous week’s range. To confirm an outside breakout, the index must push above 6427. A drop below 6212 would instead mark a breakdown from the current outside bar formation. The NYSE Advance–Decline Line mirrored this posture, also closing deeper inside its prior week’s range suggesting that much work remains before a confirmed breadth breakout.

With volume leadership pressing to unprecedented levels and the generals now occupying new high ground, the path forward for the S&P 500 appears promising. However, until the index itself breaches its own resistance zone, the campaign remains a step shy of a full breakout.

Overall, the market’s elite forces have broken new ground, and volume is confirming their advance. Yet broader participation lags, and price remains tethered inside last week’s range. The conditions are favorable for a follow-through, but a disciplined commander does not assume victory until the field is fully taken. Investors should maintain alignment with volume-confirmed leadership while respecting key support levels as lines that must be defended. Tactical stops, prudent position sizing, and diversification remain essential in case the tide shifts unexpectedly. In battle and in markets, it is not only the ground gained that matters, but the ground you are prepared to hold. And then there were none left unprepared.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 8/11/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.