Volume Analysis Flash Update – 6.30.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

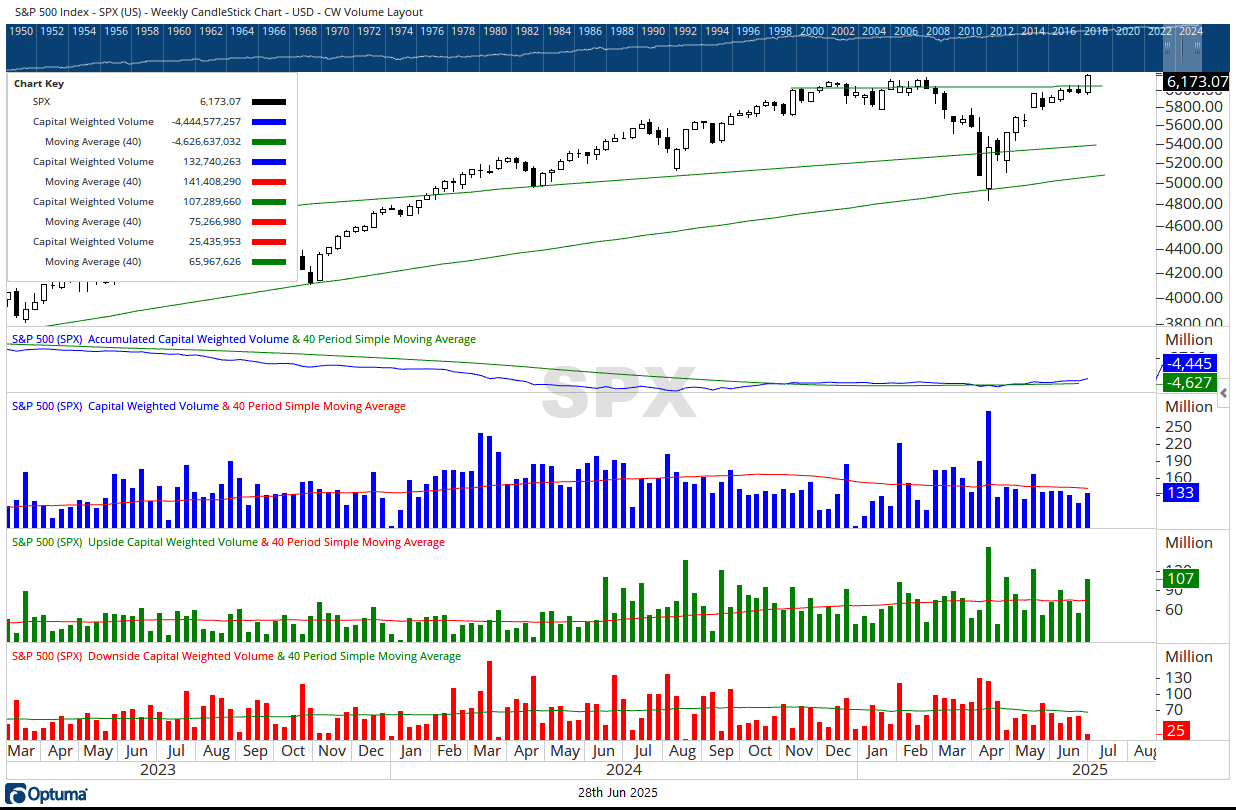

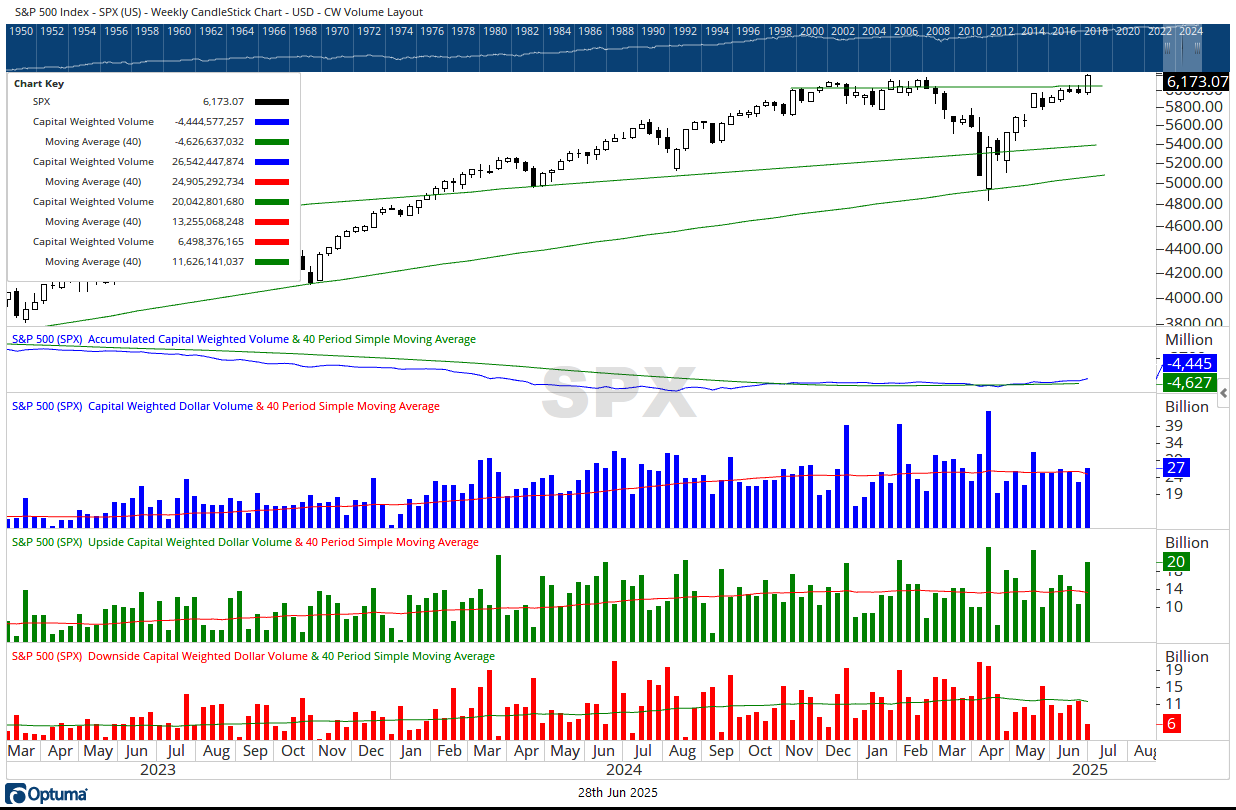

Volume Leads, Price Follows

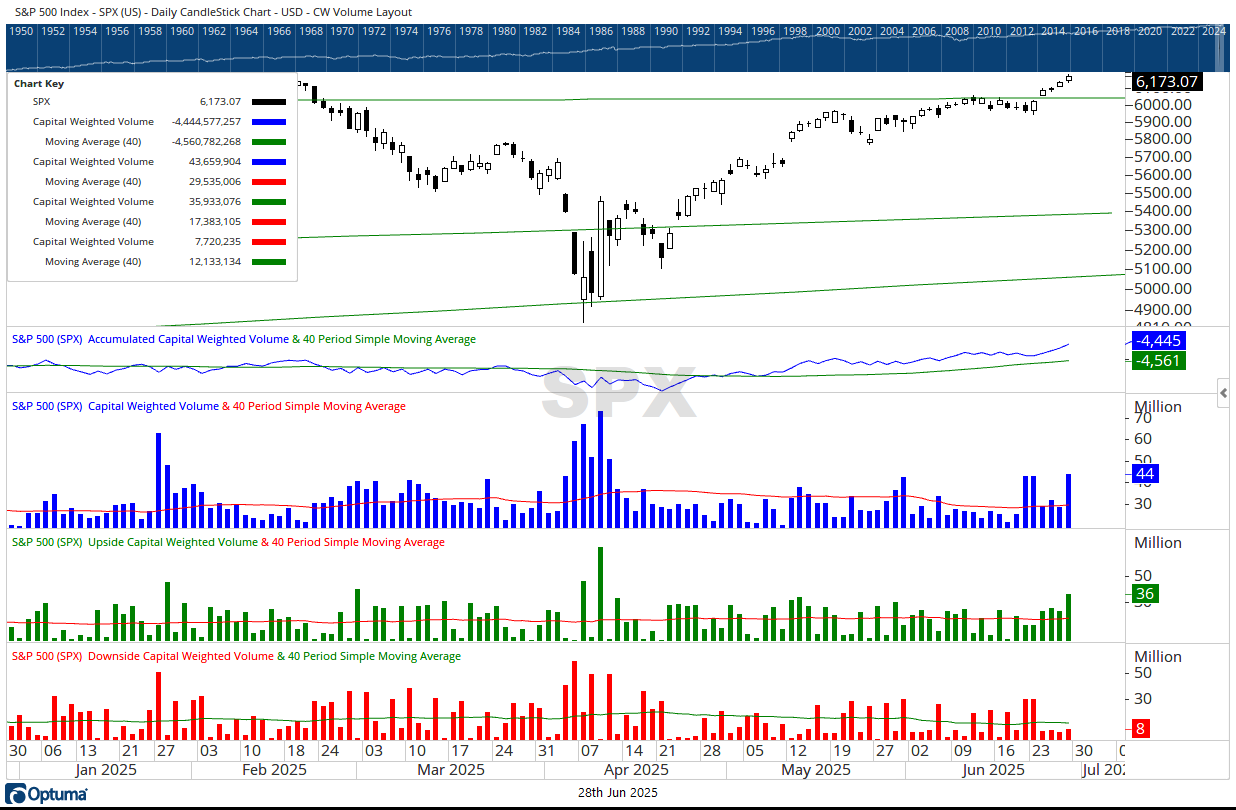

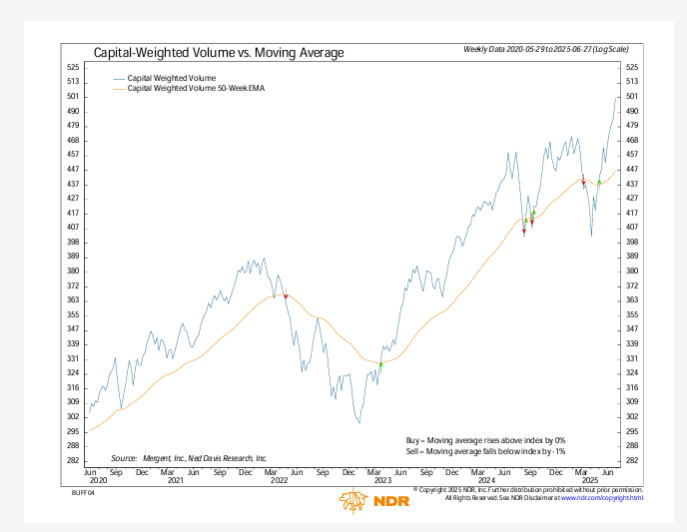

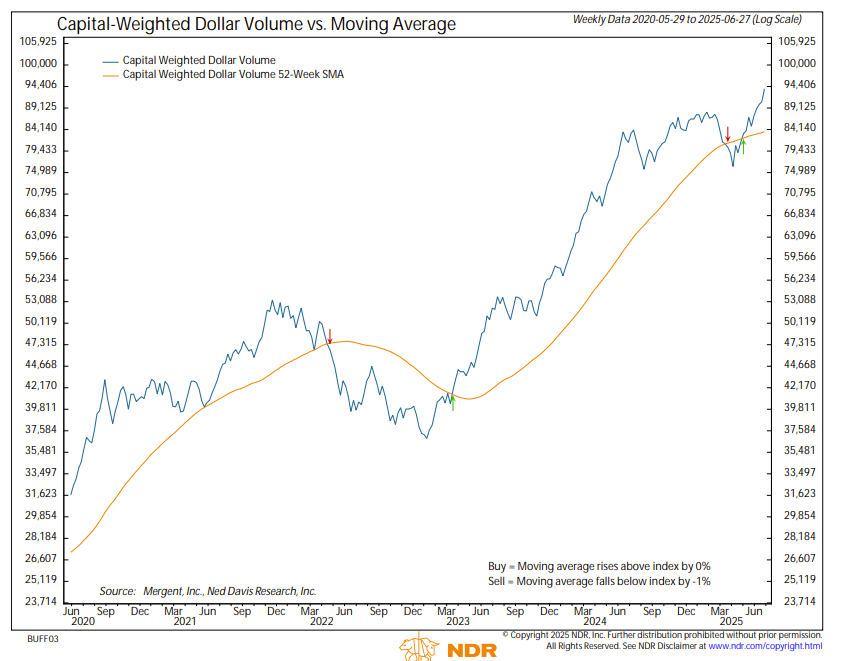

In our May 5th dispatch, we reported a strategic shift on the battlefield. Volume trends were breaching resistance well ahead of price. At the time, we noted, “The strategic stronghold at SPX 4800 was defended effectively—likely by the market’s strong hands, buying or covering near the April 9th lows. Yet these same battle-hardened investors have shown little appetite to press the attack above SPX 5500. Nonetheless, even with limited logistical support, the surge was potent enough to lift both Capital Weighted Volume and Capital Weighted Dollar Volume (Capital Flows) above trend lines—marking a tactical shift in this campaign.” That shift, we argued, reclassified the movement from a rebound to a confirmed volume-led advance.

On June 9th, we observed the troops catching their breath. Meanwhile volume was surging to fresh all-time highs and we stated, “Volume leads this market, and it just claimed fresh all-time highs. Capital flows confirm the breakout, marking a potential turning point where price could be called to follow.” Since then, seemingly every week similar sentiments have been echoed.

This past week, the call was answered. The S&P 500 broke through the long-contested 6050 resistance level pushing to new all-time highs. Volume sets the pace for capital deployment, which in turn directs the course of price action. The breach was not a solo maneuver, both Capital Weighted Volume and Capital Flows confirmed the move, with upside volume and capital inflows commanding 80 percent of total weekly activity. This was no stealth move; rather it was a coordinated offensive with volume sounding the shofar.

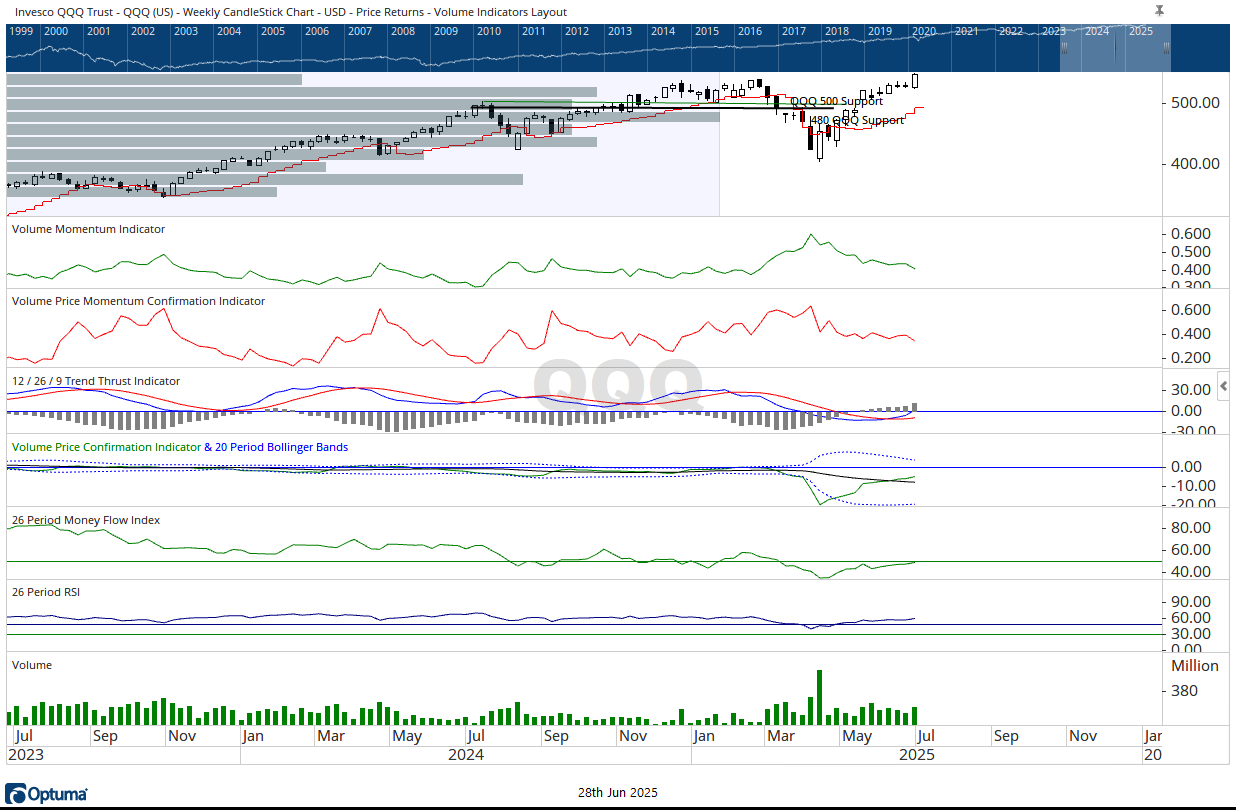

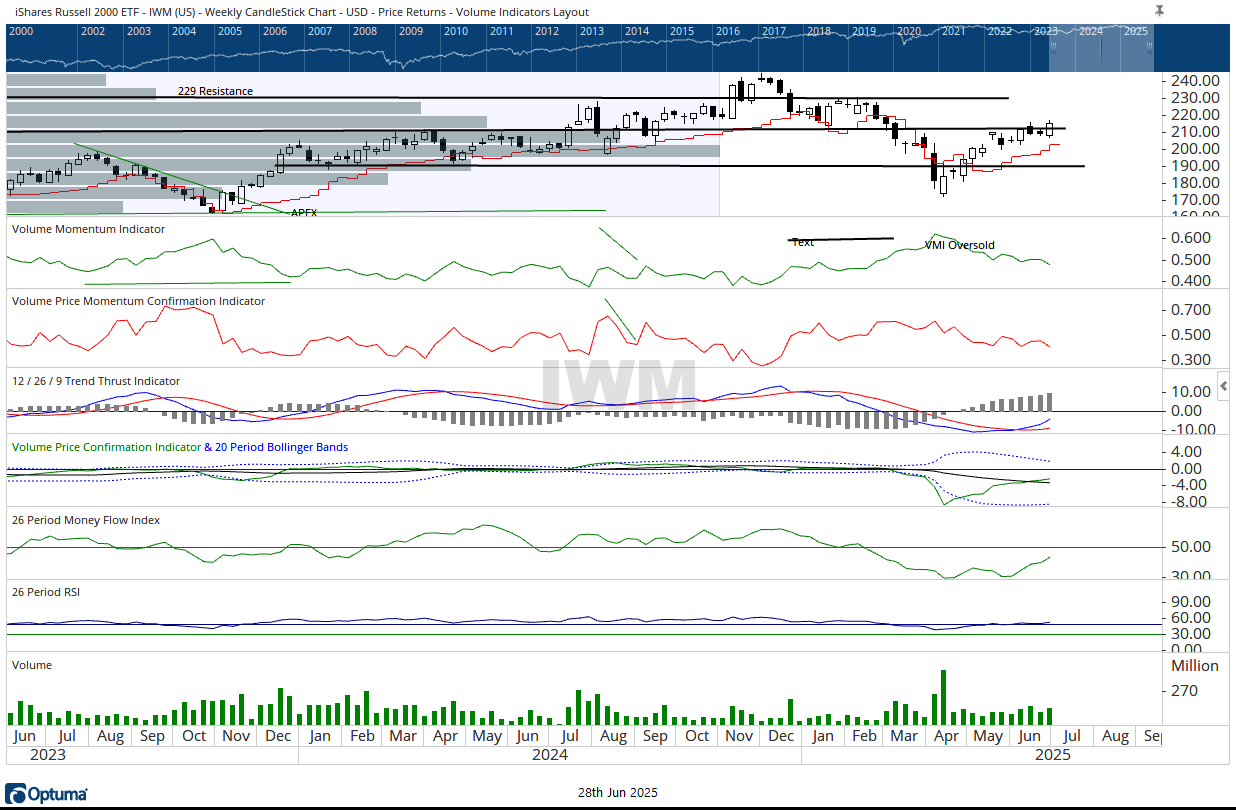

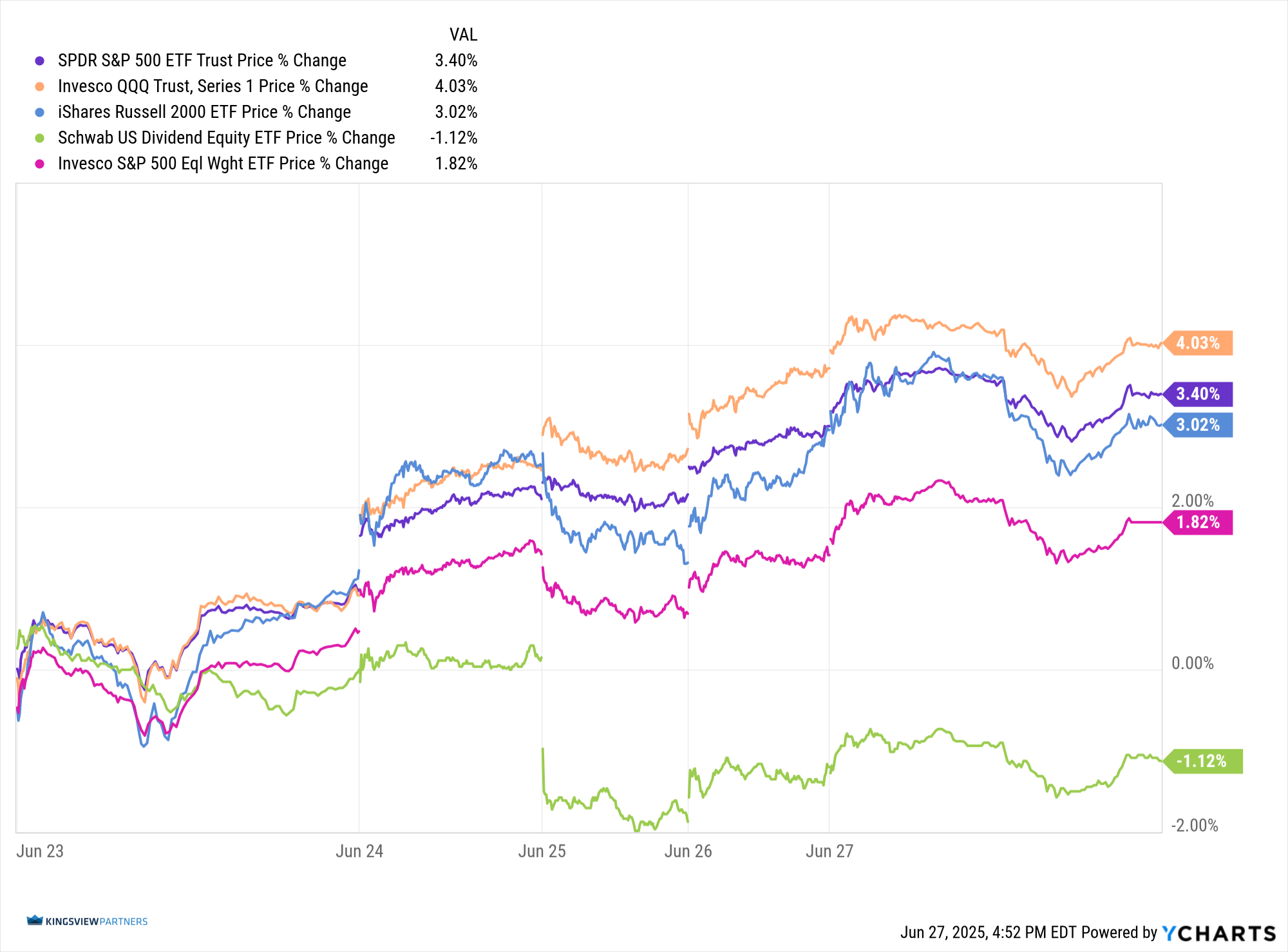

Once again, the generals (Invesco QQQ Trust ETF) led from the front, advancing 4.03%. The troops (iShares Russell 2000 ETF) posted a gain of 3.02%. Yet not all divisions moved in lockstep. The income battalion, represented by the Schwab US Dividend Equity ETF (SCHD), lost ground, falling -1.12% for the week. This retreat serves as a reminder that while the campaign is advancing, it is not yet universally supported.

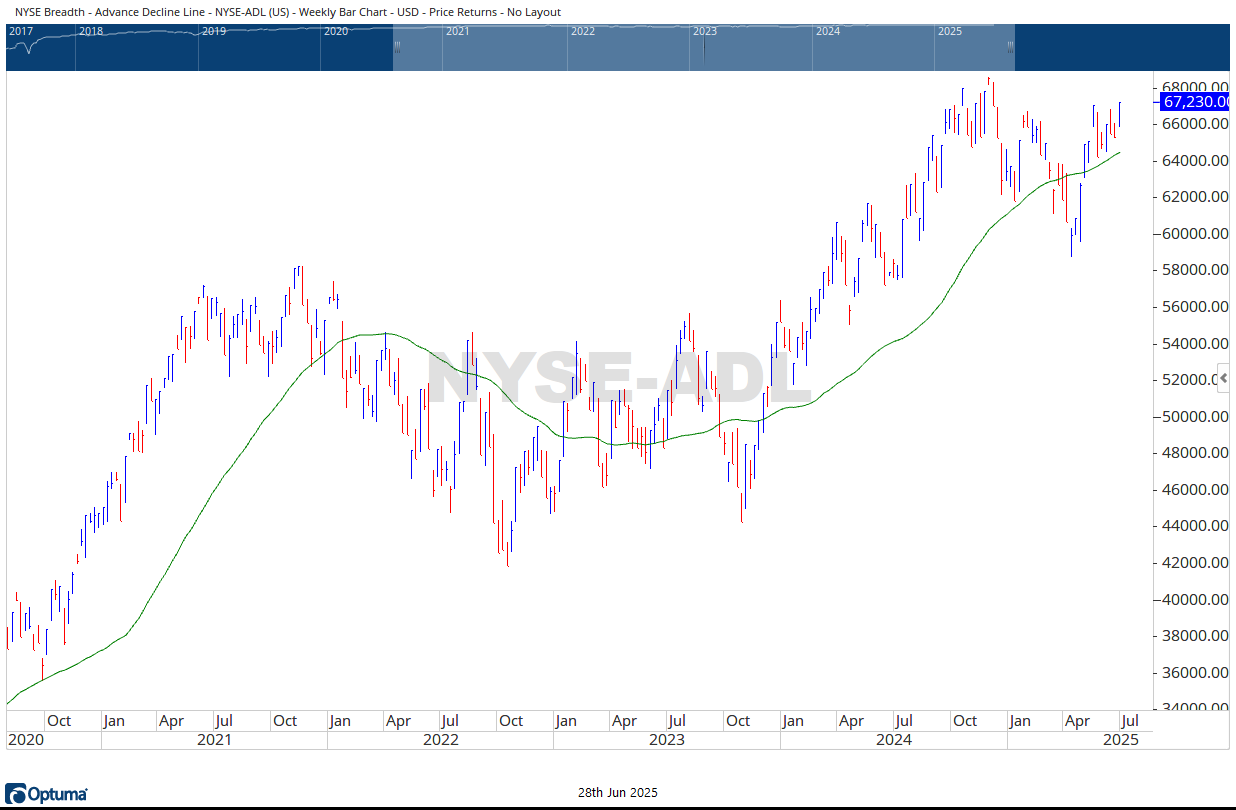

The NYSE Advance–Decline Line broke out of its prior range but still trails below all-time highs, suggesting some rank-and-file have yet to fully rally behind the generals. The troops did manage to retake 212 resistance, but rather than open ground, they now find themselves within a new set of fortifications, with the next major test looming near 230.

Despite strong supply lines and logistical support, this campaign could benefit from broader participation. Until the full force of market breadth joins the front, leadership remains concentrated among the few.

In summary, price has now followed volume into record territory, validating the capital-weighted surge we first identified months ago. The generals have taken the hill. The troops have breached enemy lines but remain constrained. The breakout is real, but for a broader advance to endure, it will need more than elite forces, it will need the army.

Overall, while some Nephilim have fallen off solider island, this market appears to be gaining back some of its 2024 Mega mojo. As we cross over into July, noted historically as one of the strongest months on the calendar, the market appears to be in a healthy state to run. However, we must also continue to exercise risk management understanding summer markets are also lauded for counter rallies and geopolitical risks continue to loom.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 6/30/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.