Volume Analysis Flash Update – 6.23.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Holding the Line, Mild Strategic Pullback Continues

Despite the distraction of geopolitical unrest and a closely watched Federal Reserve meeting, the battlefield remained largely quiet during the shortened holiday week. Both price and volume held their positions, showing minimal movement as the broader market took a well-earned pause.

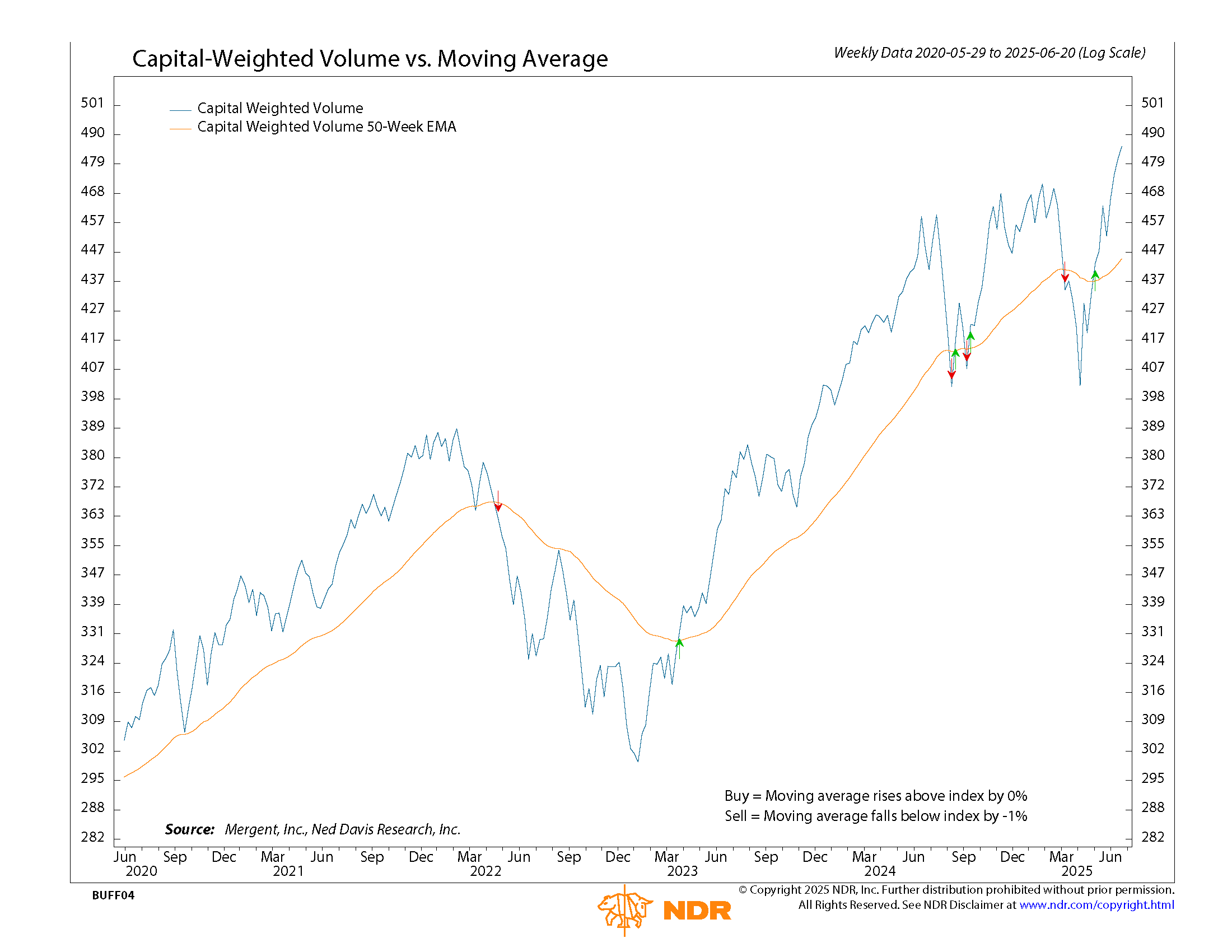

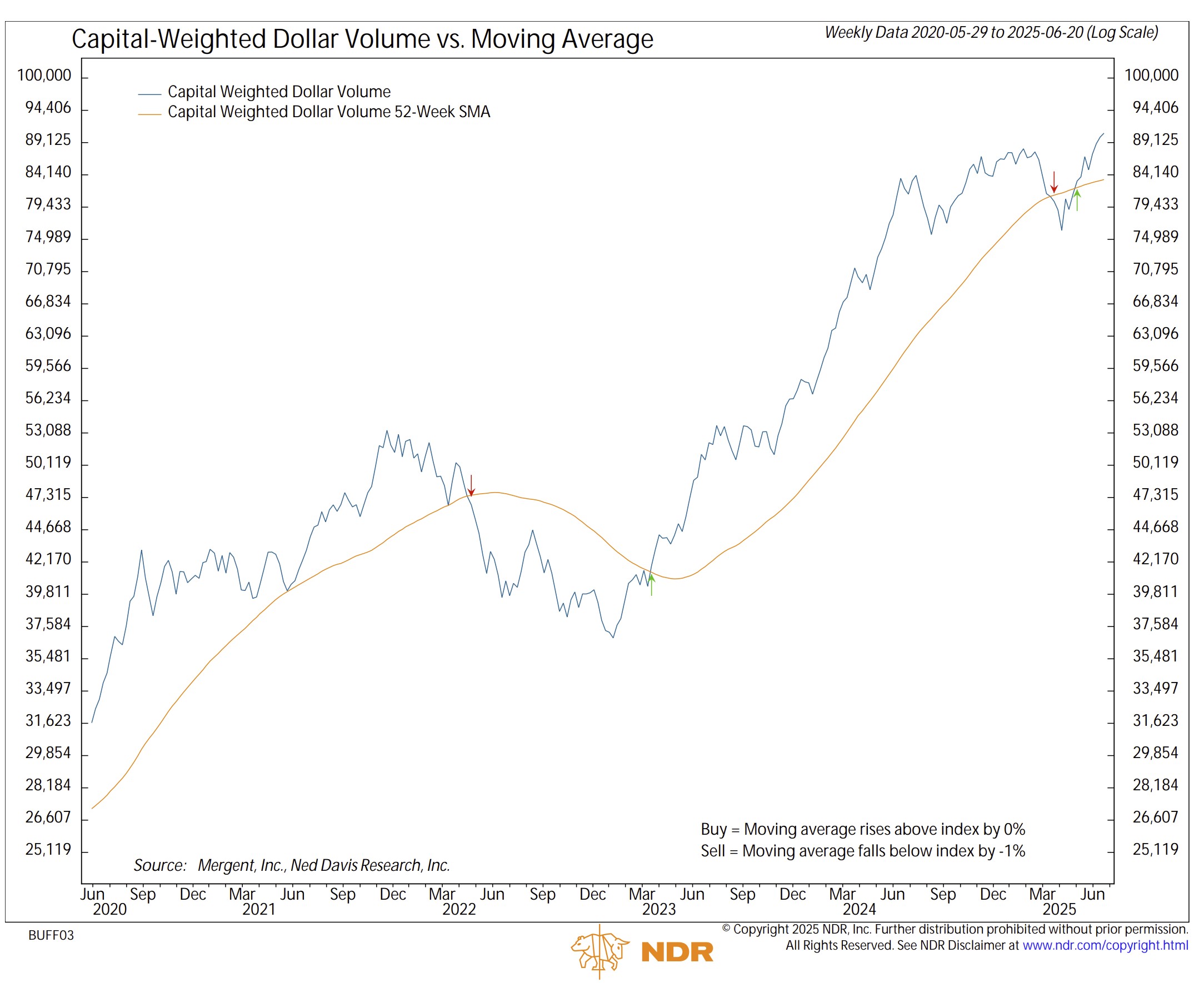

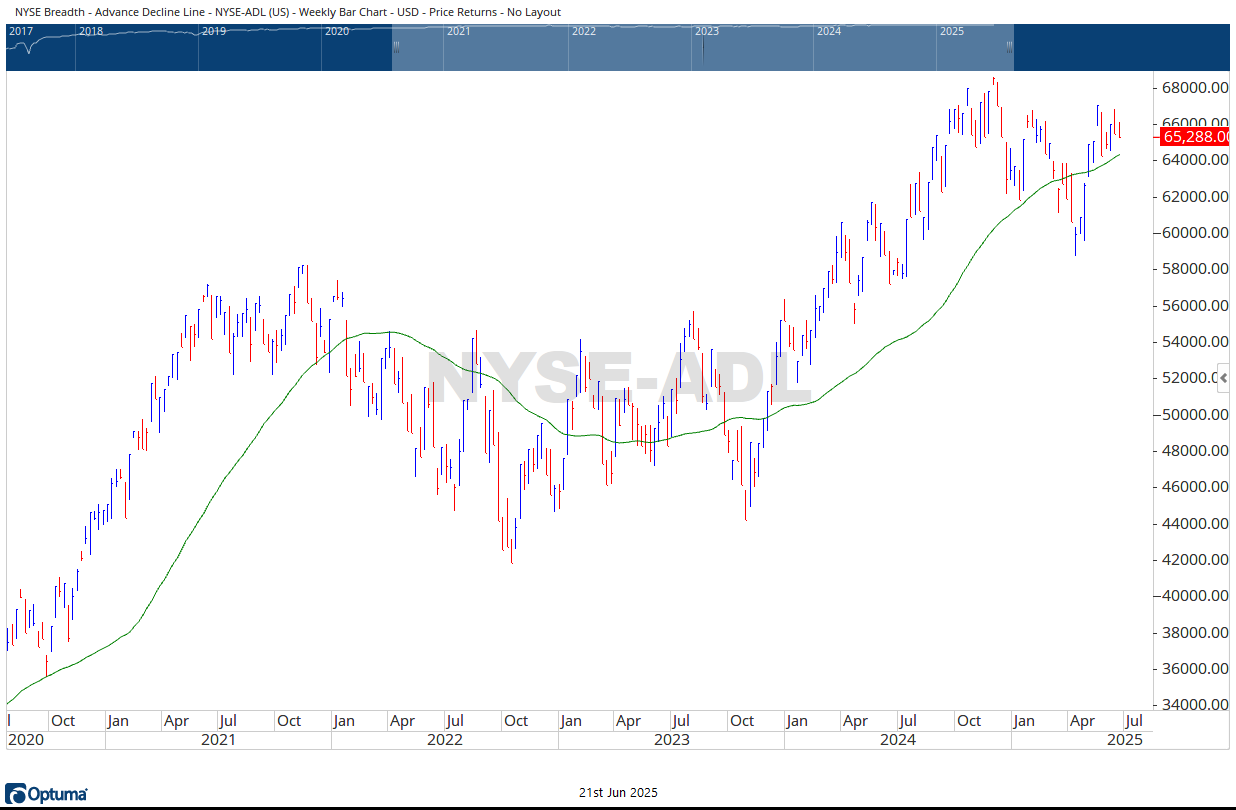

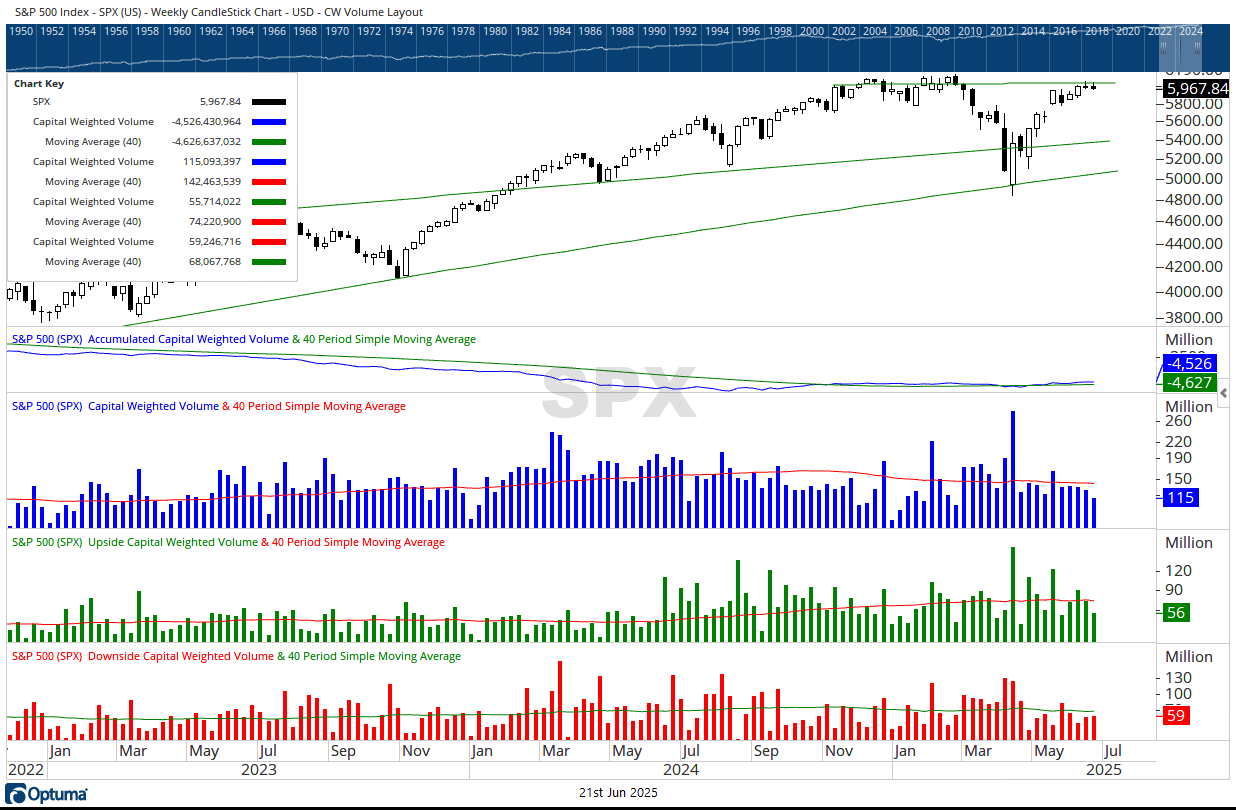

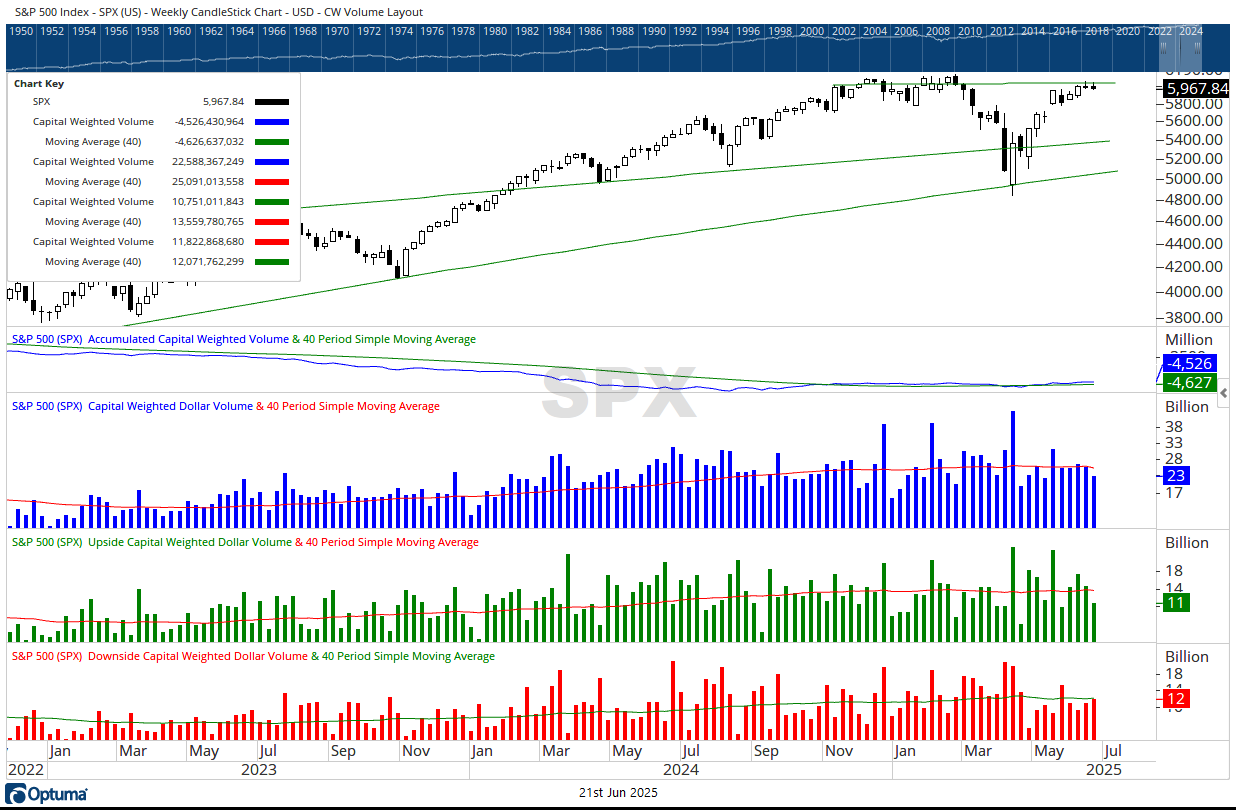

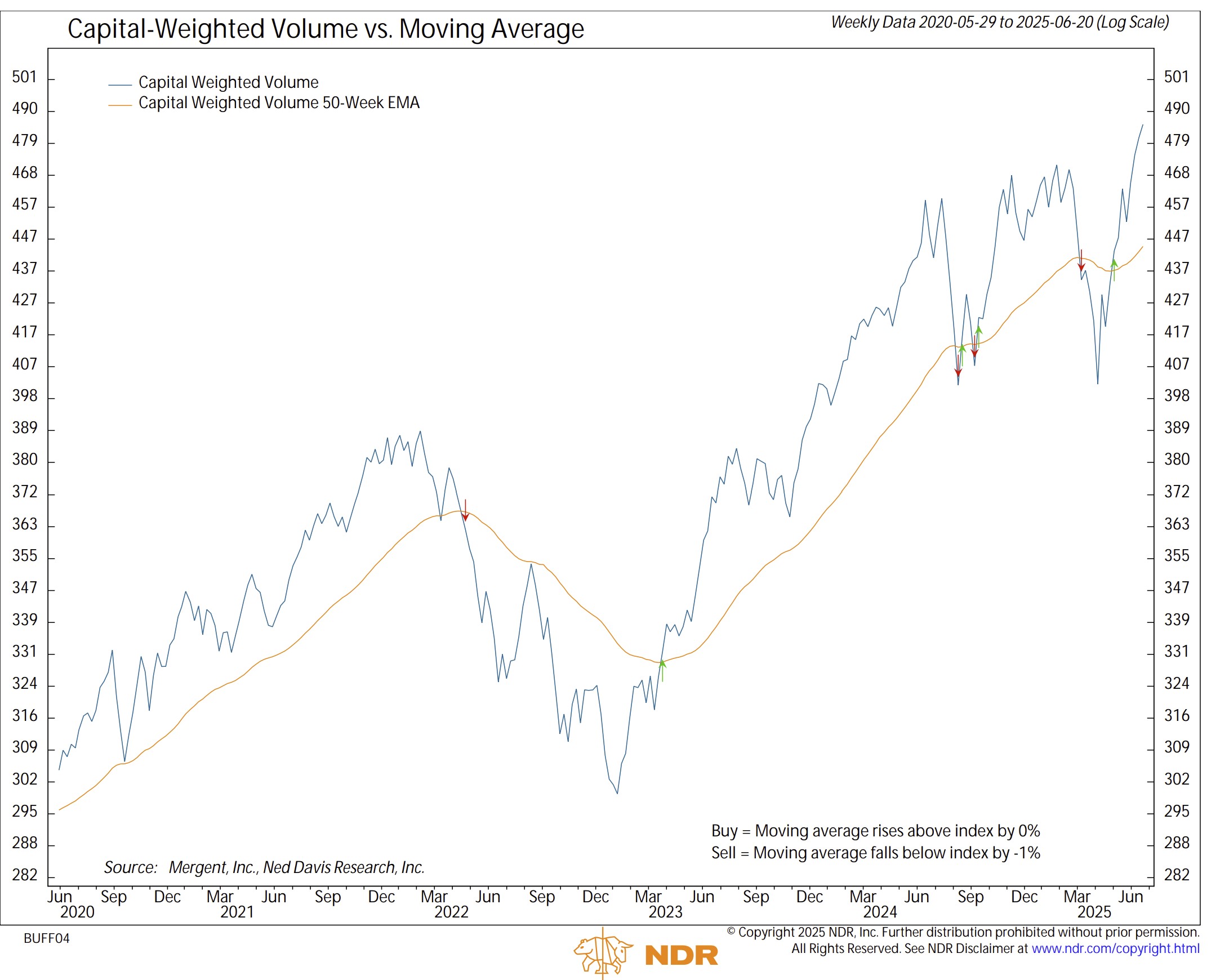

The S&P 500 and its supporting ranks posted modest declines, while volume and capital flows moved laterally, neither advancing nor retreating significantly. This stalemate supports a view we’ve maintained in recent weeks: a healthy pause was needed before price action may continue to follow volume and capital flows to new heights. The campaign cannot continue unchecked without resupply and reassessment. Markets often march not in straight lines, but in disciplined phases—pause, reposition, then advance.

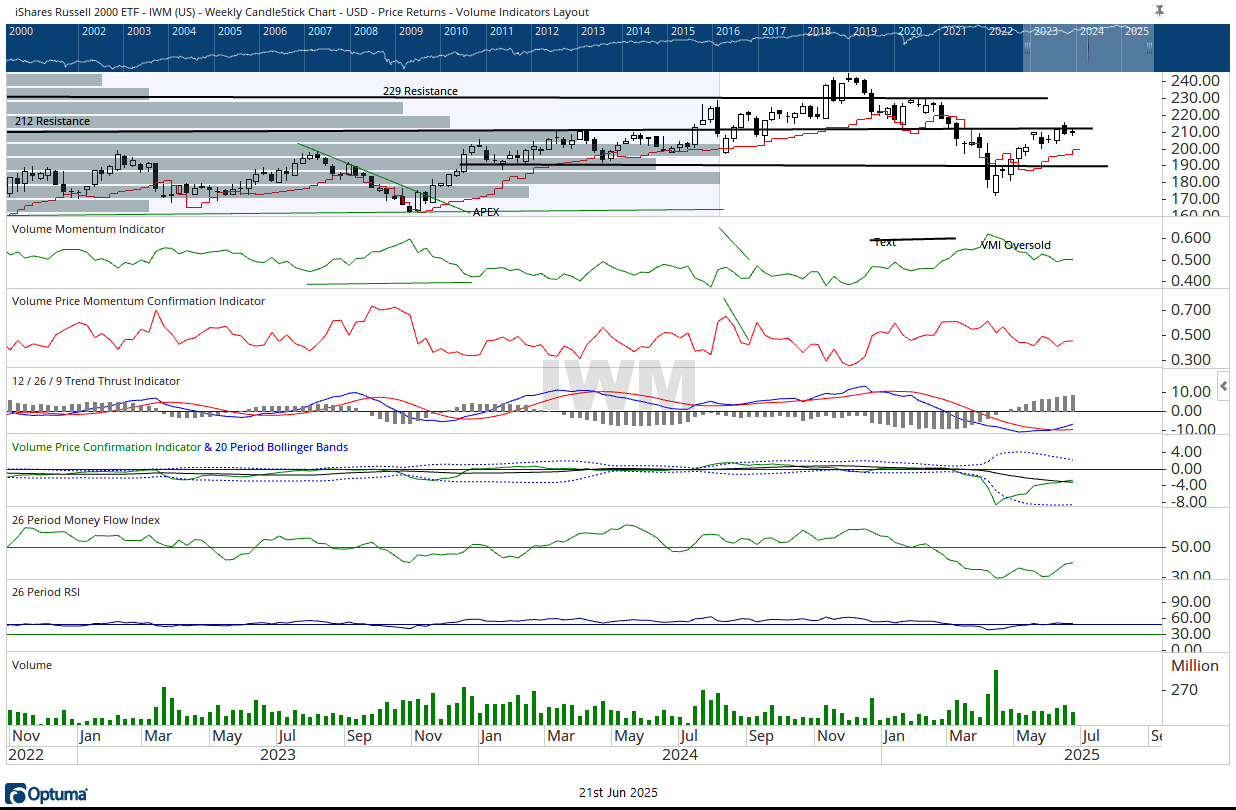

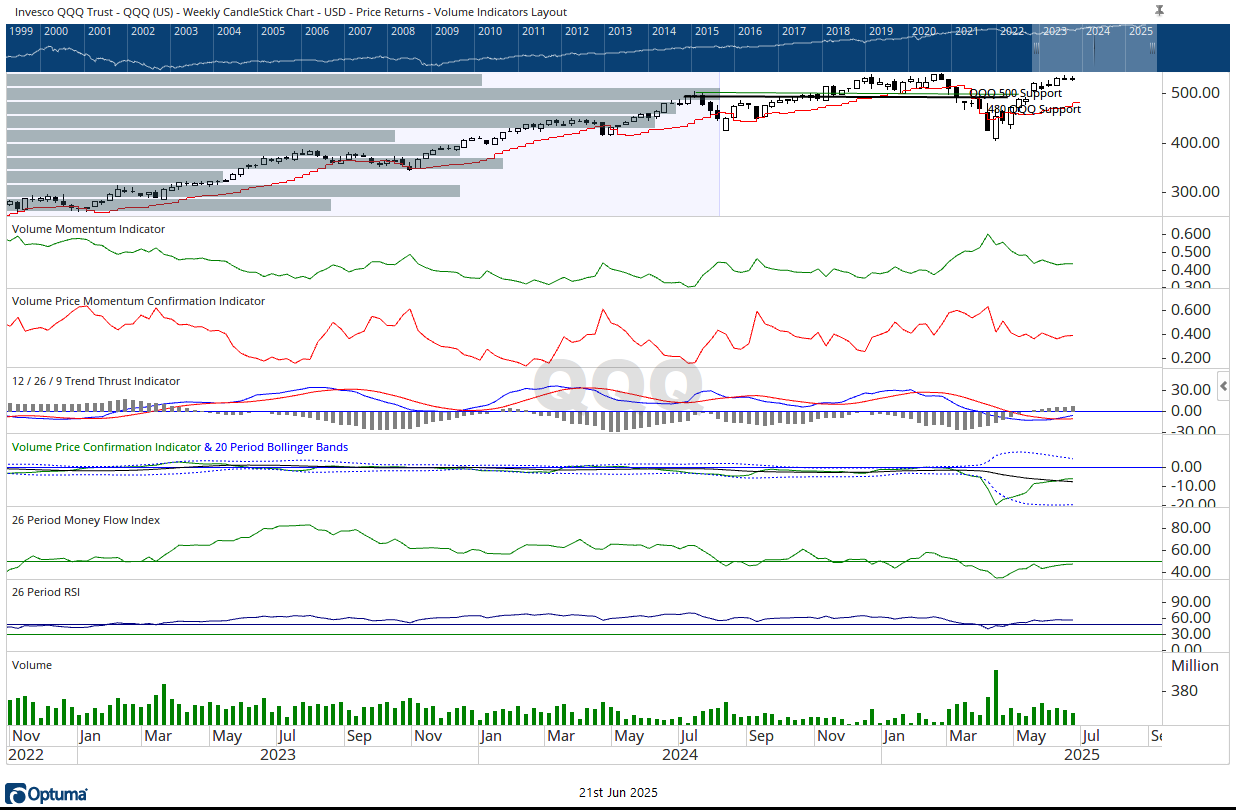

Resistance remains firmly entrenched at the 6050 level for the S&P 500, with baseline intermediate support near 5775. These are the current boundaries of the battlefield. The generals, represented by the Invesco QQQ Trust, continue to hold formation within striking distance of their all-time highs near 540. Meanwhile, the troops (IWM – iShares Russell 2000 ETF) are pressing against resistance at 210, testing their strength for a potential breakout.

Summary:

The market may not have advanced, but it also did not give ground. In warfare, as in investing, discipline during quiet moments often determines victory during the charge. Volume and capital flows remain elevated, suggesting the battle is not over—but simply waiting. With resistance defined and leadership within reach of their objectives, the next move may decide which side breaks first. And then there were none left uncommitted.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 6/23/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.