Volume Analysis Flash Update – 6.9.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

All-Time Highs Breached as Capital Flows Leads the Advance

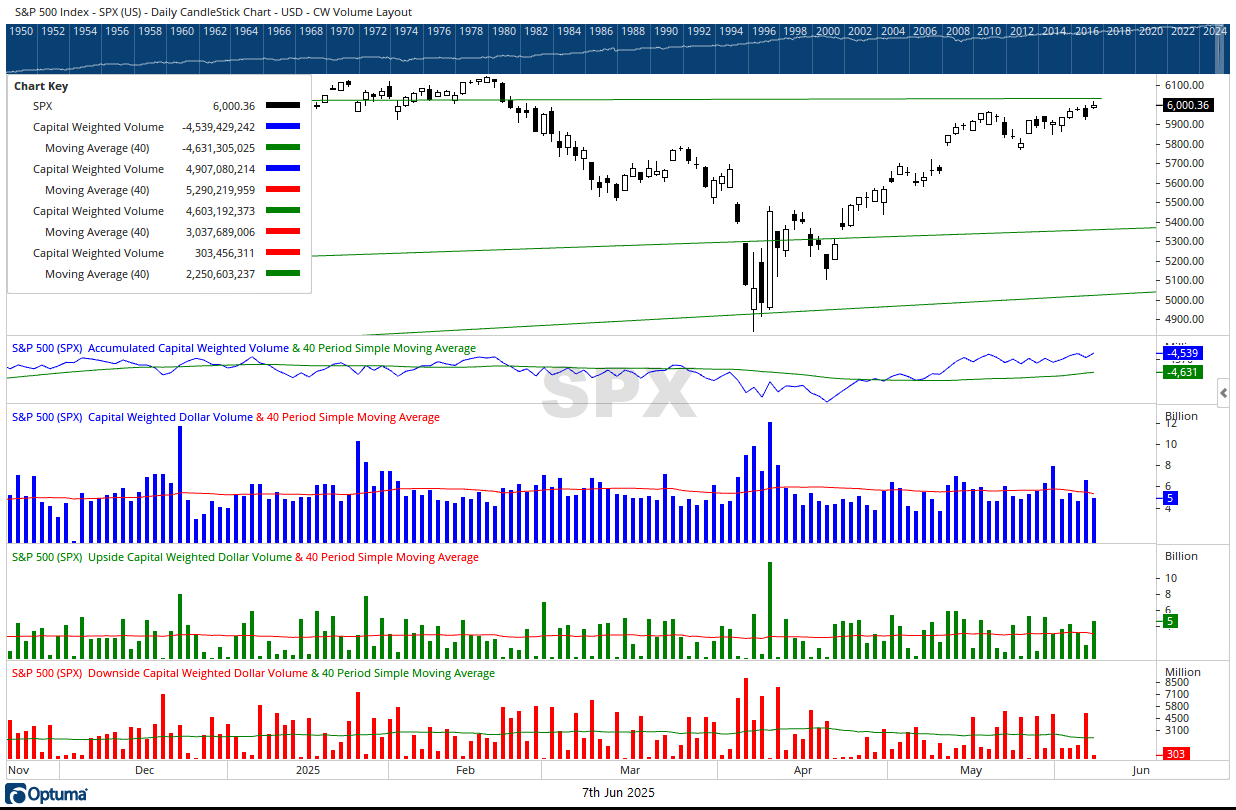

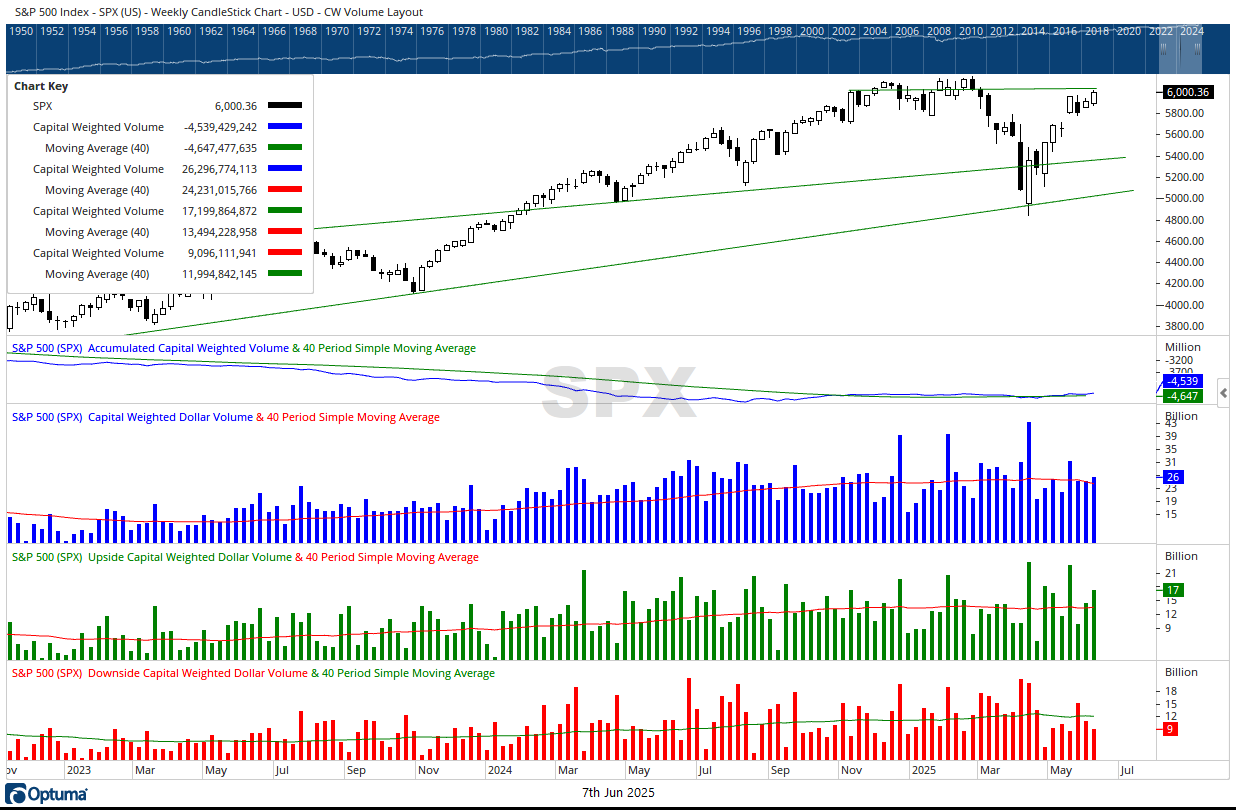

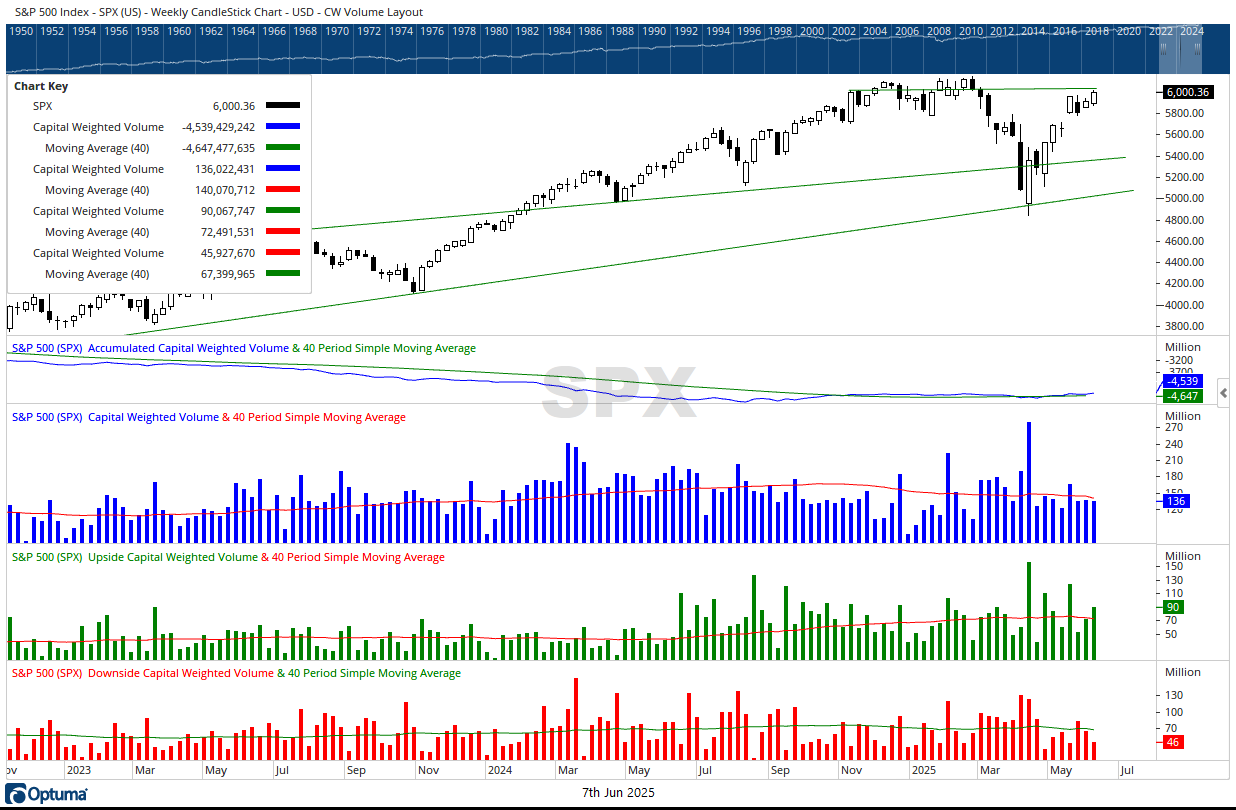

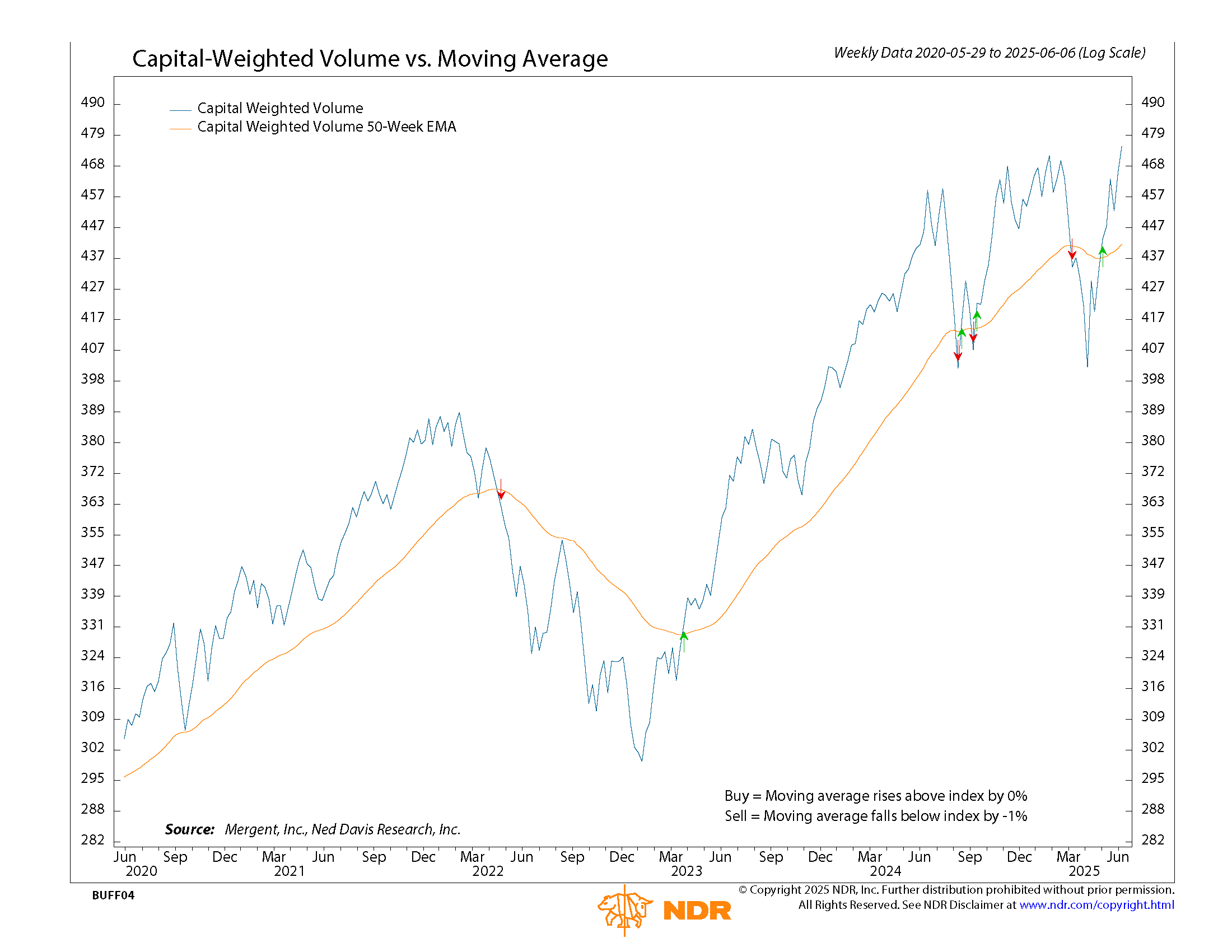

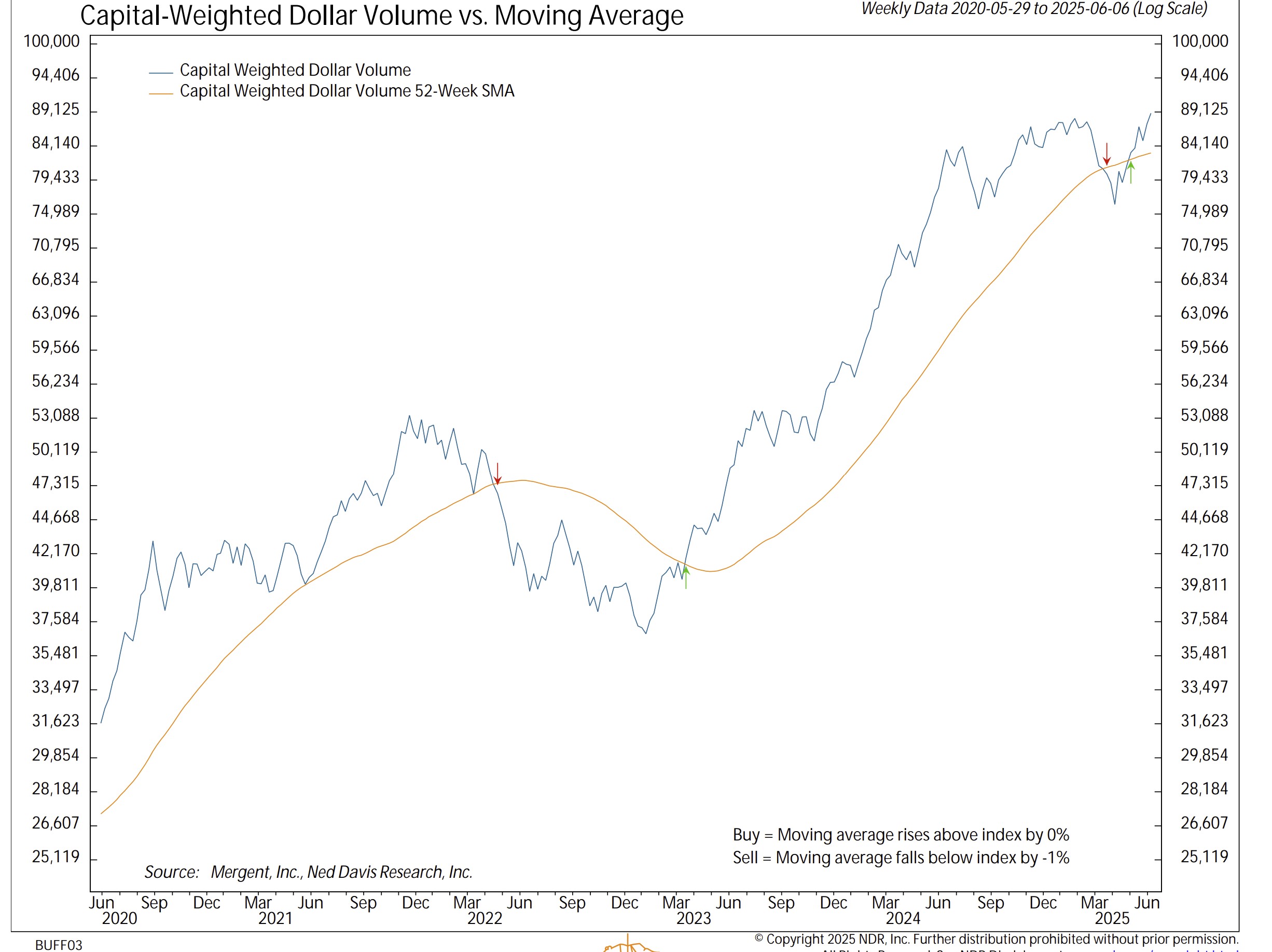

Last week concluded with a decisive show of strength as Friday’s capital flows recorded a commanding 95% inflow day. For the week, inflows outgunned outflows by nearly a two-to-one margin based on total capital-weighted dollar volume. In our prior dispatch, we noted that supply lines were supporting the advance, with Capital Weighted Volume and capital flows breaching their own resistance levels ahead of price. Specifically, we stated, “On the volume front, supply lines supported the advance, with Capital Weighted Volume and capital flows both outflanking price by breaching its own comparable resistance levels. While the S&P 500 Index remains entrenched just below the psychological 6000 resistance line, should either of our volume gauges successfully break through this critical ceiling, it may serve as a forward reconnaissance harbinger for price to follow suit.” Thus, we suggested that if either of our volume gauges broke through their critical ceilings, they might serve as reconnaissance scouts—signaling that price could soon follow. This week, that forward signal became a reality as both Capital Weighted Volume and capital flows surged to all-time highs.

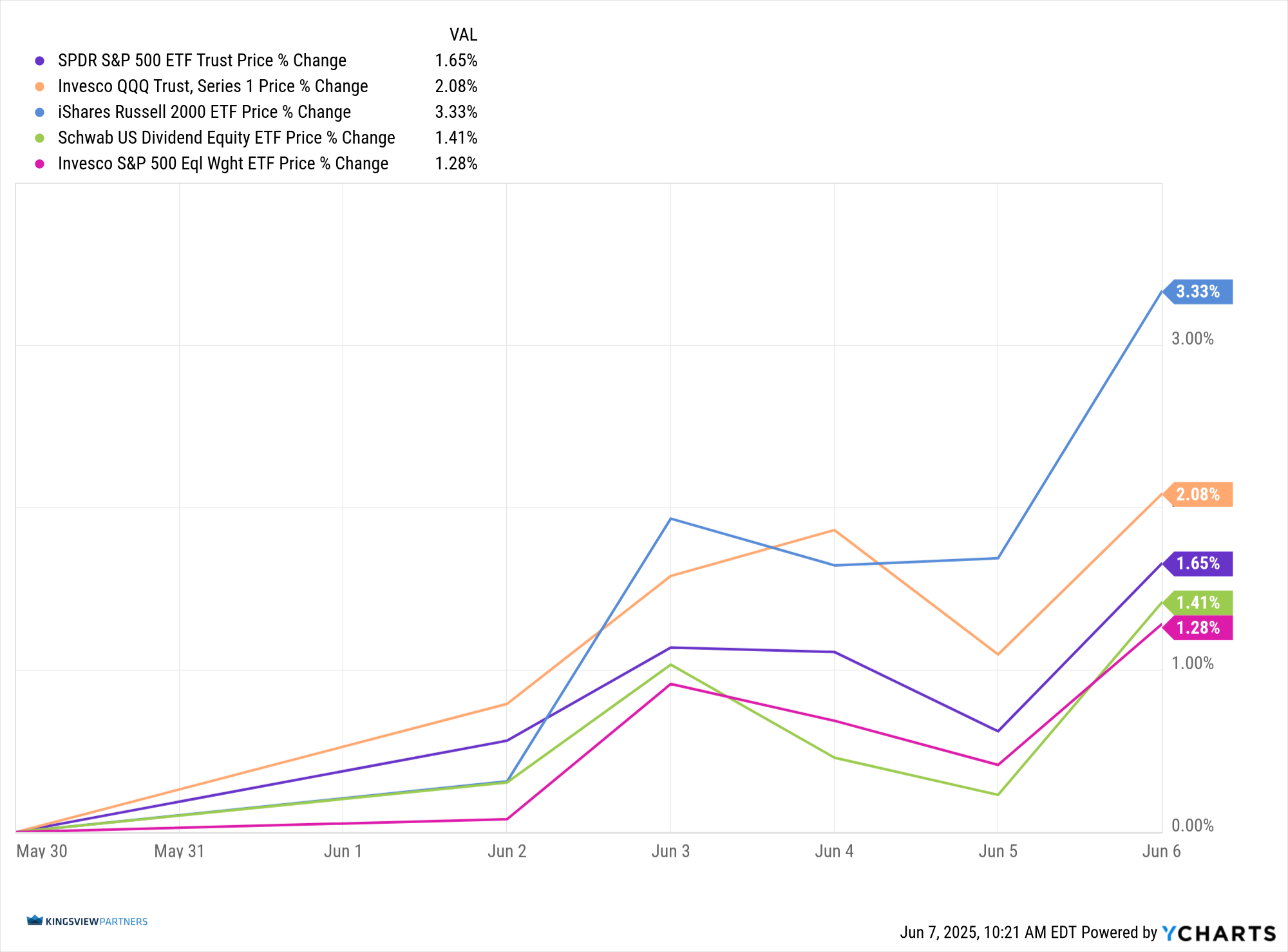

On the field, the troops (IWM – iShares Russell 2000 ETF) led the charge this past week, advancing 3.33% and halting just beneath the 212 resistance outpost. The generals (QQQ – Invesco QQQ Trust) maintained discipline and pressed forward, finishing up 2.08% for the week. Meanwhile, the brass commanders (RSP – Invesco S&P 500 Equal Weight ETF) continued to provide a solid but a much more measured rear guard, rising 1.28%.

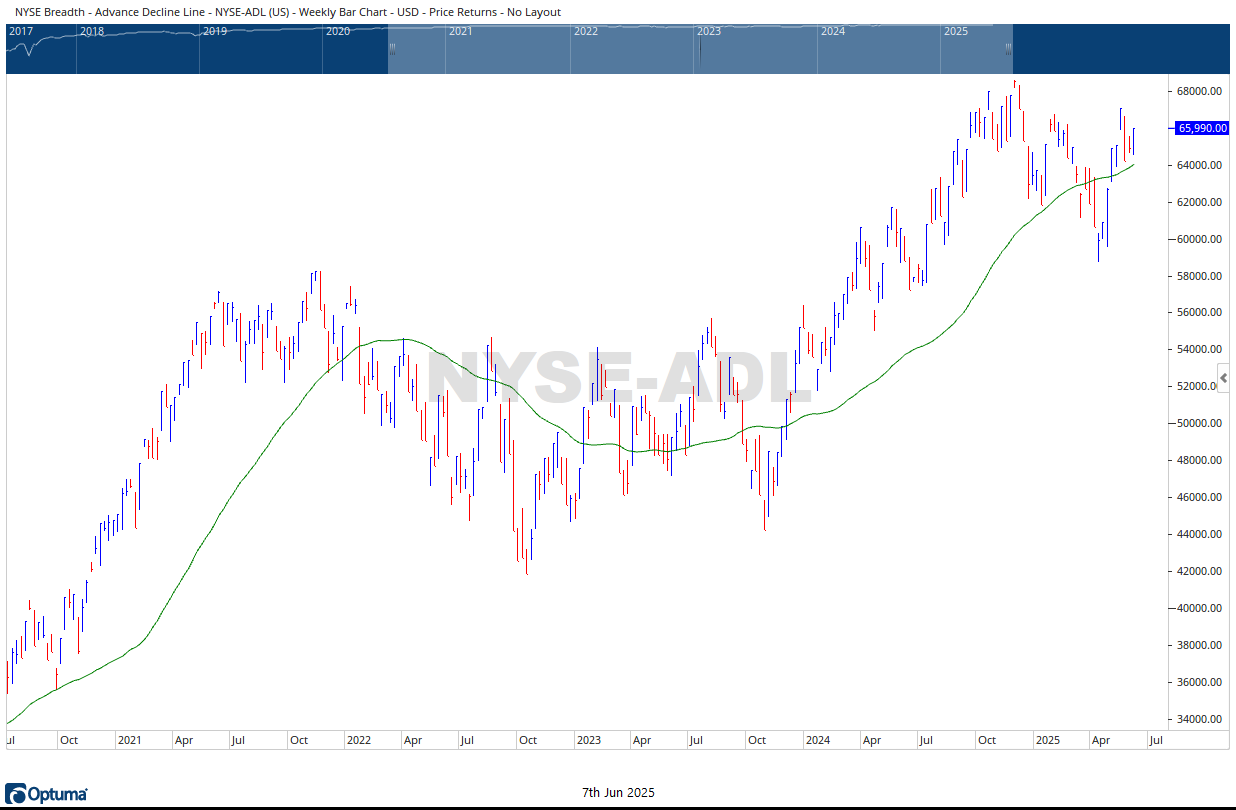

Notably, the generals are now about 2% away from breaching their own all-time highs at the 541 level. While the broader market’s breadth remains constructive, it is trailing behind both volume and price leadership, suggesting a limited campaign is still consolidating behind its front lines.

After a swift and strategic blitz off the correction lows, the S&P 500 once again finds itself encamped near resistance, just below all-time highs. Though market breadth and the troops continue their advance, they do so at a tempered cadence. However, their path forward may now be clearer. Capital Weighted Volume, the twin sibling to price, has already overrun previous highs, creating a potentially cleared lane for the broader forces to potentially follow. Still, following such an aggressive push, it may be tactically sound for markets to pause, regroup and consolidate before mounting a sustained offensive.

Summary:

Volume leads this market, and it just claimed fresh all-time highs. Capital flows confirm the breakout, marking a potential turning point where price could be called to follow. With the troops advancing, the generals pressing toward uncharted territory, and volume breaching resistance, this campaign may be poised for another leg forward—though a short regroup at the front lines may be imminent. For now, the volume victors stand tall, and then there were none left above.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 6/9/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.