Volume Analysis Flash Update – 6.2.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

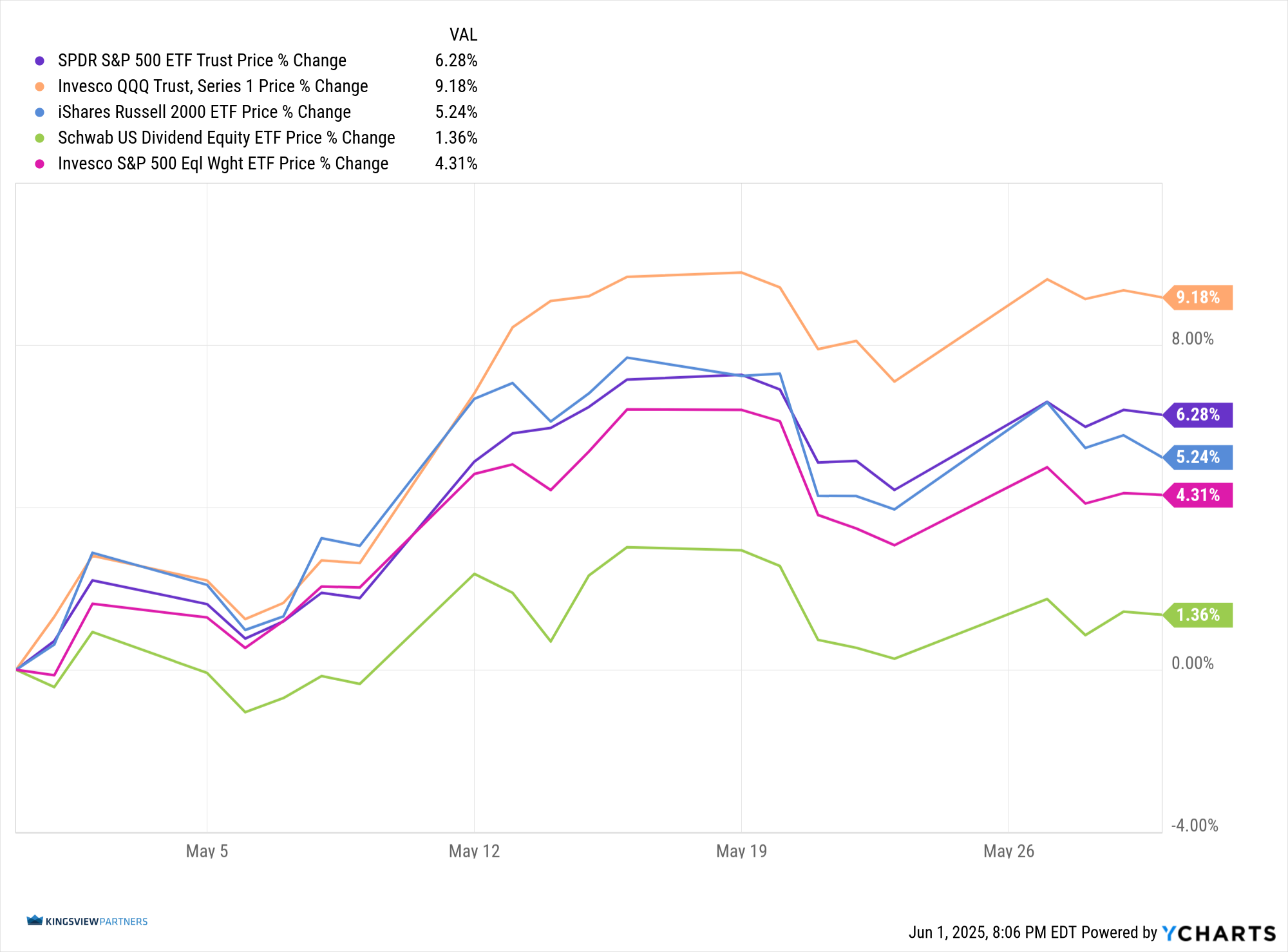

After a strong advance at Tuesday’s opening bell, effectively a gap-and-go maneuver, the markets held their ground, trading largely within Tuesday’s battlefield range. For the month, the generals (Invesco QQQ ETF) led the charge with a decisive 9%+ surge, rallying the broader forces higher. Meanwhile, the dividend brass commanders (SCHD – Schwab U.S. Dividend Equity ETF) brought up the rear, advancing just over 1%, a more defensive posture amidst the offensive.

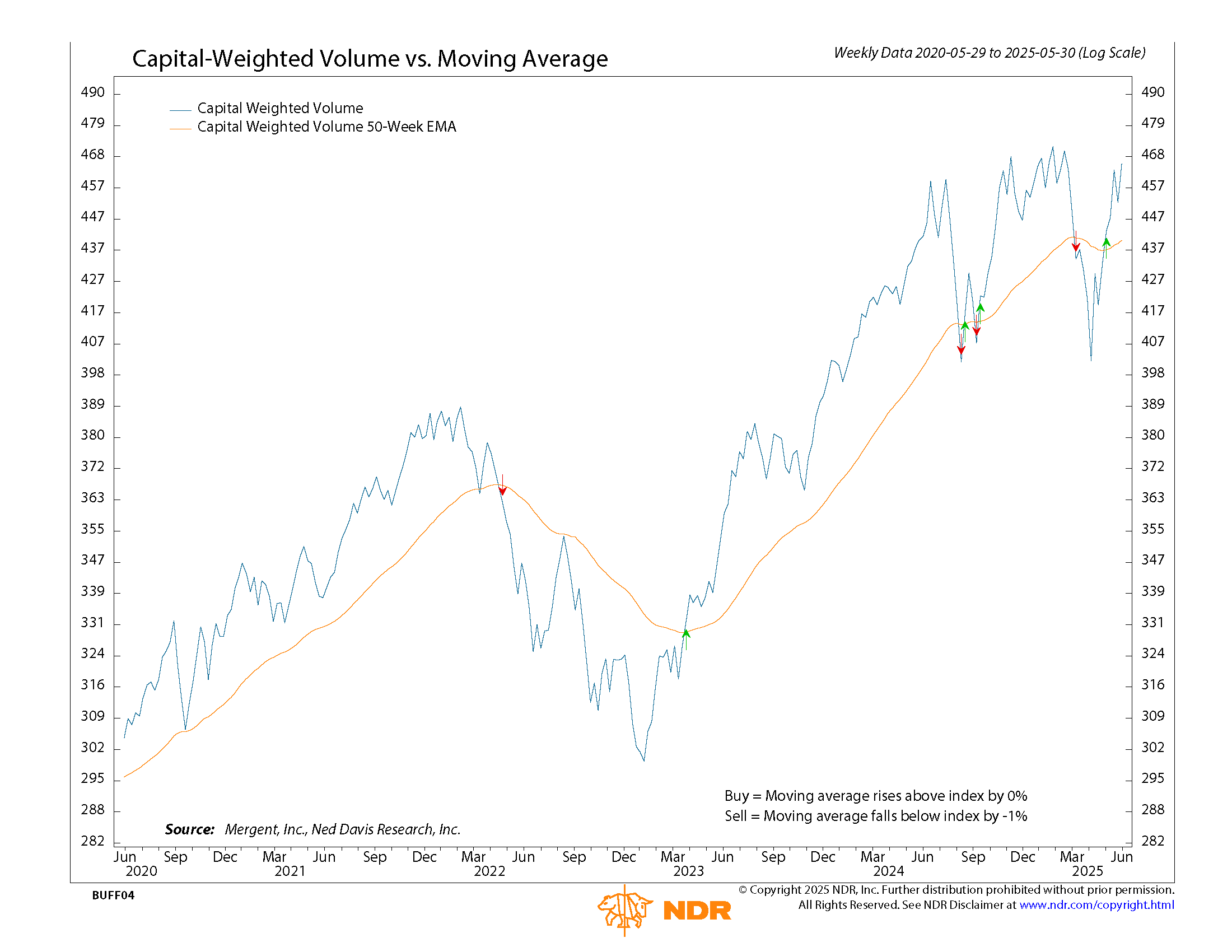

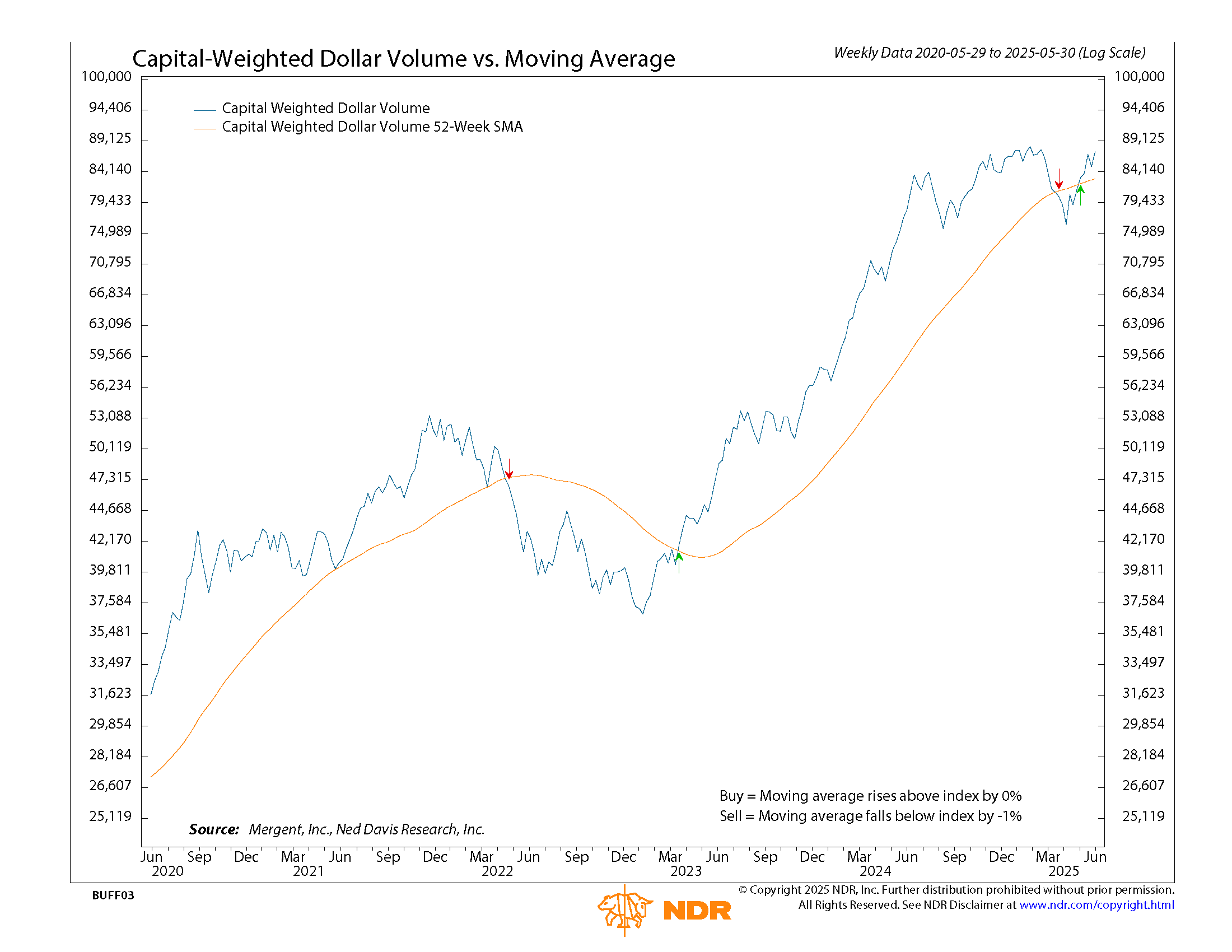

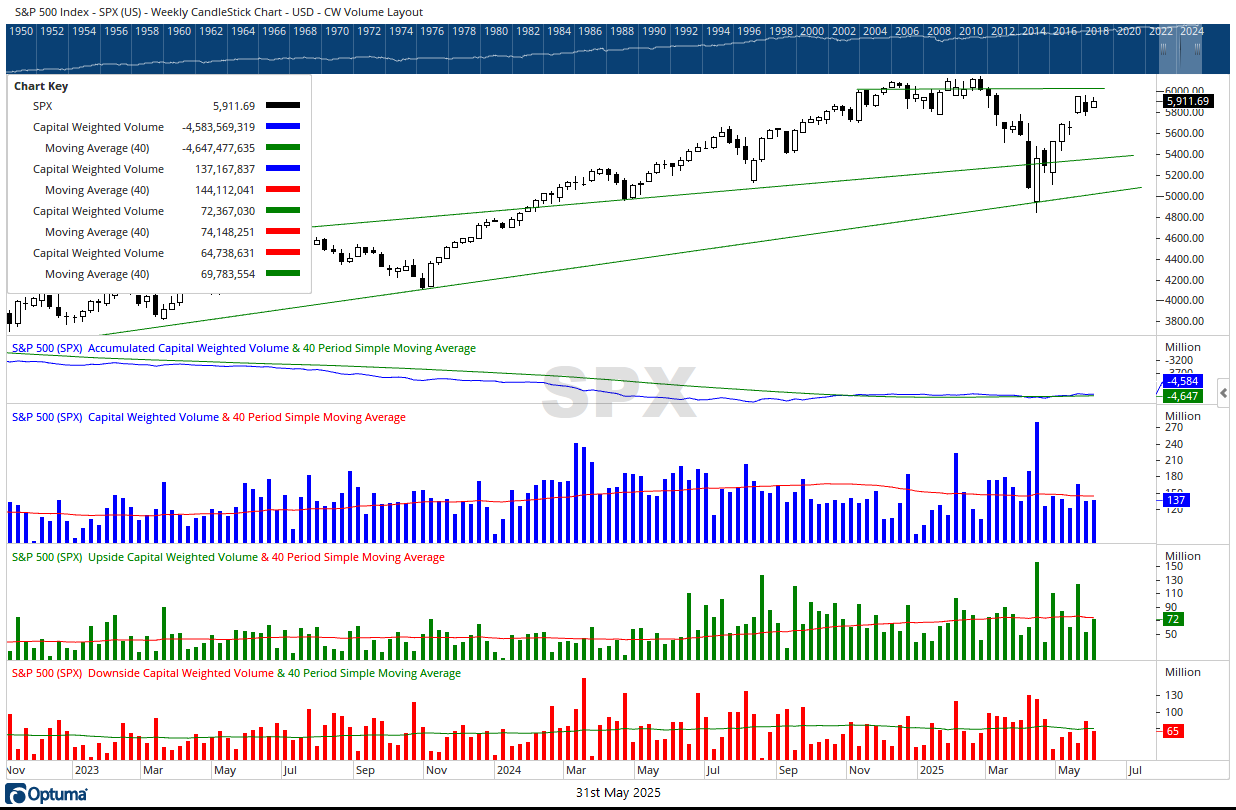

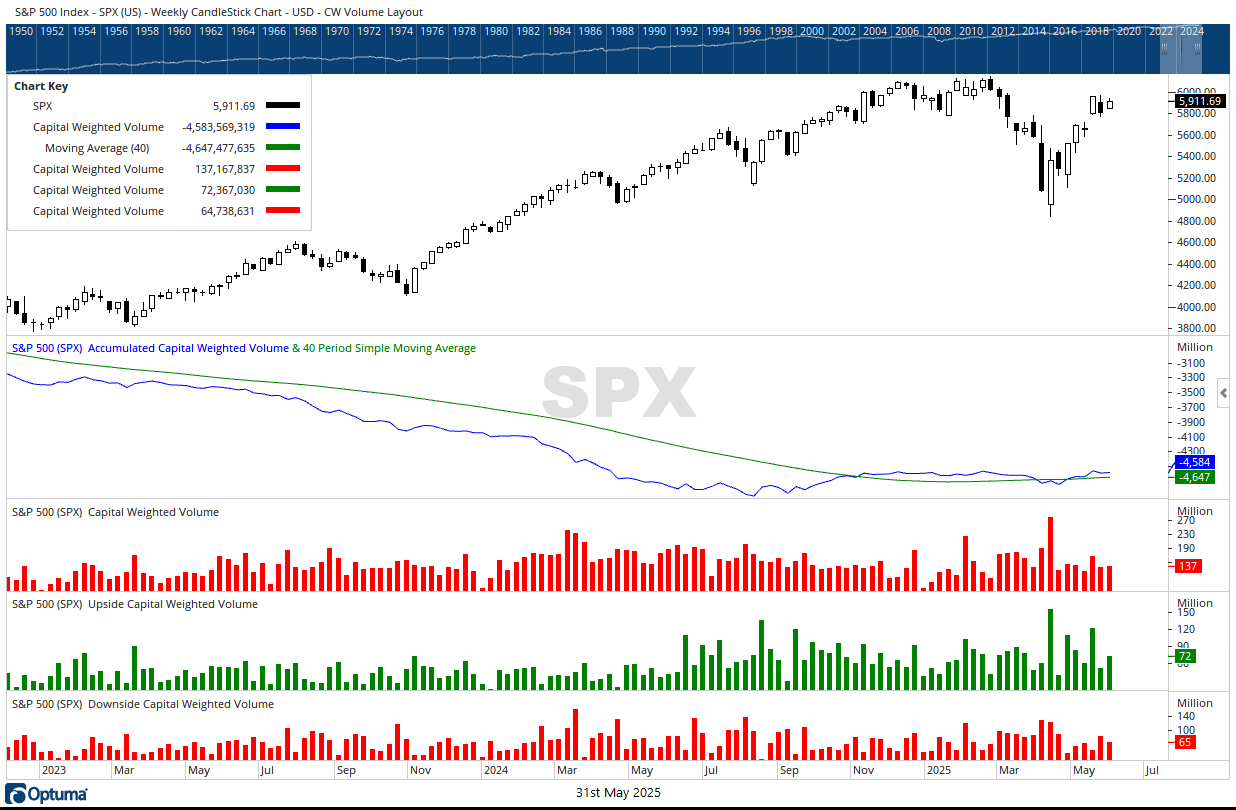

On the volume front, supply lines supported the advance, with Capital Weighted Volume and capital flows both outflanking price by breaching its own comparable resistance levels. While the S&P 500 Index remains entrenched just below the psychological 6000 resistance line, Capital Weighted Volume and capital flows are pressing toward all-time highs. Should either of our volume gauges successfully break through this critical ceiling, it may serve as a forward reconnaissance harbinger or price to follow suit.

After consolidating its opening thrust, the S&P 500 finished the month near the top of its range, perched just below the 6000 line like troops preparing to scale a final ridge. Volume intelligence suggests the bulls may still have momentum on their side. Yet, with the index already advancing sharply from its April lows, a strategic pause or pullback may be warranted—an opportunity to regroup before the next mission.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 6/2/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.