Volume Analysis Flash Update – 5.12.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Market Stands at Ease

The stock market took a much-needed breather this week. After several long weeks of intense combat in the markets, the S&P 500 took a tactical pause this week, marking time within the confines of last week’s battlefield. Volatility retreated as the index closed entirely within the prior week’s range, a classic breather in a longer campaign.

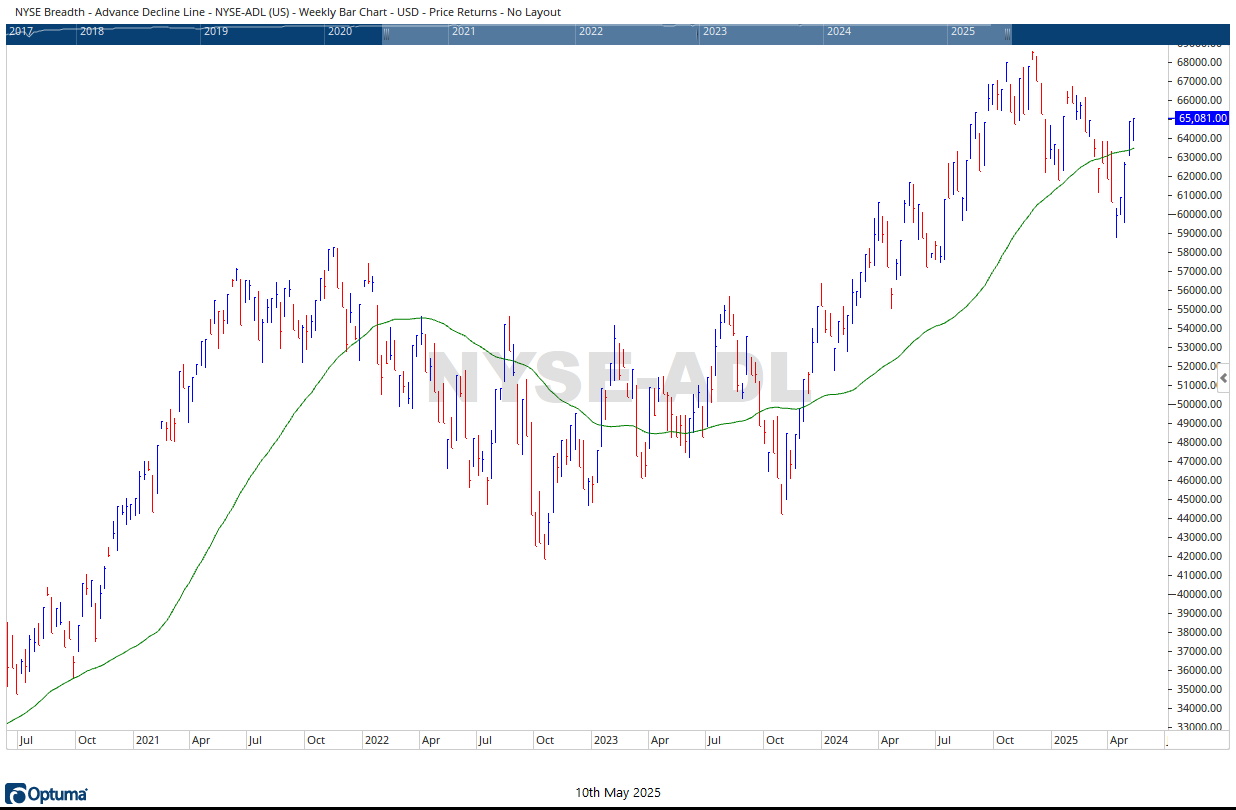

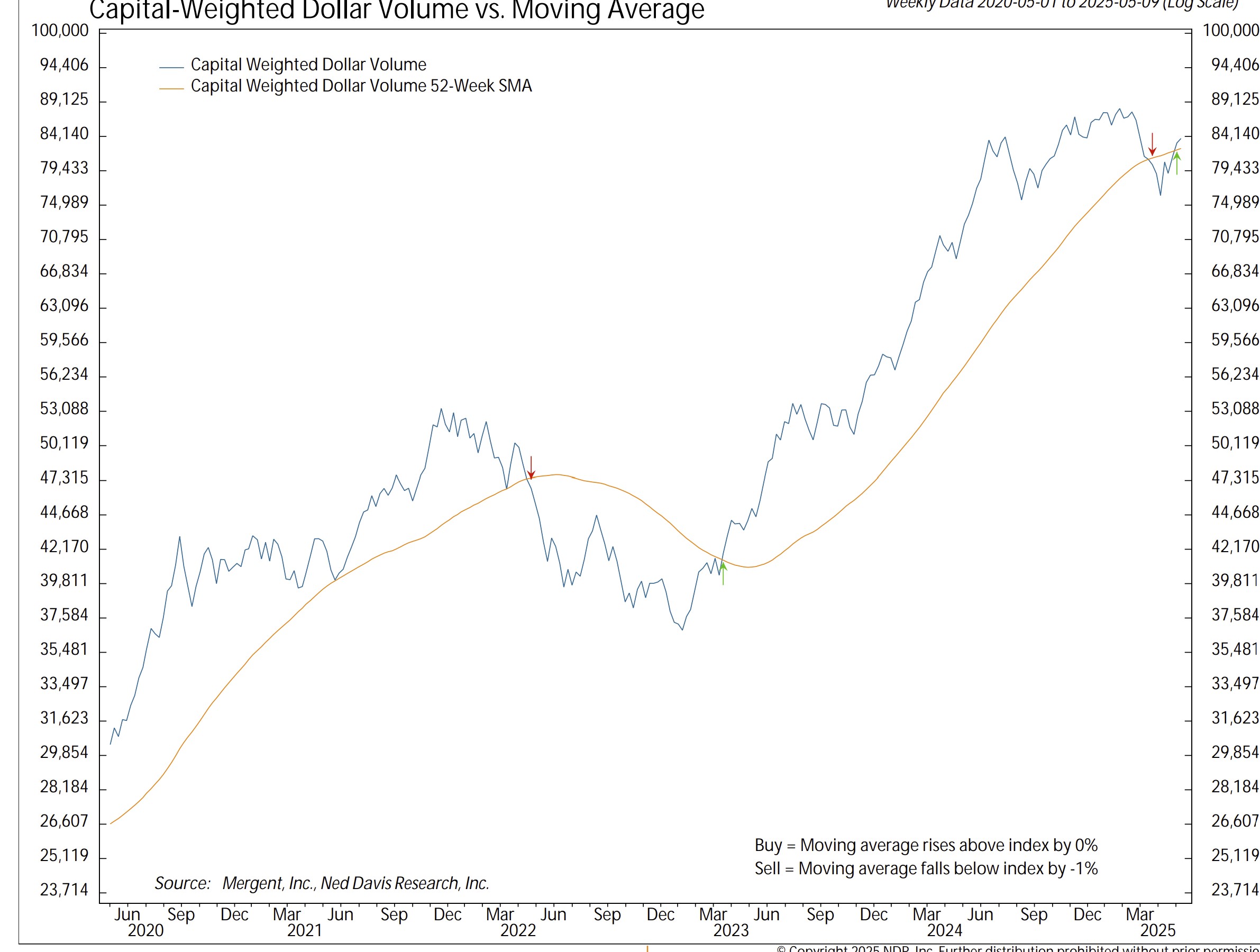

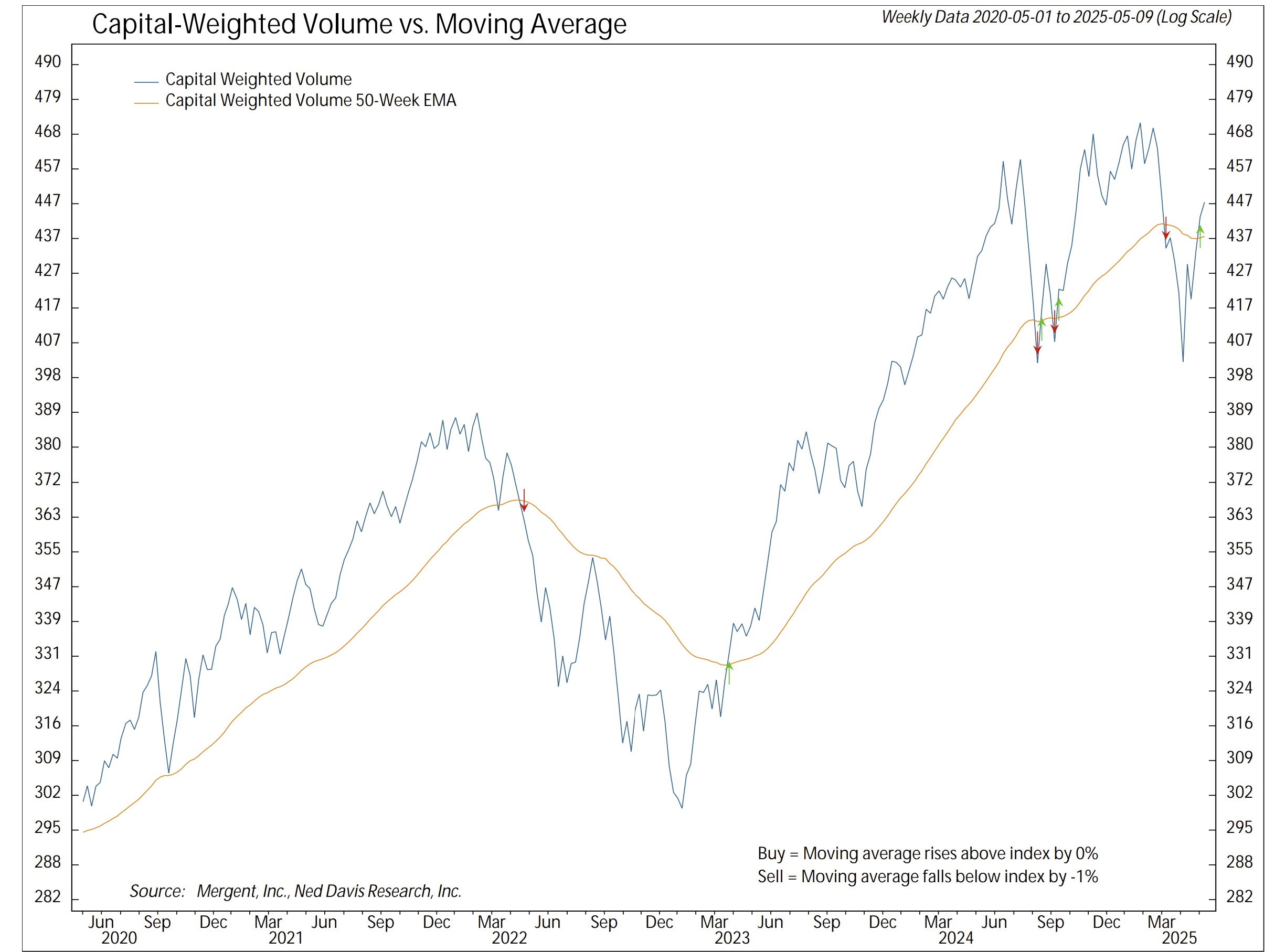

Volume firepower remained subdued across the board. Capital Weighted Volume, Dollar Volume, and both upside and downside volume registered below their historical averages. Still, despite light ammunition, accumulated volume trends continued to advance in formation. Market breadth, as measured by the NYSE Advance–Decline Line, also maintained its forward march.

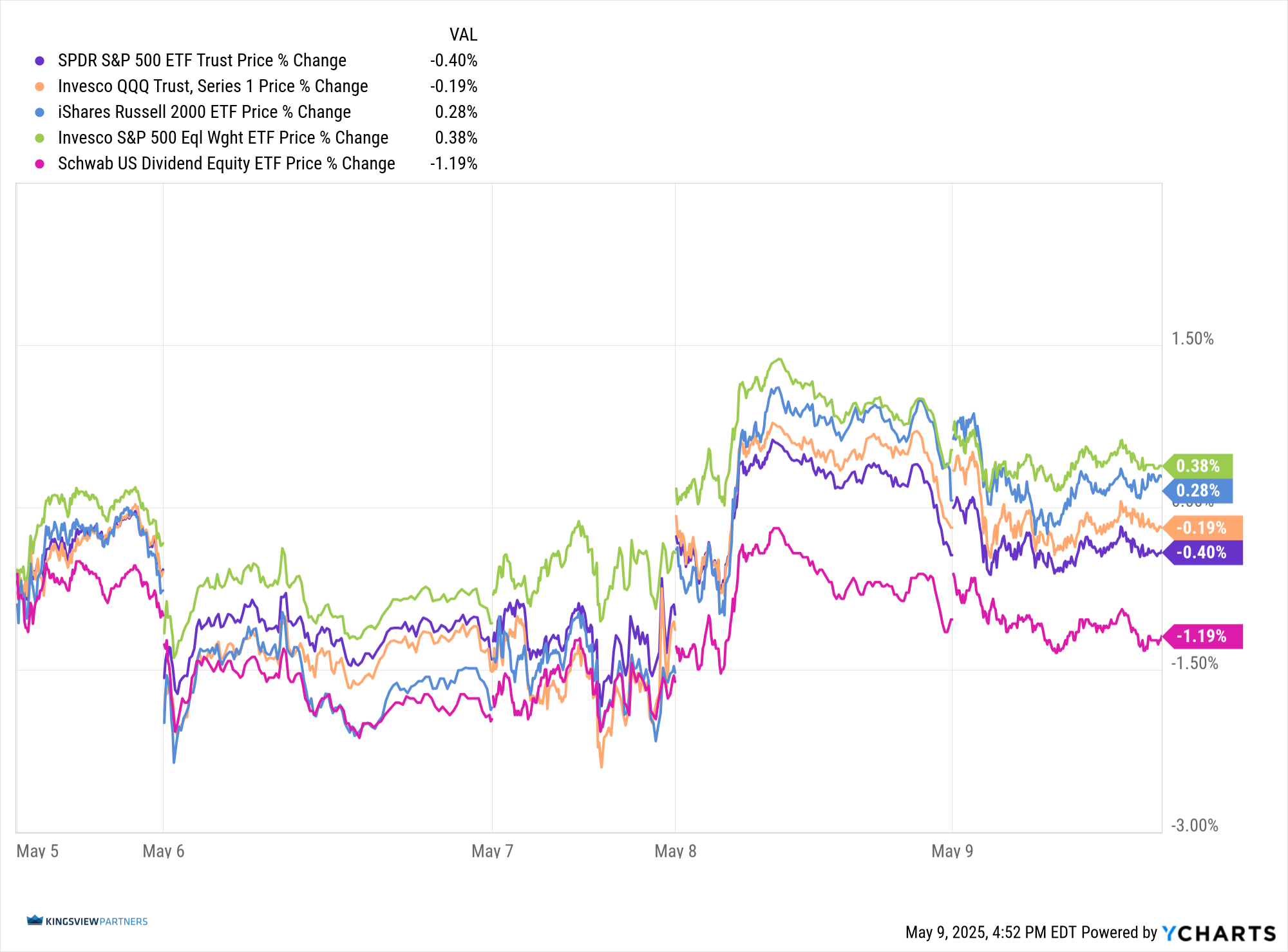

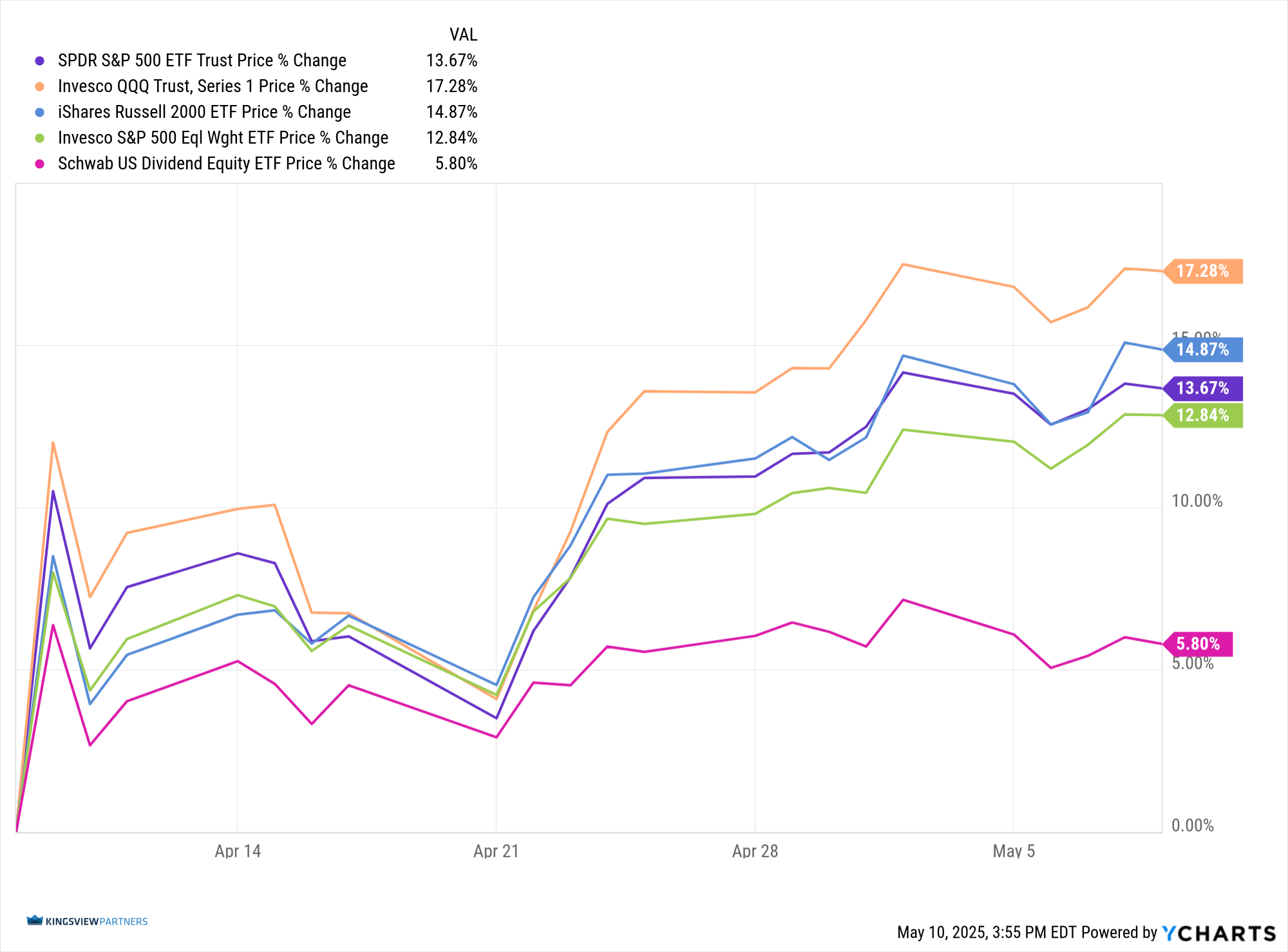

This week saw a shift in leadership across the front lines. The Invesco S&P 500 Equal-Weight ETF (RSP) took command, inching ahead by 0.38%. The troops, represented by the iShares Russell 2000 ETF (IWM), followed closely, advancing 0.28%. Meanwhile, the general namely, the Invesco QQQ Trust (QQQ) and SPDR S&P 500 ETF (SPY) — fell back slightly, down -0.19% and -0.40% respectively. Still, the troops have been gaining the most ground since the April 9th low, up more than 17%, illustrating resolve.

Strategically, the S&P 500 remains boxed in, with this week’s range entirely engulfed by last week’s price range. For a breakout to occur, the index must breach either the 5701 resistance line or surrender below 5443 support. The diminishing volume suggests traders are conserving strength, typical bullish behavior in the buildup of an ascending triangle formation.

For now, the market stands at ease. But as always, the next movement could sound the call to charge or retreat.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 5/12/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.