Volume Analysis Update – 4.28.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Marty’s Market Revival

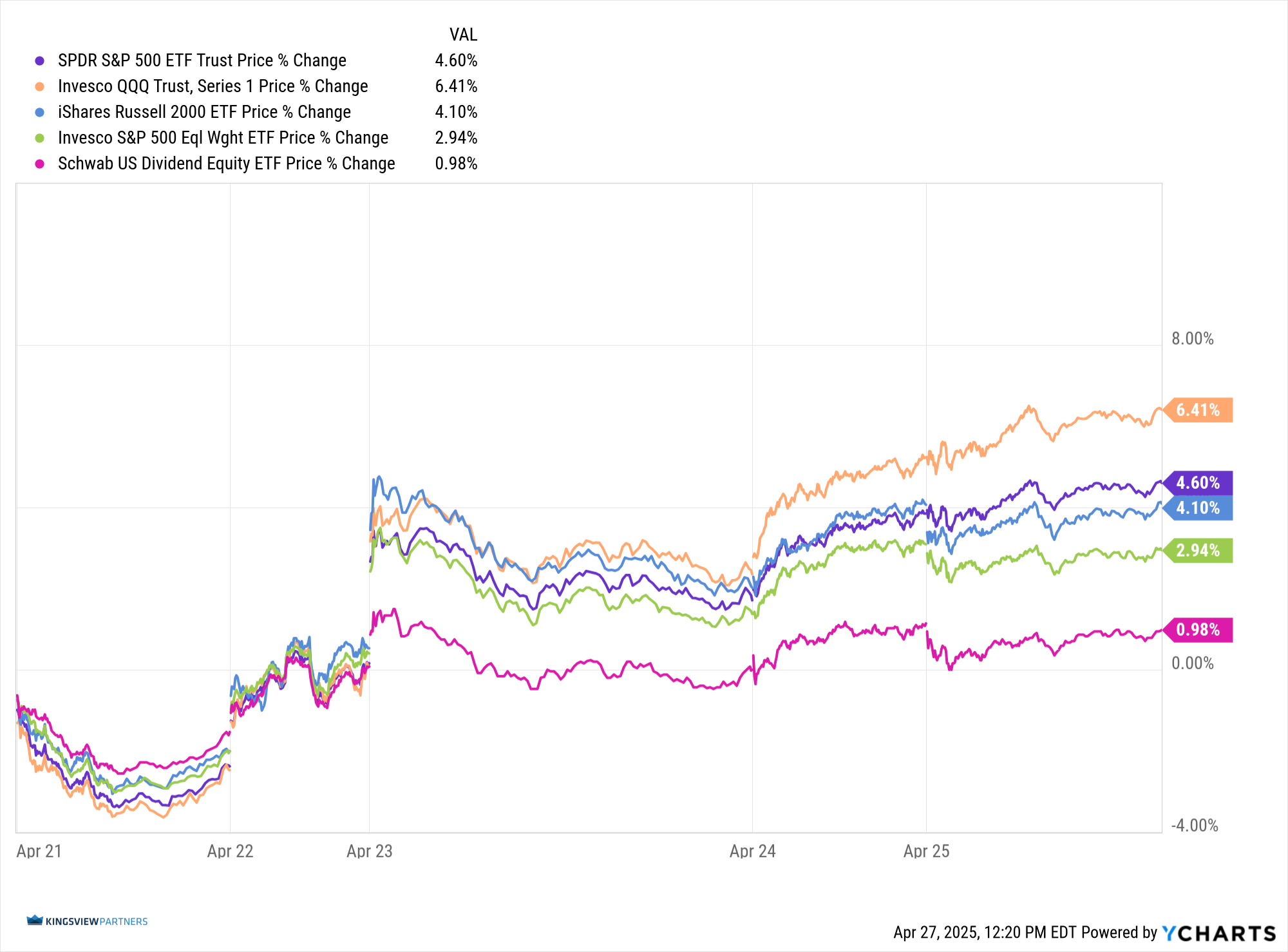

The generals, Invesco QQQ Trust (QQQ), resumed command of the battlefield last week, surging ahead by 6.41%, while their lieutenants, SPDR S&P 500 ETF (SPY), and troops, iShares Russell 2000 ETF (IWM), followed closely behind, posting gains of 4.60% and 4.10%, respectively. Meanwhile, the brass commander — the Invesco S&P 500 Equal Weight ETF (RSP) — made progress but at a slower march of 2.94%, and the Schwab U.S. Dividend Equity ETF (SCHD) advanced at 0.98%.

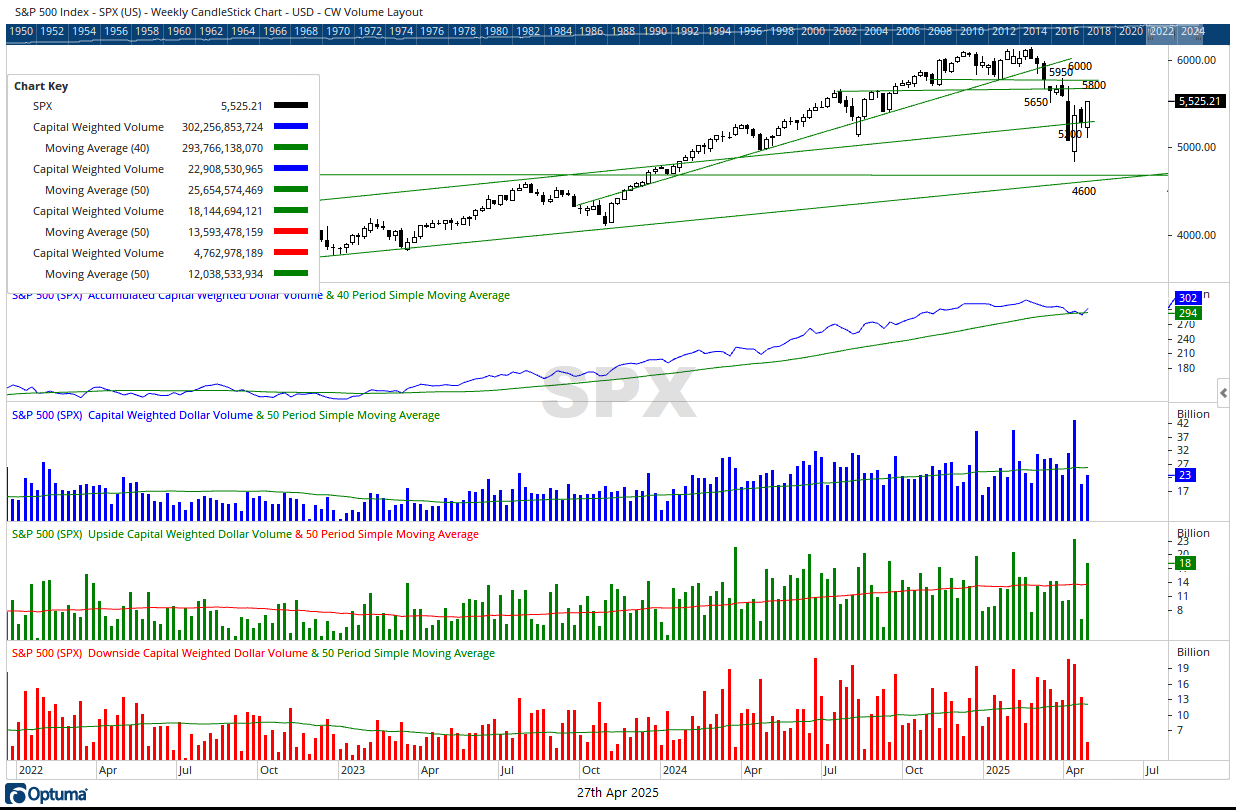

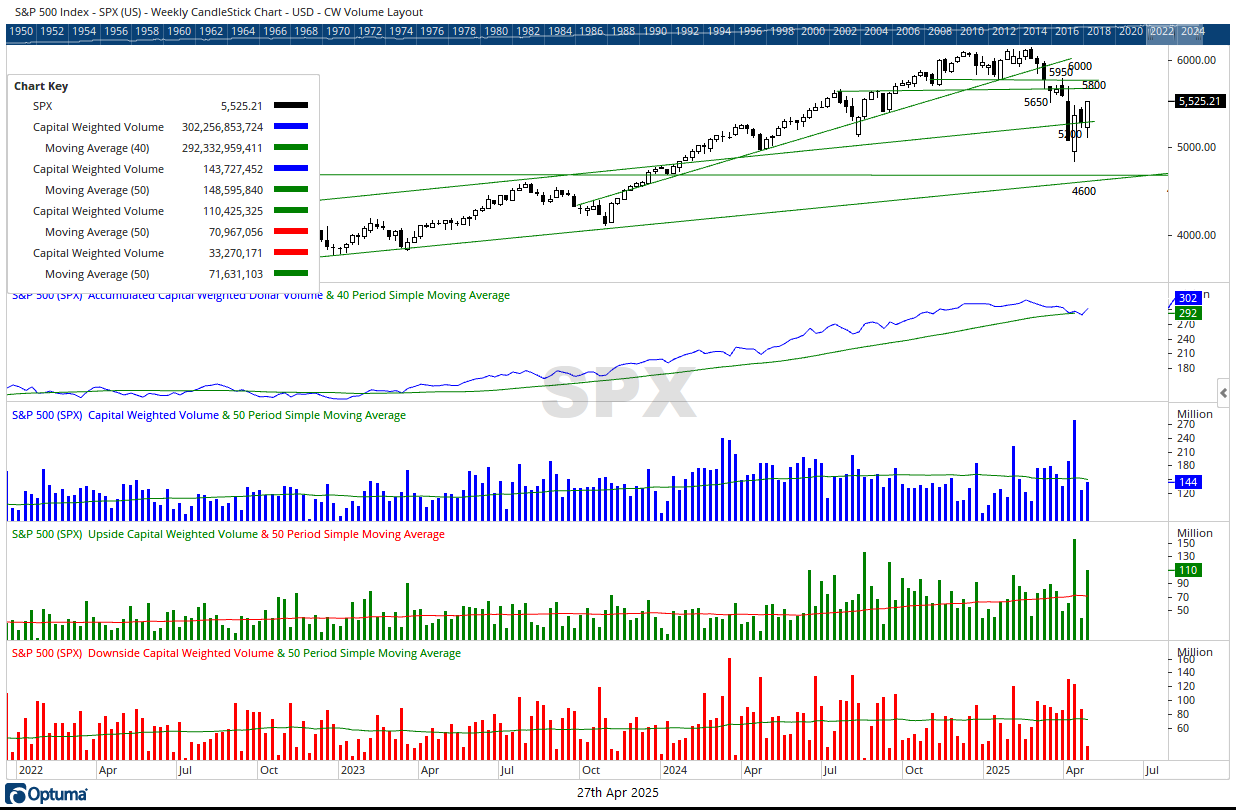

Although the price movement was decisive, volume remained modest. Yet capital flows were overwhelmingly one-sided, with 83% of inflows favoring the upside and 72% of Capital Weighted volume flows surging higher. Yet, the week’s biggest story wasn’t just price or volume—it was the rapid reversal in market breadth. Allow me to tell you a story of a man name Zweig.

Marty Zweig: The Tale of the Breadth Thrust

Amid the nerve-jangling jungle of Wall Street roamed market wizard Marty Zweig. A finance professor by day, a market whisperer by night, Marty preferred data over drama, signals over noise. Like a Sherlock Holmes of the stock exchange, he looked beyond the obvious, listening intently to the heartbeat of the stock market.

In the turbulent 1970s, as bear markets and inflationary storms raged, Marty noticed something most ignored: market breadth—the number of stocks rising versus falling. While others fixated on the Dow’s headline numbers, Marty theorized that a true recovery meant not only the generals advancing, but also the foot soldiers charging behind them.

Out of this insight, he crafted what would become legendary—the Zweig Breadth Thrust (ZBT). Marty’s ZBT focused on a simple but profound measure: if the average of the advancing-to-advancing-plus-declining stock ratio on the NYSE surged from an oversold state (below 40%) to an overbought level (above 61.5%) within just 10 trading days, it was a powerful sign of internal momentum swinging bullish.

In Marty’s research, this event was exceedingly rare. But when it triggered, it was akin to pulling a slingshot to its limit and suddenly letting go—a potent revival. According to his 1986 book Winning on Wall Street, when a ZBT occurred, the S&P 500 historically advanced an average of 24.6% over the next 11 months. Marty’s Breadth Thrust was like a wizard’s spell, revealing hidden bullishness when others still trembled with fear.

So, Why This Story?

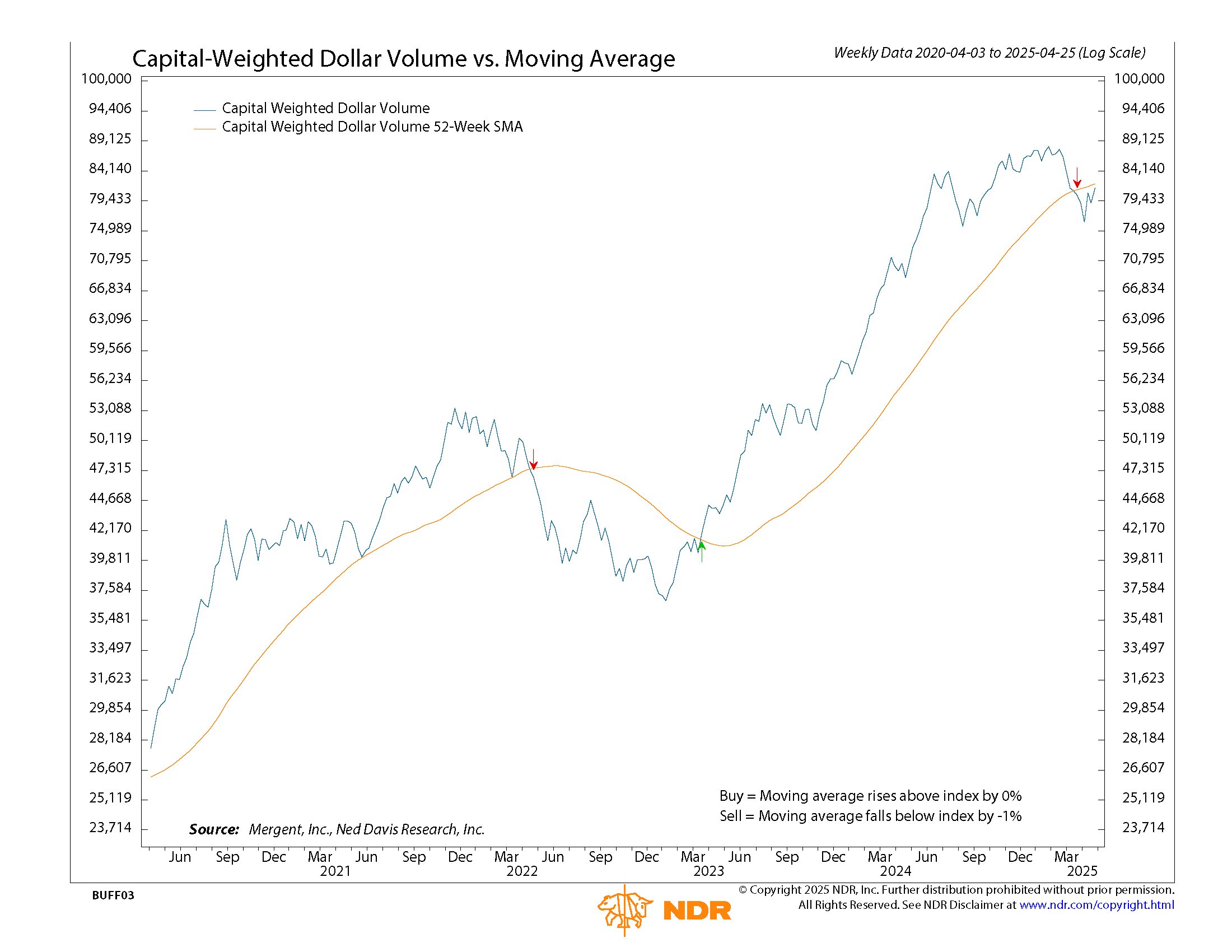

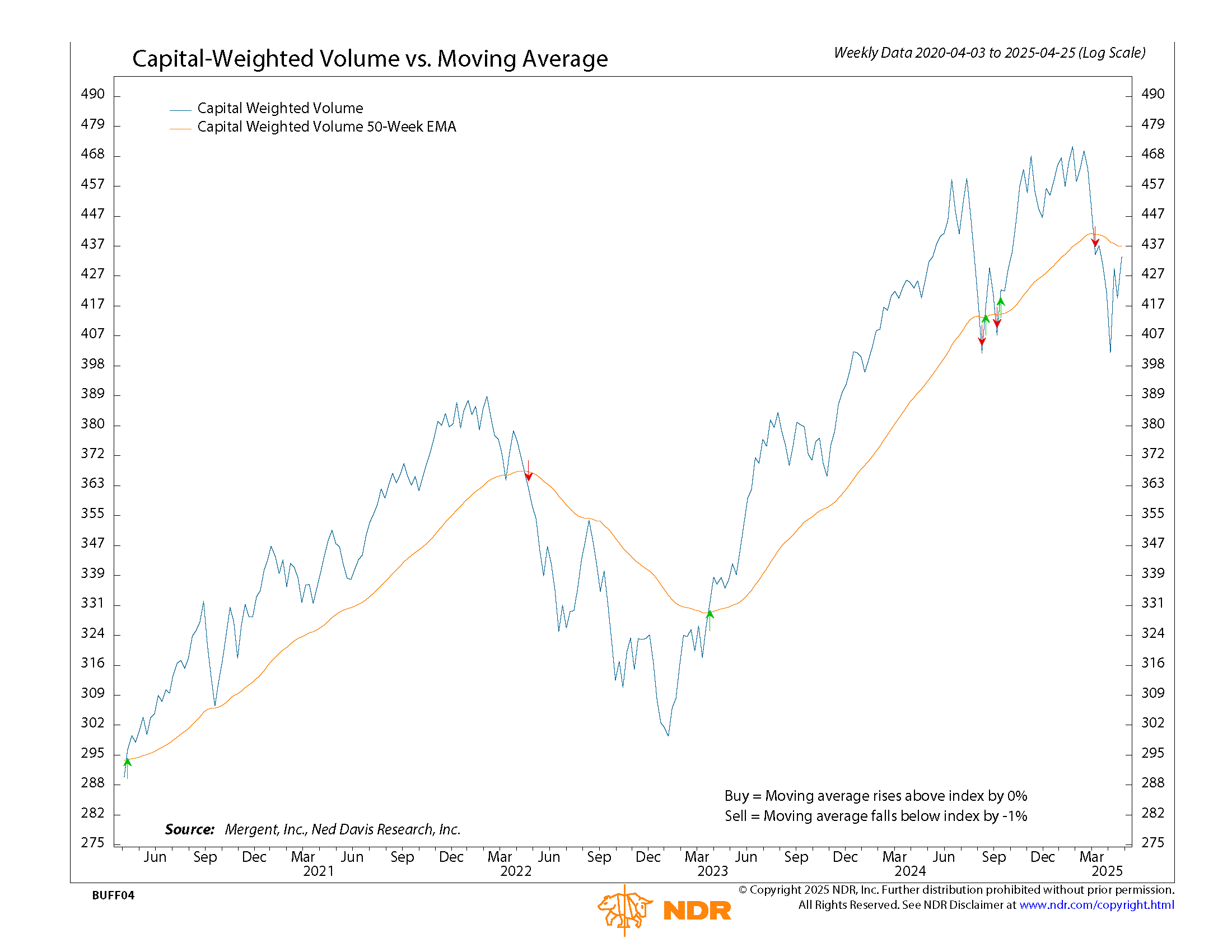

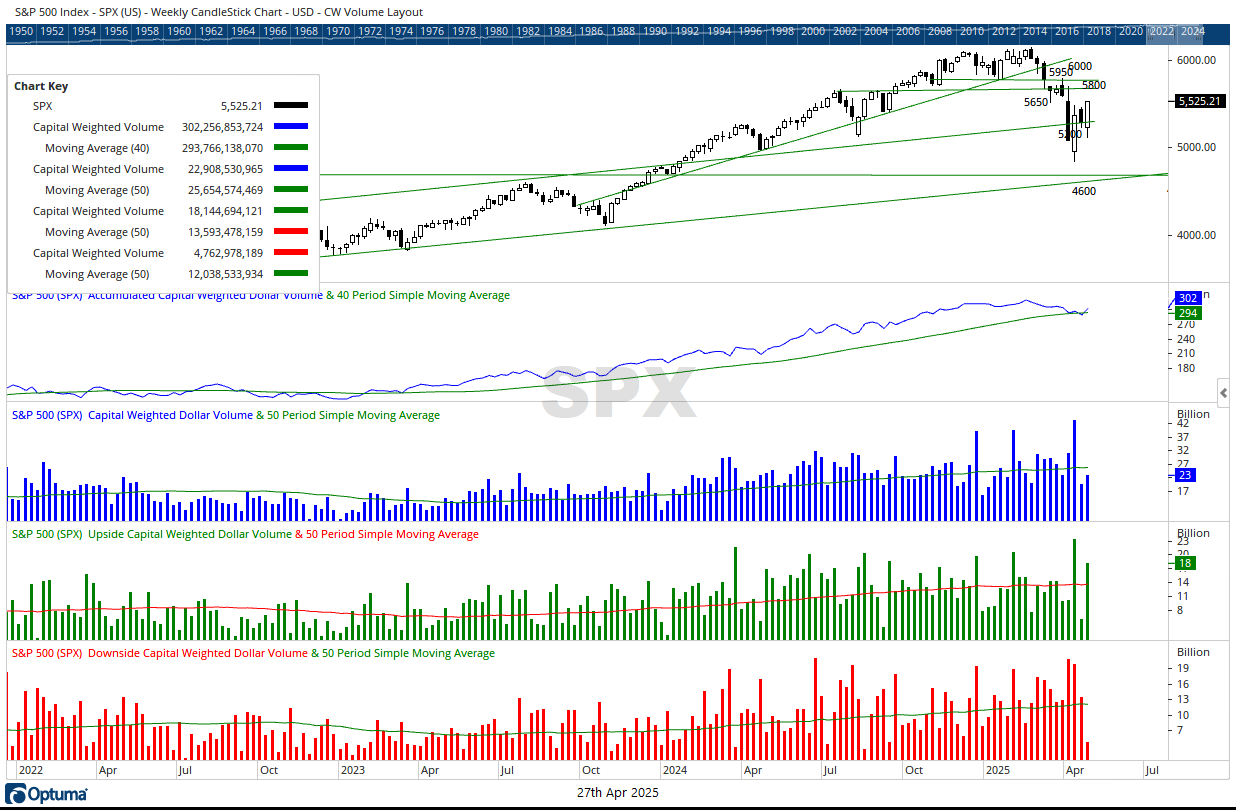

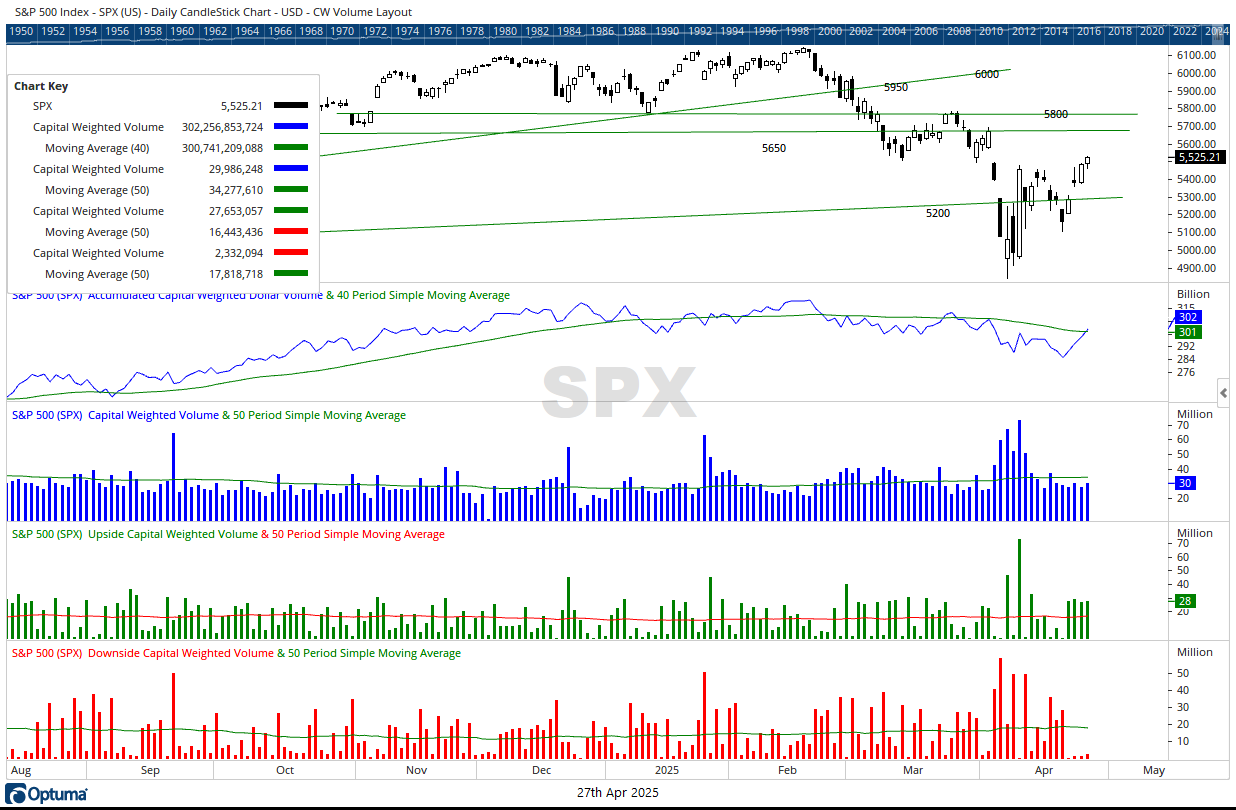

Because last week, we didn’t just see strong gains—we witnessed a Zweig Breadth Thrust Signal! At the close of trading on Thursday, April 24, the market officially delivered this rare and bullish indication. Meanwhile, low but decisively one-sided capital volume flows pushed both Capital Weighted Volume and Dollar Volume close to the top of their trendline resistance.

The S&P 500 itself remains trapped in a wide battlefield between 5600 (ceiling) and 4800 (floor). Cutting through this broad range is a critical rising trendline, drawn from the highs of 2022 and 2023 through the low of 2024. This trendline now rests above 5250. The immediate tactical objective? The S&P 500 needs to close above 5270 this forth coming week to hold trend Should it hold pace above this rising trendline, the index could forge a bullish ascending triangle, aiming its apex at 5650. However, if the S&P 500 falters below this trendline, it risks reverting back into the wide 4800-5650 trading range, an open battlefield without clear direction. Overall, the generals are again charging, the foot soldiers are rallying closely behind, and the ancient wizard Marty Zweig is once again sounding his ZBT trumpet.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 4/28/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.