Volume Analysis Flash Update: – 2.10.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

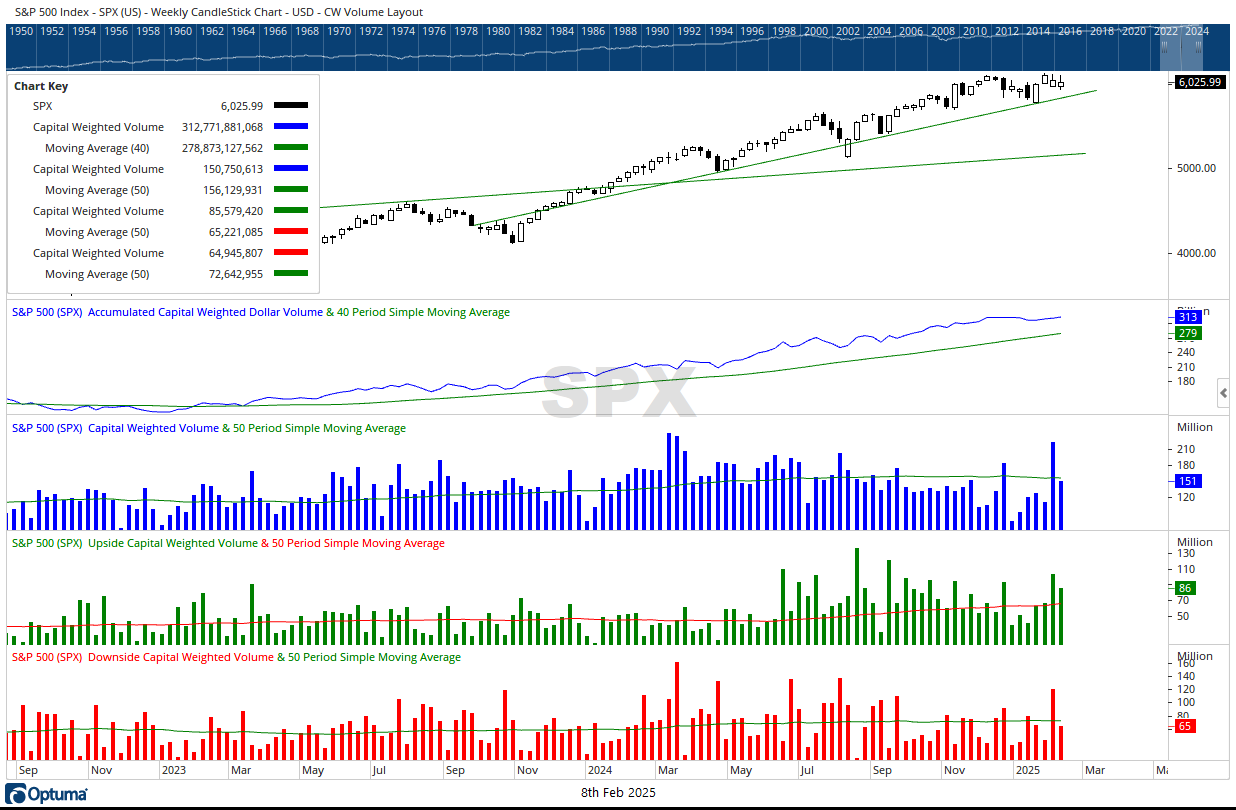

In last week’s intelligence briefing, surging market volume suggested major market offensives maybe setting up. This past week, the market engaged with tariff skirmishes, employment intel, and a barrage of earnings reports from the S&P 500’s elite forces, the Magnificent 7. However, those seeking a decisive victory may have found themselves in the disappointment of a strategic stalemate.

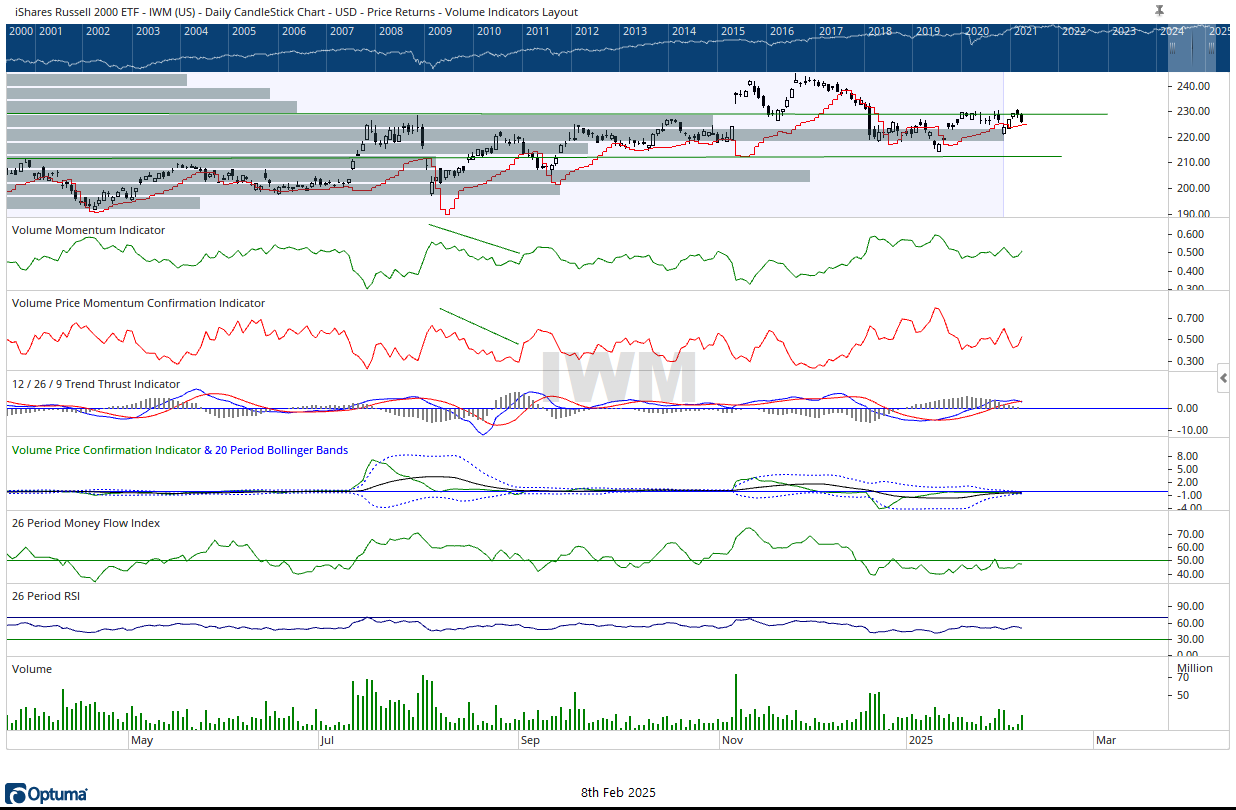

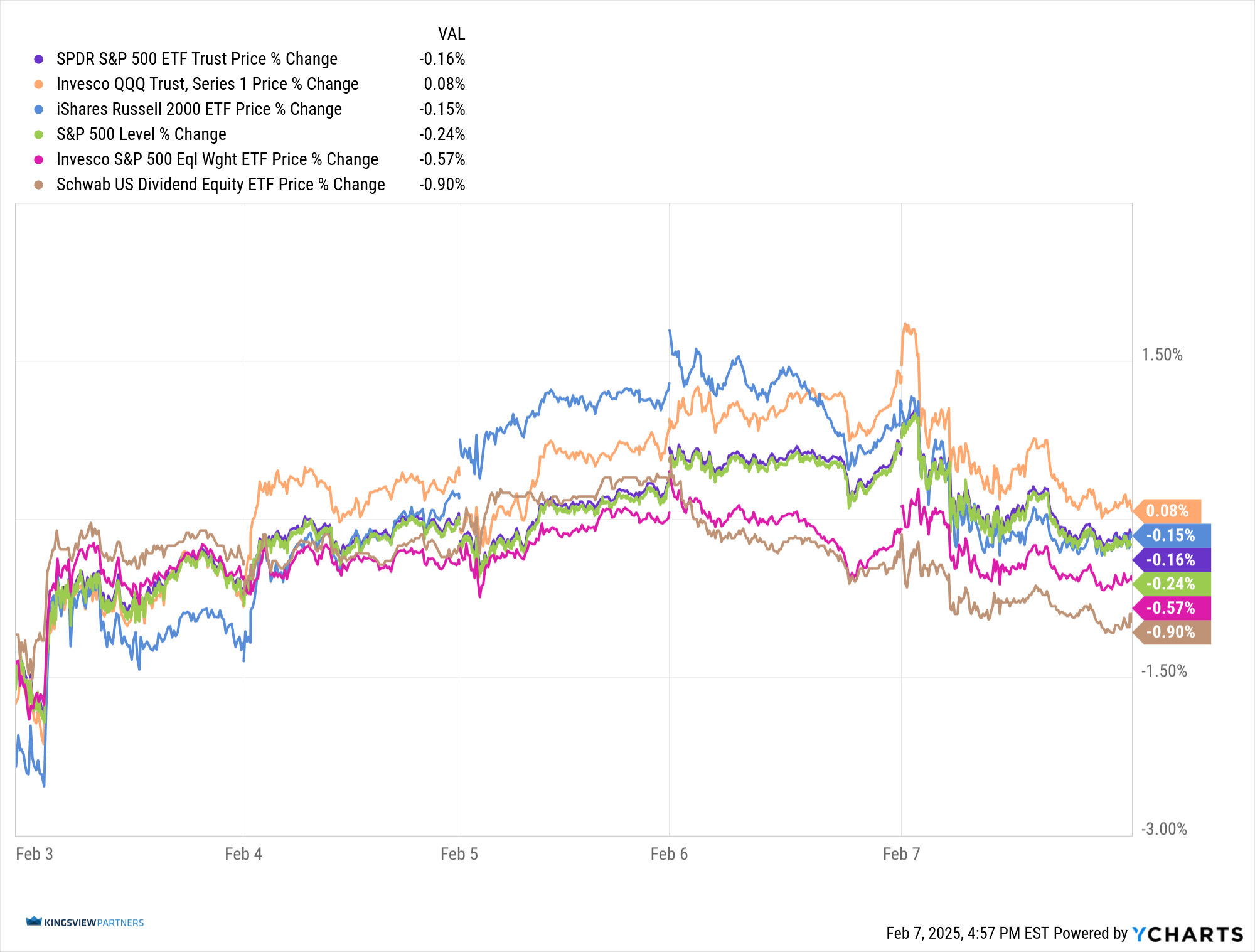

The Generals, Invesco QQQ Trust (QQQ). were the only unit to finish the week in positive territory, advancing a mere 0.08% despite disappointing field reports from its tech titans. The Troops, iShares Russell 2000 ETF (IWM), held the line, retreating just -0.15%, while the dividend defensive line, Schwab US Dividend Equity ETF (SCHD), suffered the heaviest casualties, falling -0.90%. Thus, despite high expectations, the first week of February’s market Super Bowl failed to deliver the anticipated blowout but rather a tightly played game.

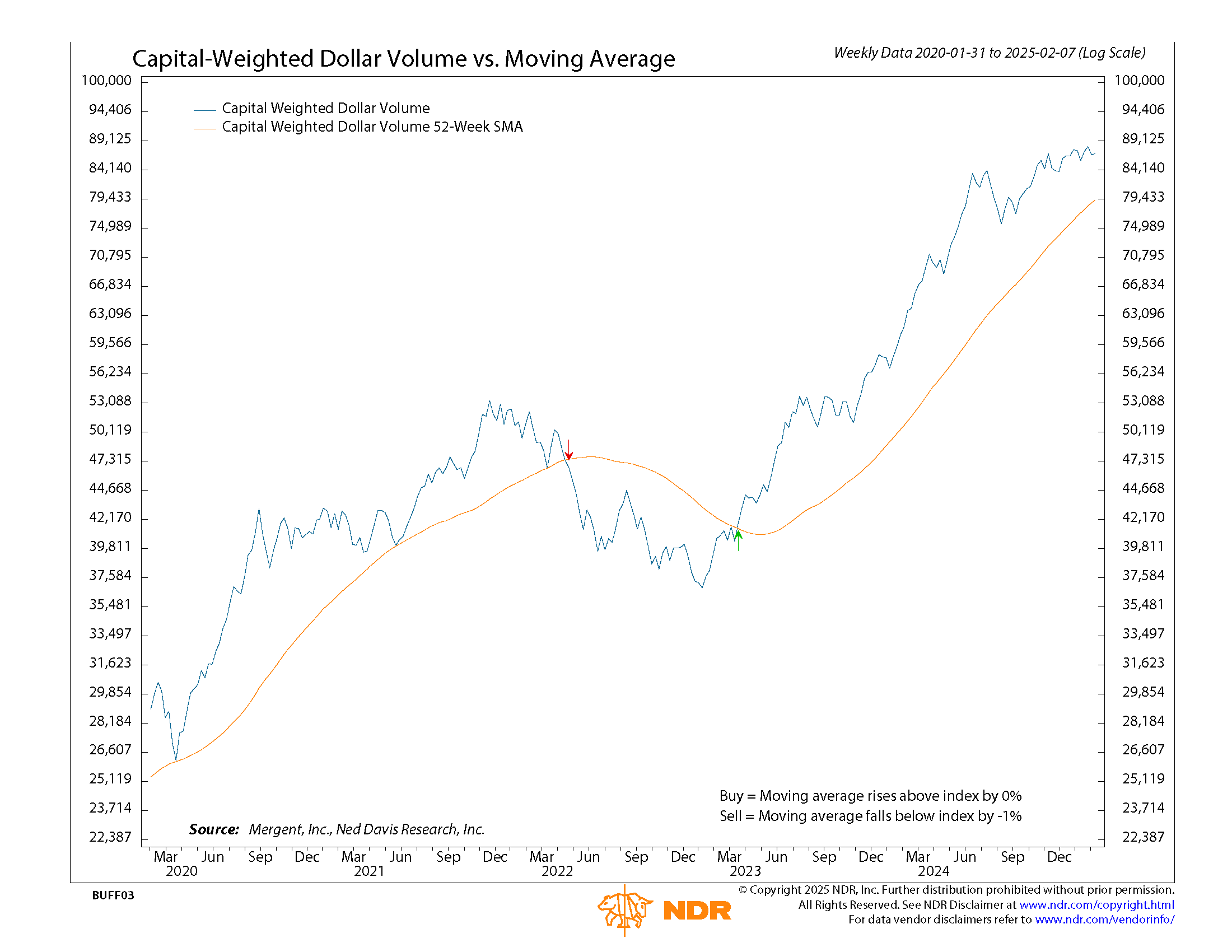

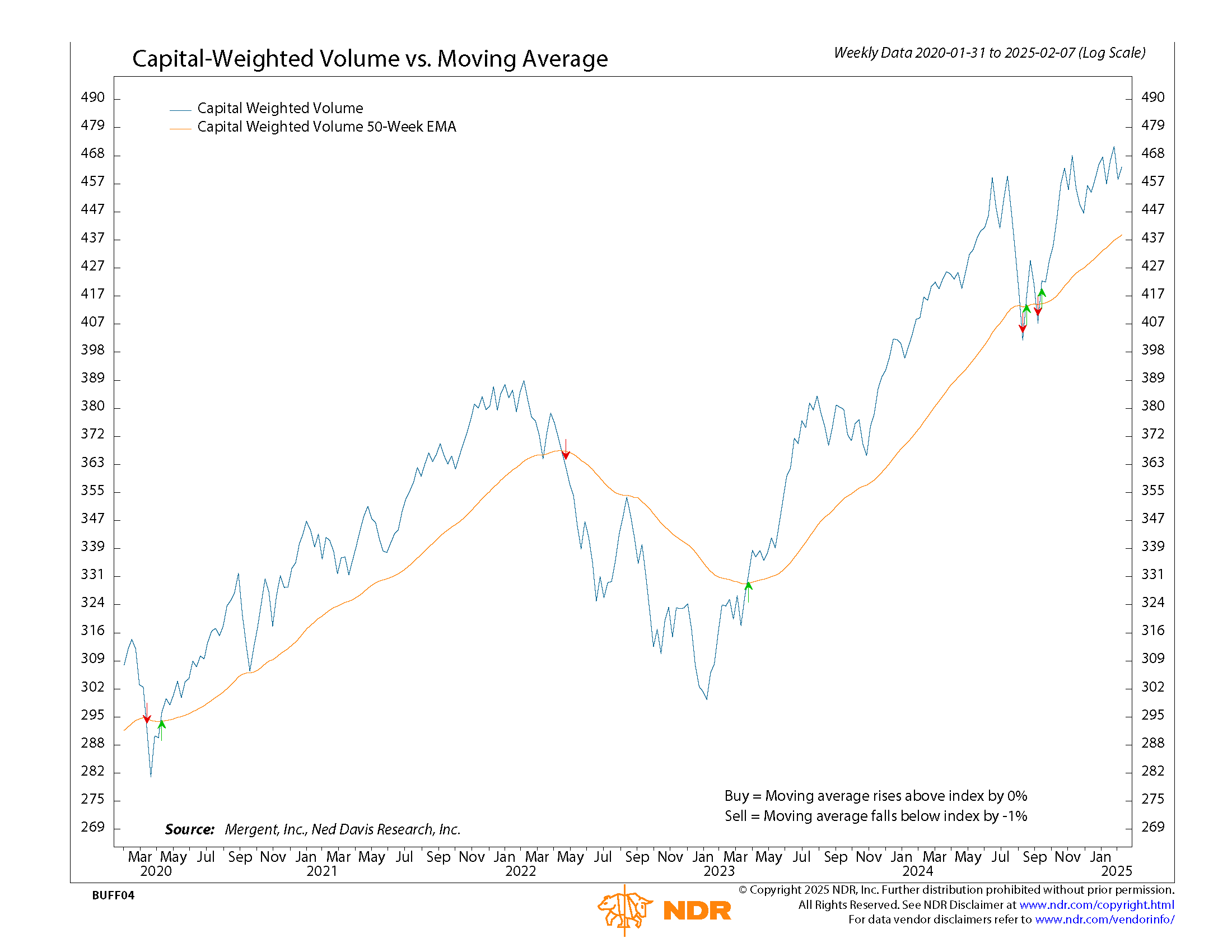

Despite a blitz of crucial headlines, this week’s trading volume was only average, a significant drop from January’s final week blowout. Although the S&P 500 suffered a minor setback, both Capital Weighted Up Volume and Capital Weighted Upside Dollar Volume (Inflows) outflanked Capital Weighted Down Volume and outflows. This suggests that demand for US equities remains strong, even in the face of imperfect field conditions.

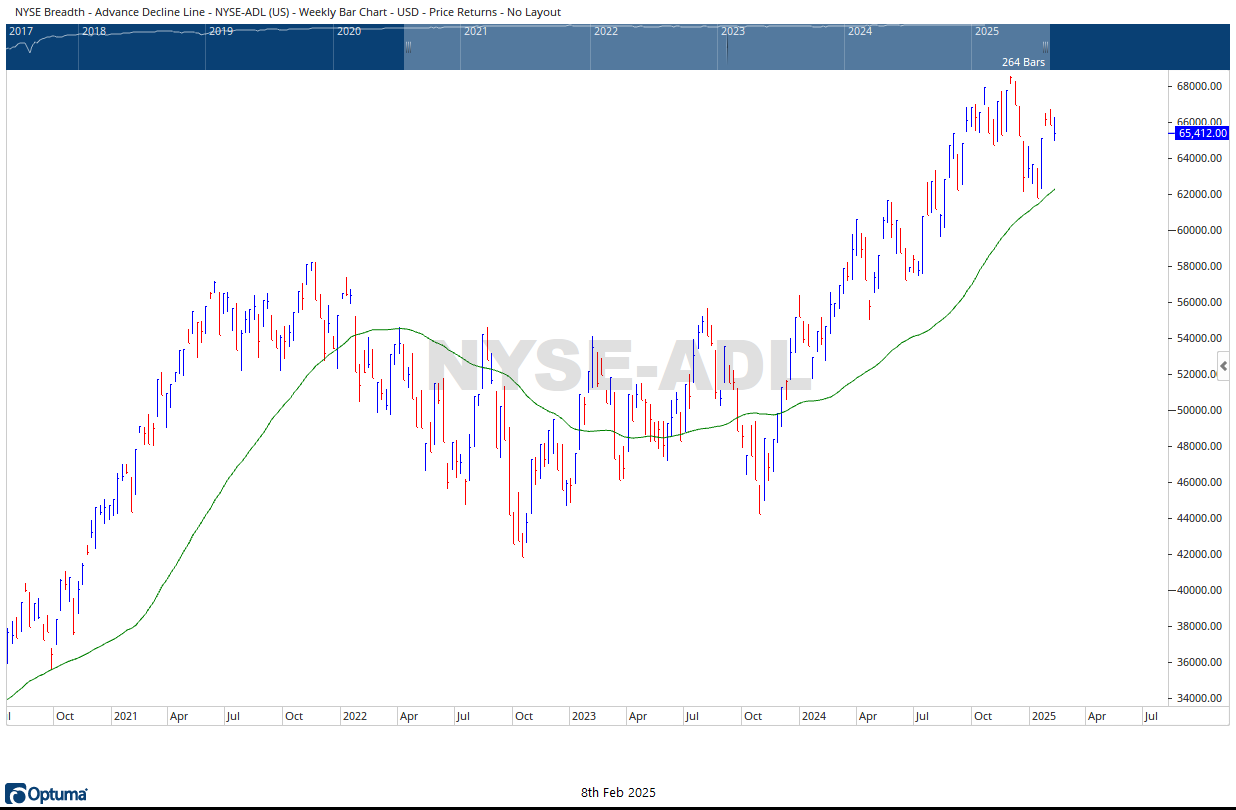

Market breadth, as measured by the NYSE Advance-Decline Line, retreated below its former range but still holds above major support lines. Earlier in the week, IWM attempted to breach the 230 resistance, but failed to capture this high ground, finishing slightly lower. Overall, the bears landed a few solid punches on the bulls this week. Yet, like a championship team, strong markets shake off disappointment, and that’s exactly what the bulls did, showing resilience worthy of a Super Bowl comeback. Stay tuned for next week’s market playbook. Like the Chiefs and Eagles preparing for their epic showdown in New Orleans, the bulls and bears are gearing up for what each hopes to be a game-changing move ahead.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 2/10/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.