Volume Analysis Flash Update: Market Reconnaissance and Strategic Analysis – 2.3.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Tactical Overview:

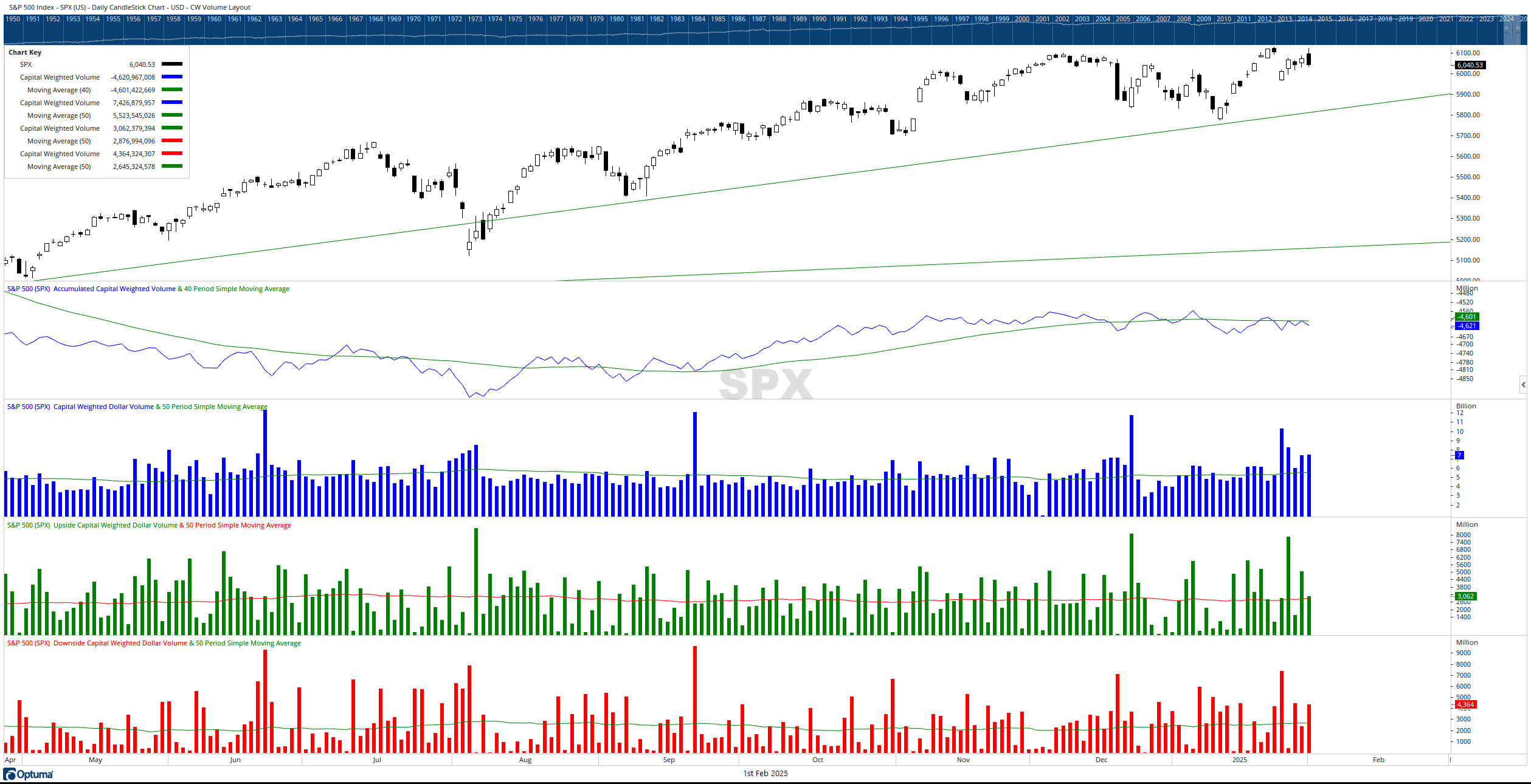

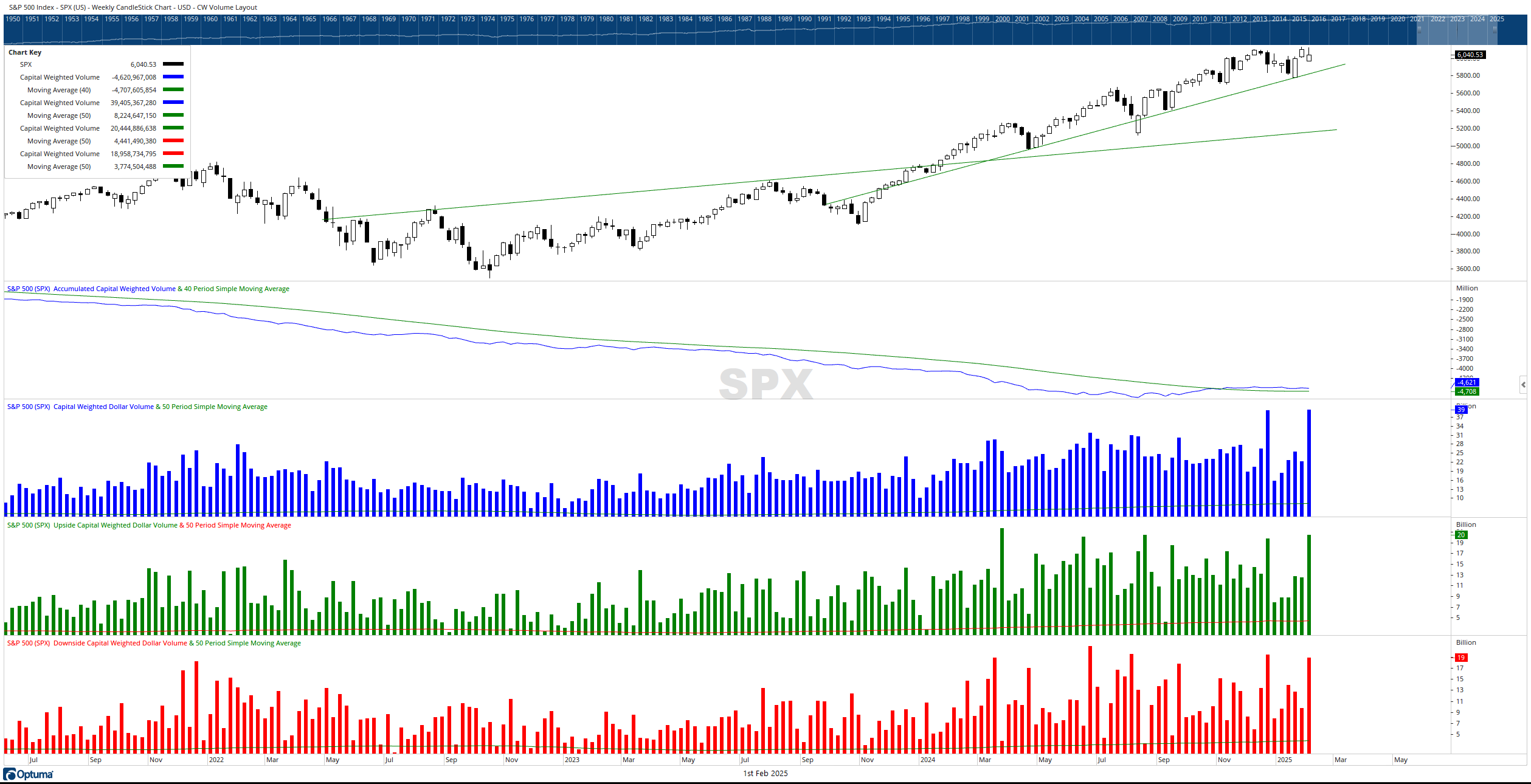

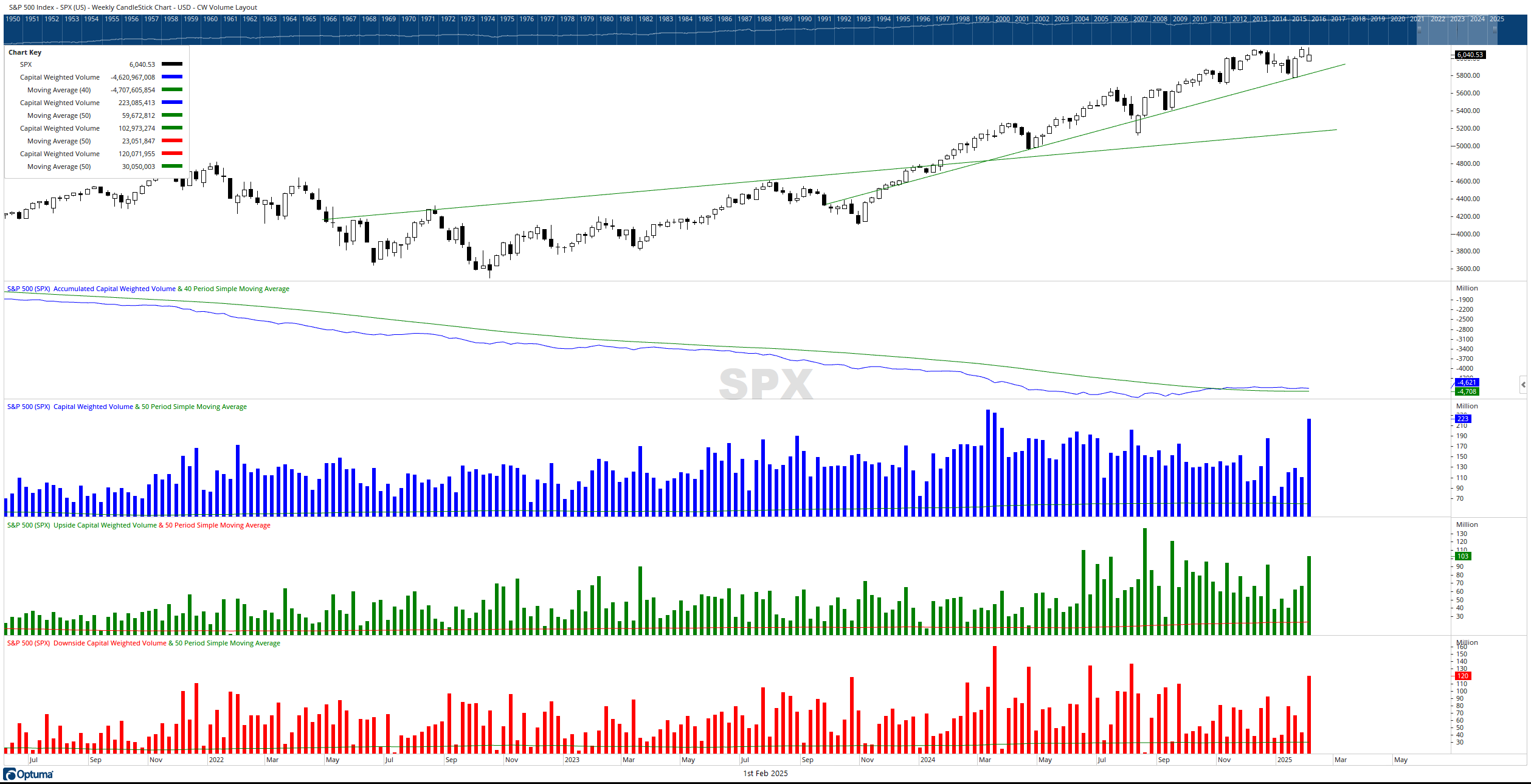

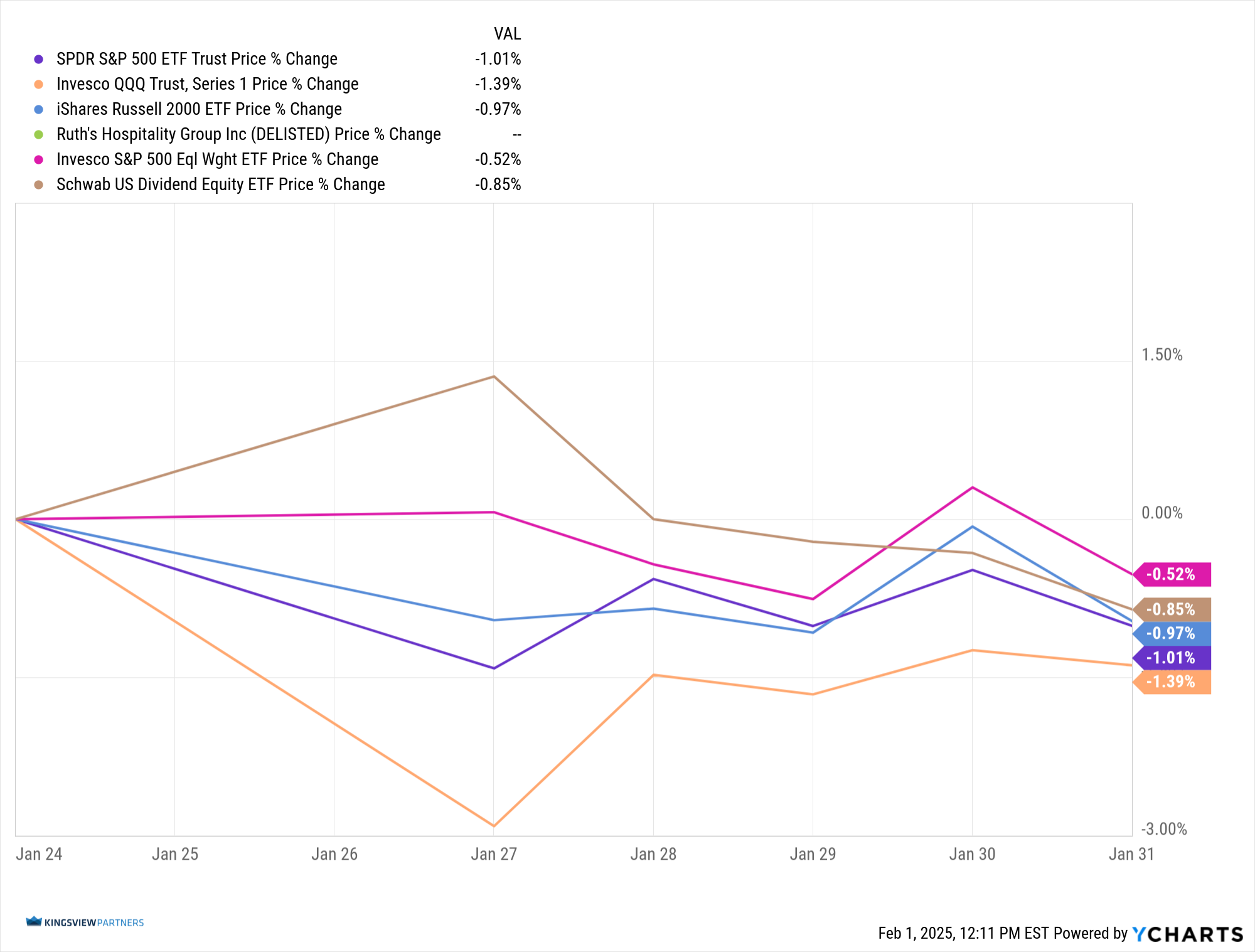

This past week’s market engagement revealed extensive high-intensity operations across all of our broad market forces. The theater of operations is primed for a pivotal week ahead, with critical earnings intel, potential tariff maneuvers, and key economic data deployments on the horizon. In this week’s Battlefield Report, all major indices executed strategic withdrawals on the highest S&P 500 capital weighted dollar volume recorded in a decade. The elite forces, Invesco QQQ Trust (QQQ), retreated the furthest (-1.35%) while the brass commanders, Invesco S&P 500 Equal Weight ETF (RSP), held the most ground with minimal losses (-0.52%). Despite the narrow price range, volume metrics surged to decade-high levels, indicating massive tactical movements.

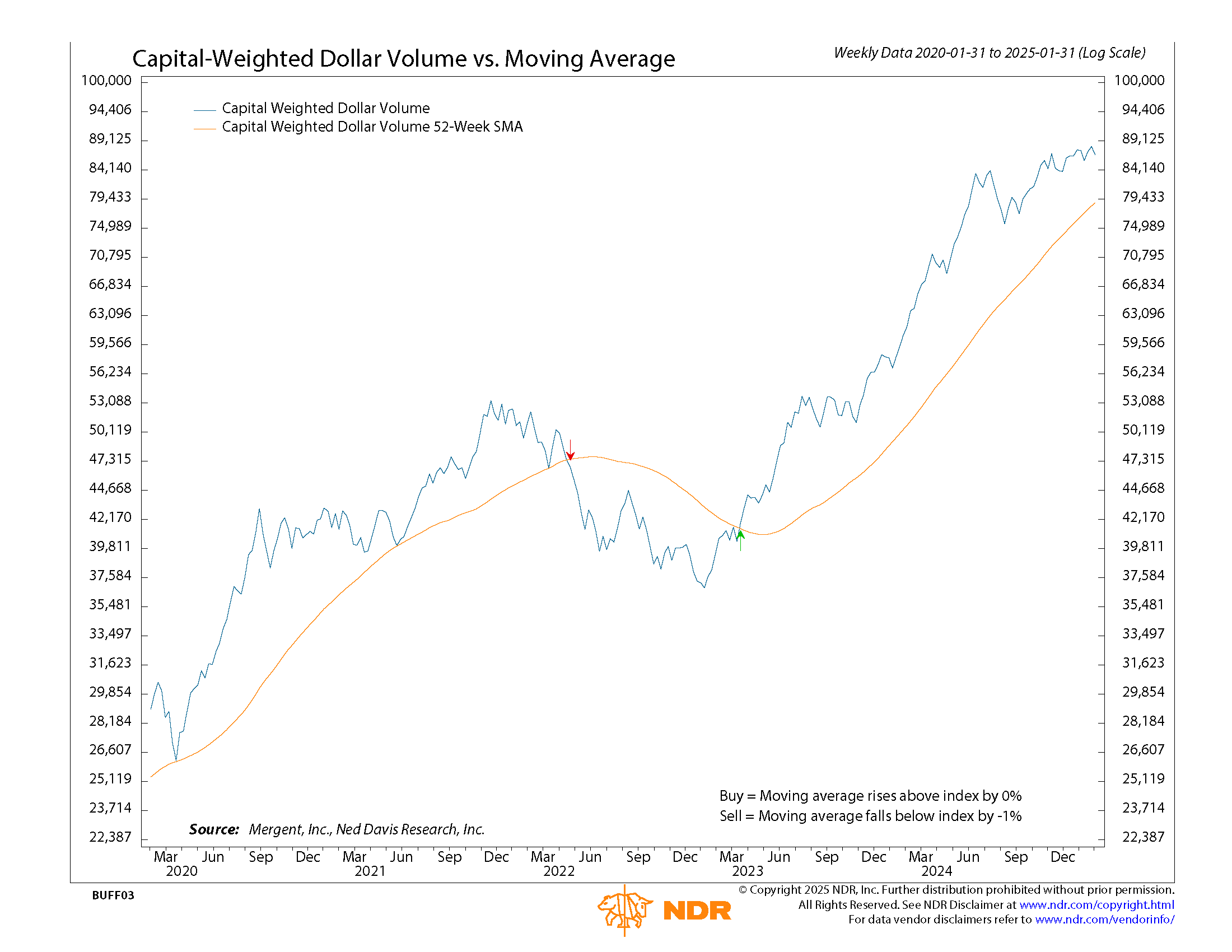

Market intelligence reveals Capital Weighted Dollar Volume achieved unprecedented levels, surpassing the December 20, 2024 surge. This twin-peak formation on the charts signals extraordinary market activity amidst otherwise unremarkable terrain. Capital inflows and outflows both reached high levels of critical mass. Additionally:

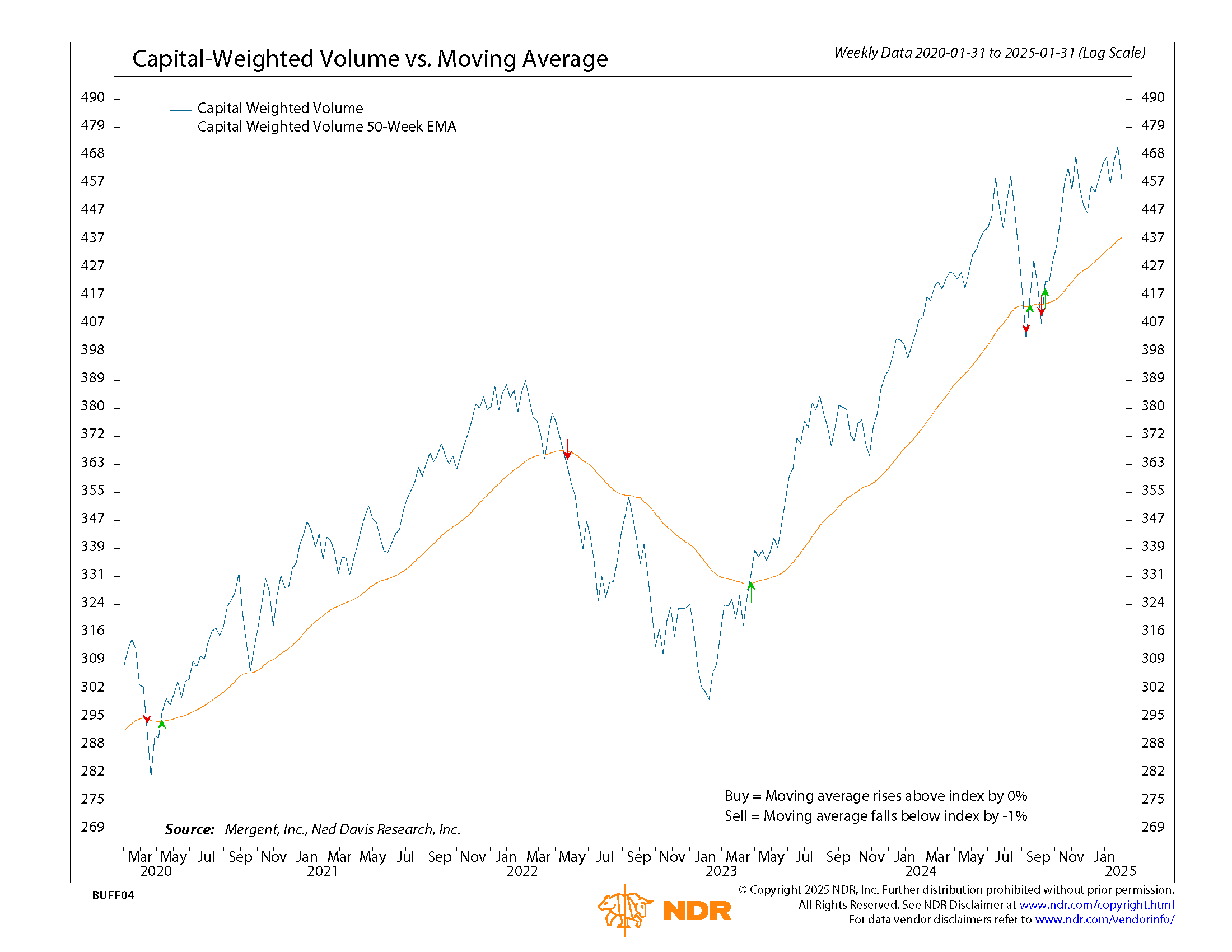

- Capital Weighted Volume hit levels unseen since March 2024.

- Upside Volume peaked at September levels,

- Downside Volume neared August highs

- Net capital movement: $20.4B inflow vs $19B outflow

- Volume metrics: 103M upside vs 120M downside

Tactical Maneuvers

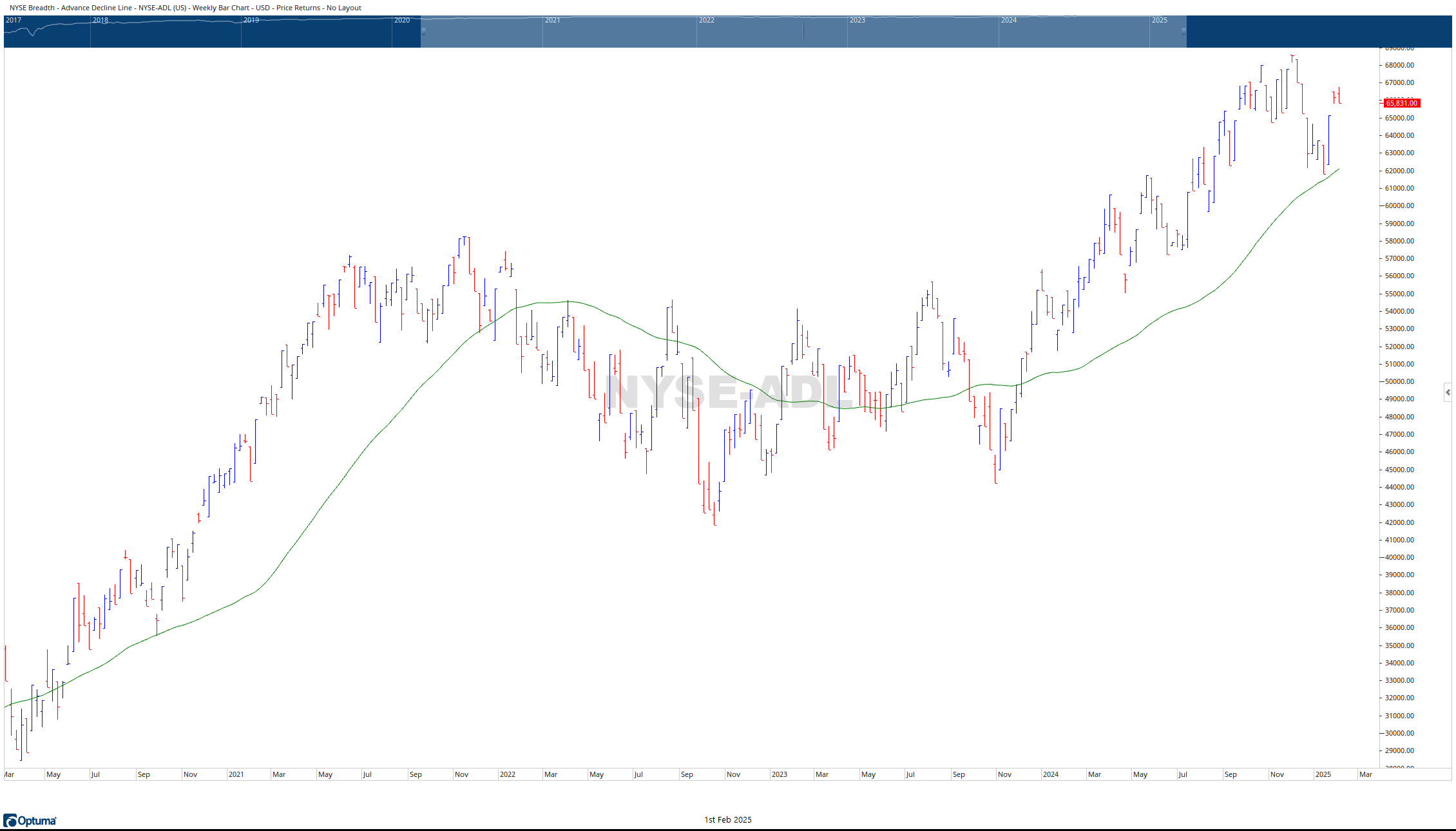

Despite broad market declines, S&P 500 capital inflows marginally exceeded outflows while S&P 500 Capital Weighted Volume data largely confirmed the S&P’s downward price movement. Despite the extraordinary volume week, there was only one 10% outside day on the week. Thursday’s special operation saw a 95% capital inflow surge and 94% upside Capital Weighted Volume, marking the sole 10% volume day of the week. On the frontline, the light infantry, iShares Russell 2000 ETF (IWM), encountered resistance, while the NYSE Advance-Decline Line retained inside its former range.

My Strategic Assessment:

Major forces are repositioning, with both offensive (bull) and defensive (bear) units deploying significant resources. The theater remains highly volatile and contested. Big picture, money is changing hands with both the bullish and bearish forces repositioning large bets.

End of Transmission.

BUFF DORMEIER, CMT®

Updated: 2/3/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.