Volume Analysis Flash Update – 1.27.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

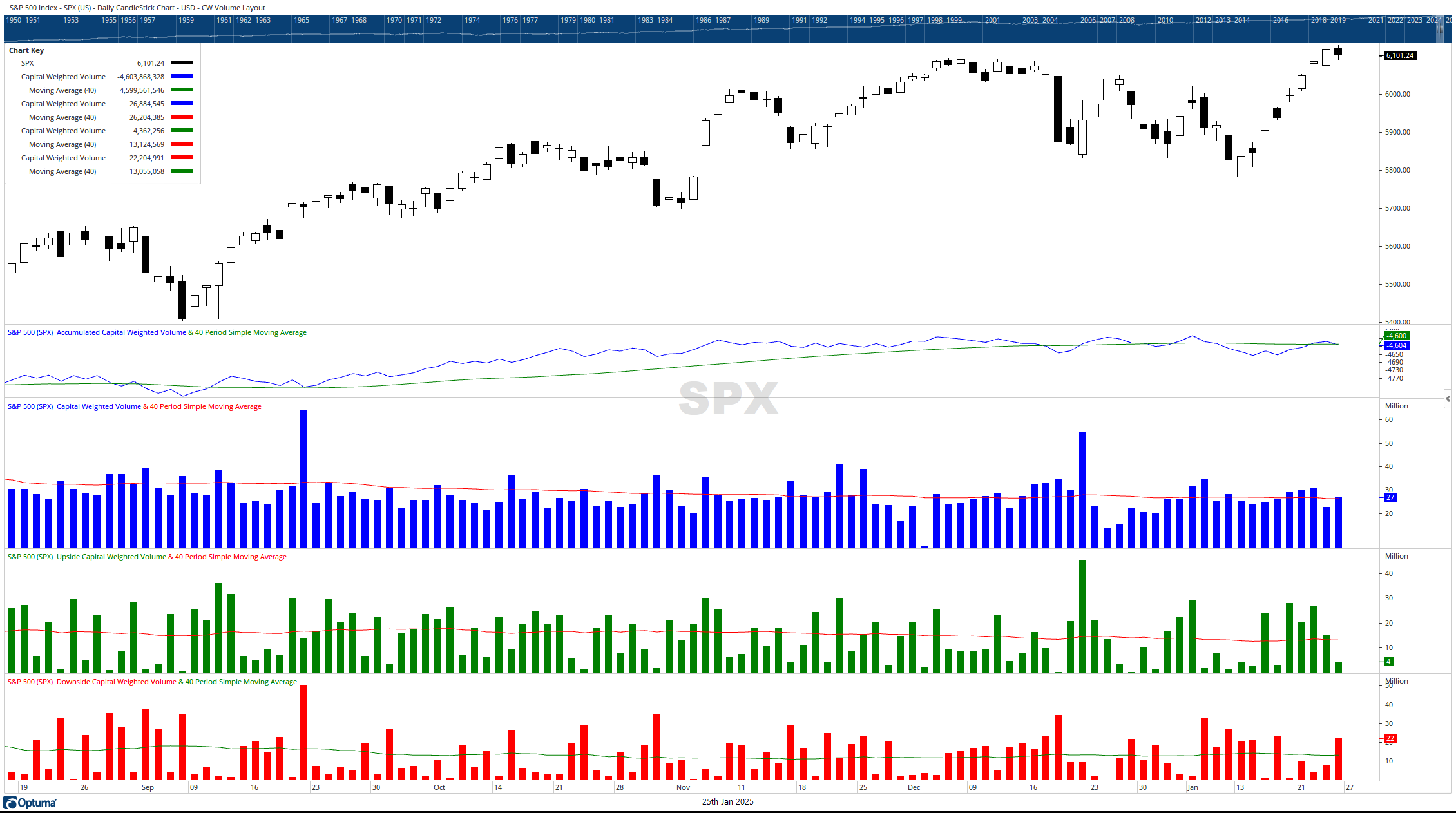

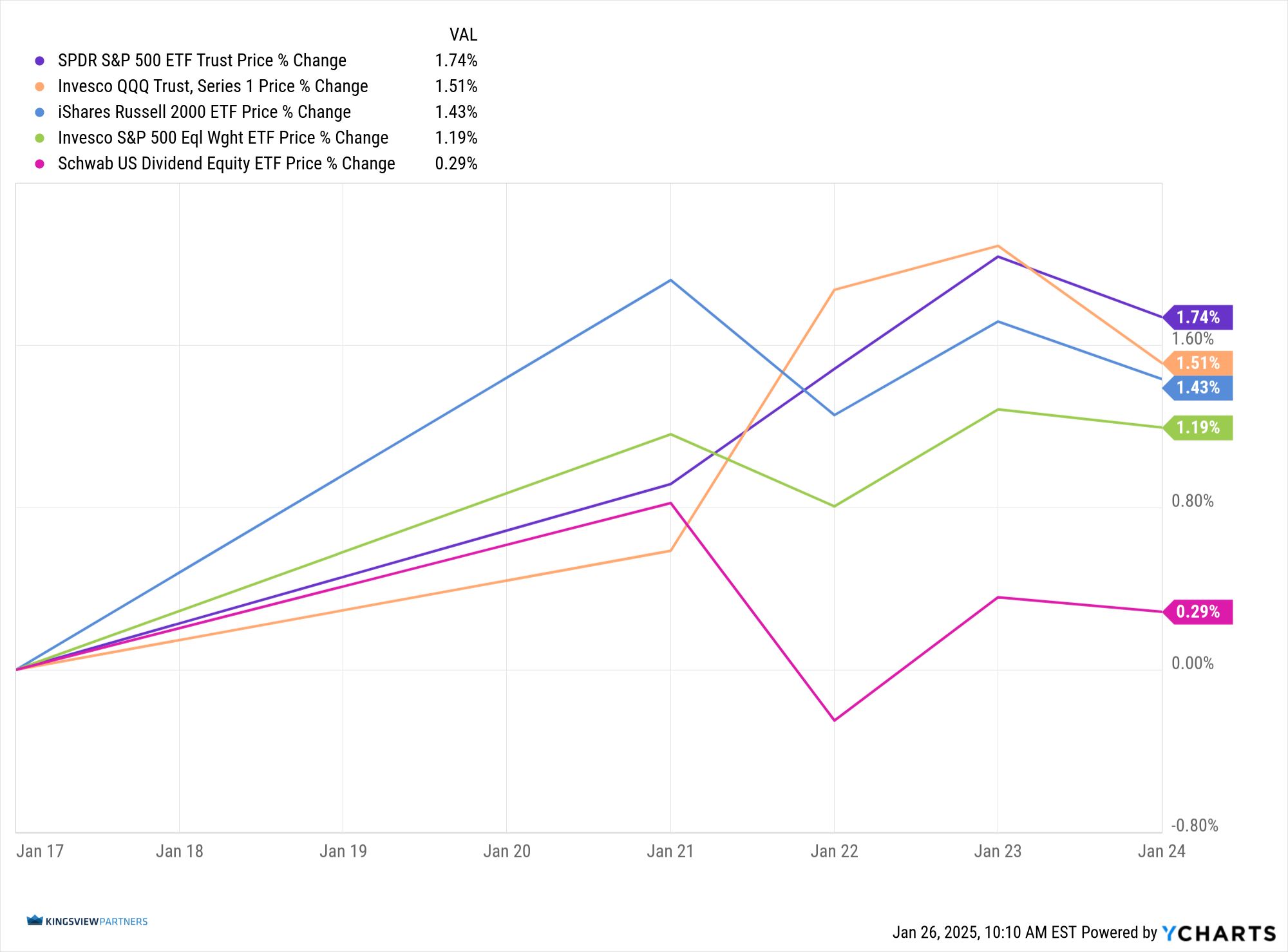

The generals led the charge this week, while the rank and file executed a strategic withdrawal. The capital-heavy SPDR S&P 500 ETF (SPY) battalion advanced 1.74%, pulling the elite Invesco QQQ Trust (QQQ) forces up 1.51%. Meanwhile, the infantry iShares Russell 2000 ETF (IWM) moved in lockstep with bond prices much of the week, gaining ground up 1.43%. The high command showed mixed maneuvers: Invesco S&P 500 Equal Weight ETF (RSP) gained 1.19%, while the dividend regiment Schwab US Dividend Equity ETF (SCHD), lagged both the leadership and the front line to finish up just 0.29%. Volume flows were modest, with engagement levels slightly below average during another abbreviated 4-day campaign on Wall Street. Both Upside Capital Volume and Dollar Volume led their downside counterparts on a 4:3 basis, revealing a slightly bullish push.

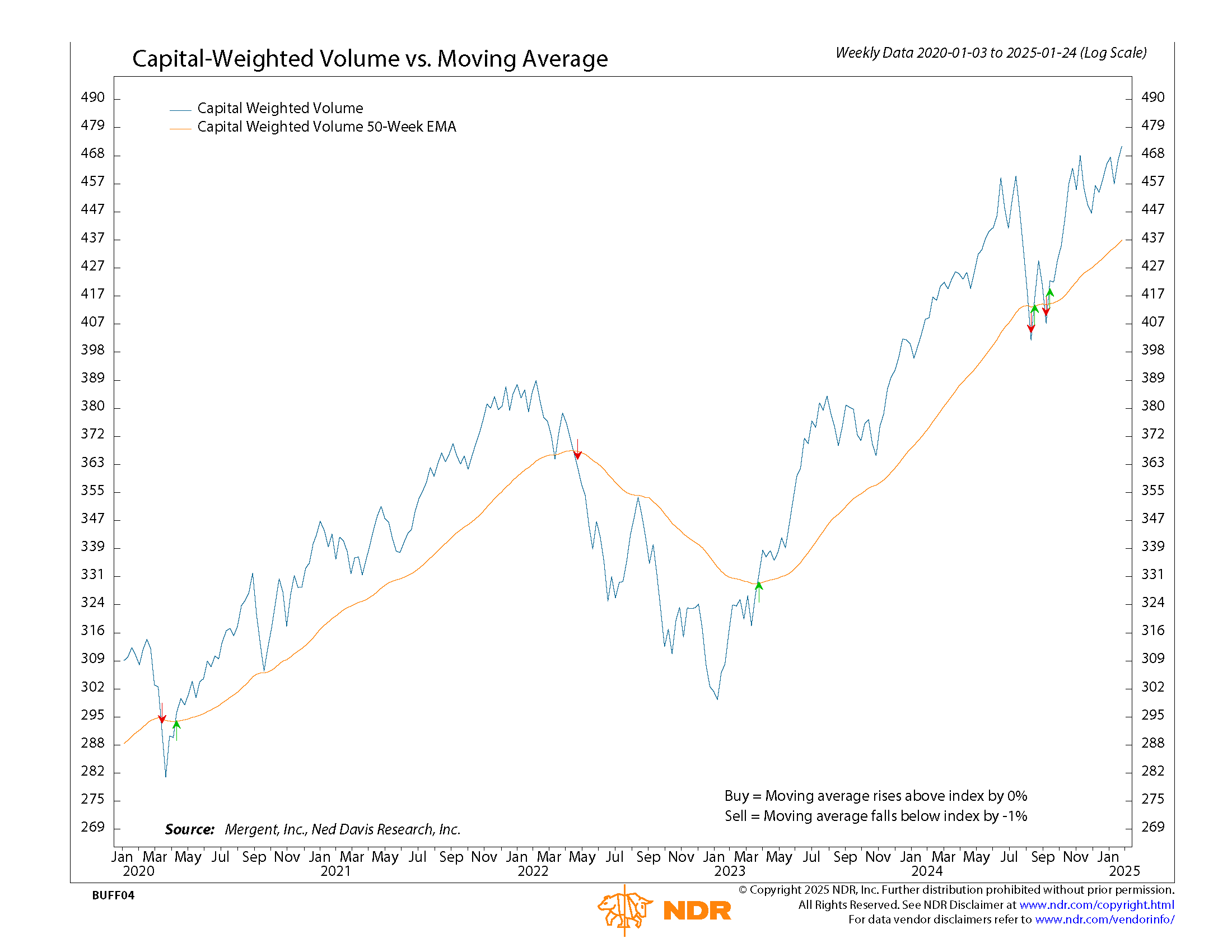

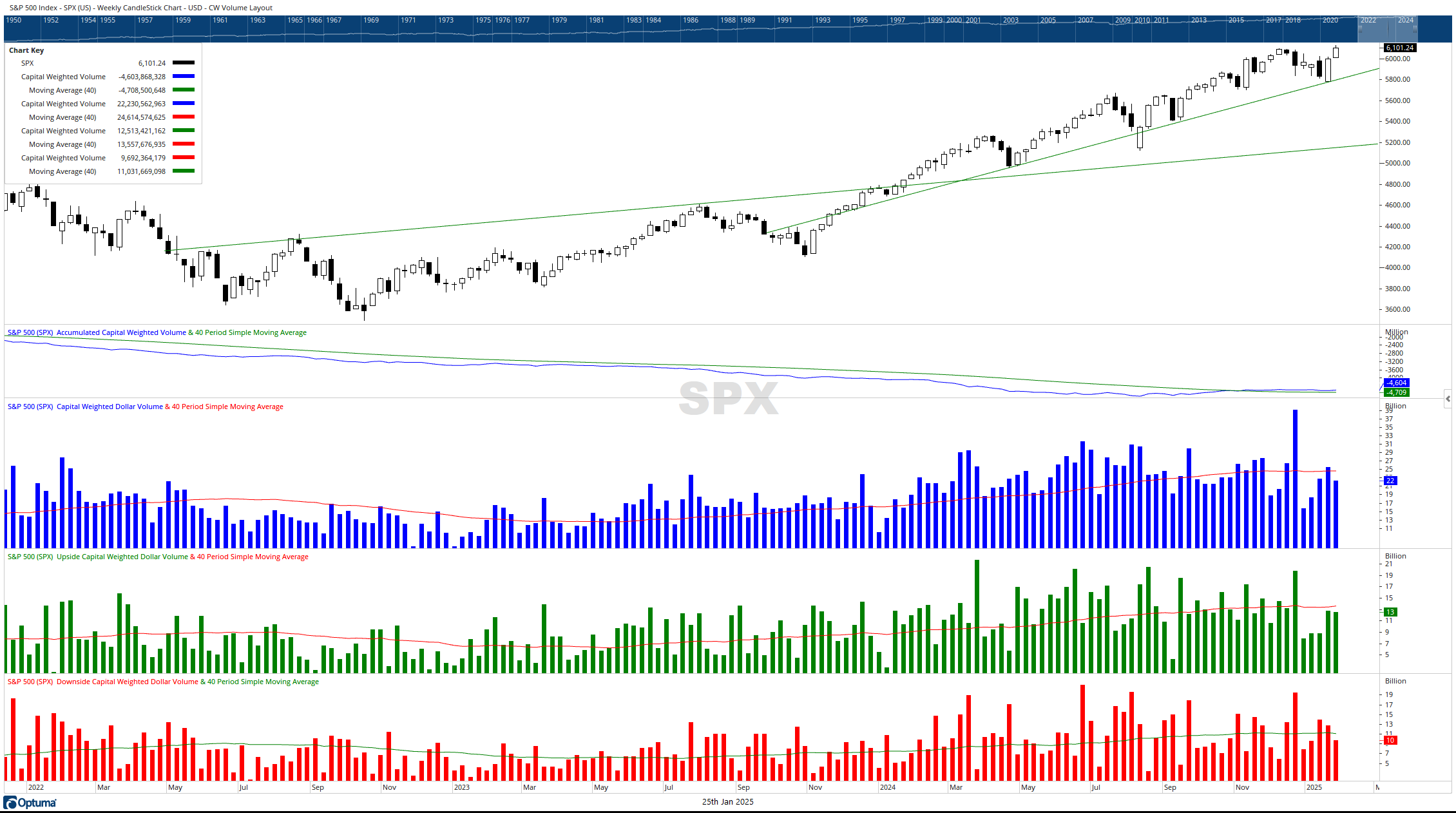

The S&P 500 fortified its position, closing at 6101 – a new all-time high weekly close, breaching the 6100 resistance line. Both S&P 500 Capital Weighted Volume and Dollar Volume reinforced this advance, reaching unprecedented levels. It’s a formidable defensive position for the bulls when price, liquidity, and capital flows are all at their zenith. Market breadth, though not at new highs, broke through resistance lines, bolstering the overall offensive.

The S&P 500’s battle lines are drawn with support at 6100 and a fallback position at 5900. The infantry (Russell 2000) could be the key to decoding the broader market strategy. They’ve taken a tactical pause to regroup after probing the 230 resistance line early last week. Keep your field glasses trained on interest rates and iShares 20+ Treasury Bond ETF (TLT), as bond movements have been dictating the broader market maneuvers.

This battlefield analysis suggests a strong bullish formation, but vigilance is crucial as we monitor the troops’ next deployment and the bond market’s strategic shifts.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 1/27/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.