Volume Analysis Flash Update – 1.20.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

The broader market rallied from its foxhole, closing the week near former resistance levels on poor volume. As intermediate and longer-term interest rates retreated, the troops and the brass led the charge while the generals followed in their wake.

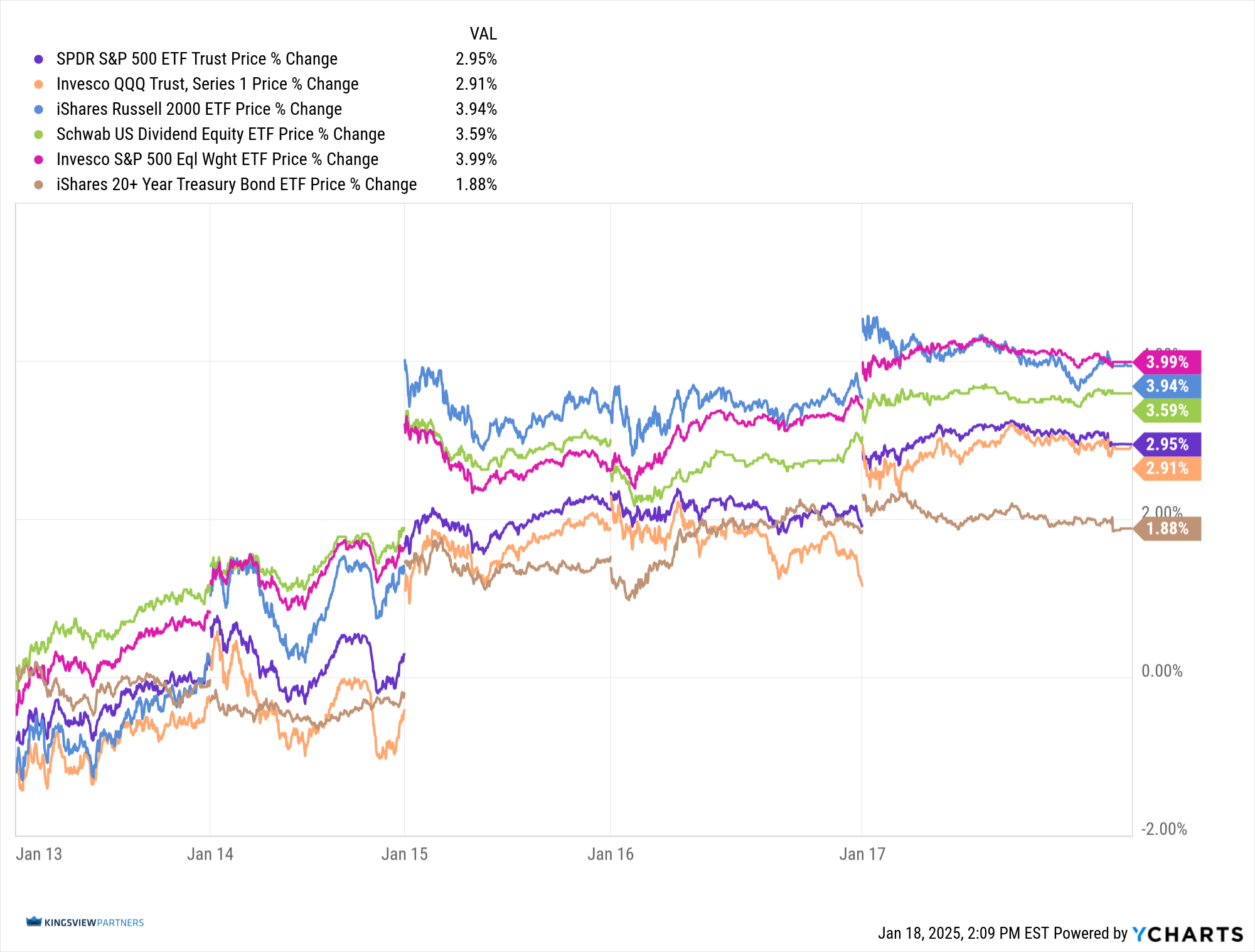

The Invesco S&P 500 Equal Weight ETF (RSP) led our forces for the first time in a long while, advancing 3.99% in the first full trading week in nearly a month. Hot on their heels, the troops, iShares Russell 2000 ETF (IWM), surged 3.94%, rebounding from their oversold condition noted in last week’s battlefield report. The Schwab US Dividend Equity ETF (SCHD) rounded out the broader market’s 3%+ advance, finishing up 3.59%. The generals, Invesco QQQ Trust (QQQ) and their capital-weighted orderlies, SPDR S&P 500 ETF (SPY), both finished the full week up just under 3%, at 2.91% and 2.95%, respectively.

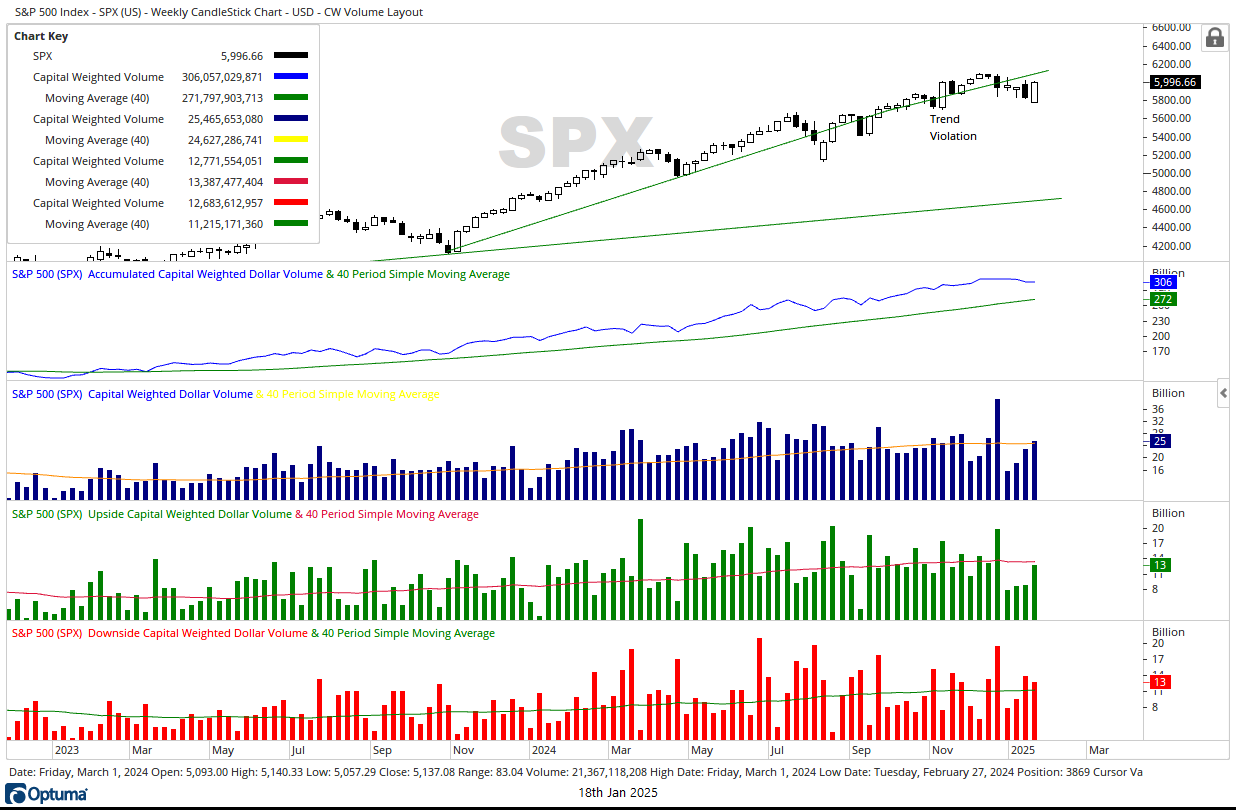

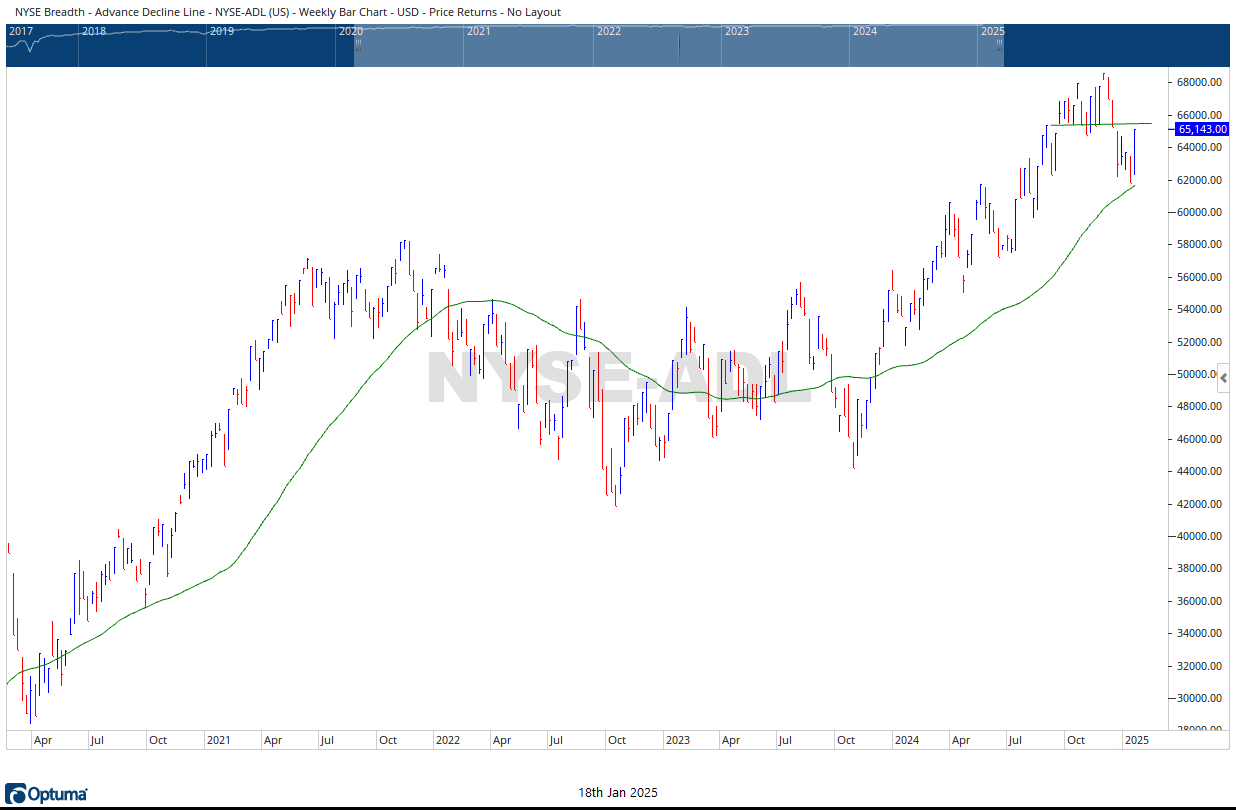

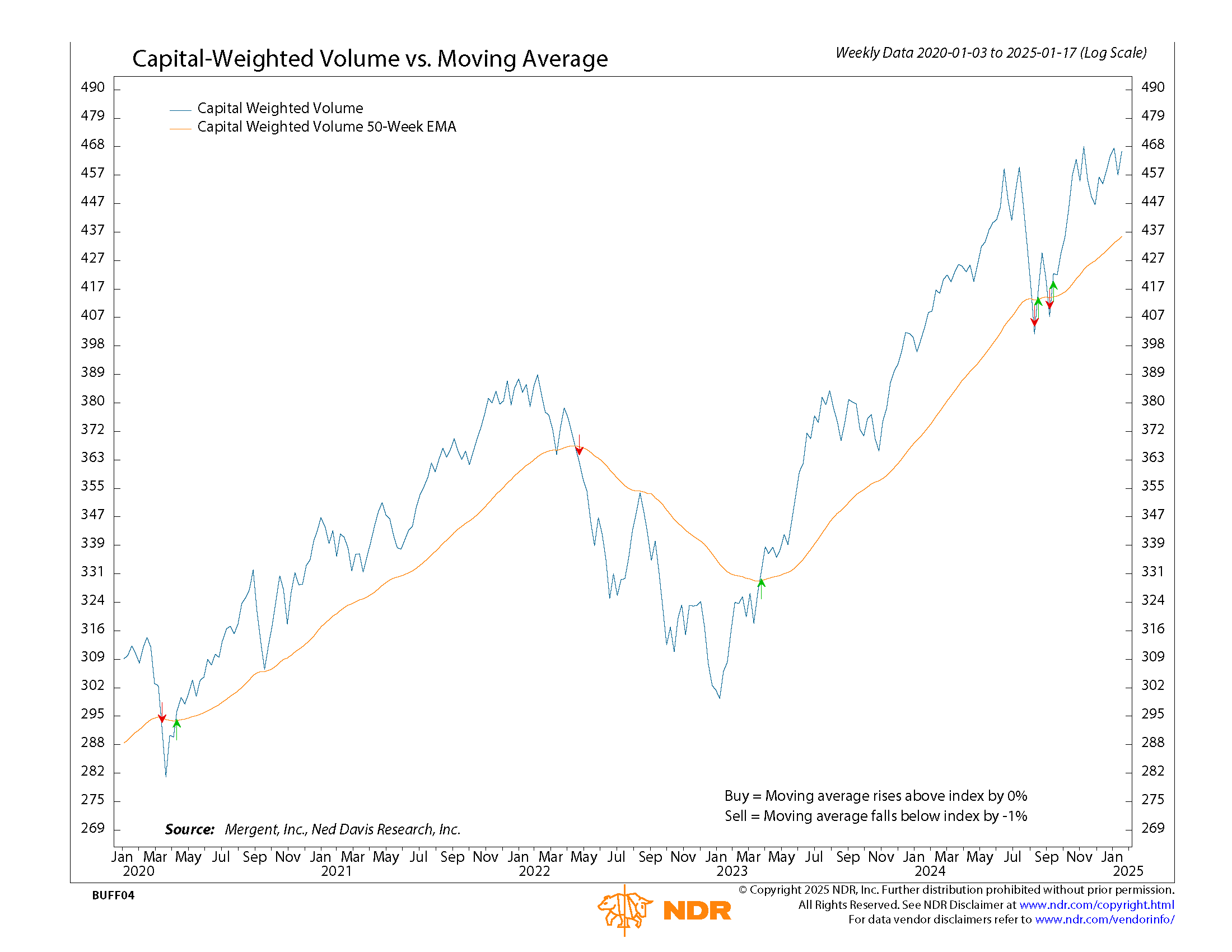

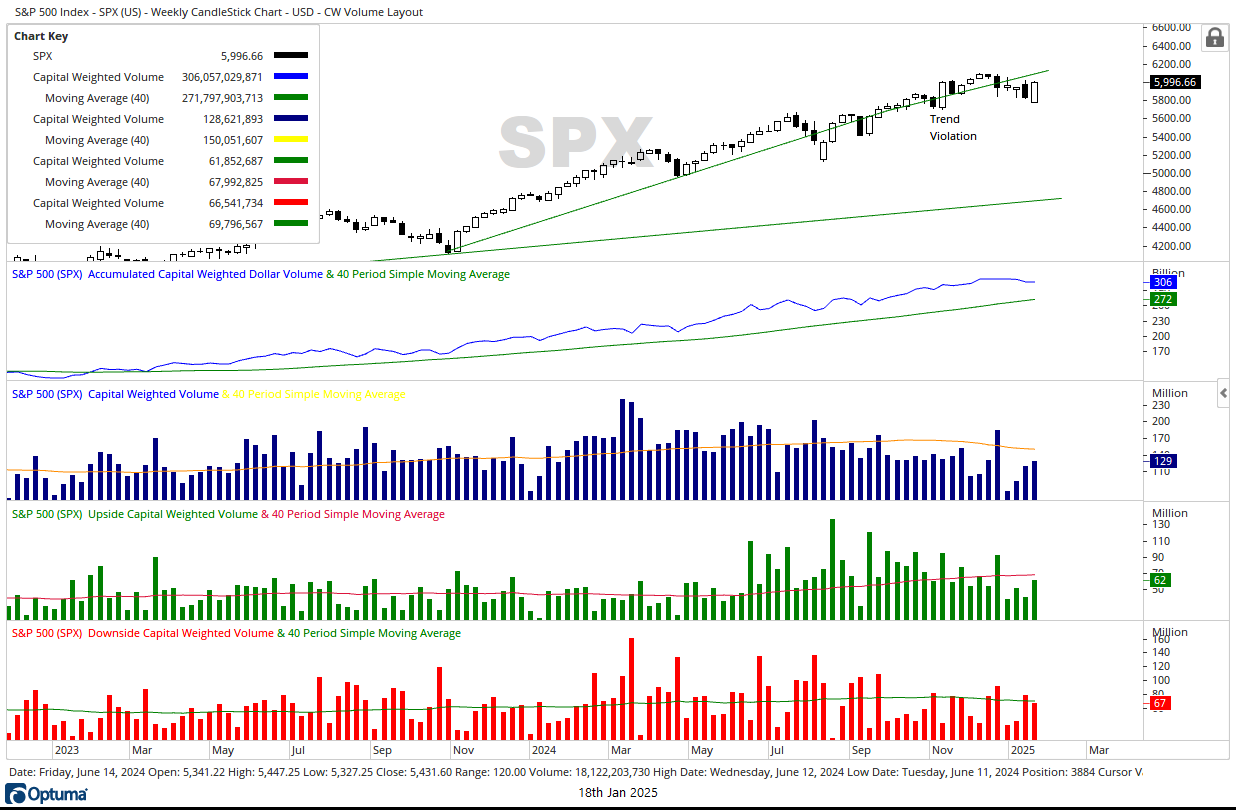

Despite being the first full week in several sessions, the volume figures were as scarce as survivors on Soldier Island. Both Capital Weighted Volume and Capital Weighted Dollar Volume showed below-average engagement in total volume and even upside volume. The only volume stat showing above-average activity was capital outflows (downside Capital Weighted Dollar Volume). Meanwhile, following the movements of the troops, the NYSE Advance Decline also rallied from support back to its former resistance line.

Overall, the markets are now entrenched in a trading range, with January’s early lows acting as a defensive line and this past week’s highs as no man’s land. The S&P 500 is up against trendline resistance at 6000, with all-time highs looming near 6100. Both the Advance-Decline Line and the troops’ finished close to resistance, with IWM resistance at 230 and support at 220. The stakes of these lines are high, their breakout or breakdown likely to determine the intermediate-term action of the markets, with interest rates and TLT potentially serving as the market’s tell.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 1/20/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.