Volume Analysis Flash Update: Rising Bond Yields Drive Down Stocks – 1.13.25

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

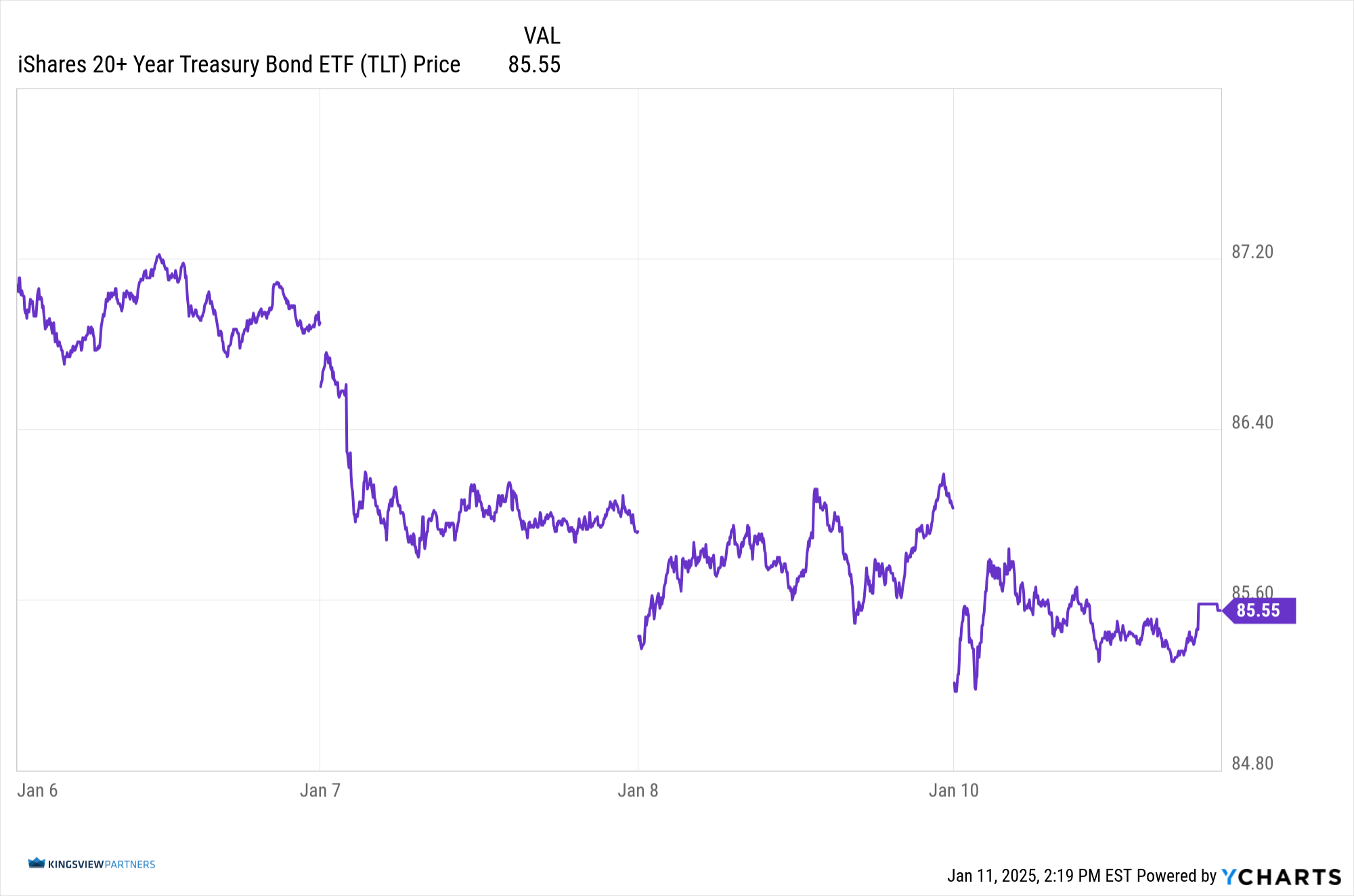

Our 12/30 bond focused flash report stated:

“On the front lines of this conflict, we’re closely monitoring the 10-year US Treasury Bond yield, where resistance stands firm at 4.7%. This level represents a key strategic position; a breach could signal a new offensive in the bear market for bonds. Simultaneously, we’re watching the iShares 20+ Treasury Bond ETF (TLT) for signs of weakness. A strong breach below the 87 level in TLT could confirm a new bearish trend in bonds, potentially unleashing a wave of selling pressure across fixed-income assets.

The impact of these bond market maneuvers on equities cannot be overstated. While the troops (small-cap stocks represented by the Russell 2000) initially showed resilience in the face of rising yields following the August lows, the correlation has now completely reversed. Since December, the troops have been moving in inverse relation to effective long-term yields, demonstrating their vulnerability to interest rate fluctuations. This shift in market dynamics suggests that further increases in bond yields could pose a significant threat to the broader equity markets, particularly impacting the small-cap sector that has recently shown signs of strength.

The hierarchical nature of financial markets means that disruptions in the bond market can have far-reaching consequences, potentially causing substantial losses across multiple fronts. As we navigate this complex battlefield, investors must remain alert to the evolving interplay between bond yields and equity performance, recognizing that the current environment may require swift tactical adjustments to protect and advance their positions.”

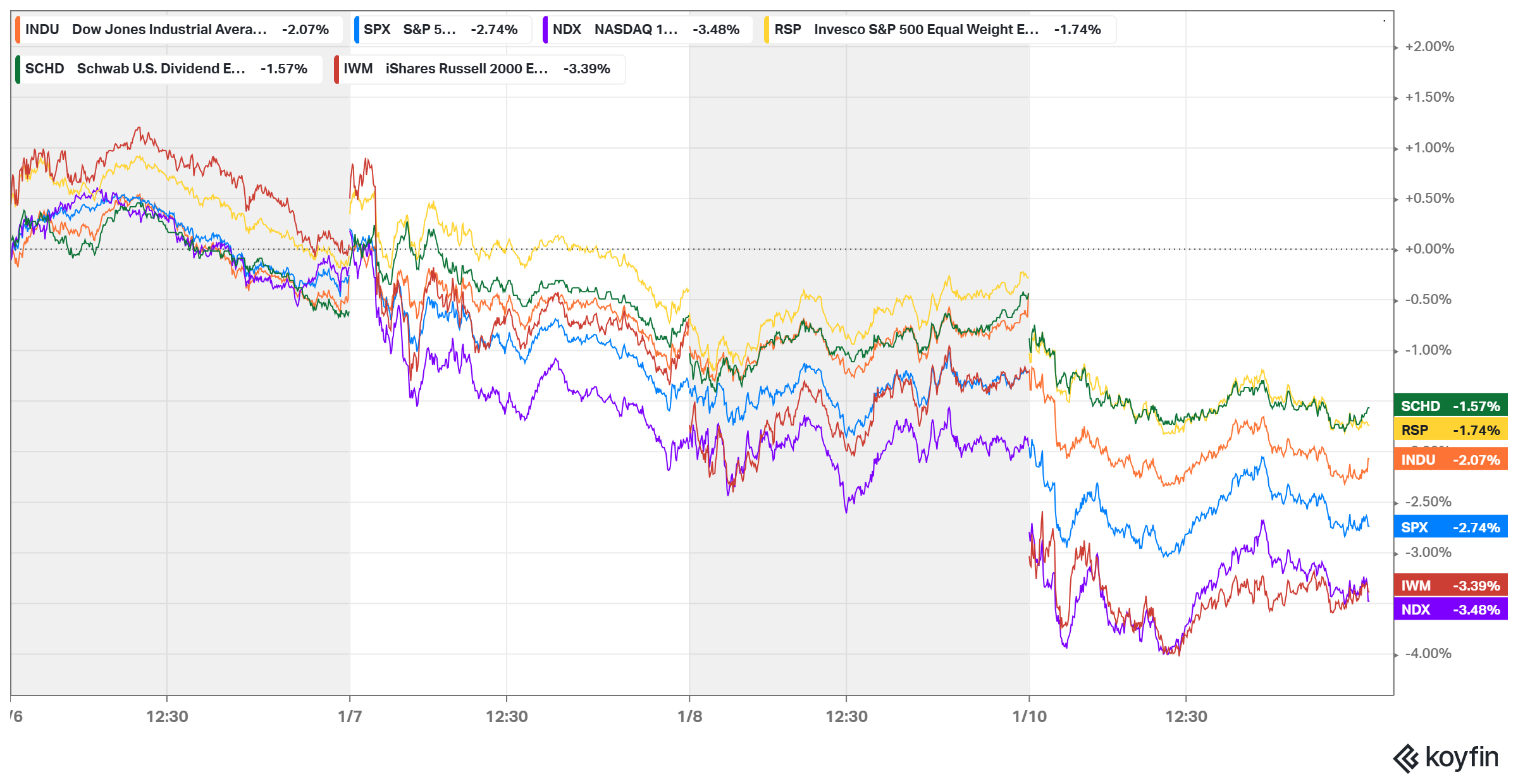

This week, TLT breached the forementioned 87 support level like a hot knife through butter. In a coordinated assault, falling bond prices pulled stocks down in their wake. For the calendar week, both the troops, iShares Russell 2000 ETF (IWM), and the generals (NDX 100) led the retreat, with IWM down -3.39% and the Nasdaq 100 down -3.48%. Our brass commanders held their ground better, with Invesco S&P 500 Equal Weight ETF (RSP) down -1.74%, outperforming their capital-weighted counterpart the S&P 500 Index which fell -2.74%.

Strategically, our next two critical defensive positions are IWM 212 and TLT 82. If IWM breaks and closes below 212, our small-cap battalion’s intermediate support is in jeopardy. Should TLT fall below October 2023’s low of 82, the bear trend in bonds will be further entrenched and solidified. The good news for our bullish forces is that IWM support still holds. More importantly, IWM’s Volume Momentum Indicator is at a deeply oversold level of 0.595. Historically, when IWM (and other securities) is above 0.6 (oversold), it has historically created conditions for successful counteroffensives.

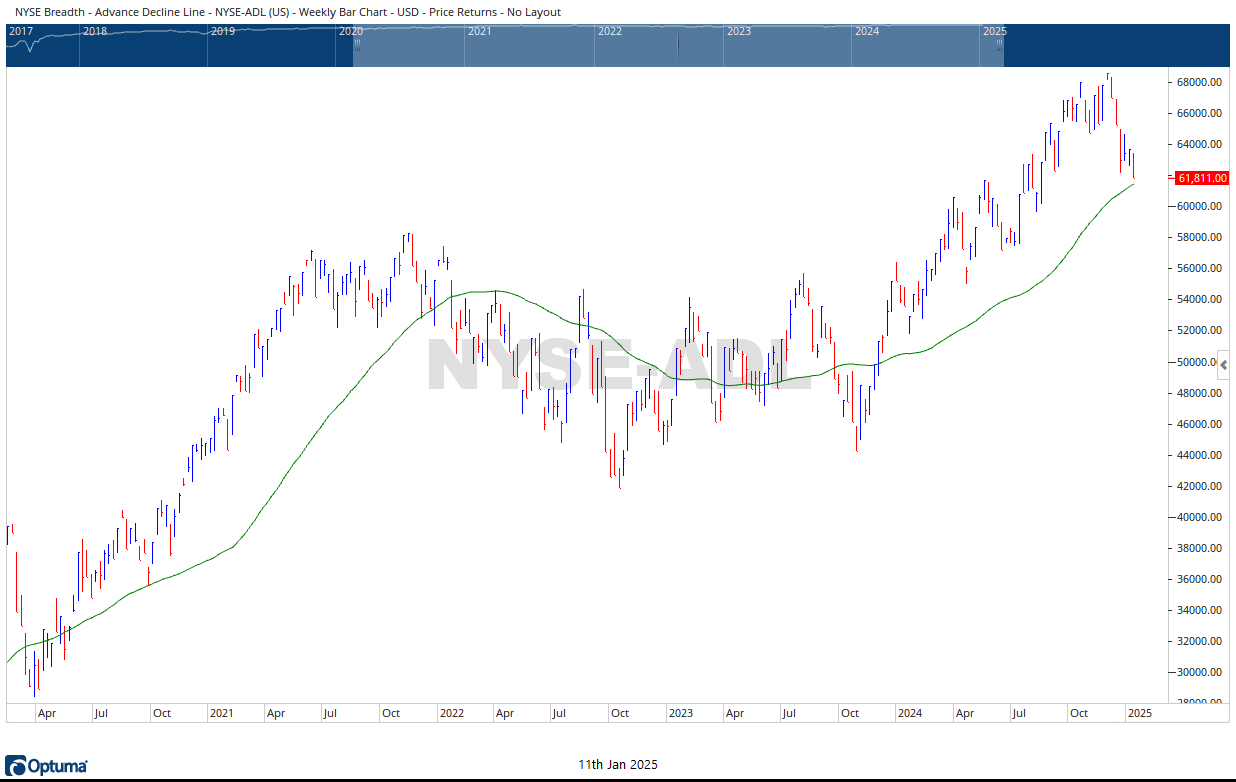

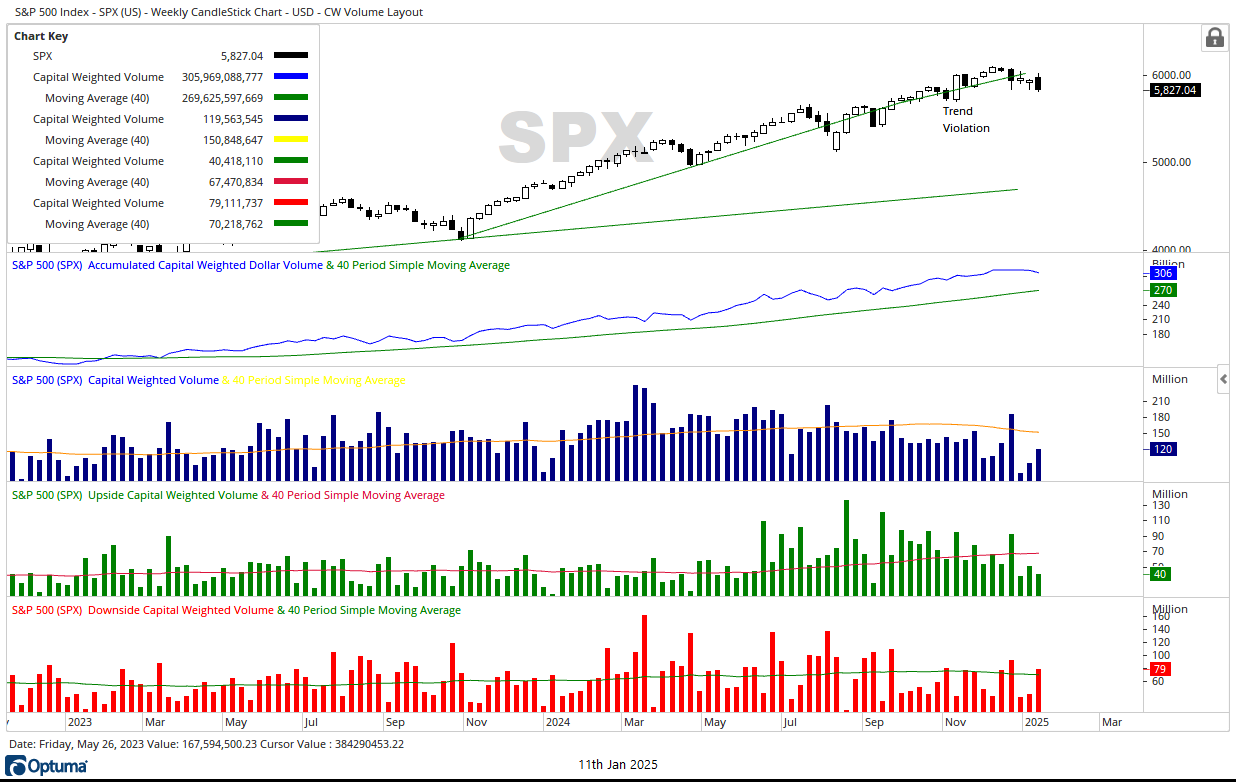

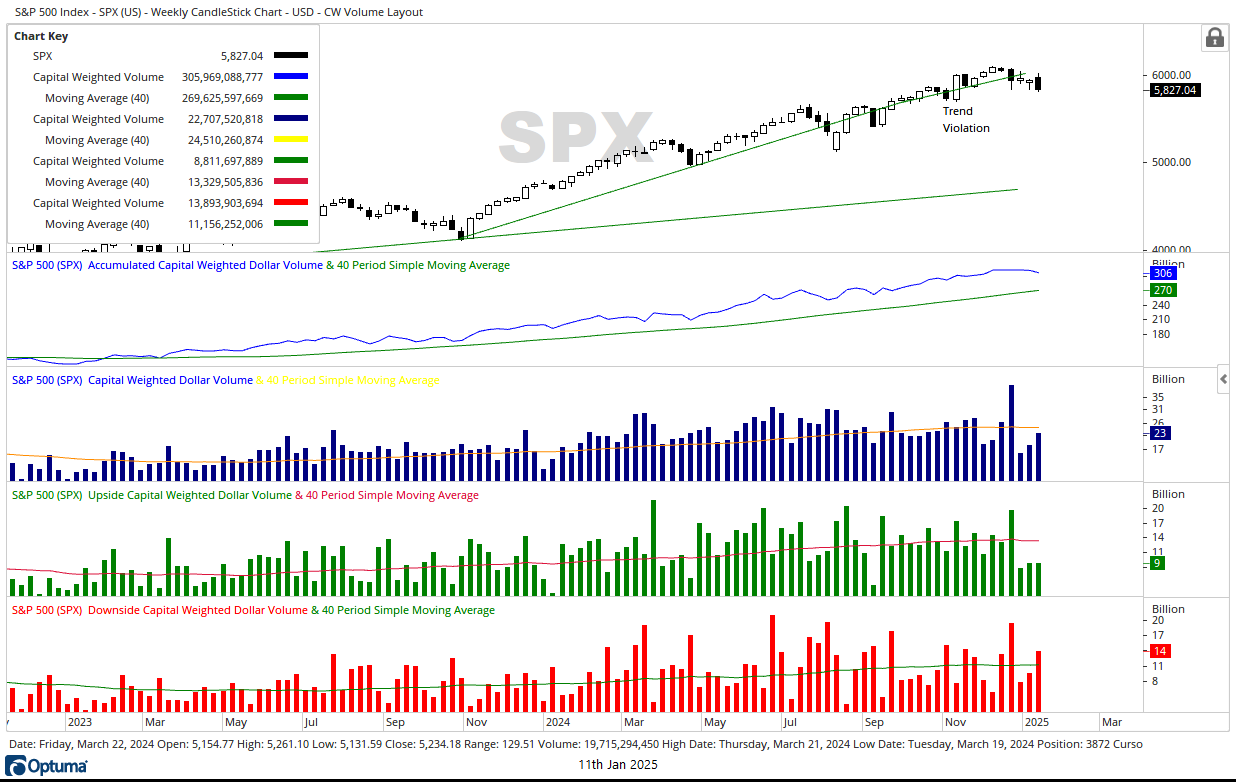

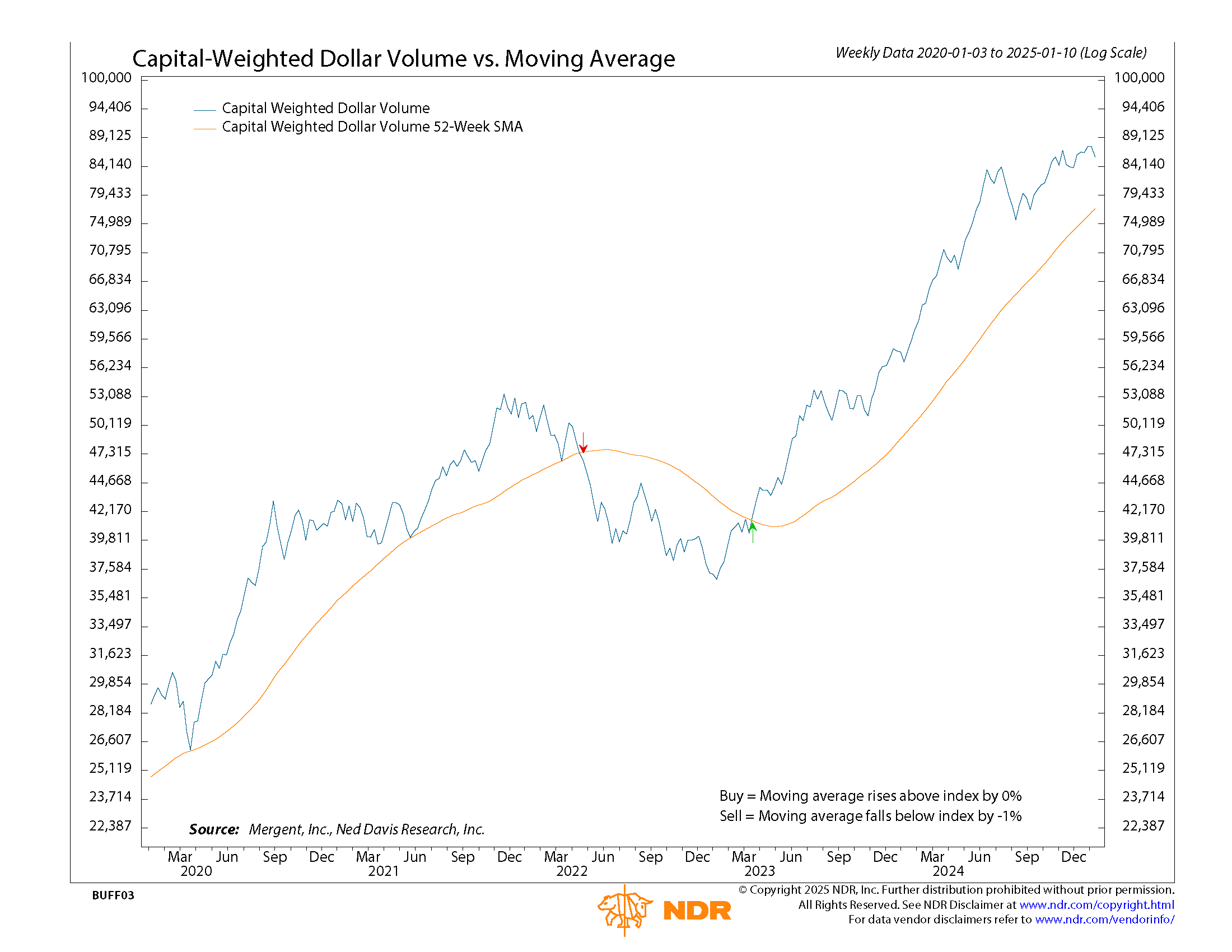

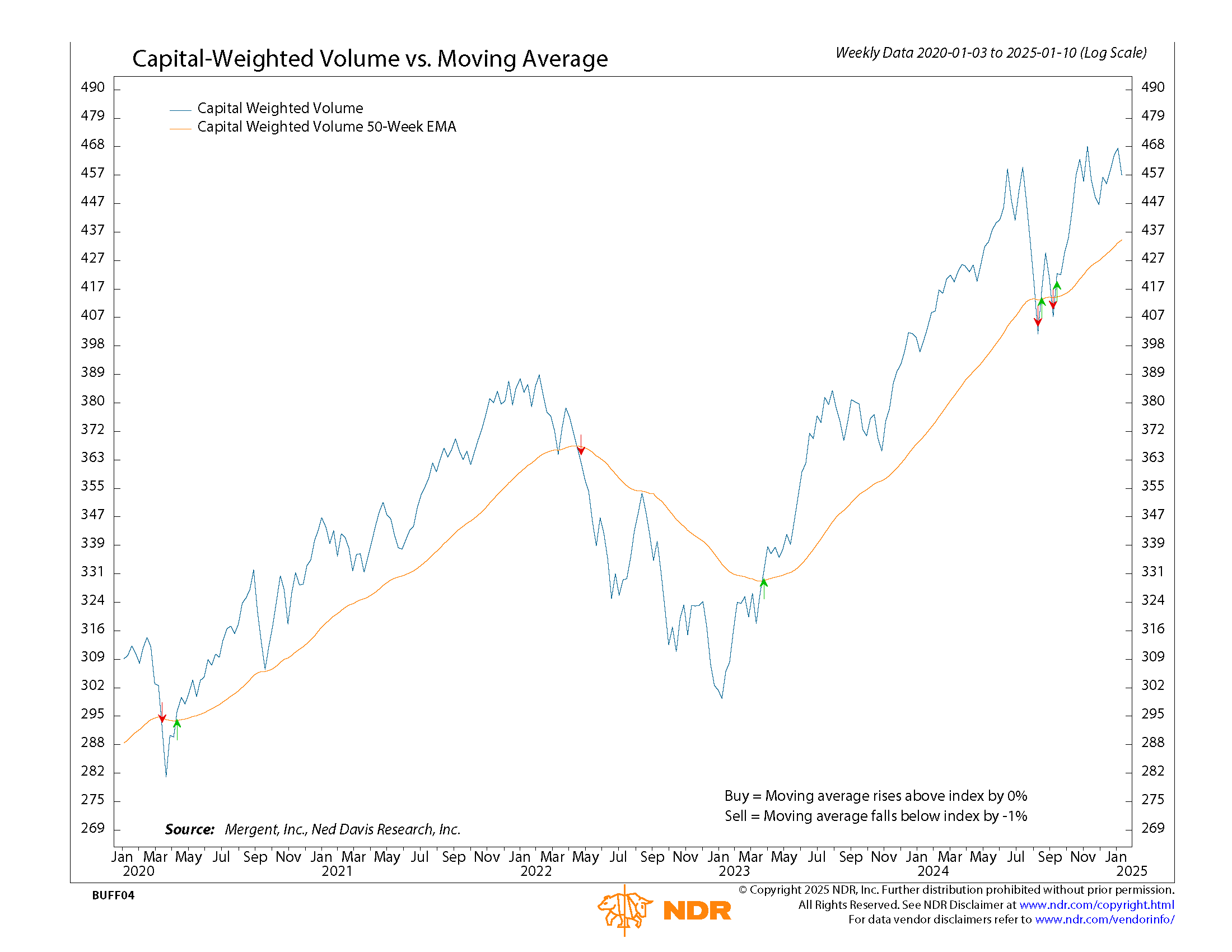

Weekly volume was below average for the third session in a row, but keep in mind this is the third week with fewer than five sessions. Despite the four-day trading week, both Capital-Weighted Volume and Dollar Volume outflows were above average, with downside Capital-Weighted Volume doubling upside. Market breadth was weak, with the NYSE Advance-Decline Line falling below the December 20th support level. The AD Line is now just barely above its rising trend, holding onto its position by a thread.

In summary, the Advance-Decline Line, the Russell 2000, and TLT are all in lockstep collisions moving toward support, like allied forces converging to a strategic objective. Although the broader market trends are in jeopardy, the S&P 500 remains well-entrenched above its intermediate trend, like a fortified stronghold. Most importantly, Capital Weighted Volume and Dollar Volume, though weakened, also remain in steady uptrends, providing a solid supply line for our market forces.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 1/13/2025. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.