Portfolio Manager Insights | How Behavioral Science Helps Us Avoid Financial Traps 12.18.24

Click here to download this commentary in PDF format.

When it comes to managing our investments, we can be our own worst enemies. Behavioral finance research has revealed how emotional and cognitive biases can lead investors to make financial decisions that harm rather than benefit them. From panic selling during market downturns to overconfidence in bull markets, ingrained behavioral patterns frequently result in inappropriate asset allocation, poor market timing, and reduced long-term returns.

This is especially relevant as we enter 2025. With the stock market and many other asset classes near all-time highs after two years of strong returns, understanding these biases is more important than ever. They are also the first step in developing a more disciplined and rational approach to investing. What are some of the most common behavioral traps and how can investors avoid them?

Recency bias results in short-term thinking

First, recency bias, or focusing too much on recent events rather than long-term patterns, can lead investors to make bad decisions. Market gains over 2024 are a perfect example of the perils of letting short-term concerns drive long-term investment decisions. Despite many concerns around a recession, the Fed, the presidential election, geopolitical conflicts, and the general fear of volatility, the S&P 500 has gained nearly 30% with dividends. This highlights how markets can climb a “wall of worry” even during challenging times.

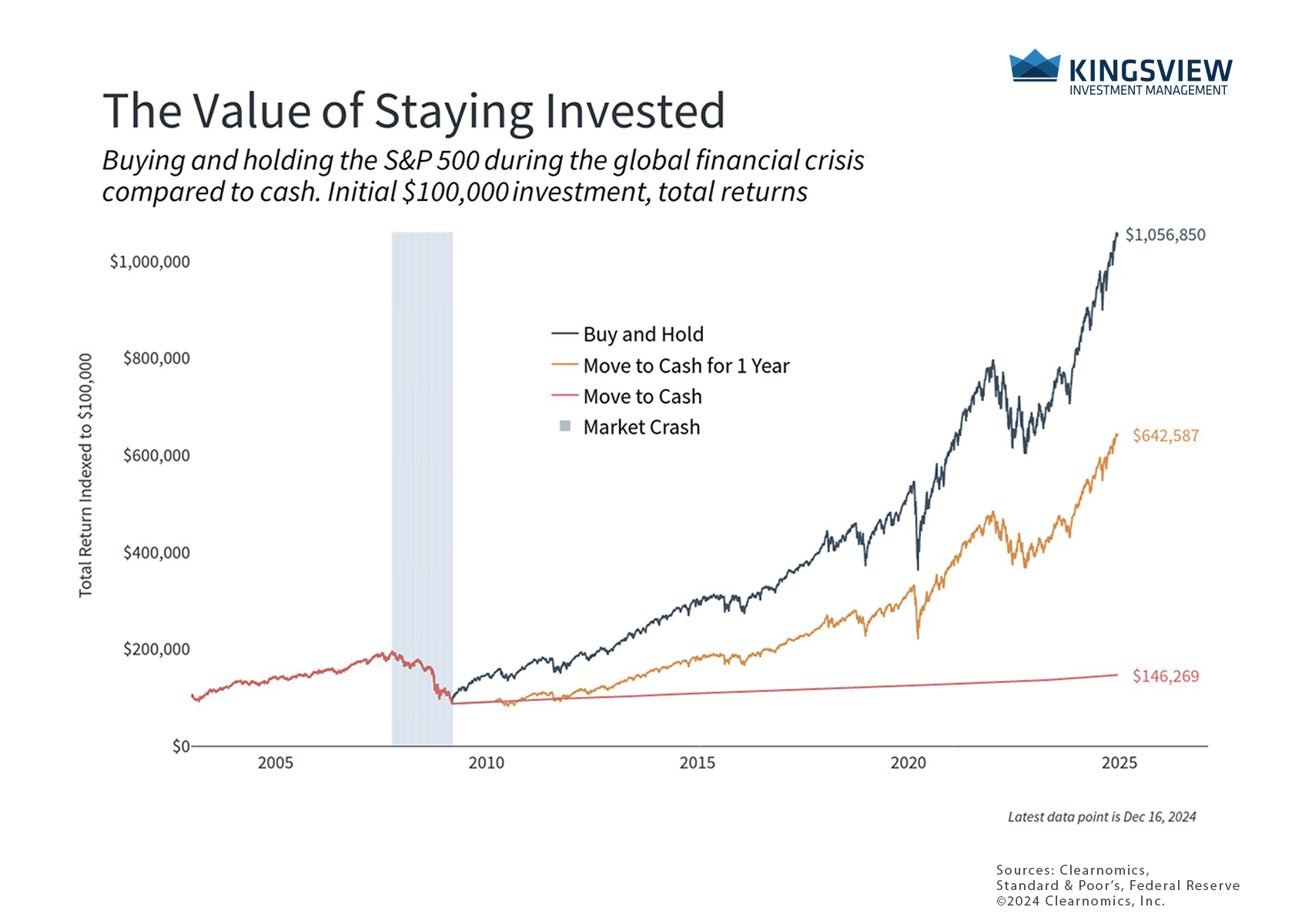

As this chart shows, investors who did not stay invested in an appropriate portfolio during the 2008 financial crisis most likely derailed their financial plans. Those who switched to cash for extended periods missed out the most, but even investors who did so for only one year at the market bottom in March 2009 ended up significantly worse off than those who stayed fully invested, despite the significant market swings.

While we’re focusing on the 2008 financial crisis in this example, the same is even more true for the 2000 dot-com crash, the 2020 pandemic bear market, the 2022 pullback, or any other period of market turmoil.

Recency bias can cause investors to put too much emphasis on recent market events while undervaluing longer-term patterns. This can mean pulling money out of the market after a crash, or over-allocating to stocks when they are doing well, at the expense of portfolio balance. While it’s normal to feel concerned during periods of uncertainty, emotional reactions to market movements tend to lead to poorly timed investment choices and missing out on long-term gains.

Rather than trying to predict short-term market moves, investors should maintain a disciplined approach aligned with their risk tolerance and time horizon – ideally with the guidance of a trusted advisor. Having a well-thought-out financial strategy can help provide perspective during both bull and bear markets.

Fear of loss can hold investors back

The next cognitive trap investors should be aware of is loss aversion. Popularized by psychologists Daniel Kahneman and Amos Tversky, loss aversion is the concept that people experience greater negative emotions following a loss than they do positive emotions from a gain of equal size. For example, finding a ten dollar bill on the sidewalk feels great, but realizing you dropped a ten dollar bill on the ground – or that you overpaid for something by ten dollars – feels comparatively worse.

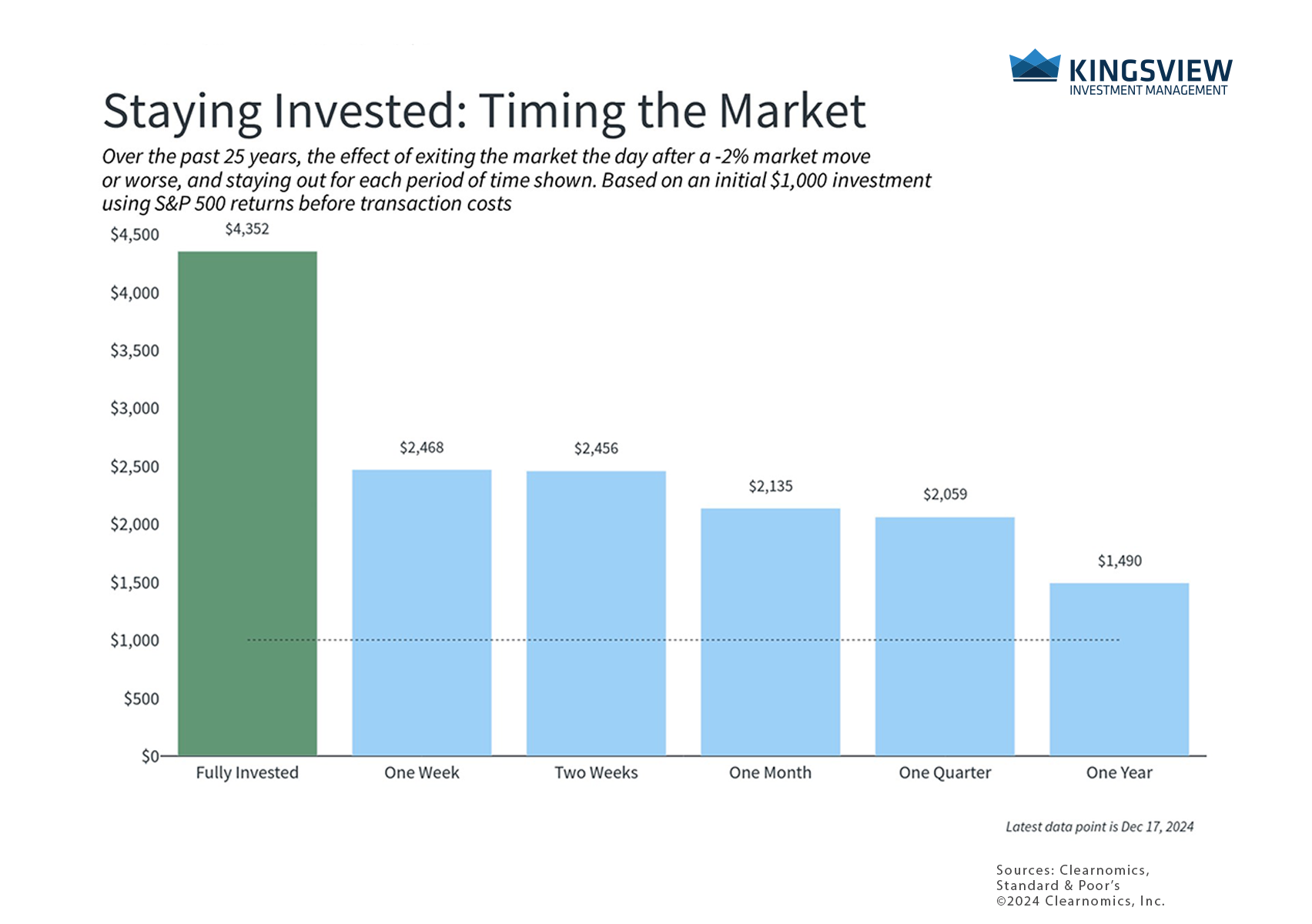

Fear of losses can make investors overly cautious, causing them to keep too much in cash and potentially miss out on long-term growth opportunities. Loss aversion can also drive investors to panic sell during market declines, locking in losses at the worst possible time. This bias can lead to opportunity costs when investors refuse to invest available funds during periods of uncertainty – such as staying out of markets due to fears of potential losses.

For example, during the 2020 market downturn, many investors panicked and sold their holdings at the bottom, causing them to then miss out on the rapid recovery, highlighting how loss aversion can lead to poor timing. Historical market corrections show that patient investors who stayed in the market through temporary declines generally benefitted in the long run. To put it another way – the fact that it is challenging to stay invested is exactly why investors are rewarded.

Home bias can lead to missed opportunities

Third, home bias is the tendency to favor domestic stocks over international ones because of a feeling of familiarity or comfort. In the extreme, investors may focus only on the companies they or their friends and family work for, those in their hometowns, etc. While this may make sense because these are the companies and stocks they know well, it limits portfolio growth and diversification. Investments in other countries, which are less correlated to U.S. markets, can act as a hedge, helping to reduce risk in an investor’s portfolio.

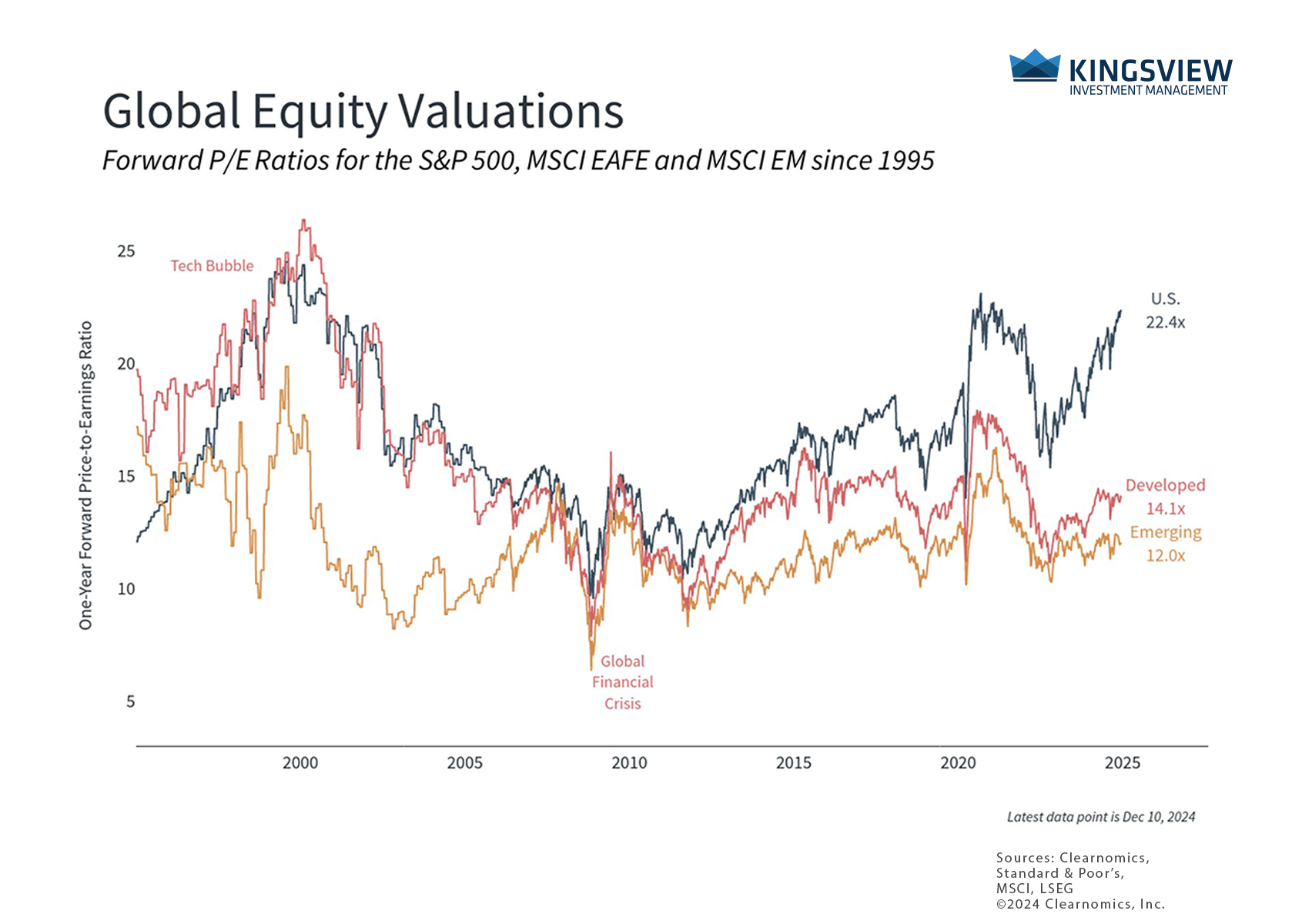

Concerns about currency fluctuations, international regulations, and perceived higher risks in foreign markets can reinforce this bias. Additionally, U.S. stocks have outperformed international markets over the past decade and have consistently delivered superior returns over that time, driven by a dynamic and innovative economy, robust corporate governance, and deep, liquid capital markets.

Despite this, international markets continue to offer unique opportunities and potential diversification benefits for global investors, along with lower valuations. Even though there are greater risks in other parts of the world, especially in emerging markets, investors are often rewarded for these risks over long periods of time. As the accompanying chart shows, international markets are far more attractive than U.S. markets when comparing valuation ratios.

The bottom line? While behavioral biases can work against investors, understanding these biases is the first step toward better decision-making. Rather than allowing emotions to drive investment decisions, having a disciplined, long-term approach is the best way to achieve long-term financial goals.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2024)

The illustrations, charts, and other visual materials included in this marketing material are provided by third-party sources. These illustrations are for informational purposes only and do not represent the actual performance of any specific investment, product, or strategy. The third-party information presented herein has been obtained from sources believed to be reliable; however, Kingsview Wealth Management makes no warranty or representation, expressed or implied, as to its accuracy or completeness. The inclusion of this material does not imply an endorsement of any third-party content, nor should it be construed as financial advice.