Volume Analysis Flash Update – 11.25.24

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

And Then There Were None Part XI – “The Market Rallies as Dangers Potentially Lurk Beneath the Surface”

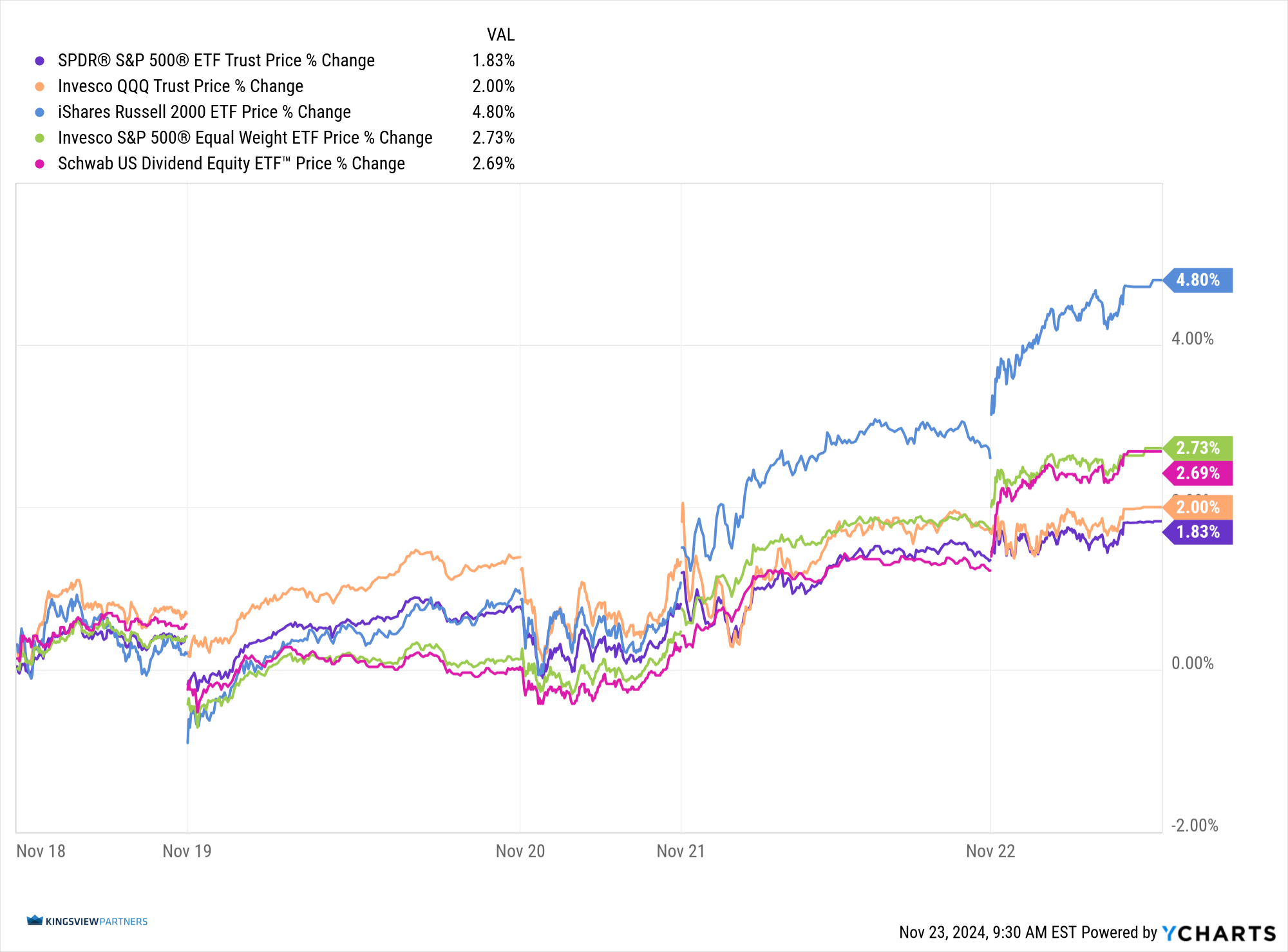

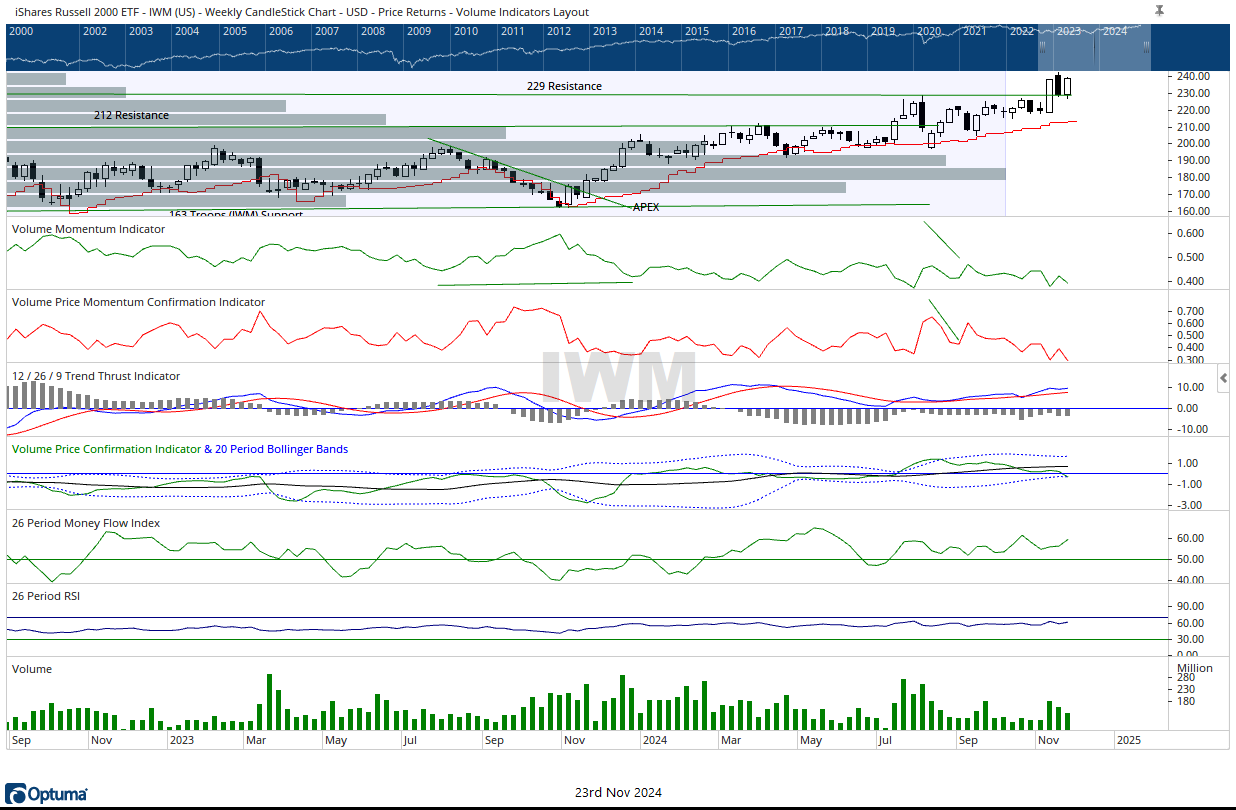

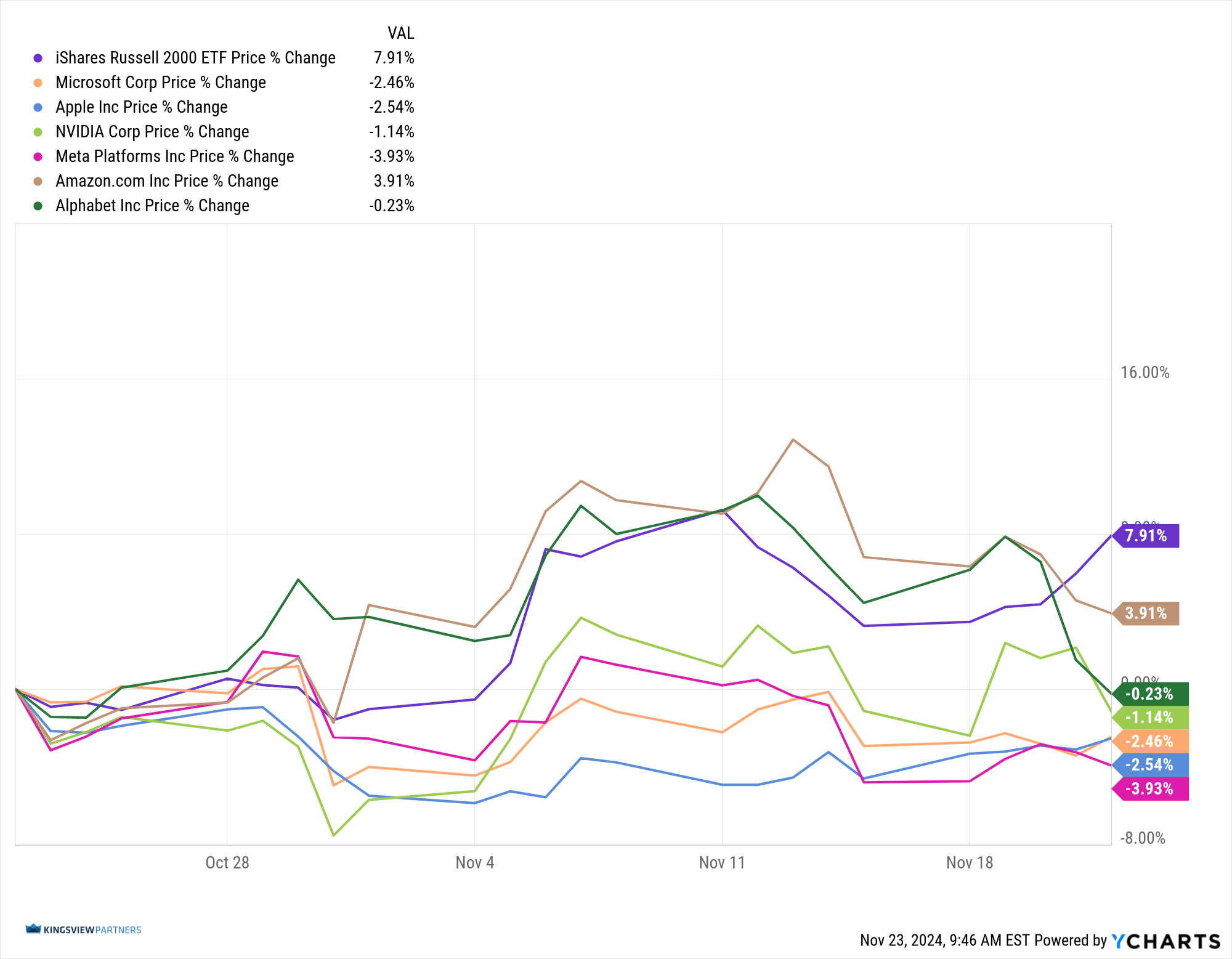

This past week, the markets rallied back, nearing their election week closes with the Troops leading the charge once again. The Troops (iShares Russell 2000 ETF – IWM) finished the week up 4.80%, followed by our Brass Commanders: Invesco S&P 500 Equal Weight ETF (RSP) up 2.73% and the Schwab US Dividend Equity ETF (SCHD) up 2.69%. The Generals – Invesco QQQ Trust (QQQ) closed the week up 2.00% with SPDR S&P 500 ETF (SPY) close behind, up 1.83%. This past week’s action brings additional reinforcement to our June 2024 broadening theme.

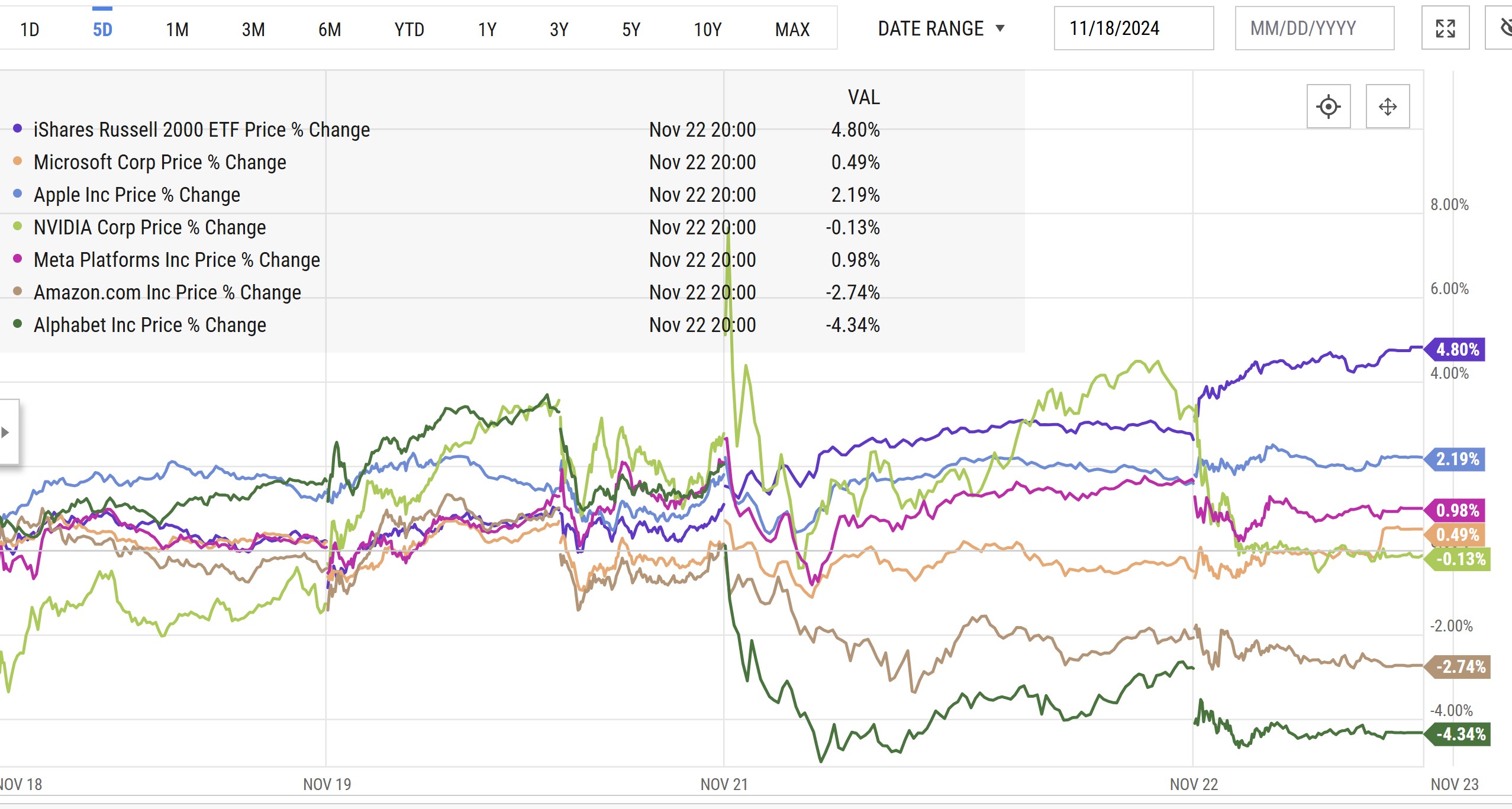

Delving deeper into the numbers, more evidence of broadening emerges, reminiscent of Christie’s larger-than-life characters. The General’s top market Nephilim all underperformed the Troops on the week, with half of the top 6 losing ground on an up week. AAPL (Apple) was the only stock to outperform the S&P 500, up 2.19%. Looking back a month, AMZN (Amazon) is the sole Nephilim in positive territory (+3.91%). Meanwhile, the Troops are up 7.91%. It appears our elite cast of resilient characters may be fading.

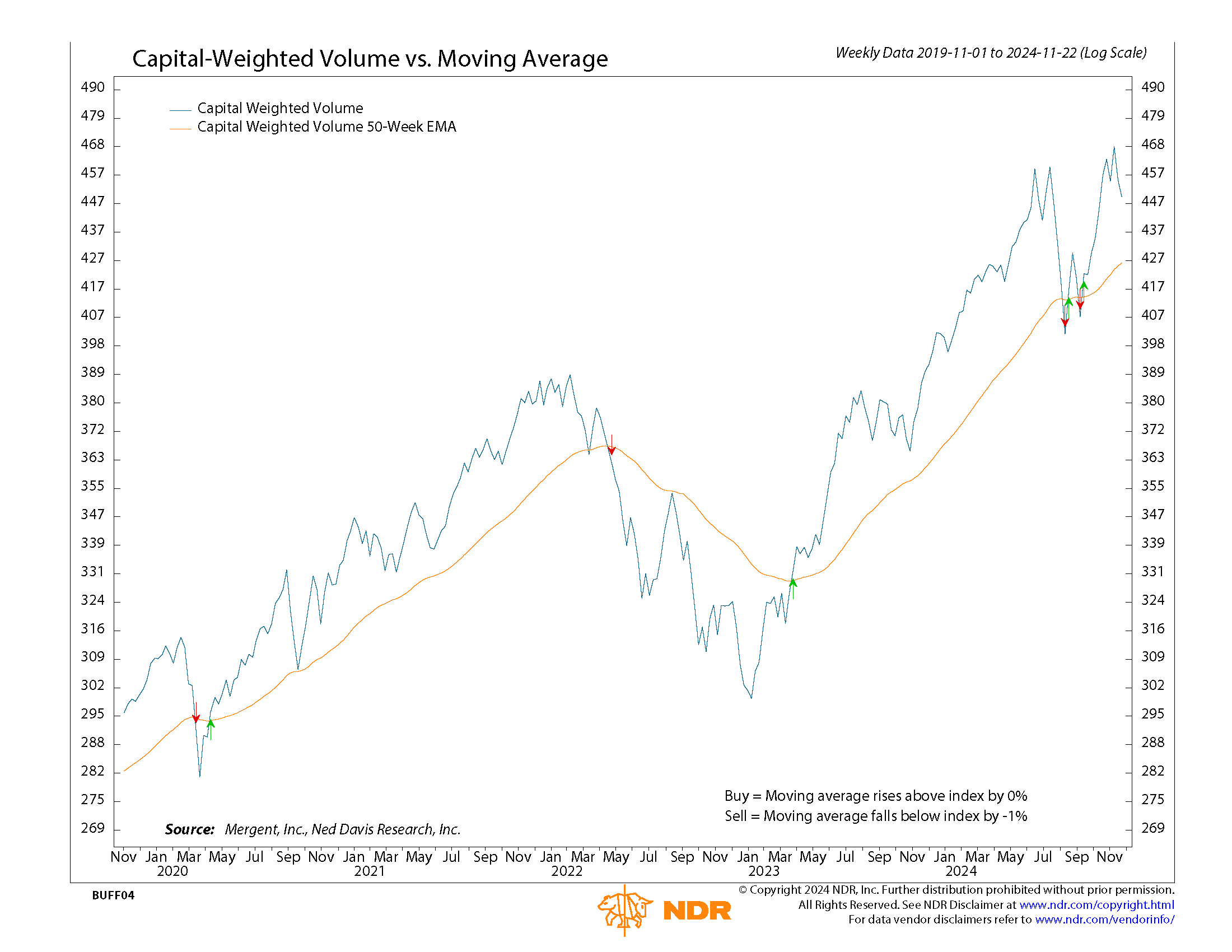

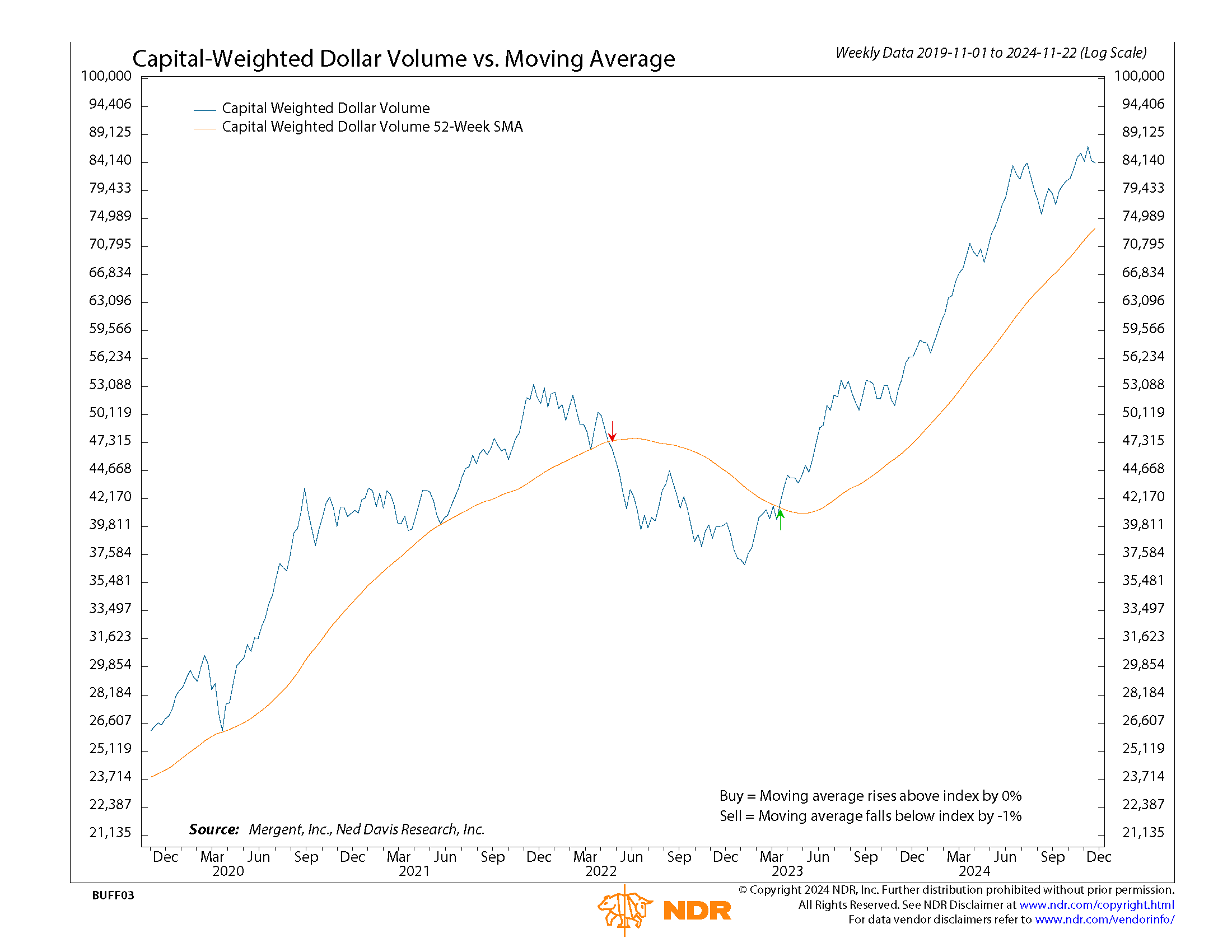

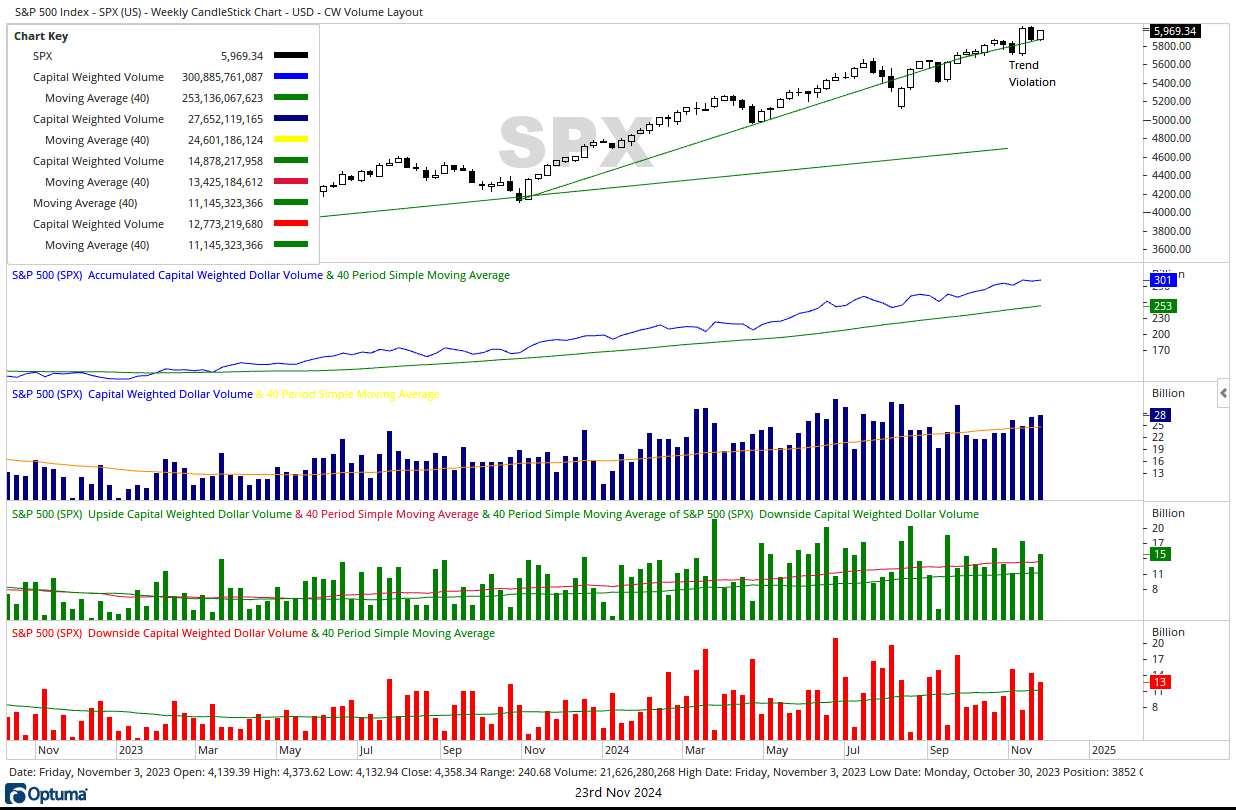

Beneath the surface, our leading indicators did little to support this past week’s market rally. Our top indicator, S&P 500 Capital Weighted Volume, strongly diverged from S&P 500’s positive week. S&P 500 Capital Weighted downside volume more than doubled upside volume. Additionally, S&P 500 Capital Weighted Dollar outflows were over 30% higher than inflows on above average volume.

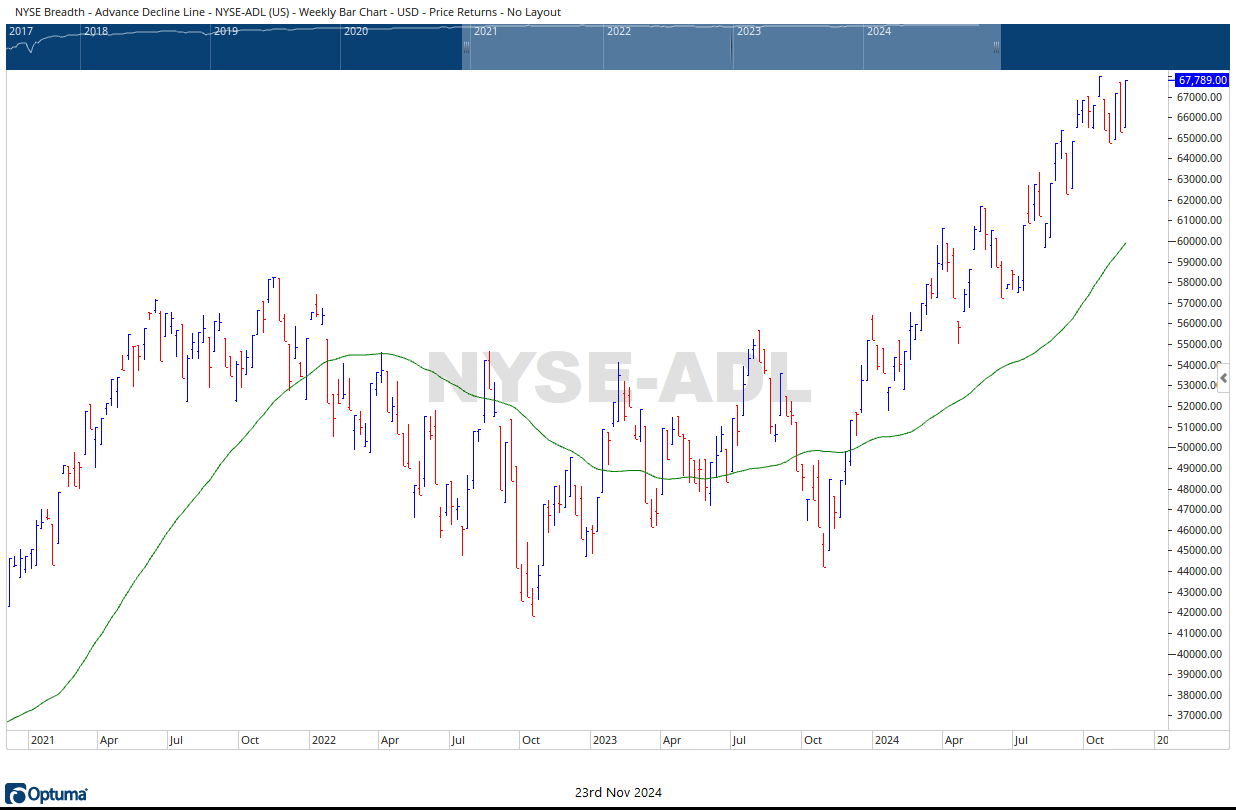

Turning the proverbial page, market breadth as measured by the NYSE Advance Decline Line marched forward. Like the price indexes, breadth recouped last week’s losses to close at its former election week closing high. Meanwhile, the number of stocks in the Russell 3000 making 52-week highs continues to steadily rise. In this way, our internal data may be suggesting liquidity could be fleeing the mega caps in favor of broader markets.

Conclusion:

As we approach these chapters within the market narrative, we find ourselves in a situation not unlike the dwindling cast of Christie’s “And Then There Were None.” The market’s surface appears calm, with rallies and recoveries painting a picture of stability. However, like the characters on Soldier Island, we must remain vigilant of potential dangers lurking beneath.

The divergence between our leading indicators and the market rally serves as our own “Ten Little Soldier Boys”. As liquidity potentially shifts from these mega caps to the broader markets, we’re reminded of the novel’s theme of justice and retribution. Will the market’s Nephilim face their comeuppance as the broader troops rise to prominence or shall another narrative prevail?

In this financial thriller, we must keep our wits about us, for like the novel’s characters, we don’t know who – or in this case, which sector or stock – will be the next to rise or fall. As we navigate these ever-treacherous financial waters, we must remember that in the market, as in Christie’s masterpiece, appearances may be deceiving as only the astute observers survive to thrive in the final market revelation.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 11/25/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.