Volume Analysis Flash Update: Battle Report– 10.21.24

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Volume Analysis Flash Update: Battle Report

Troops Lead the Charge

Led by the valiant troops, iShares Russell 2000 ETF (IWM), our market forces continued their broad advance this week, bolstered by reinforced supply lines (stronger volume and breadth). All major equity divisions reported gains, with the troops spearheading the offensive, up 1.96%. The brass commanders, Invesco S&P Equal Weight ETF (RSP), gained 1.07%, followed closely behind by their big brother, the SPDR S&P 500 ETF (SPY), advancing 0.90%. The mighty generals, Invesco QQQ Trust (QQQ), squeaked out a modest victory, up 0.25%. This coordinated assault resulted in both brass forces (S&P 500 and S&P 500 equal weight) achieving intraweek all-time highs.

Supply Lines Fortified

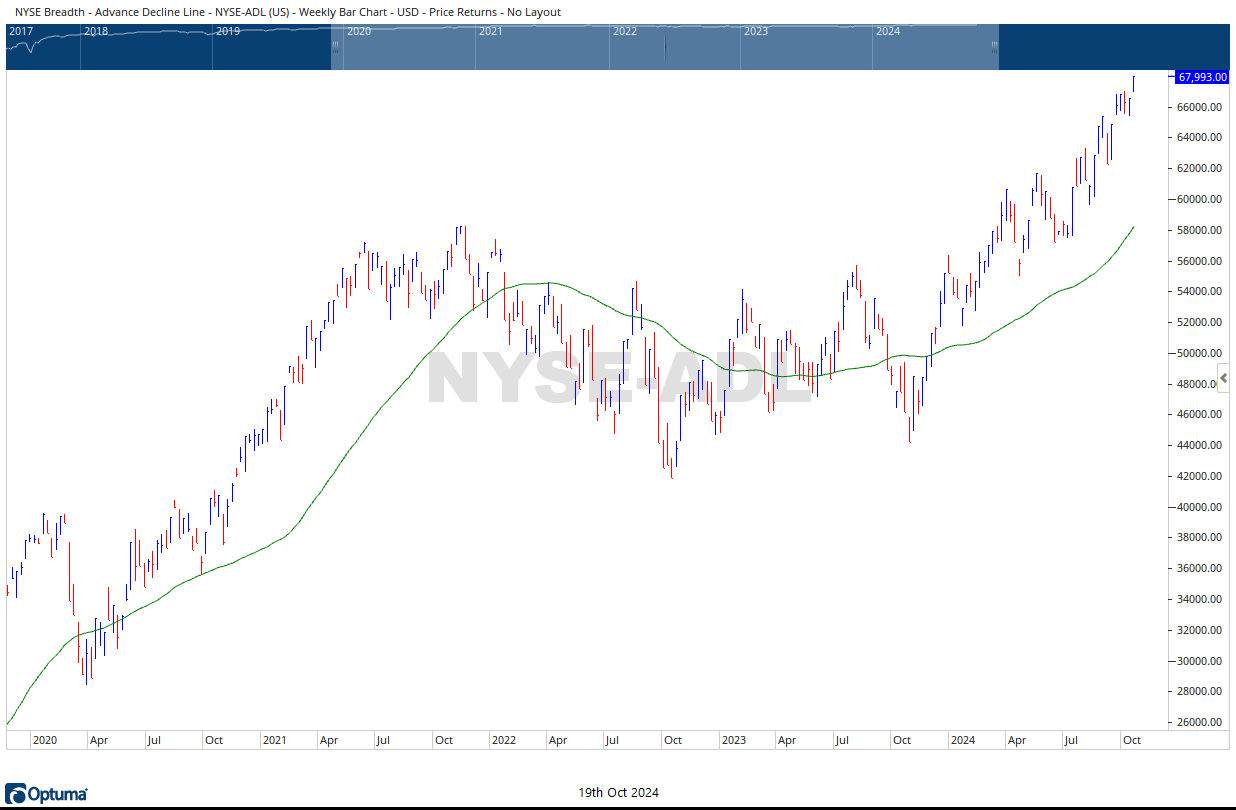

Our previous concerns regarding our supply lines being inefficiently fueled relative to the bullish advance are slowly being alleviated. Capital reinforcements accelerated significantly this past week, with the S&P 500 receiving a substantial infusion of $16 billion, more than doubling the $7 billion in capital outflows. The trend of Capital Weighted Dollar Volume has reached but not breached its former zenith, with Capital Weighted Volume in close pursuit. Meanwhile, our troops (225.65) are once again testing their July resistance stronghold @ 228. Market breadth reconnaissance reports that the NYSE Advance-Decline Line has once again broken through enemy lines, establishing new all-time highs. Although our troops and internal forces still trail the S&P 500’s vanguard, they appear to be providing crucial confirmation of our market’s direction.

This coordinated advance across all divisions, supported by strengthened supply lines and improved battlefield intelligence, creates a robust tactical position. While we remain vigilant, this favorable terrain suggests that any temporary retreats may present opportunities for strategic reinforcement.

As we conclude this week’s battle report, our forces stand in a position of strength. The synchronized advance across all divisions, bolstered by improved supply lines and positive internal indicators, paints a picture of a well-coordinated and potentially sustainable offensive. While we must remain alert to potential counterattacks in this overstretched field, the current battlefield conditions suggest that our bullish posture remains sound. Troops should be prepared to capitalize on possible tactical retreats, viewing them as possible opportunities to fortify their positions for the continued campaign ahead.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 10/21/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.