Volume Analysis ‘Flash Market Update’ – 10.7.24

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Volume Analysis Flash Update

In the theater of financial warfare, this week’s campaign was marked by a lull in both price and volume. The battlefield, despite the curious clamor of headlines, remained surprisingly dull from a volume analysis perspective.

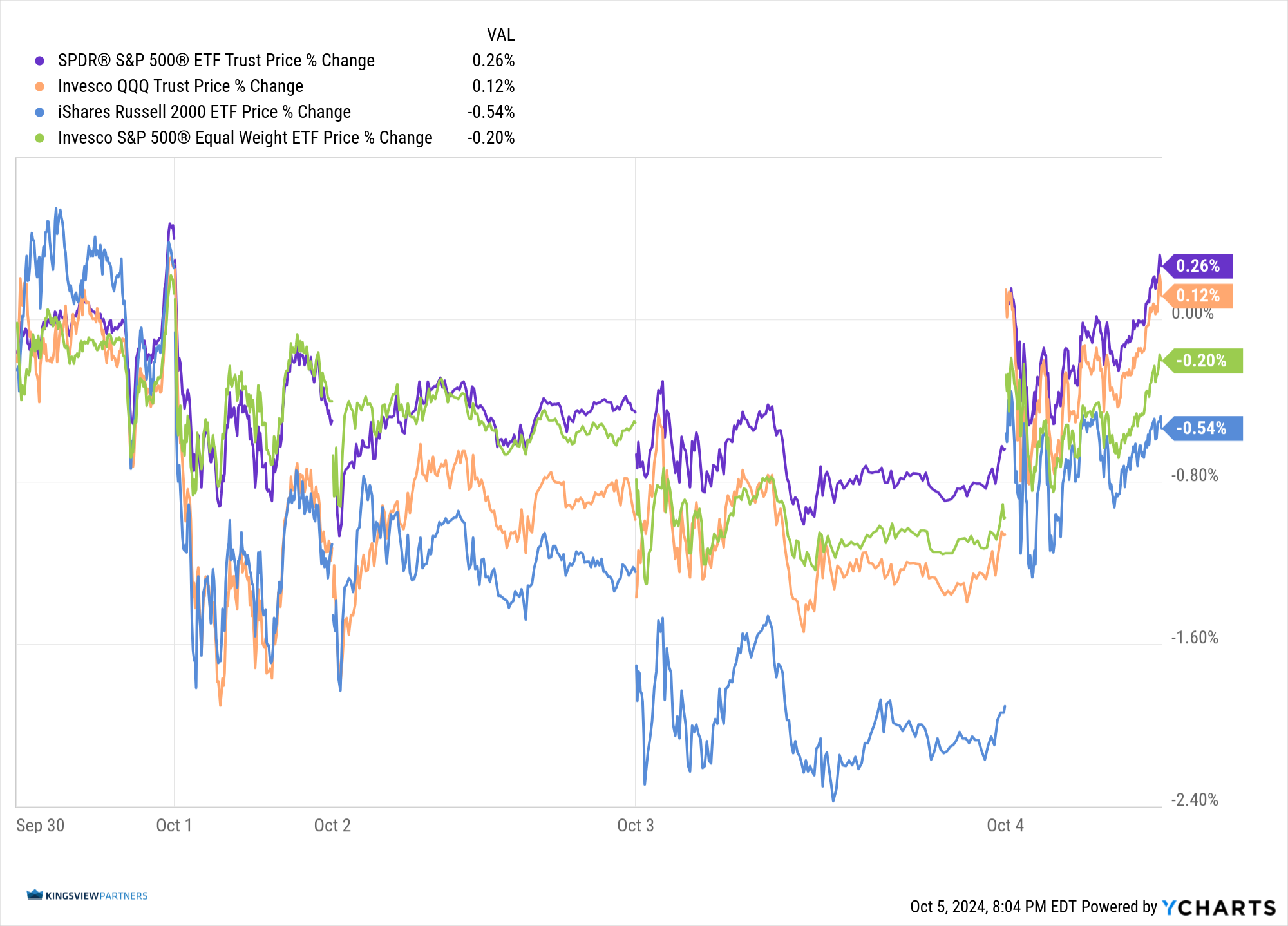

The generals, represented by the Invesco QQQ Trust (QQQ), seized command with a narrow victory, advancing a mere 0.12%. Their influence weighed on the capital-weighted SPDR S&P 500 ETF (SPY) to lead the charge, gaining 0.26%. However, the equal-weight counterpart, Invesco S&P 500 Equal Weight ETF (RSP), retreated, finishing down -0.20% for the week.

On the frontlines, the troops, iShares Russell 2000 ETF (IWM), faced another challenging week, struggling to hold their ground for the second consecutive weekly engagement. Even the resilient NYSE Advance-Decline line, a beacon of strength in recent battles, succeeded some ground. These tactical shifts suggest a temporary and minor reversal in the ongoing broadening campaign, as market forces regrouped and reassessed their strategies.

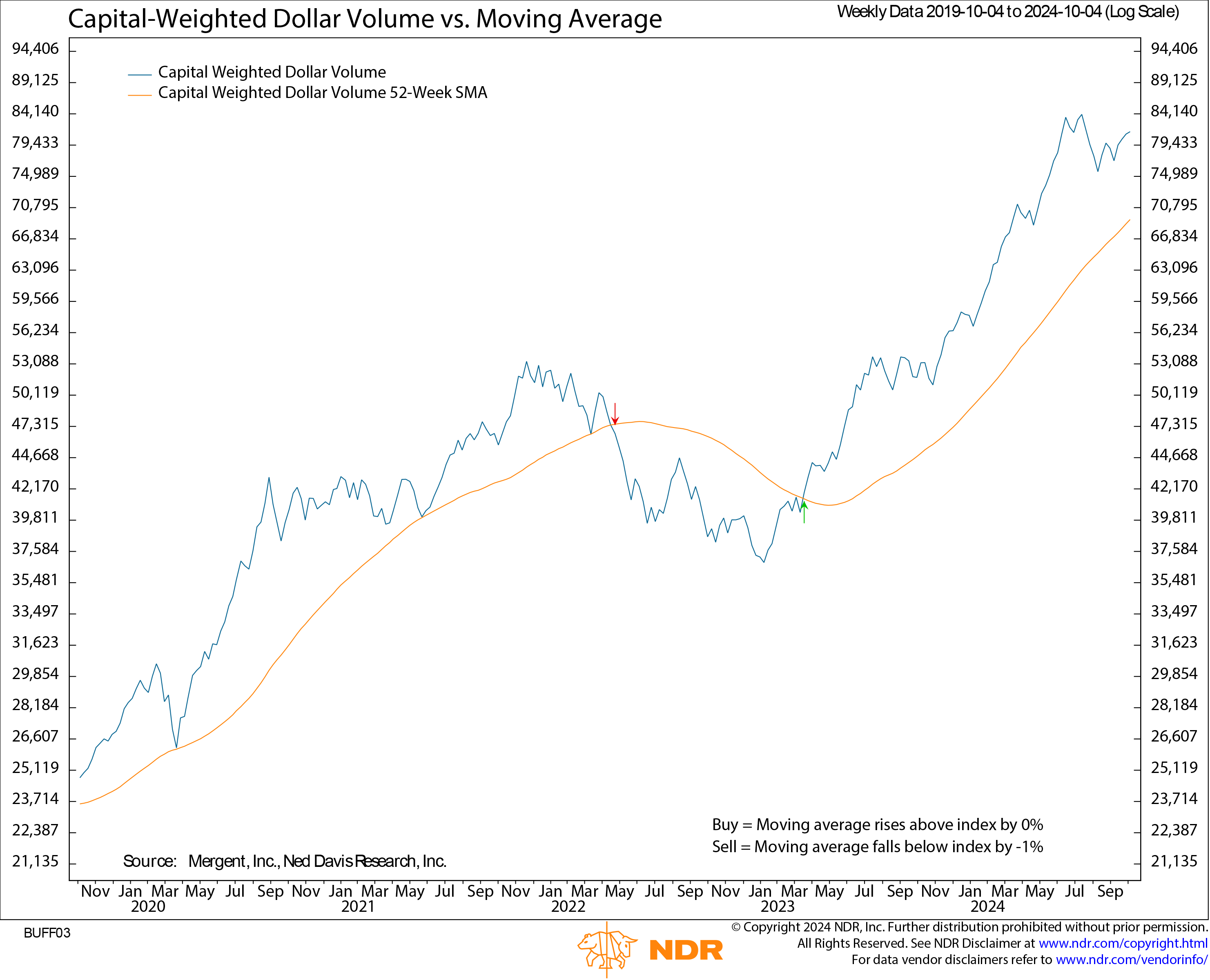

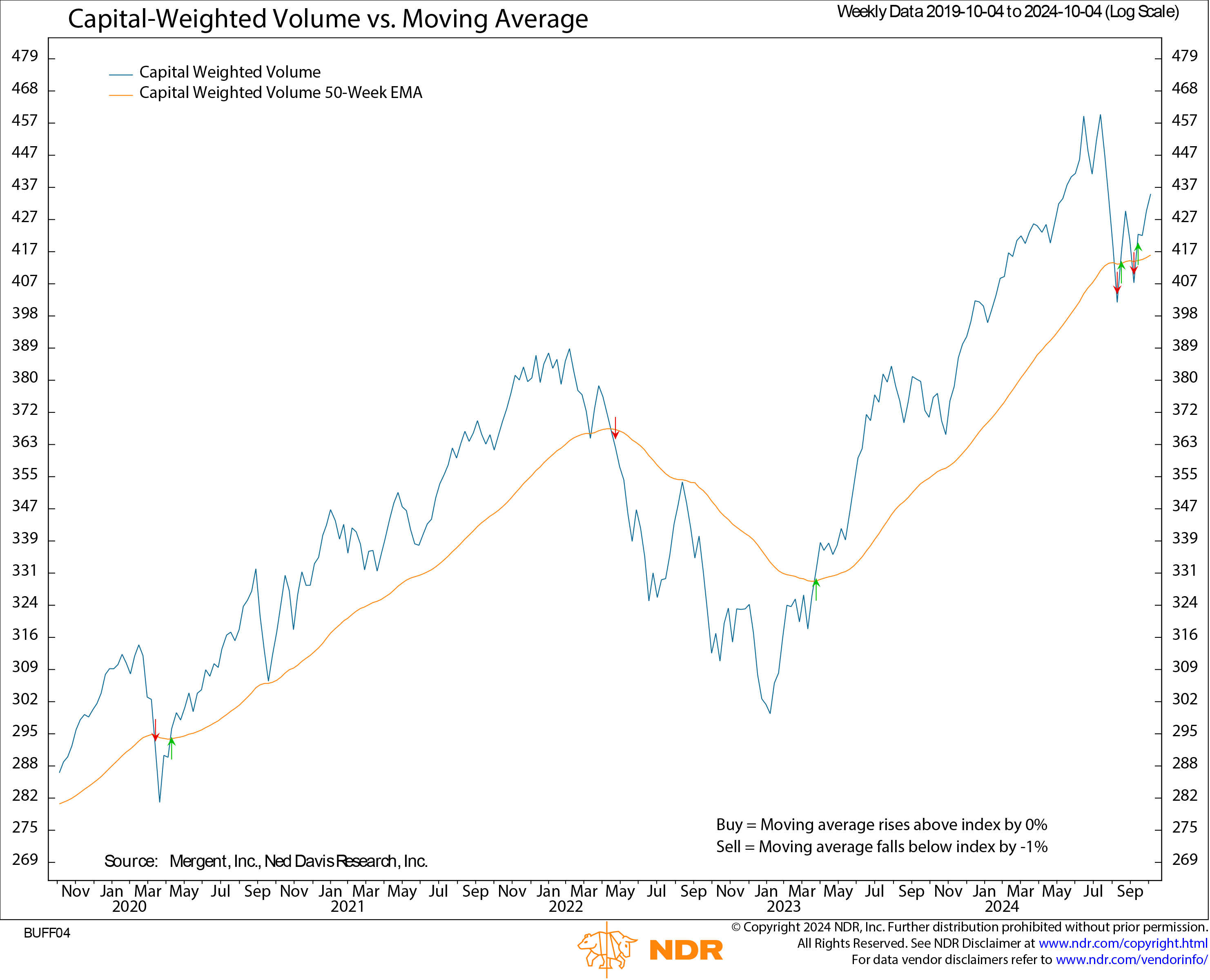

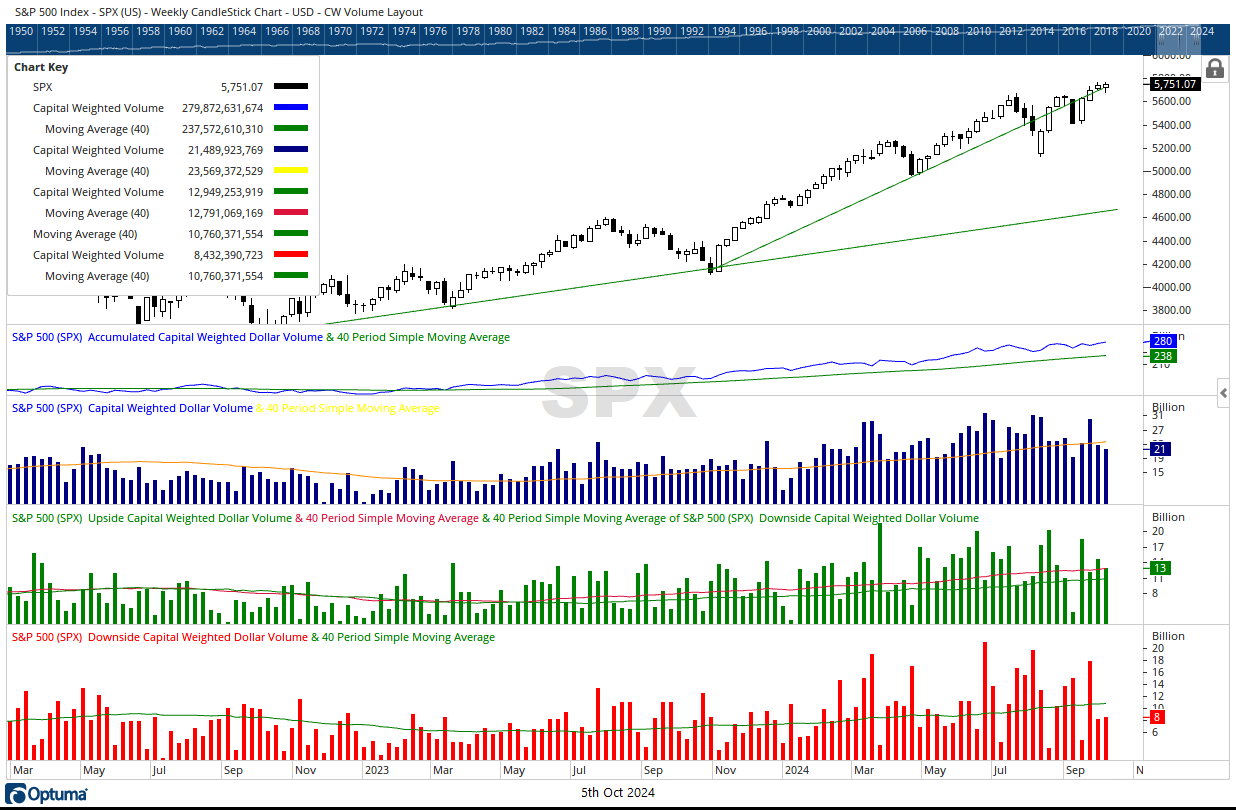

The supply lines of capital remained relatively quiet, with modest reinforcements of only $13 billion in inflows outpacing the $8.4 billion in outflows. Capital-Weighted Volume, while still trailing behind price and well below its historic peaks, continued its recent upward march, suggesting a relatively weak but gradual build-up of forces.

As we approach the pivotal election day, it’s crucial to note that our key indicators – the S&P 500’s price trend, S&P 500 Capital Weighted Volume, S&P Capital Weighted Dollar, and the NYSE Advance-Decline Line – all maintain their upward trajectories. These battle-hardened metrics suggest that despite the week’s lull, the overall campaign remains on an advancing front. This period of relative calm may well be the calm before the storm. As we venture deeper into election territory, market participants should remain vigilant, ready to adapt to rapidly changing conditions on this ever-evolving financial battlefield.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 10/7/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.