Volume Analysis ‘Flash Market Update’ – 9.30.24

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Volume Analysis Flash Update

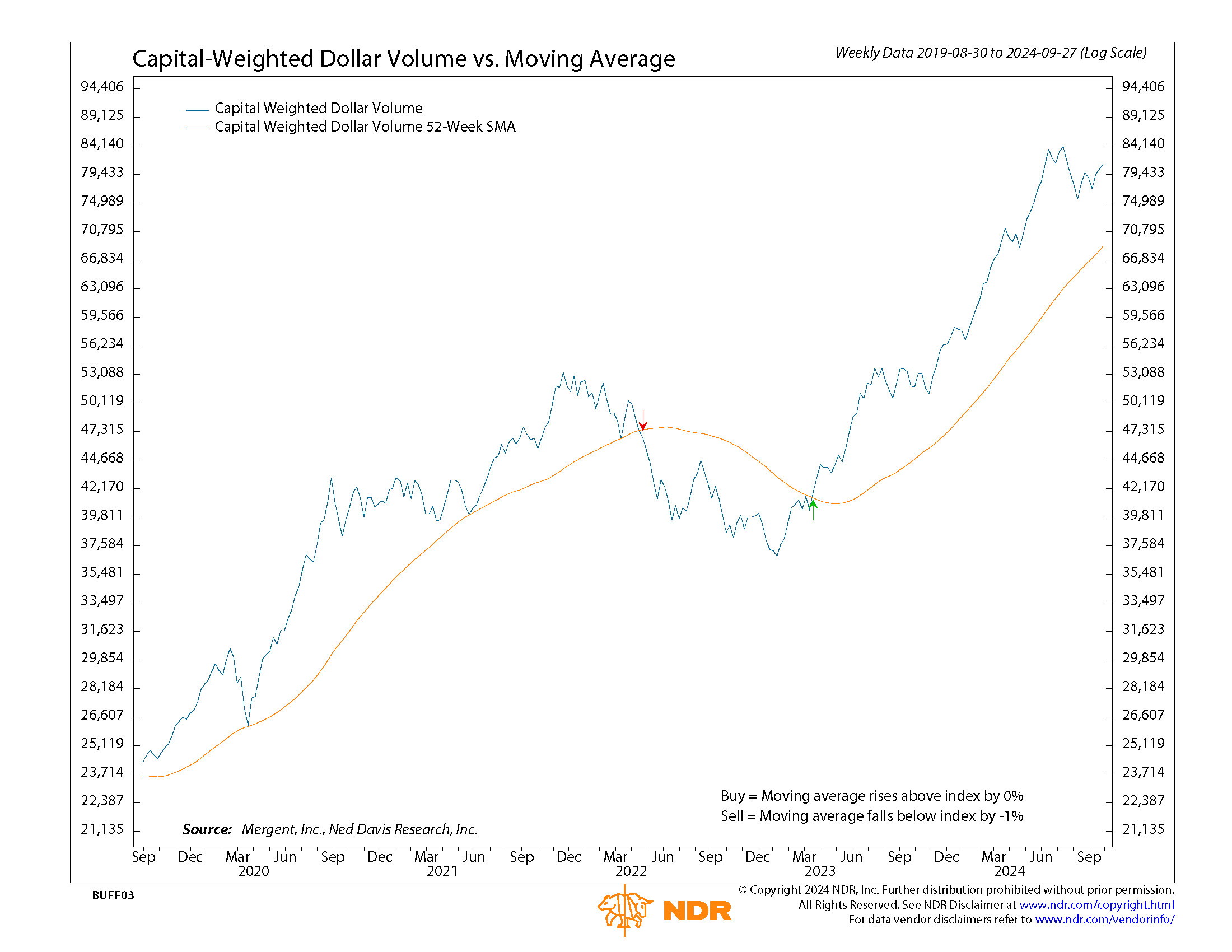

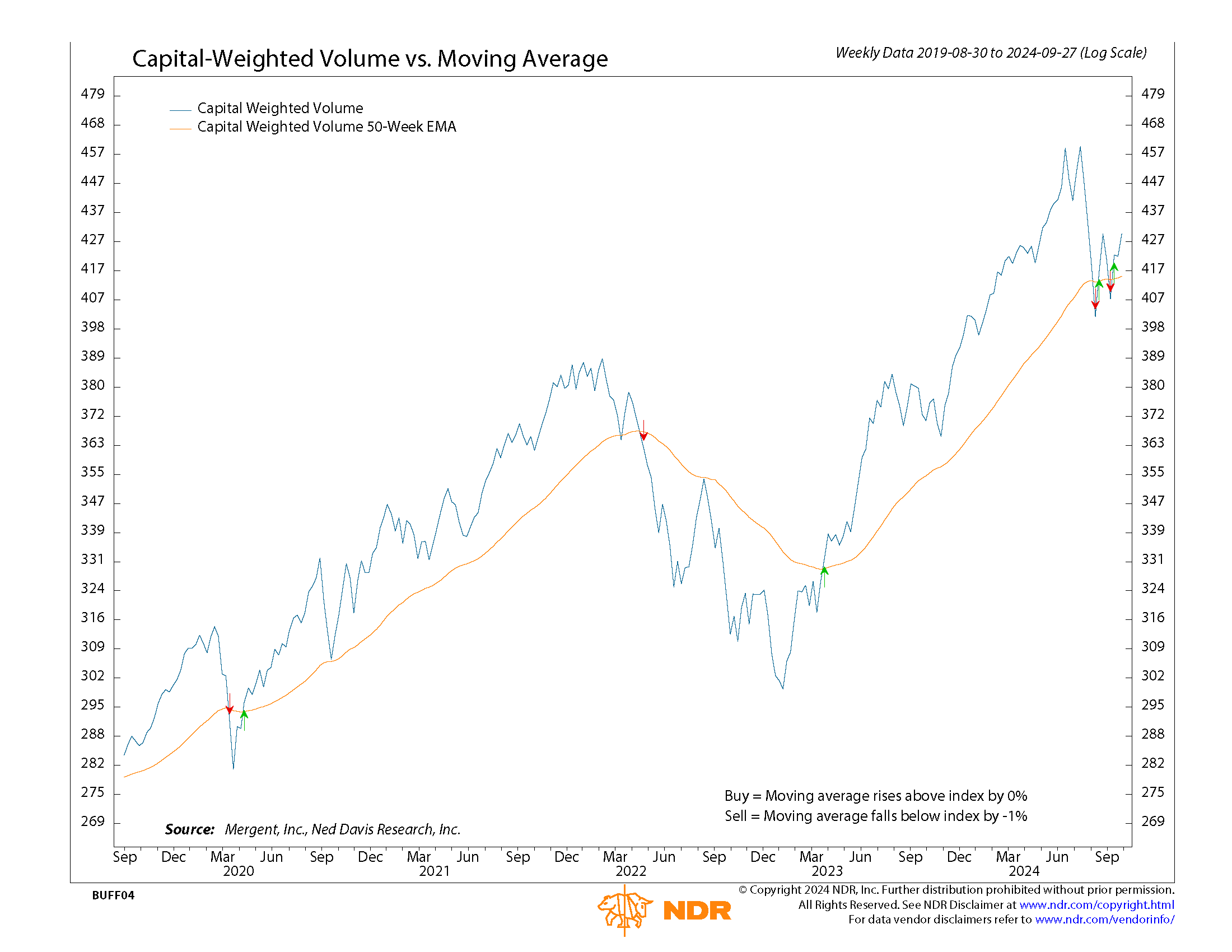

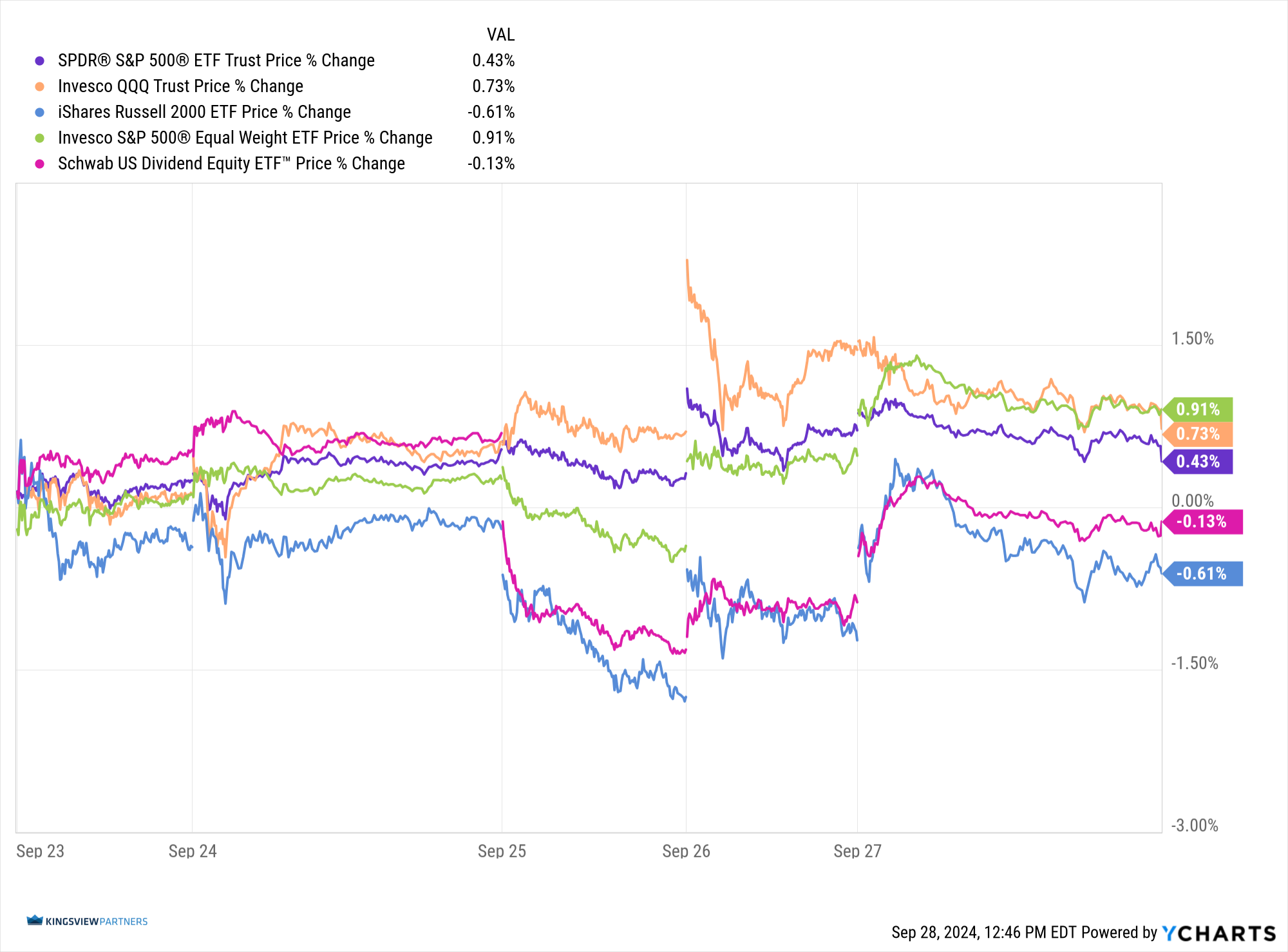

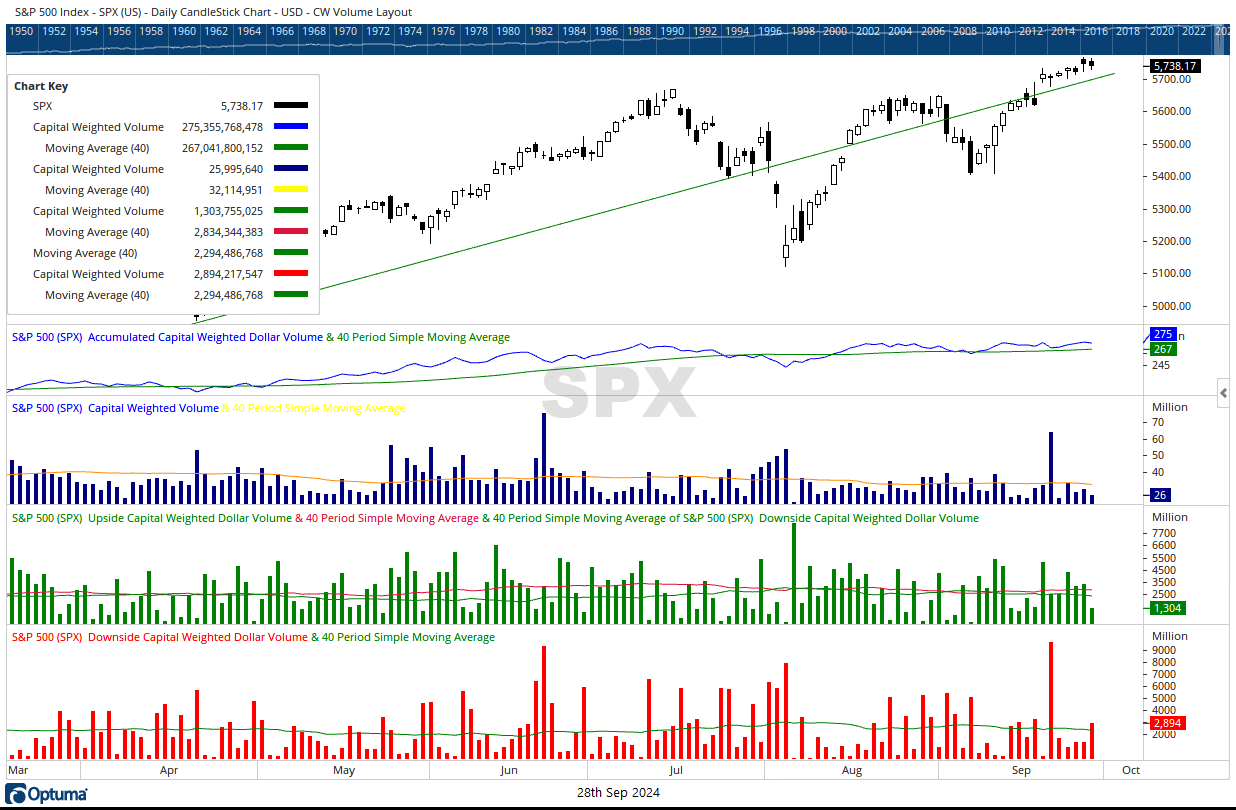

In the latest skirmish on the financial battlefield, the S&P 500 advanced to new strategic heights, though its supply lines seemed stretched thin with below-average volume and capital flows. The assault was led by a mixed battalion of market forces. The vanguard, represented by the Invesco S&P 500 Equal Weight ETF (RSP), spearheaded the charge with a 0.91% gain. Hot on their heels, the generals of the Invesco QQQ Trust (QQQ) pushed forward 0.73%, while the SPDR S&P 500 ETF Trust (SPY) secured a 0.43% advance.

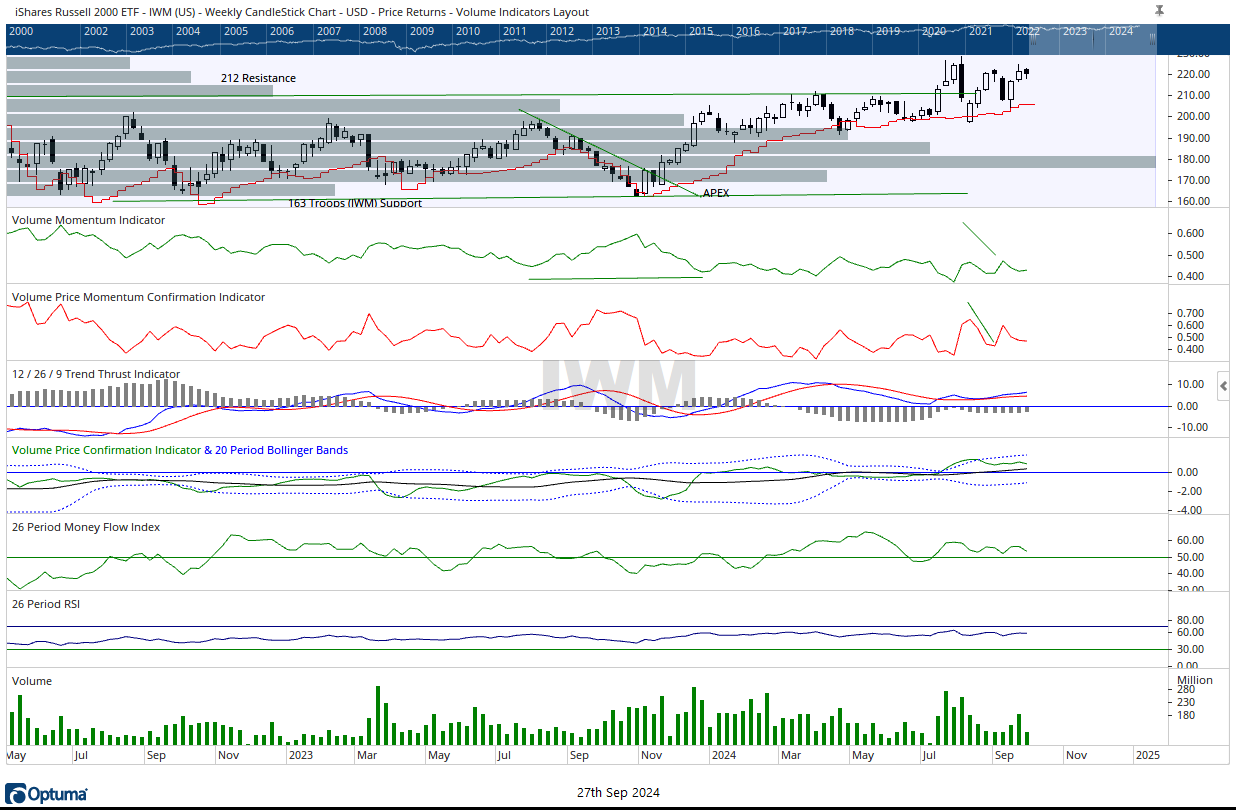

However, not all units emerged victorious from the fray. The foot soldiers (troops) of the iShares Russell 2000 ETF (IWM) suffered a tactical retreat of -0.61%, while the Schwab US Dividend Equity ETF’s (SCHD) defensive position was breached by a marginal -0.13%. In the logistics of this financial warfare, reinforcements arrived in the form of $14.5 billion in inflows, outpacing the $8.1 billion retreating from the field. As the dust settled on this week’s engagement, neither the bulls nor the bears could claim a decisive victory, leaving the battlefield in a tense stalemate. The campaign continues, with both sides regrouping and strategizing for the battles to come in this high-stakes financial war.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 9/30/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.