Volume Analysis ‘Flash Market Update’ – 8.5.24

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

This week, the S&P 500 continued to slide from its near 5670 high. Meanwhile, the generals have corrected -11.74% so far from July 10th’s 20,691 highs to August 2nd’s low of 18,263.

First of all, big thanks to all of you who have complimented us on our commentary since the birth of the bull market on September 30, 2022 to the recent “about face” and rotation we just experienced. Although I appreciate your encouraging words, I am not actually making forecasts. Rather, this commentary is designed to inform you on what the market is communicating to us through data. If you have the correct data sets such as Capital Weighted Volume, it has been plain to see the recent changes occurring under the surface. I am simply sharing with you what I see happening, not necessarily forecasting what may happen. So first, let’s take a step back and look at some highlights over the past few quarters which triggered our “And Then There Were None” series to get a better understanding of what is happening now.

Review:

March 10, 2024 Prelude “Doji you know?”

“Doji” notice the signs provided by the stock market this week? When a market breaks out of its upper and lower range only to close approximately at the same level where it began, it is referred to as a “Doji cross or star” in Japanese candlestick analysis. Both the S&P 500 and the troops formed Doji stars on their weekly charts last week.

Doji stars are not necessarily bullish or bearish. Rather, the expectation from a doji star is a pause in the prevailing trend. Dojis may indicate parity building between the forces of supply (bears) and demand (bulls). Because the S&P 500 is in an upward trend, it’s Doji star may suggest a breather is needed before resuming its upward trajectory. Unlike the upward-trending S&P 500, the troops have been stuck in a sideways consolidation pattern.

June 24, 2024 Intro

My previous experiences observing such remarkably high downside Capital Weighted Volume corresponding with subdued prices could possibly be viewed as an omen of change. For example, similar immense downside Capital Weighted Volume behavior accompanied by only modest price change occurred just a few weeks prior to the Flash Crash.

Although the Nephilim enjoy their day in the sun; now they are led by just one. The mega caps are consuming the vast majority of the S&P 500’s capital inflows, leaving the rest of the S&P 500 index members fighting for table scraps. Of these titans, Nvidia (NVDA) has emerged as the new mega cap leader. However, leading into this week’s decline, NVDA’s VPCI (Volume Price Confirmation Indicator) and VPMCI (Volume Price Momentum Confirmation Indicator) both recently gave indications of volume price contradiction. Additionally, Thursday NVDA experienced a bearish engulfing pattern in its price chart. This Japanese candle is thought to signify exhaustion that may precede possible price reversals or a pause in the bullish trend.

06302024 Part II :

Under the surface, last week the broad markets appeared dull and lifeless. Nevertheless, internally strong forces were once again lively at work.

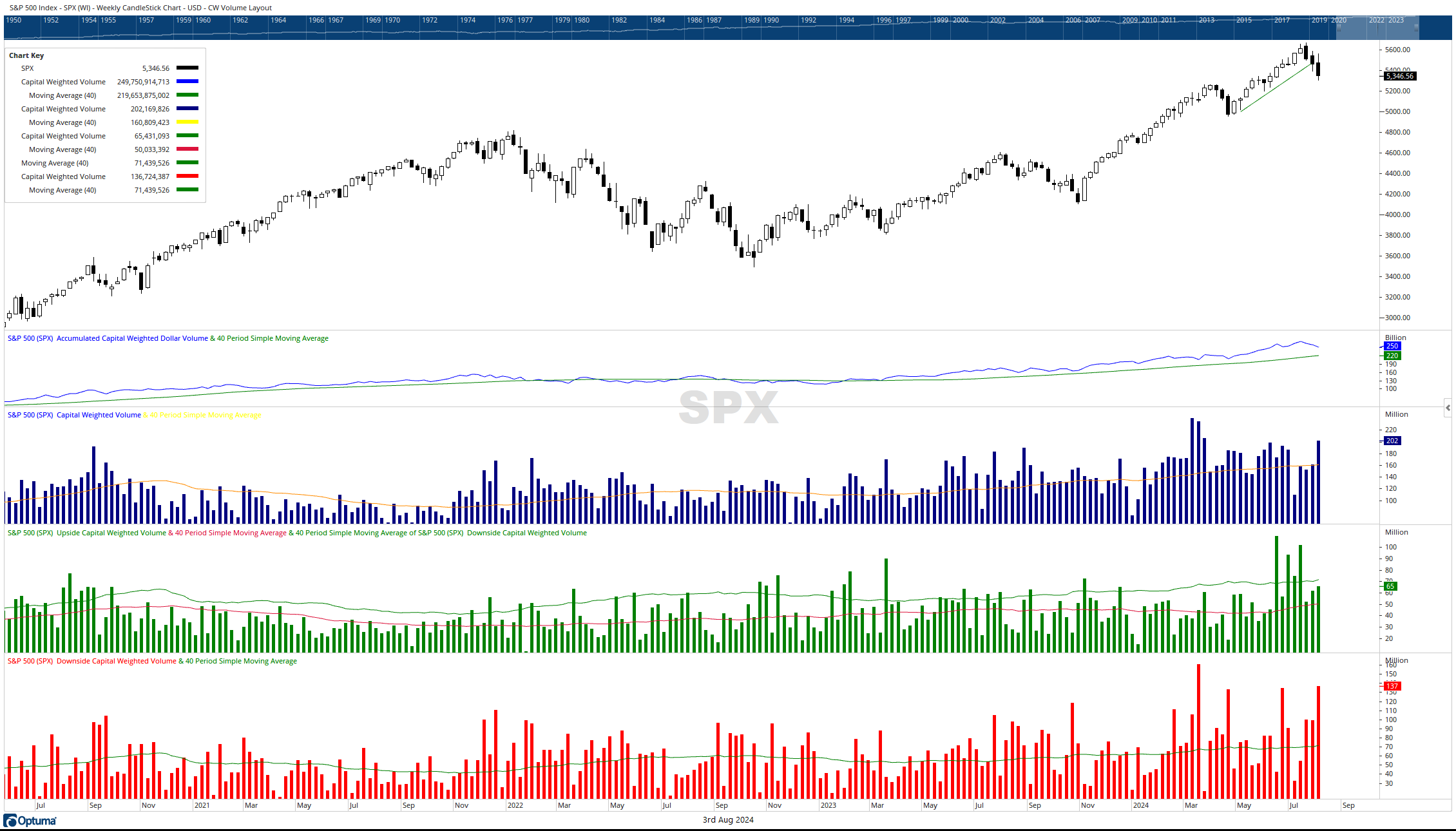

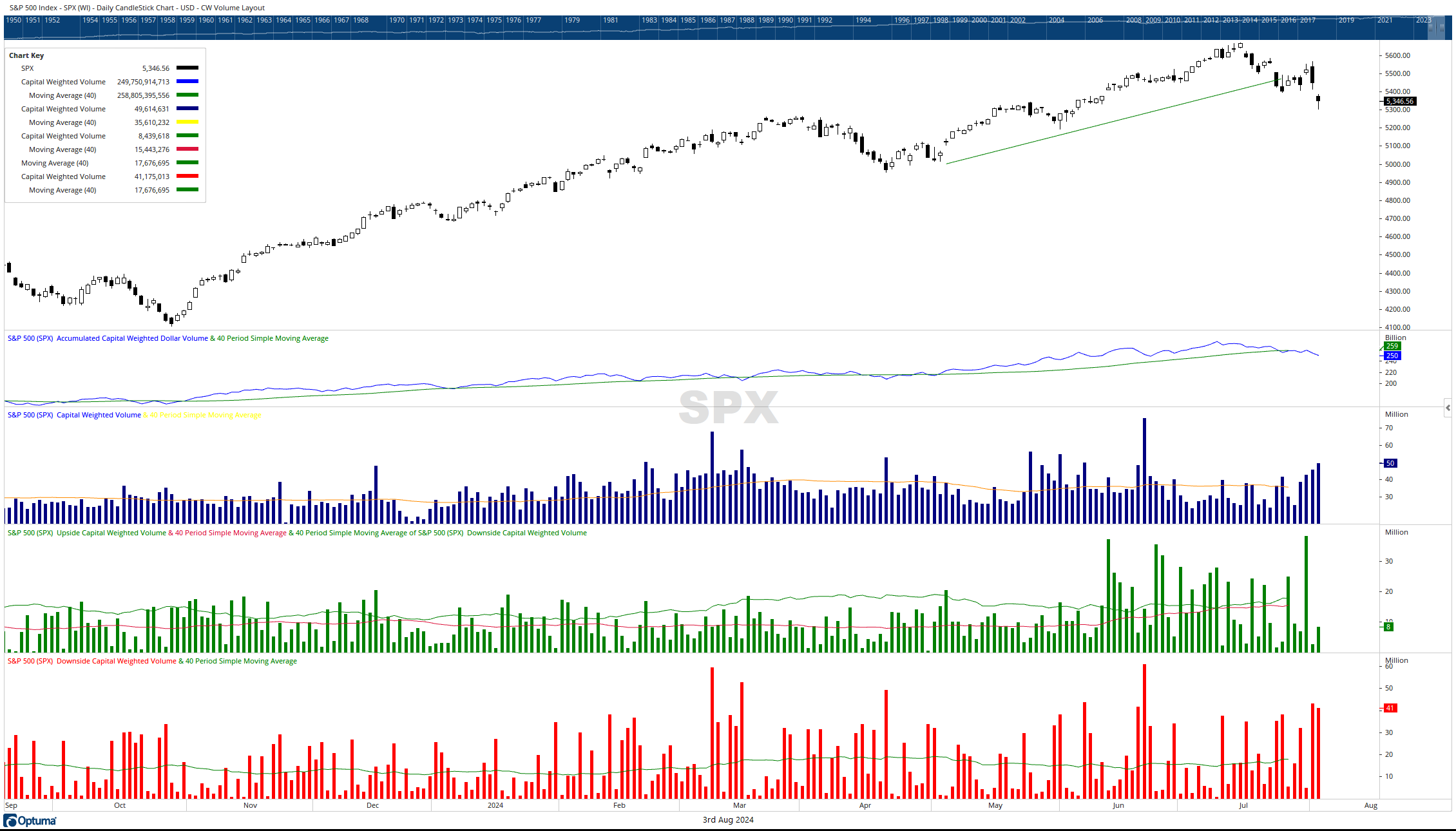

Two weeks ago, we witnessed the highest capital-weighted volume in the S&P 500 since the pandemic bottom. Although the S&P was up for the week, 70% of the volume was to the downside. This past week, capital flows were once again extraordinarily high, just slightly below the previous week’s massive surge. A similar phenomenon occurred three weeks before the flash crash: massive downside volume on muted price changes. So what does this high downside volume and muted price change infer? Imagine you are a very large institution that desires to quickly de-risk or rotate allocations. It would be difficult to scale down your mid and small caps without forcing down the prices from your operations. So instead, you might consider selling your most liquid stocks, the mega caps. These just happen to be your best performers, as the cap-heavy S&P 500 is beating the equal-weight S&P 500 14.48% to 4.96% year-to-date. The biggest contributor to the S&P 500’s outperformance is Nvidia, currently the third-largest component, up 149.50% year-to-date. With this in mind, let’s zero in on Nvidia as a case study.

Observing NVDA’s weekly chart, Nvidia’s run was built on a huge base between post-split $20 – $30 (200-300 pre-split). Notice the huge gray bar running through the bottom of NVDA’s chart. This is volume at price, indicating how many shares were exchanged between these price levels. The length of this bar is massive and overwhelming, providing the fuel to launch NVDA into orbit. On May 22nd, NVDA broke out of a consolidation pattern at $100. This breakout corresponds to the split announcement. Notice, though, that although the price moved up rapidly from $100 to $140, the volume kept falling. This is important because volume is the fuel of the market. As an analogy, pilots, to get their plane to fly higher, must aim the trajectory higher. But if the pilot fails to also provide fuel, the plane will stall. Capital is the fuel of the markets. Here, NVDA was flying higher but with less fuel. This apparent weak demand in NVDA is evident by the drop in the Volume Price Confirmation Indicator, which calculates the asymmetry between the strength of the price trend and its corresponding volume.

Falling volume corresponding with rising prices implies that institutional players may not have been heavily participating in this part of the run-up from 100 to 140. If there was institutional absence, NVDA’s price was presumably driven higher by fickle retail investors who tend to buy on greed and sell on fear. In this specific case, many retail investors may not as familiar with Nvidia’s operations as it is not a household name. But they are aware of the importance of AI, news of the 10:1 split, and NVDA’s rapid price appreciation, making NVDA temporarily the largest company in the world. The intrigue may have sucked them in. Meanwhile, institutions whose position sizes had become overly extended due to the run-up were plausible sellers.

So what’s next? NVDA still has a huge base. It has support between $116 and $110. If $110 breaks, there is very significant support at $100. This is evident by the large extended volume at the $100 price bar. It is possible that the news of NVDA’s recent correction will draw in more retail investors who saw NVDA soar from $100 to $140 but missed out. These investors may see this pullback as their second chance, supporting the price around these levels. If NVDA’s volume is high during a rebound, then that indicates that institutions may be on board with the trade too. In this scenario, NVDA could have the fuel needed to make another run to new highs. However, if the rebound rally quickly fails or occurs on light volume, then the stock may possibly test support at $115, $110, and even $100.

And now back to the present: August 5, 2024

The most significant Nephilim making up our generals is, of course, NVDA. Nvidia reached a recent low last week of $101.37, very close to our $100 support target. Meanwhile, the NDX 100 index is nearing intermediate support around 18000 and major support at 17625. Meanwhile, the S&P 500 is not too far away from its intermediate support at 5250. Additionally, Capital Weighted Volume is also within 1% of its uptrend. The rapid drop in Capital Weighted Volume has been sensational. So, what could be the underlying cause? Significant tech companies reported earnings last week and largely disappointed elevated expectations. However, it could perhaps be something more foreign. The dollar-yen carry trade hit a 38-year high a month ago. The generals have been following this trade seemingly step by step. Now, this trade has sharply reversed with a strong one-two punch: a hawkish BOJ and rising fears of a US recession. Recession fears are emboldened by the triggering of the Sahm Rule, which signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months. Should the generals desire to remain in command, we are approaching an area where they need to regroup.

This past week was another active week for market participants. Tuesday witnessed $32 billion in outflows to only $6.7 billion in inflows for an 80% downside day. Wednesday reversed with $38.1 billion in inflows compared to just $4.7 billion in outflows, nearly completing a 90% upside day (89%). Then Thursday all that was lost and more with $43 billion in outflows to only $2.7 in inflows, a 96% downside day. The week closed out on Friday with another $41.2 billion moving out and $6.5 billion of inflows for another 80%+ Capital Outflow day.

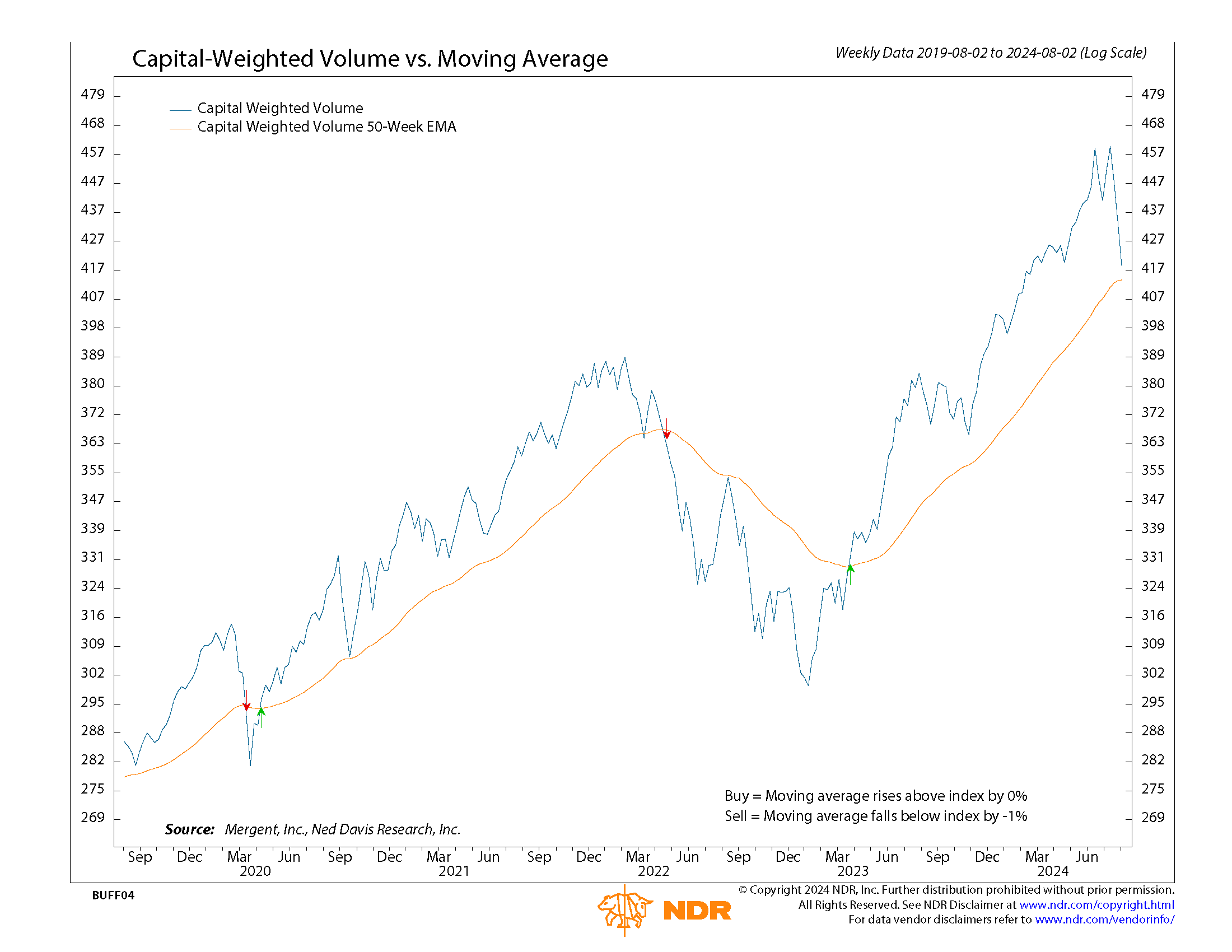

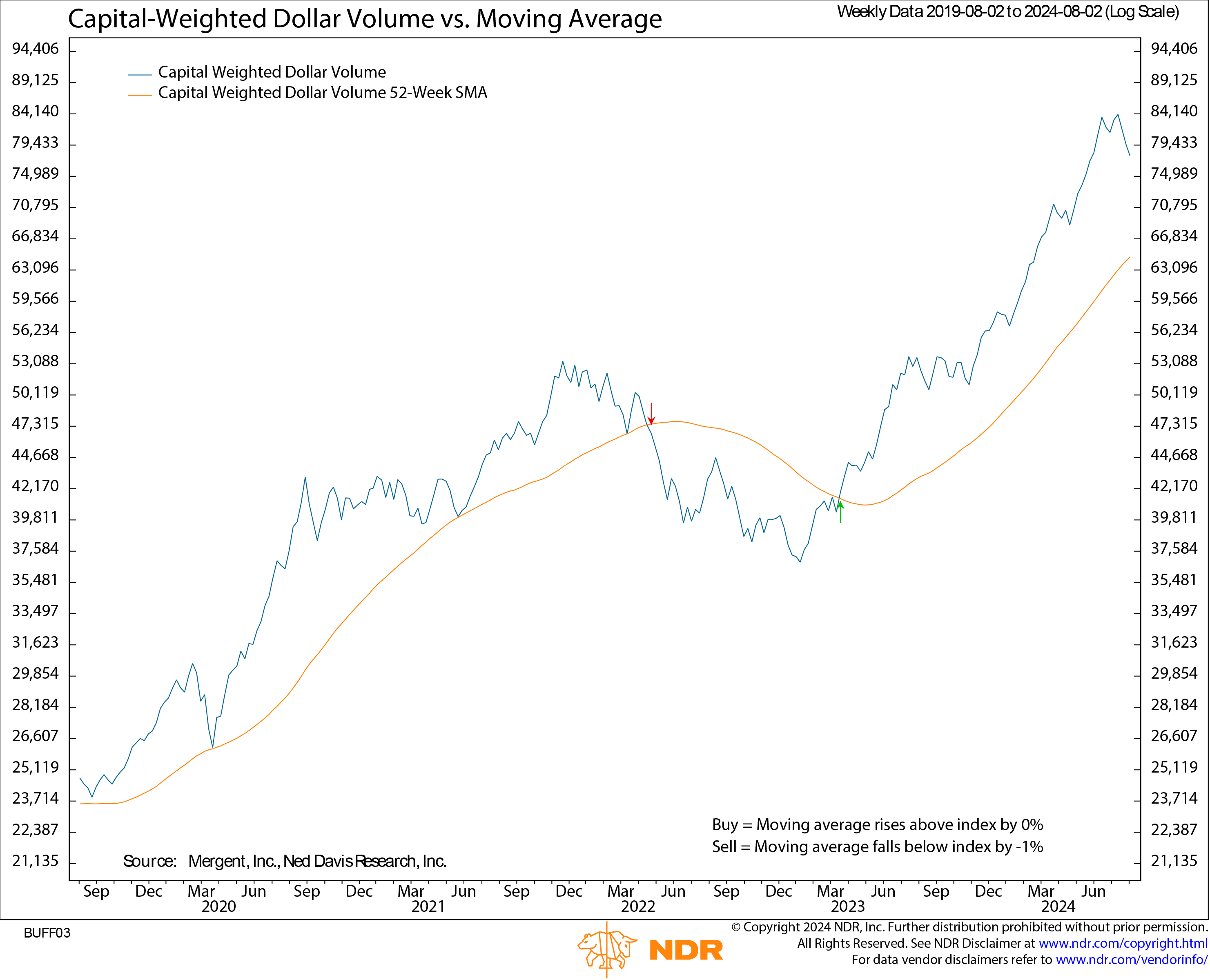

Meanwhile, the trend of Capital Weighted Volume dropped significantly over the week, placing itself very near its 50 Week Exponential Moving Average. Should this break, this Capital Weighted Volume trend signal is one of just three levers defining a Volume Analysis Bear Market. That stated our other levers, both Capital Weighted Dollar Volume and the Advance-Decline line, remain well above their uptrend lines.

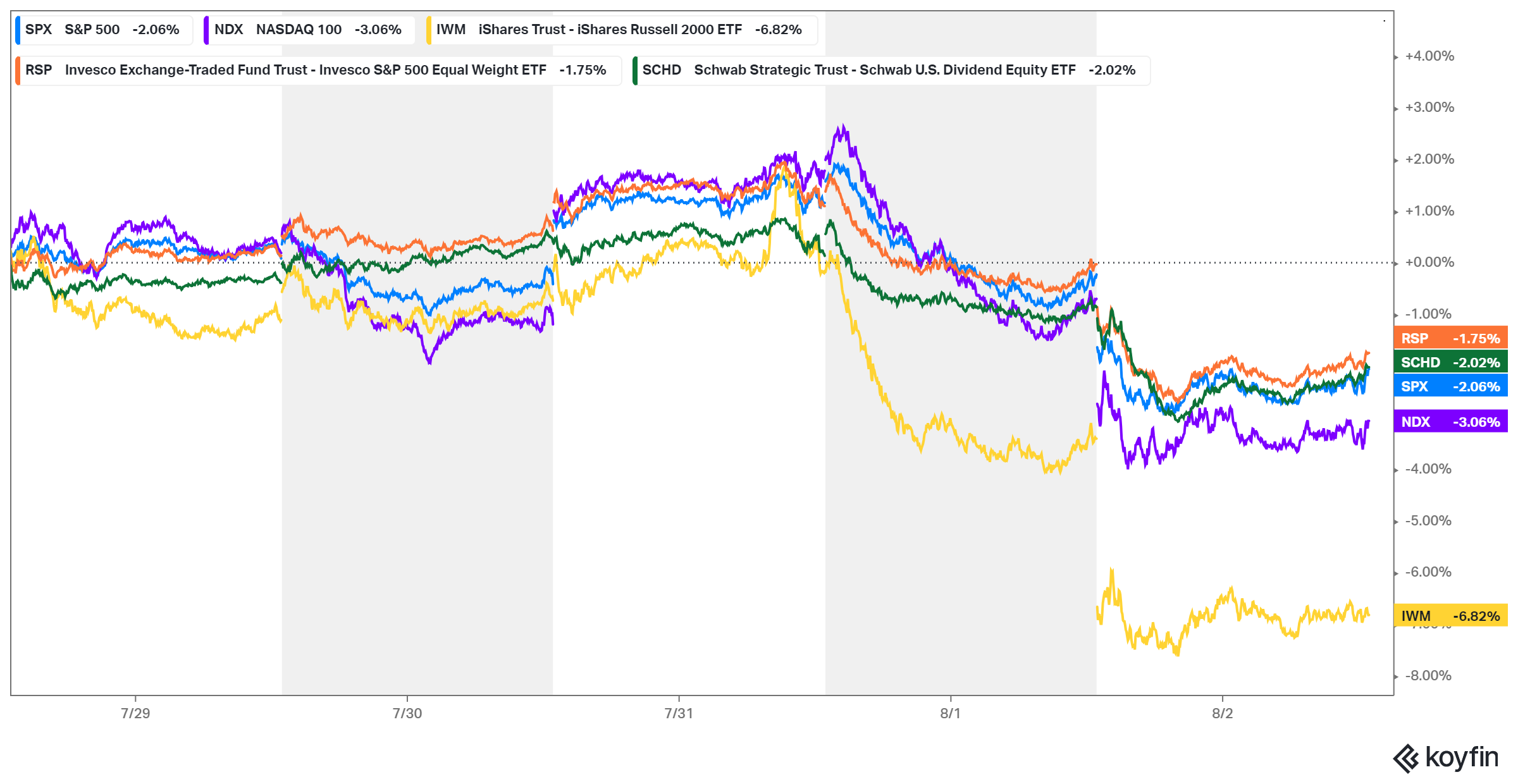

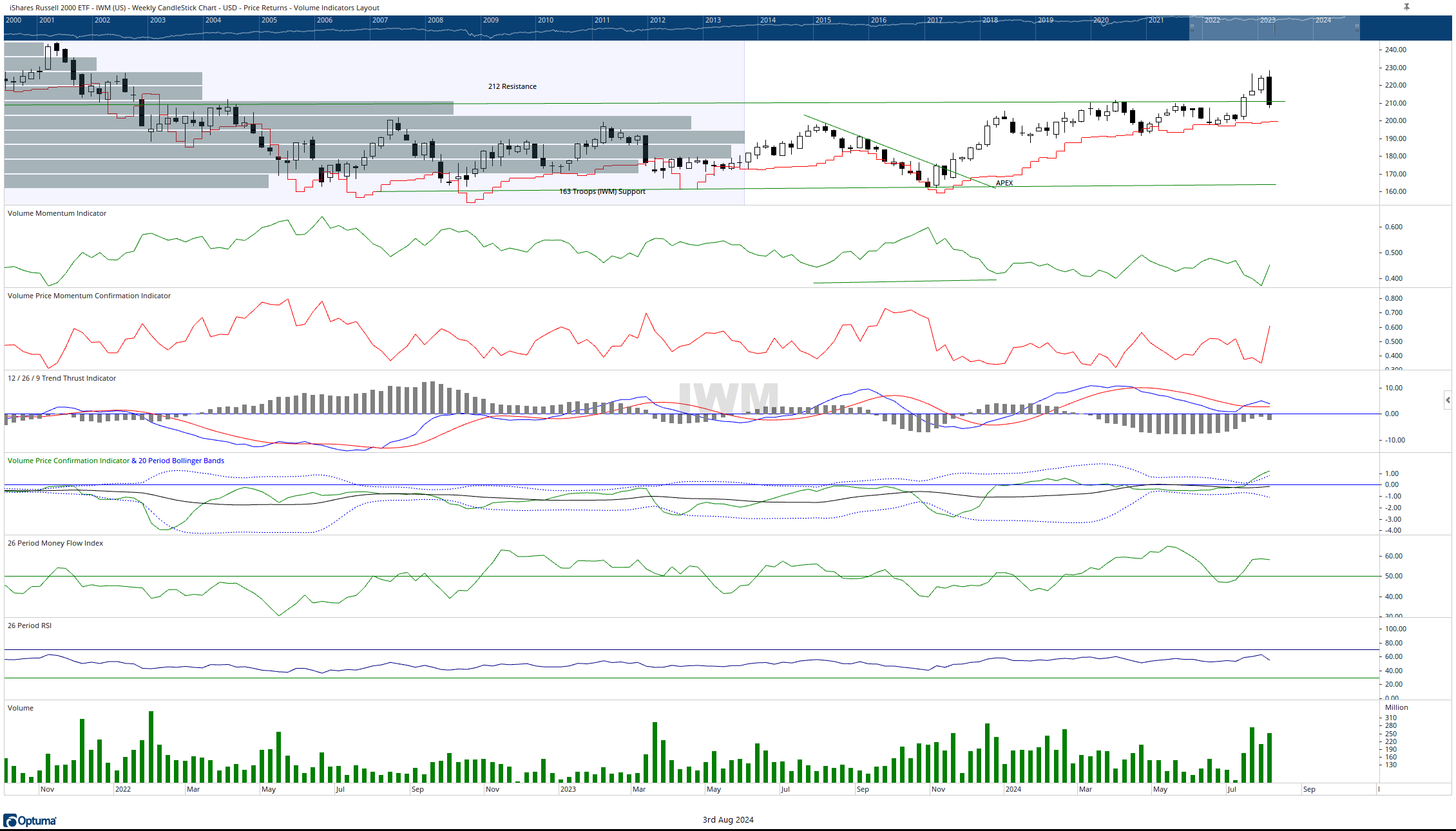

For the week, the S&P fell -2.06%, the generals (NDX 100) were down -3.06%, while the Invesco S&P 500 Equal Weight ETF (RSP) fell only -1.75%. Although the market continues its rotation, this week our troops (iShares Russell 2000 ETF, IWM) took a big step back, falling -6.82%, finishing the week underneath its former support. IWM now has resistance at 211 and intermediate support at 191, whereas the S&P 500 has resistance at 5460 and important support around 5250. The near-term action at these crucial levels could have significant implications on intermediate market trends.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 8/5/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.