Minute Market Update - Staying the Course - 8.5.24

Click here to download this commentary in PDF format.

The third quarter of 2024 has brought a sea change in market performance, as large-cap tech stocks have rotated out of vogue and fallen behind other sectors and smaller-cap stocks. Following the latest jobs report last Friday, global stocks experienced a sharp pullback due to concerns over the timing of Fed rate cuts, a weakening labor market, and disappointing tech earnings. A surprise rate hike from the Bank of Japan on Sunday night in the US during overnight futures sessions has further exasperated those concerns and pushed the markets even lower. Financial markets are on edge as investors adjust to a changing economic landscape. As of this writing, the Nasdaq is now in correction territory, defined as a 10% decline from recent highs. The S&P 500 has pulled back 8.8% from its July 16th all-time high, while the Dow has been less volatile with a decline of 6.5%. The VIX, the CBOE Volatility Index, often described as the market’s “fear gauge,” has surged to its highest level since early 2023. The 10-year Treasury yield has now fallen below 3.8%, a sharp decline from 4.7% only three months ago.

Despite the market action, current macroeconomic conditions – inflation steadily falling back to the Fed’s target of 2%, low but rising unemployment, falling interest rates, and double-digit stock market gains – are exactly what investors had hoped for at the start of the year. Now more than ever, investors need to maintain perspective to navigate the short-term turbulence and stay on track to achieve their financial goals.

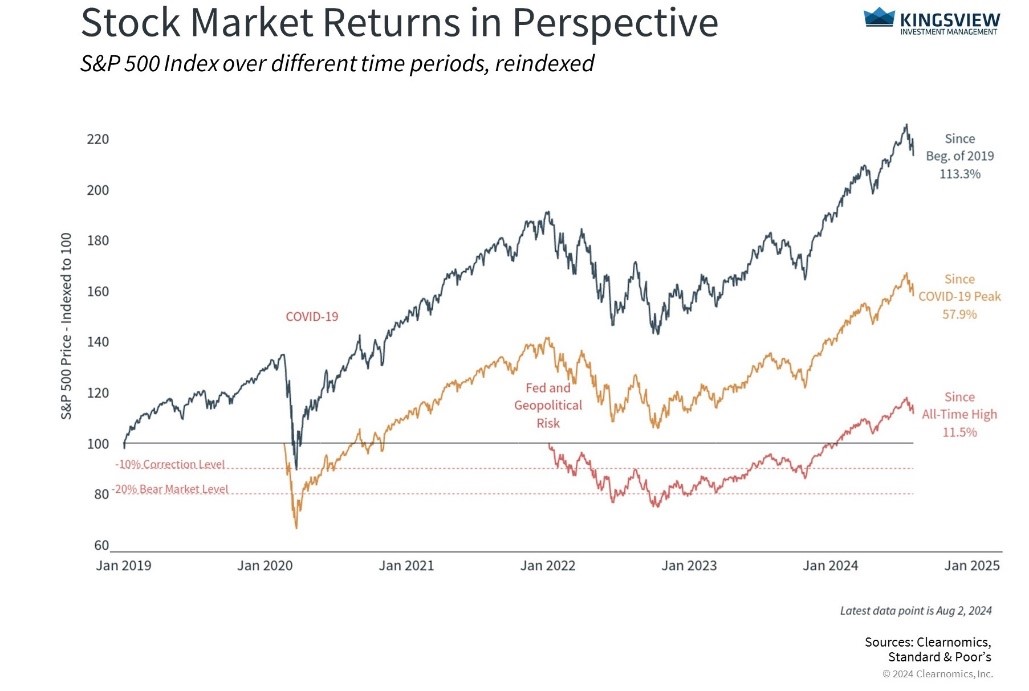

For many investors, the volatility in 2020 and the next two years may seem like a distant memory in lieu of the steady recovery coming out of 2022. As the above chart shows, the S&P 500 has gained 113% over the past five years, including the pandemic collapse and the 2022 bear market. While market pullbacks are not enjoyable in the moment, viewing the market on a longer time horizon puts the market performance into the perspective that investors must maintain.

Investors focused on recent performance alone will wonder if this bull market is over. As emotional beings, we tend to apply those emotions to investing, even if we should remain stoic and steadfast in our investment policies. While recent market events are still playing out, it is important to remember that stock market swings are normal, and can also be healthy to gain new steam and push higher.

The story of much of the last five years of market return has been the dominance and unrelenting price increase of mega-cap tech stocks. Specifically, the Magnificent Seven, a group of stocks including Nvidia has driven recent market action and is still up 115% YTD and has gained over 2,500% since early 2020 (Source: Ycharts). The rotation and now ullback in these stocks is the overdue result of investor concerns about the magnitude of the rally and large tech company earnings. The 2024 buzzword “AI” and large language models have delivered lofty promises for companies, and whether the technology can live up to the hype has yet to be seen, so it is not surprising that investors are becoming antsy to see a return on the billions invested by large companies.

Market fundamentals appear to remain strong regardless of the short-term move in stocks. Profit forecasts are still positive, with S&P 500 earnings expected to grow 13% over the next 12 months. More than half of the S&P 500 sectors are expected to grow earnings by double digits, and all 11 sectors are forecasted to experience growth. In the long run, a stock’s value projects forward earnings, and thus the economy’s health matters more than short-term stock and sector-specific trading activity.

It is important to remember how fickle market expectations have been. The year began with investors believing the Fed would need to cut rates several times due to an imminent recession. Expectations then shifted after a few hotter-than-expected inflation reports, which swung investors to believe that the Fed would not cut at all this year. Today, the markets are pricing in one rate cut in September and possibly at each subsequent meeting. These swings show how difficult it is to predict monetary policy, especially as backseat drivers.

These dynamics have shifted the Fed’s focus to the labor market, with the Fed acknowledging that it is “attentive to the risks to both sides of its dual mandate”, being inflation and employment. The latest jobs report from last Friday fanned the flames of recessionary signals, showing that the economy added 114,000 new jobs in July, lower than the consensus estimate of 175,000 (Source: Ycharts). Unemployment, which was expected to remain at 4.1%, rose to 4.3%. While this is still relatively low compared to history, it is the highest rate of unemployment we’ve seen since the pandemic. Both sides of the Fed’s mandate now point strongly to a September rate cut.

There have been several historical instances that could be called “soft landings.” Perhaps the most notable occurred from 1994 to 1995 under Fed chair Alan Greenspan when the Fed doubled the federal funds rate from 3% to 6%. Inflation remained under control, and the economy continued to grow, avoiding a recession. This was a difficult time for investors as it resulted in the worst bear market for bonds up to that point. However, the outcome was positive in the long run since it set up the conditions for stocks and bonds to restart their long bull runs.

While the market is very confident in a rate cut happening in September, the Fed will continue monitoring economic data and as they have been notably reactive since their rate hike campaign began in 2022, it is challenging to predict the course that they will chart.

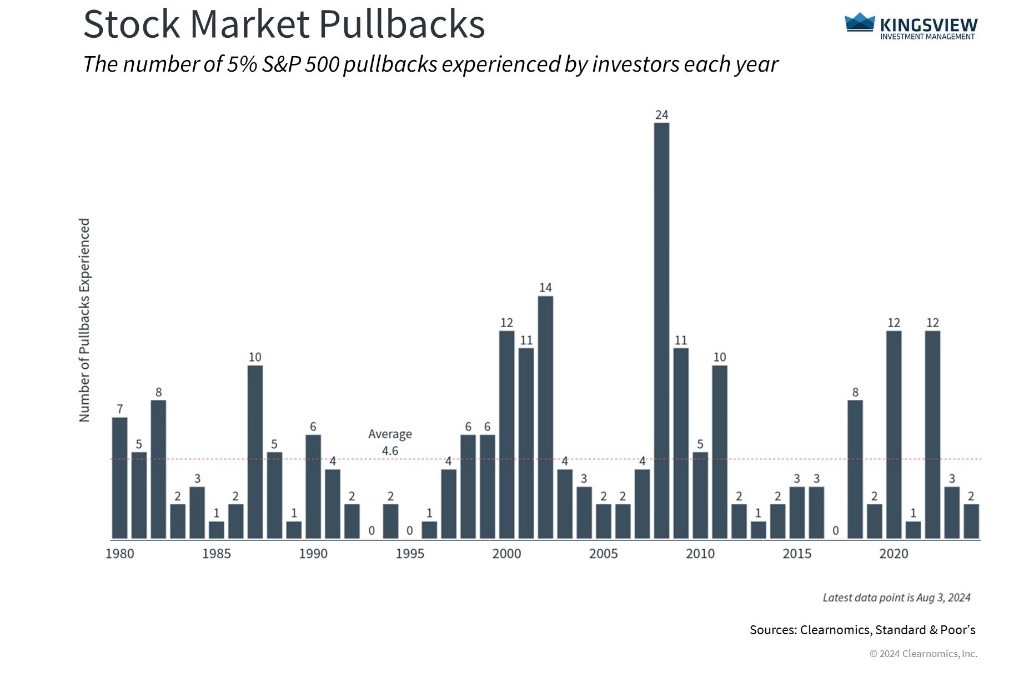

Stocks never move up in a straight line, so how we, as investors, react to market volatility is potentially more important than the volatility itself. The S&P 500 has now experienced its second 5% or worse pullback this year. As the above chart shows, this may align with the 4 to 5 pullbacks experienced in the average year, and the dozens during bear markets.

Investing in the stock market comes with inherent risks that can be managed with proper portfolio construction and a long time horizon. For the long-term investor, history shows that the market will move up and down, and despite those shifts, staying invested is still the best way to grow wealth and achieve financial goals over the course of years and decades.

Maintaining perspective on the goals and plans we have set in place is paramount when uncertainty and fear arise. While it may feel like “this time, it’s different,” history and experience suggest it is not. We have seen this movie before. As in previous similar circumstances, it can be beneficial to have an actively managed portfolio that is not emotional in its execution.

We at Kingsview Investment Management remain diligent in our processes and focused on the market’s long-term outlook. We feel it is best for investors to remain diligent with their investment solutions and utilize time-tested, defendable investment methodologies even in times of great uncertainty and new trials. Please do not hesitate to reach out to your trusted Kingsview Wealth Manager with any questions or concerns you may have.

– Kingsview Investment Committee

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2024)