Volume Analysis ‘Flash Market Update’ – 7.8.24

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

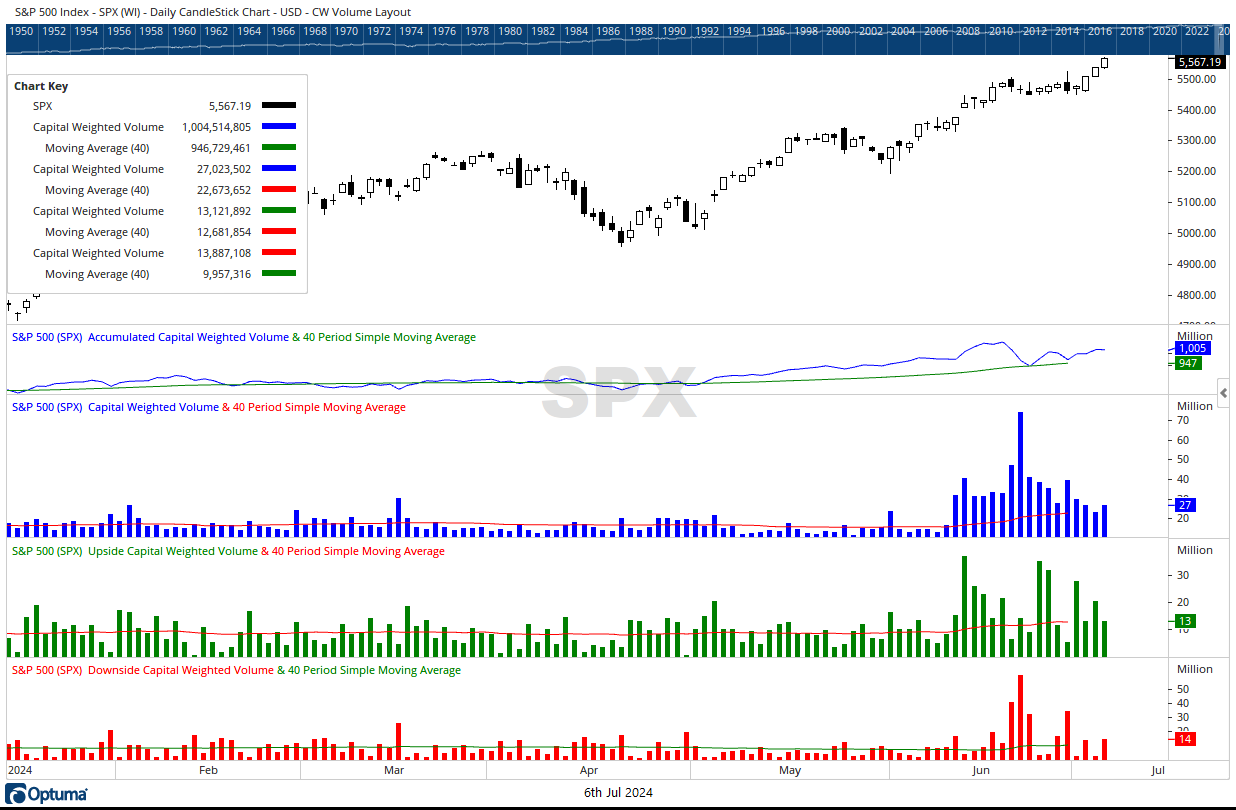

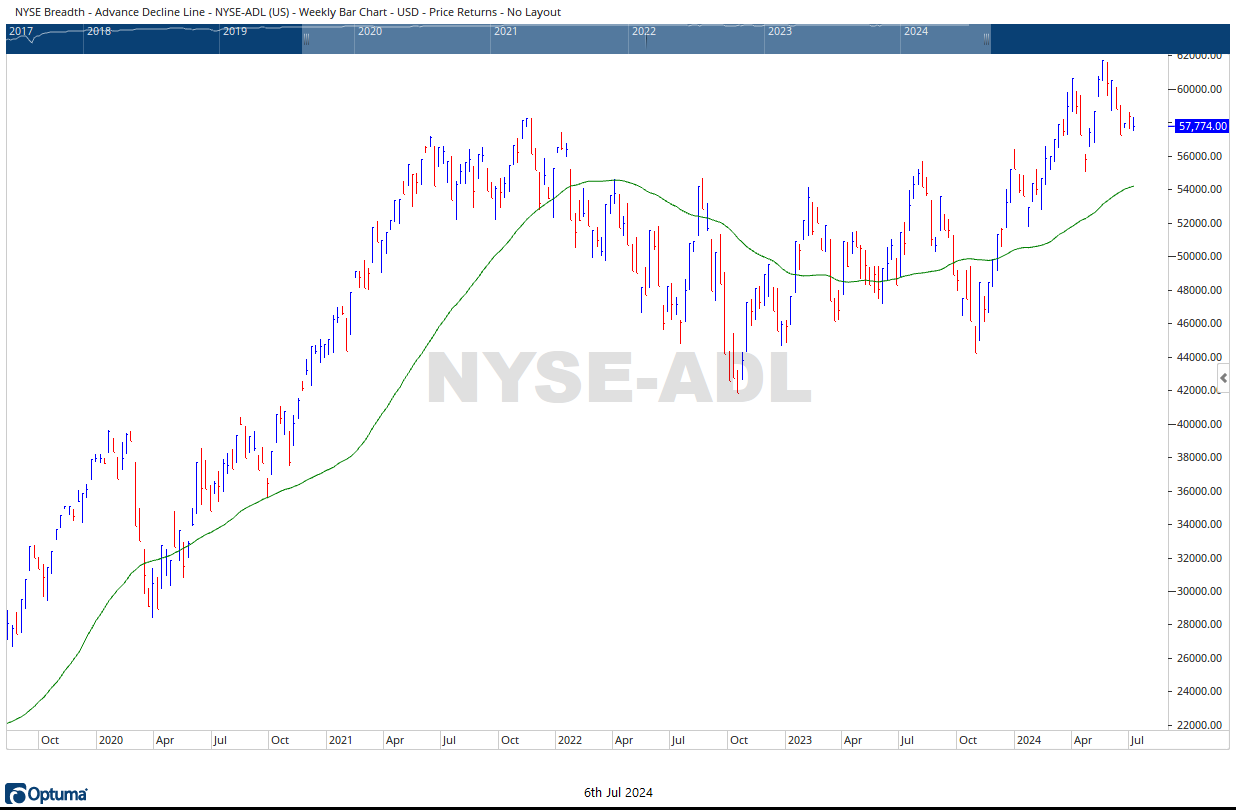

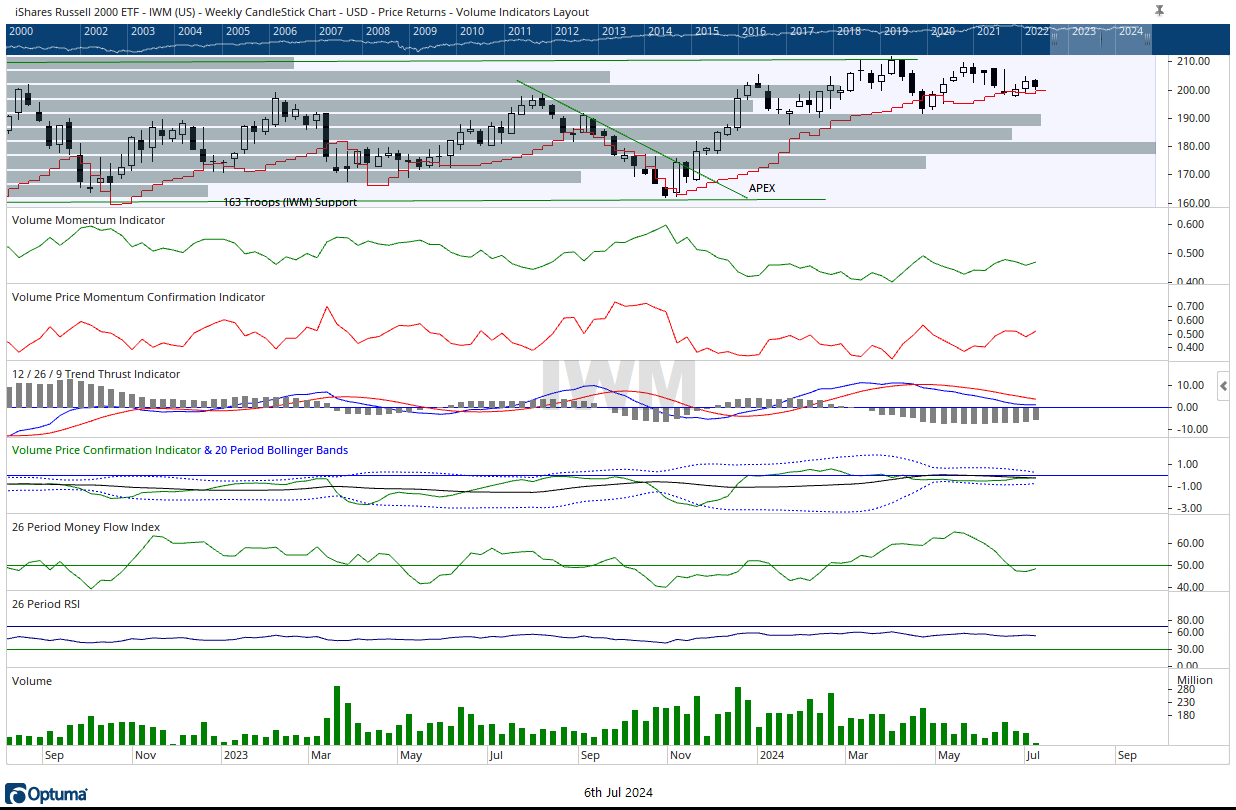

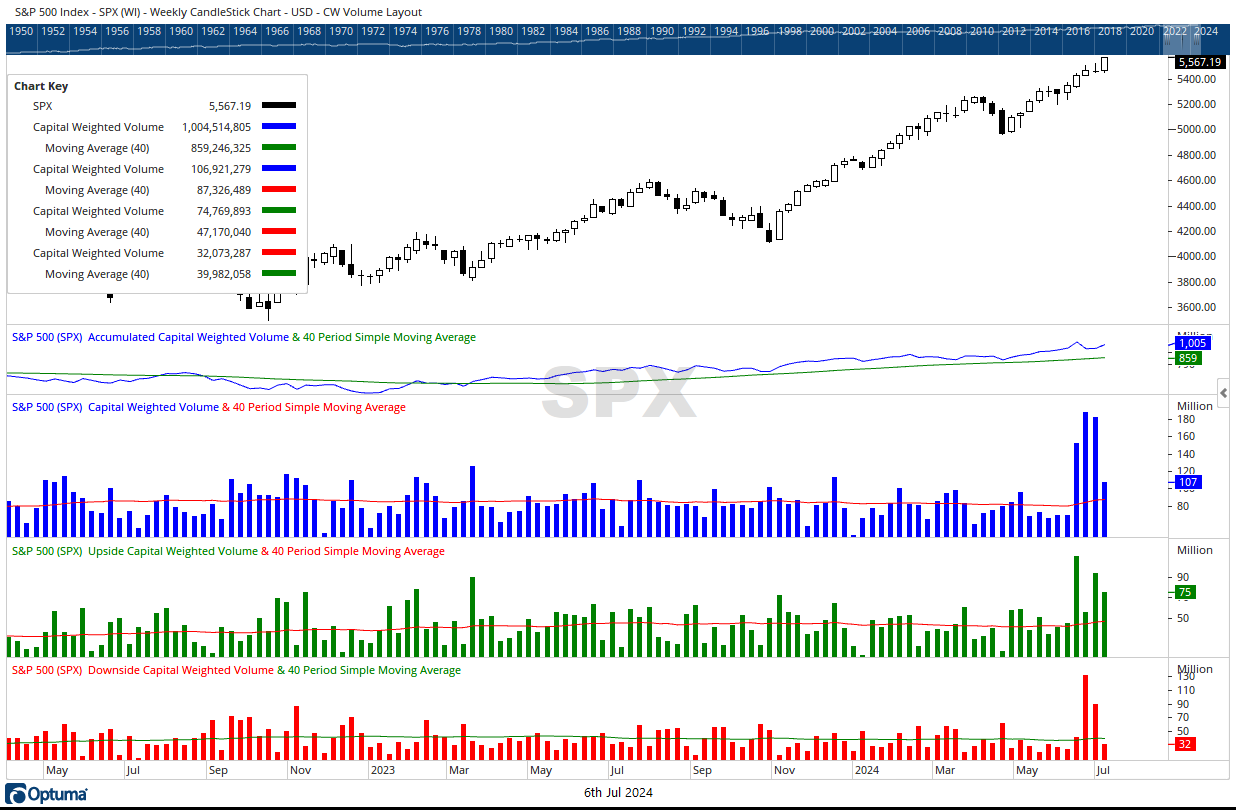

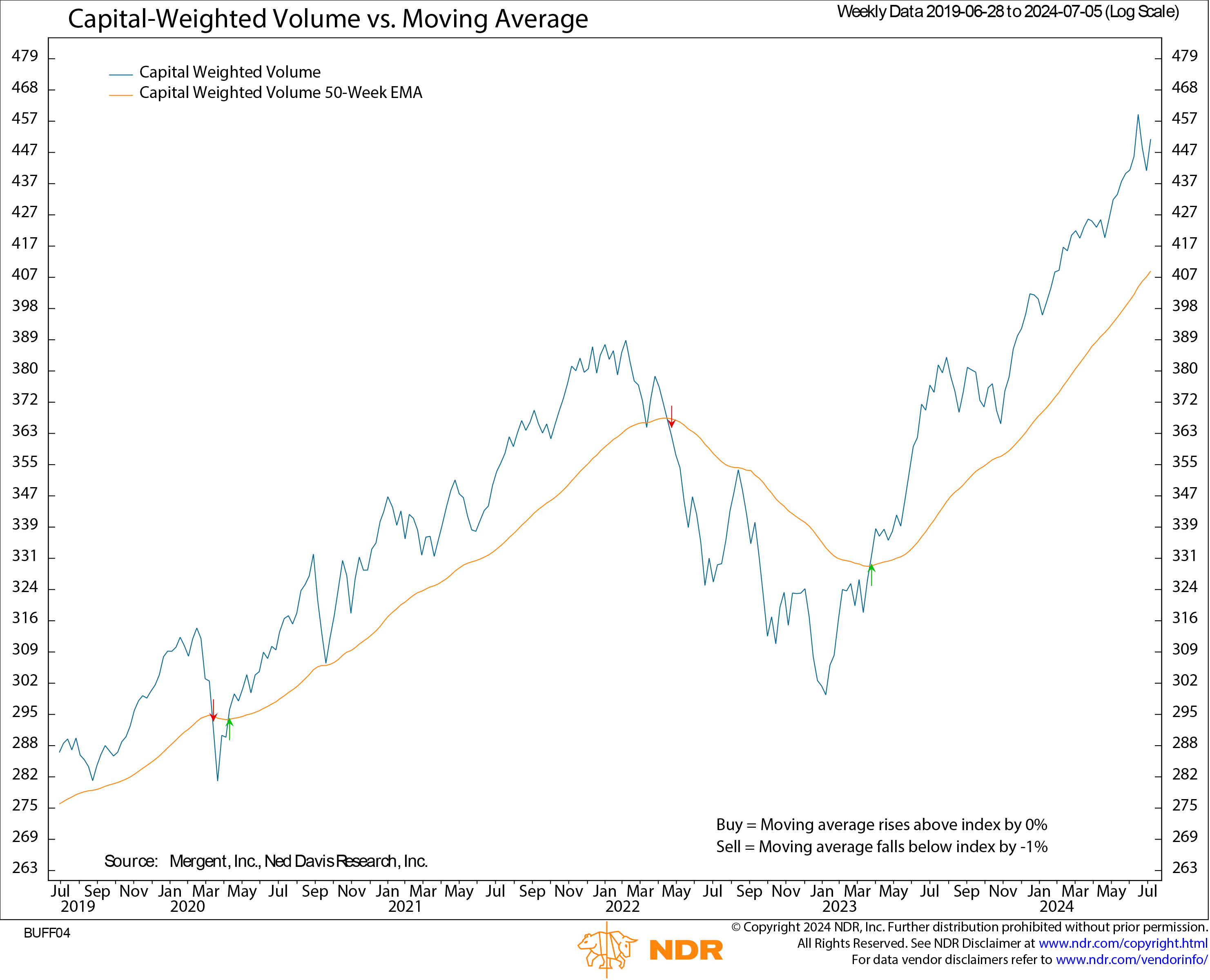

Although it was a shortened week due to Independence Day, Capital Weighted Volume remained strong, going against seasonal trends. The generals (Nasdaq 100) once again took control, finishing the week up 3.33%. The S&P 500 index closed the week at new highs, up 1.68%. However, it was once again a story of two markets, with the troops (iShares Russell 2000 ETF, IWM) retreating -1.31%. The Invesco S&P 500 Equal Weight ETF (RSP) and Schwab US Dividend Equity ETF (SCHD) also joined in the slumber, down -0.37% and -0.95%, respectively, for the week. Additionally, decliners led advancers on the New York Stock Exchange but finished above support and inside June 14th’s massive outside day.

The week and the month started out strong for the S&P 500, with July 1st inflows outpacing outflows by a 9 to 1 ratio, scoring yet another 90% CW Volume Upside Thrust day. For the shortened week, Capital Weighted Inflows finished well above average at $74.75 billion, while CW Outflows were slightly below average at $32 billion. The troops (IWM) remain inside June 14th’s weekly range, with support at $197 and resistance at $208. Meanwhile, last week’s S&P 500 range of 5570 and 5445 constitutes short-term support and resistance. Overall, despite a week where institutional traders are expected to be relaxing in the Poconos, the markets remained robust and lively beneath the surface.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 7/8/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.