Volume Analysis ‘Flash Market Update’ – 6.17.24

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way” – Charles Dickens

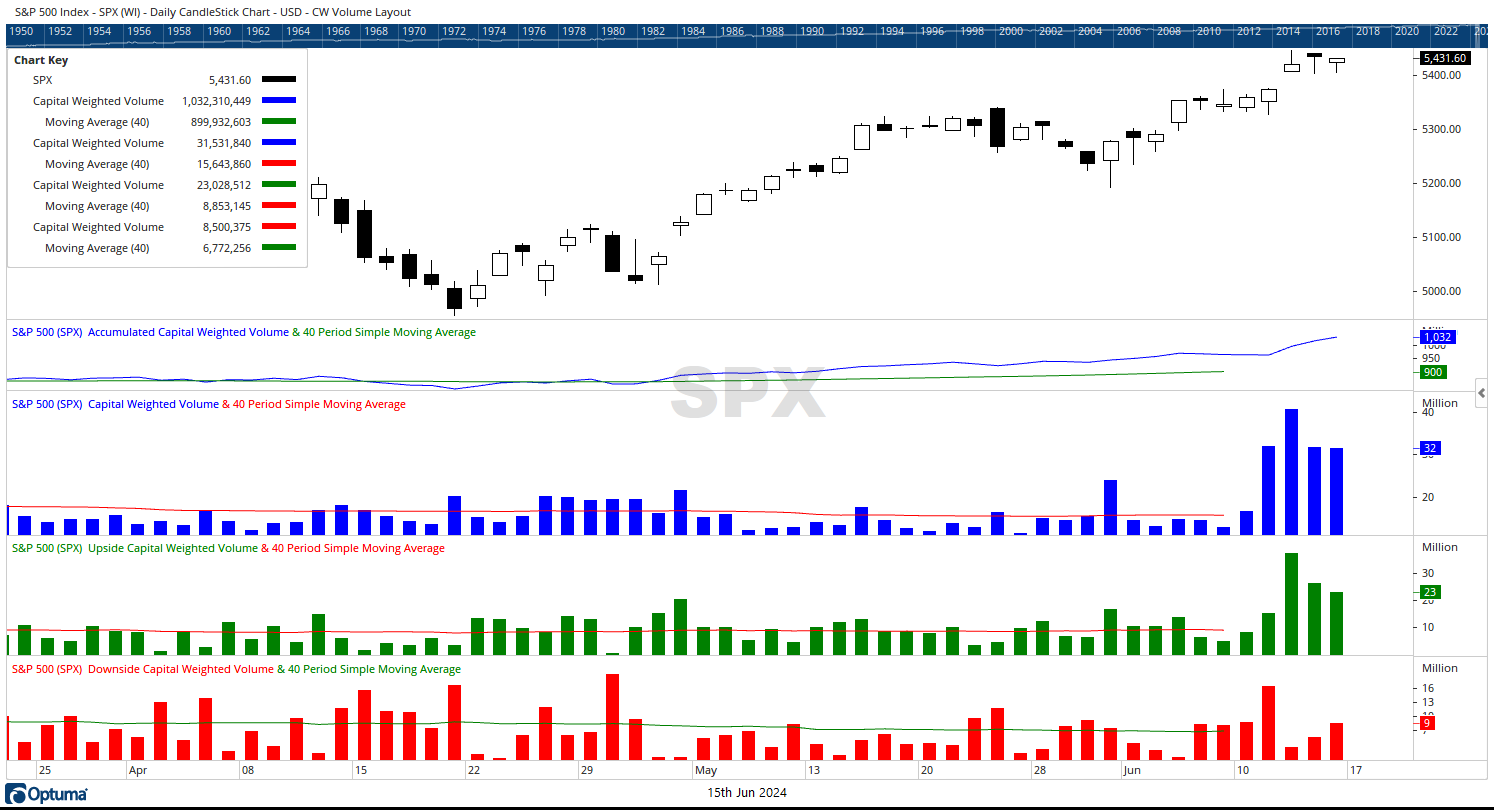

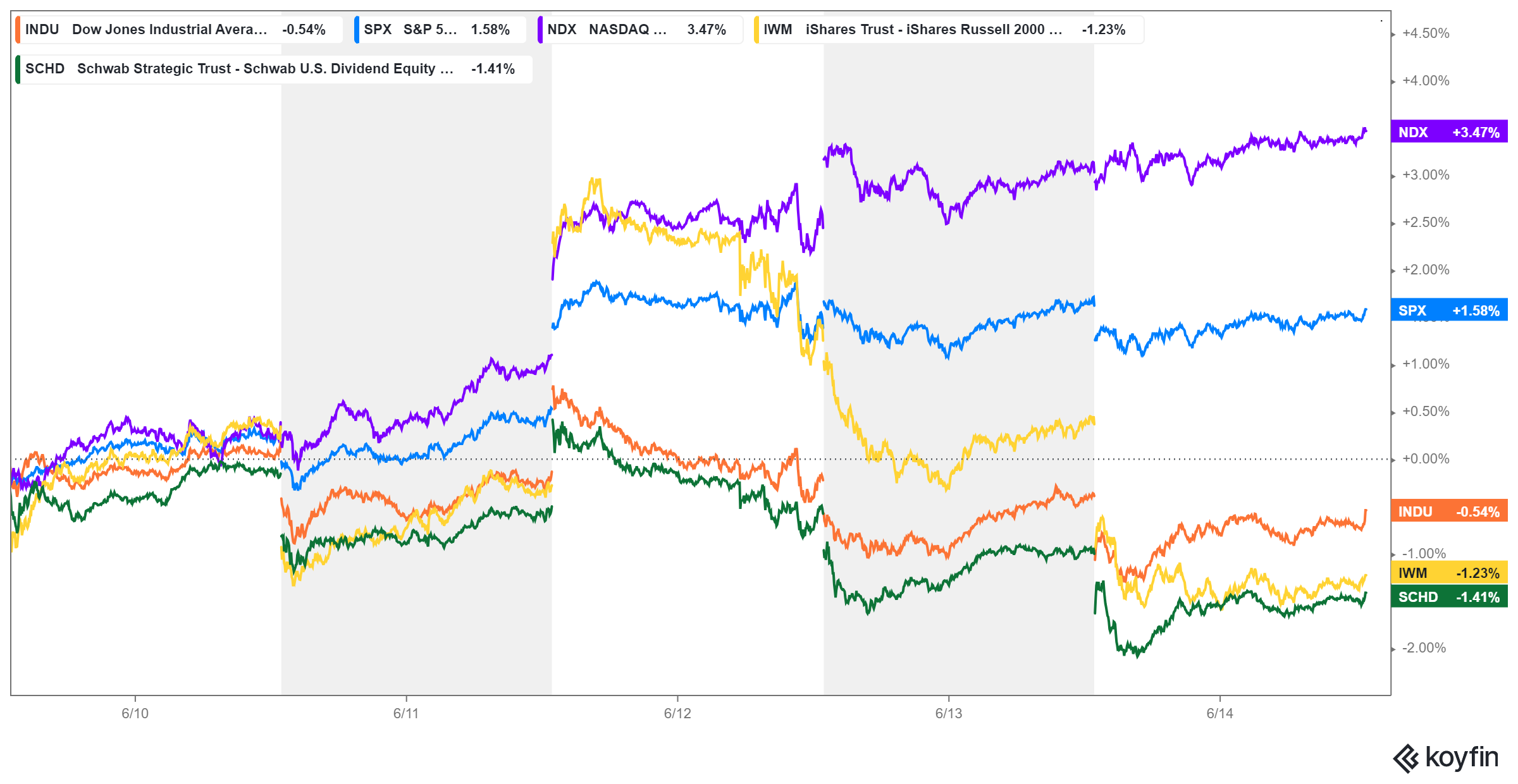

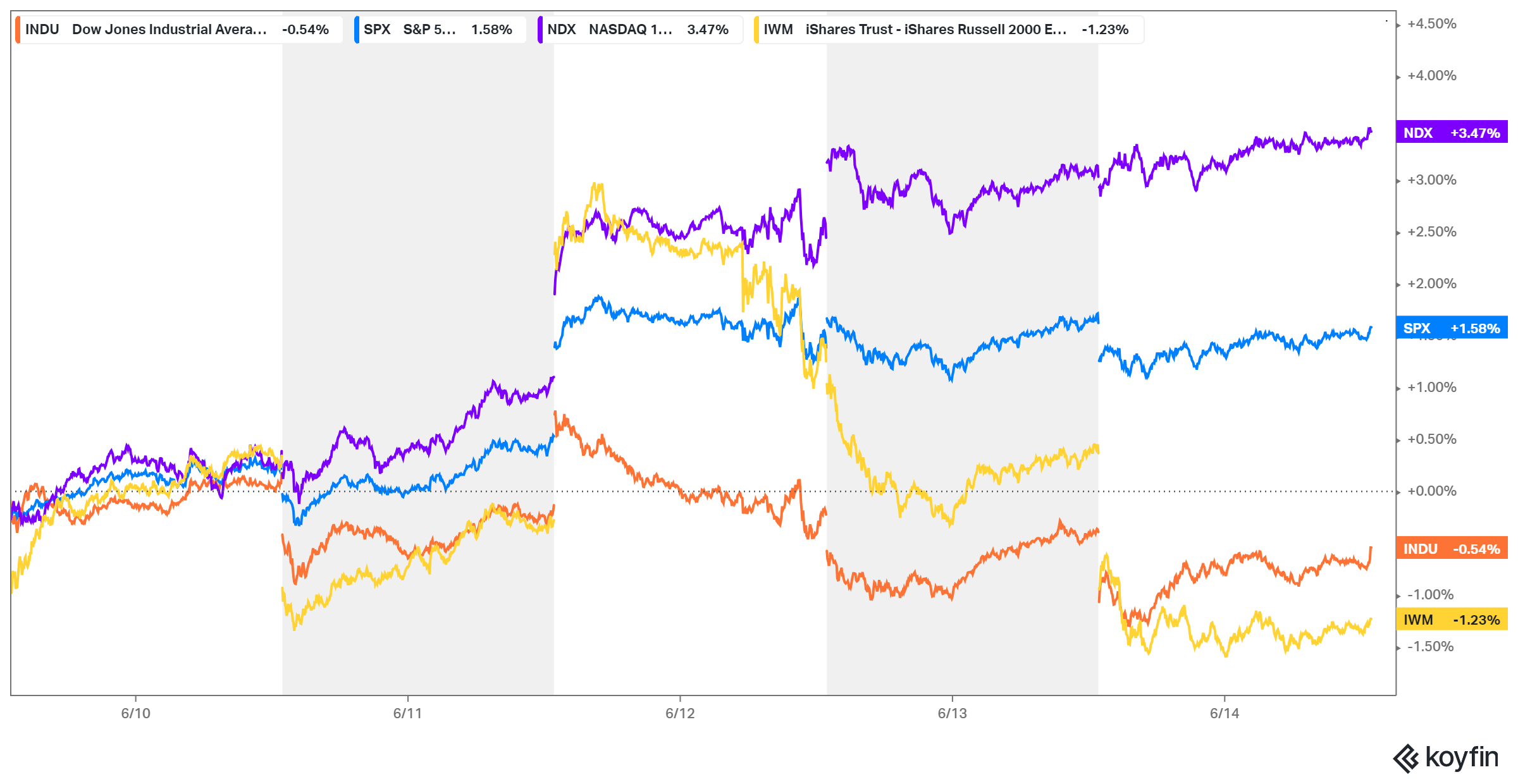

This week the generals (NDX 100) continued their upward ascension to the heavens while the troops (iShares Russell 2000 ETF, IWM) went the other way. The generals finished the week up 3.47%. The cap-heavy S&P 500 finished up 1.58%, backed by the strongest Capital Flows in over two years. Capital Inflows were extremely hefty, nearing $110 billion. Outflows were above average at approximately $42.5 billion.

With the Federal Reserve meeting and news of lower-than-expected inflation, Wednesday was one of the most robust Capital Weighted Volume days of recent memory, with over $40 billion changing hands. That tally matches some weekly totals. The vast majority of flows were to the upside—over 91%—marking another Upside Capital Weighted Volume Thrust day. The rest of the week’s volume remained strong but was more fairly distributed between upside and downside volume.

While the mega-caps sprang into hope, parts of the broader markets continued their slide into despair. In many ways, this action is counterintuitive, given the backdrop of falling bond yields and lowered inflation expectations. The fundamental textbooks might suggest such conditions favor the troops. However, the NYSE Advance-Decline fell back down to its May lows. Meanwhile, many of the high and modest-yield dividend stocks continued their season of darkness this quarter. This is evidenced by one of the largest dividend ETFs, the Schwab US Dividend Equity ETF (SCHD), falling -1.41%. Both the troops (IWM) and the NYSE AD Line are nearing their intermediate-term support levels. Forthcoming near-term action could predicate the course of summer trading.

Overall, there are generals in uptrends with strong capital inflows, an age of belief. There are troops stuck sideways in a range, an age of incredulity.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 6/17/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.