Volume Analysis ‘Flash Market Update’ – 6.3.24

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

Last week, we finished our volume analysis commentary with these thoughts, “Holistically, this data may suggest that the broad markets could benefit from a pause to refresh during their bullish journey.” This past week, the markets did pause. However, could this week’s encouraging data suggest that the pause may be short-lived?

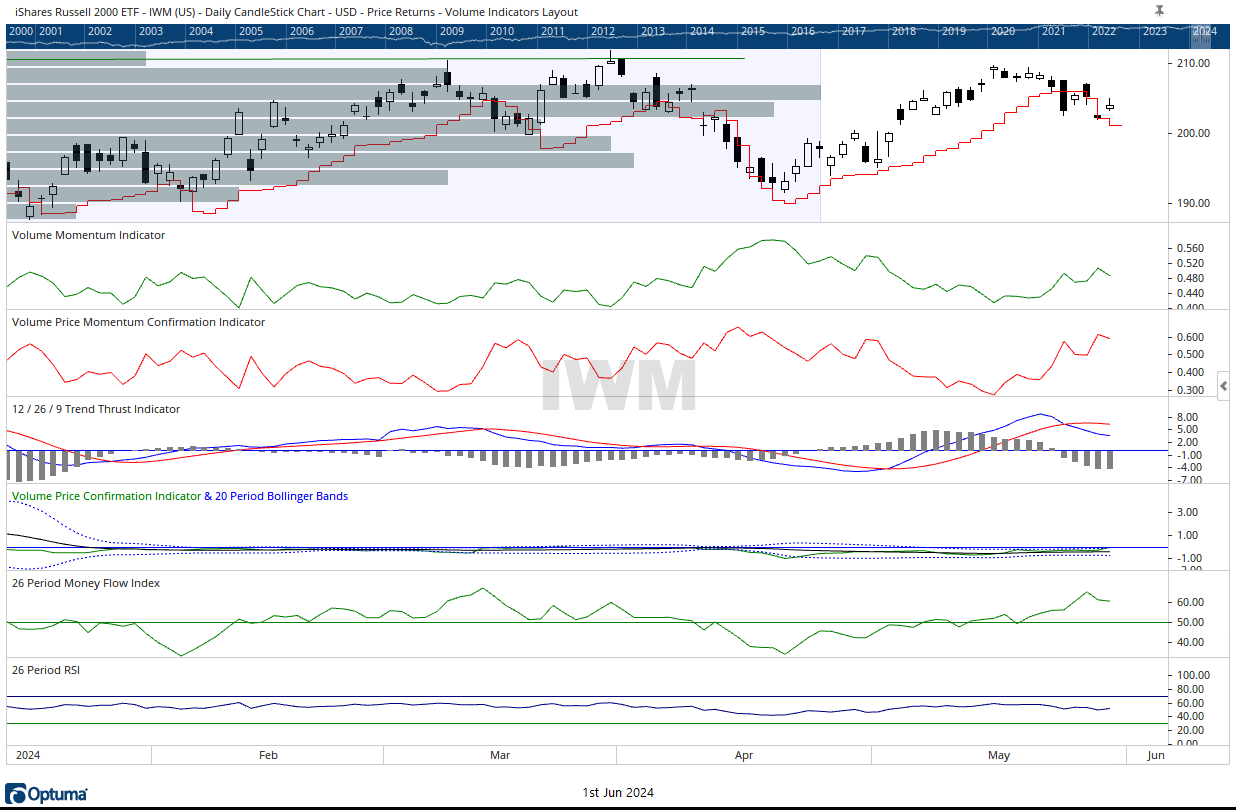

This week, our leading generals led the holiday shortened week down. The NDX 100, ended this week at 18537, down from its previous week’s close of 18808, a -1.44% loss. The troops (iShares Russell 2000 ETF – IWM) bucked the downtrend. IWM closed the previous week at 205.44, finishing up to 205.77, gaining 0.16%. Meanwhile, the S&P 500 closed the previous week at 5305 and finished this week at 5278 for a -0.51% loss.

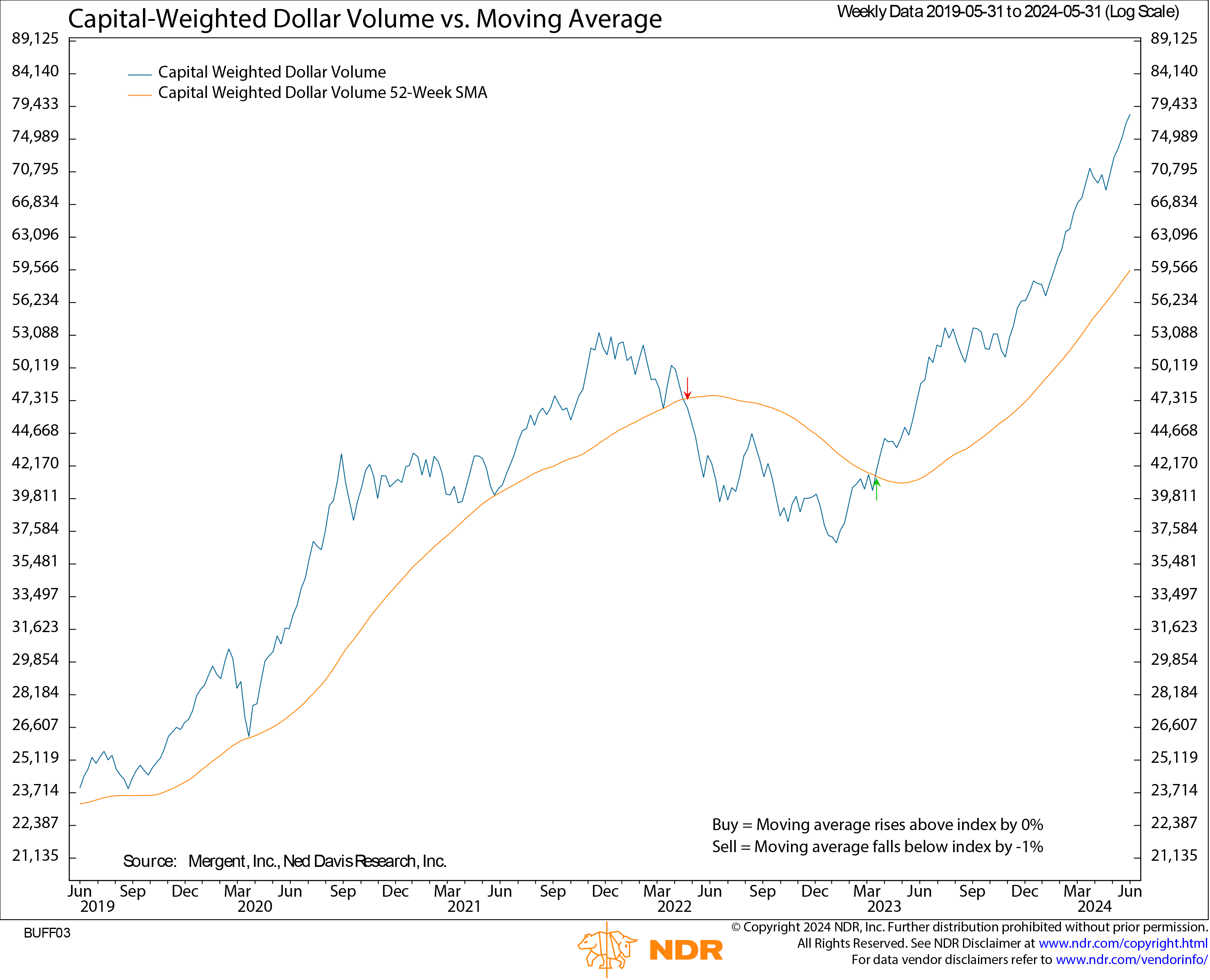

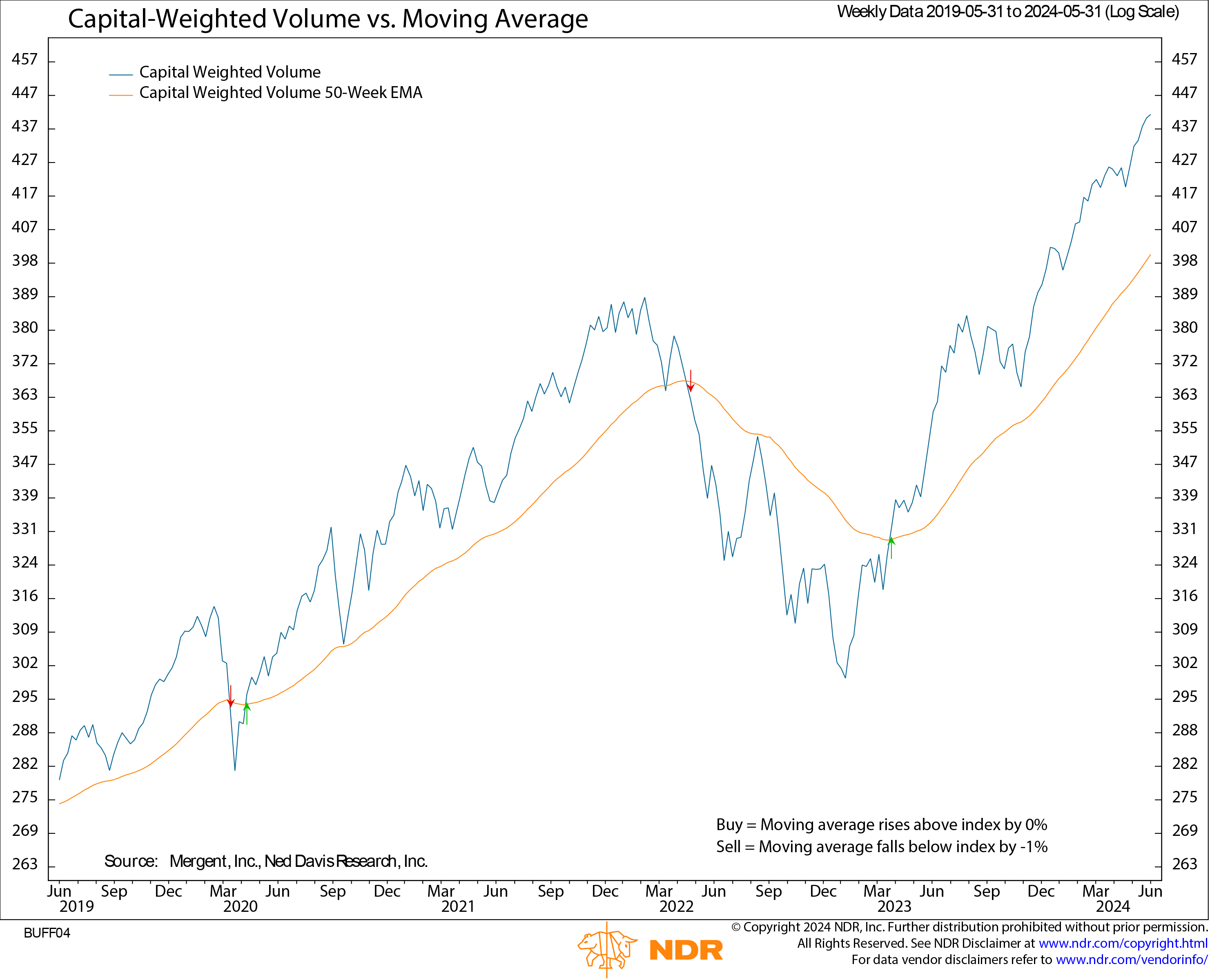

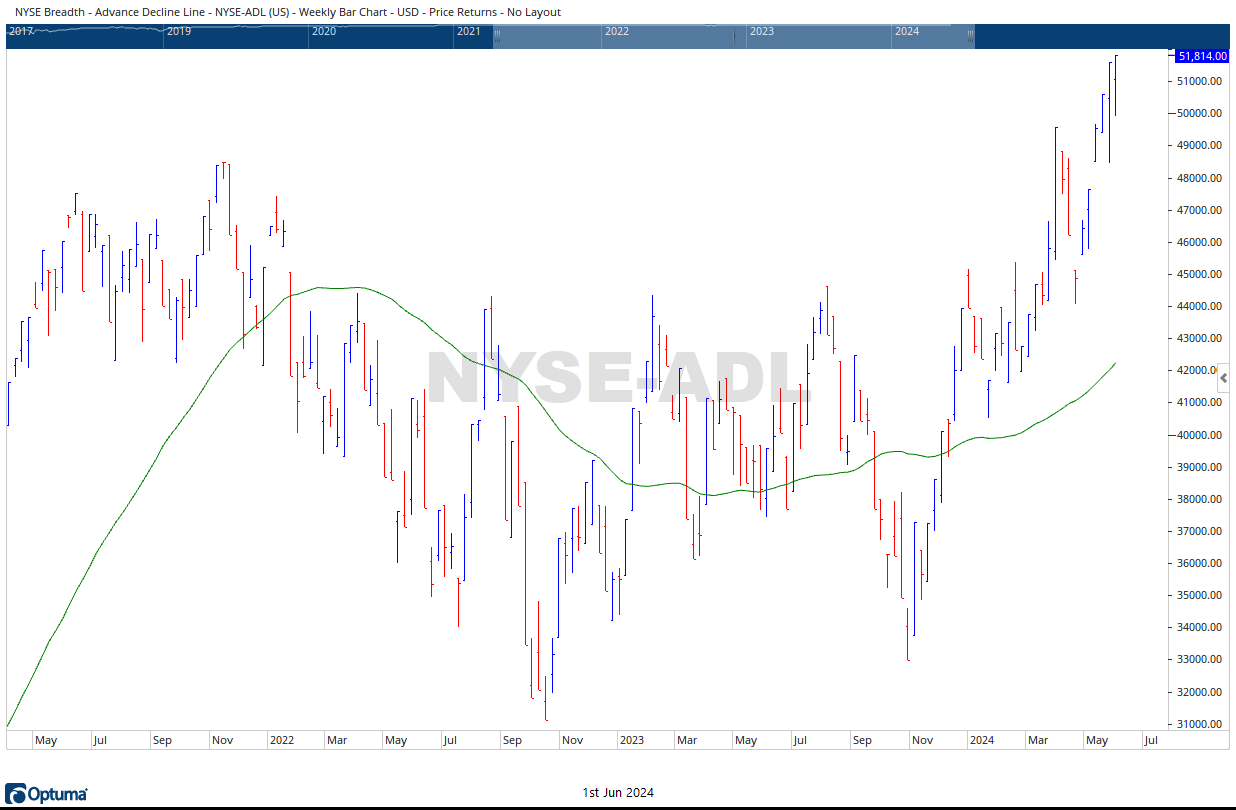

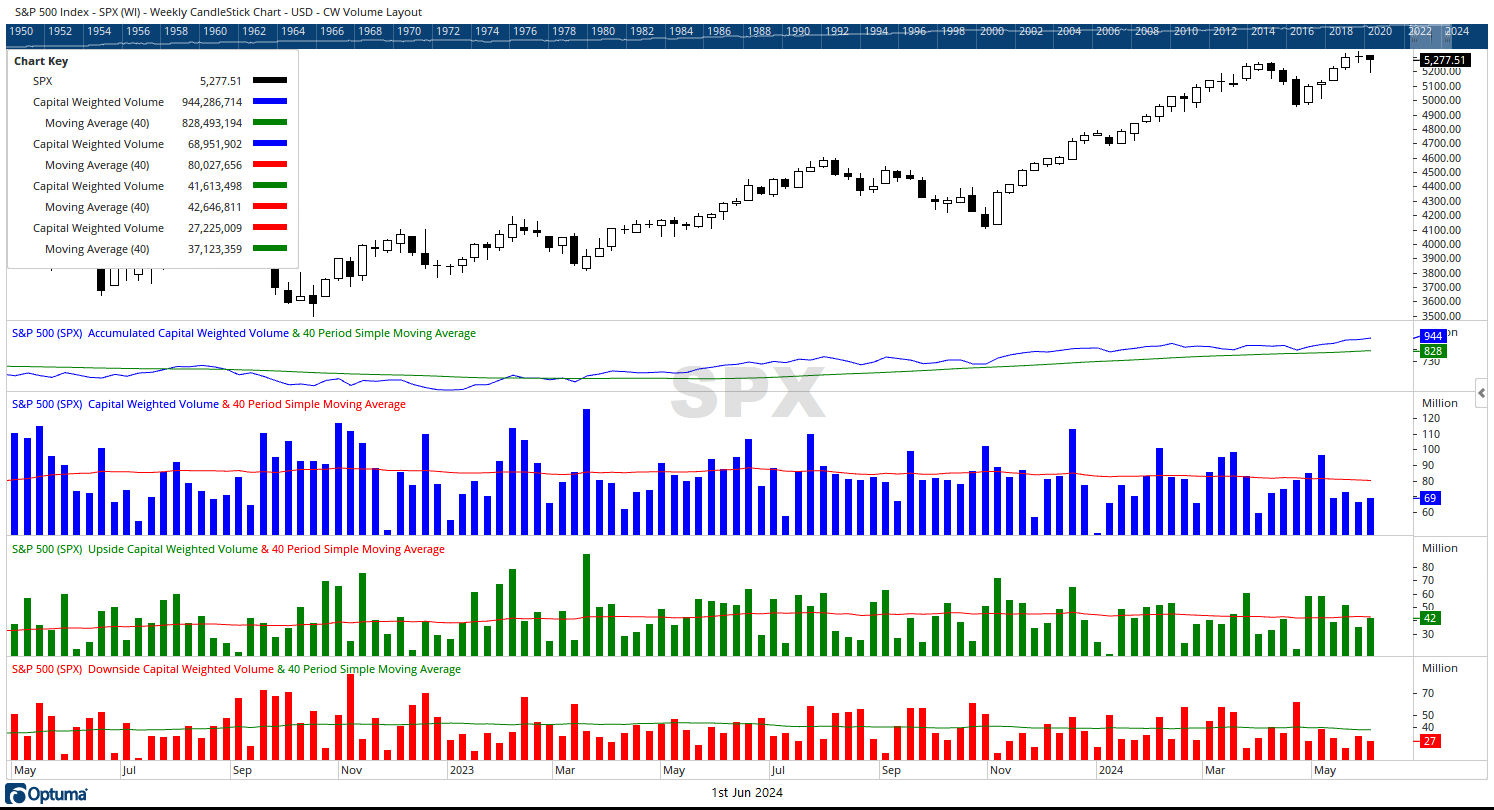

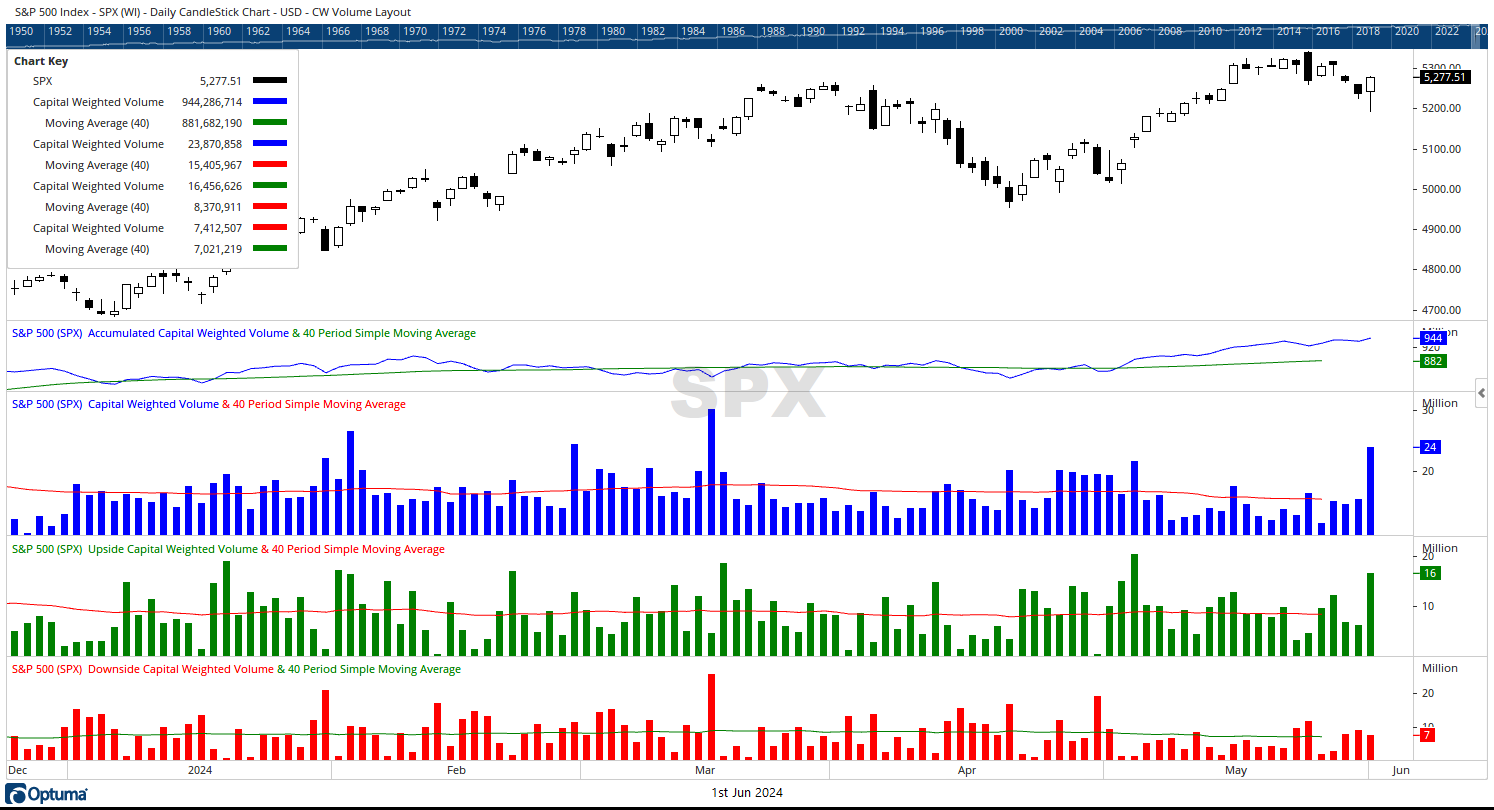

Although the price index was down, S&P 500 capital flows remained positive for the week. S&P 500 outflows were light at $27.2 billion. Yet, considering the short week, inflows were strong at $41.5 billion. Likewise, S&P 500 capital-weighted upside volume led downside volume on a 0.25% weekly gain. Additionally, the accumulated NYSE Advanced-Decline Line advanced to close at an all-time high. Thus, both S&P 500 accumulated Capital Weighted Volume, Capital Weighted Dollar Volume (Capital Flows), and the NYSE Advance-Decline Line all closed the week at all-time highs despite the poor showing in the price indexes.

Volume has been leading the market higher since early 2023. Now, market breadth is finally following suit. From a technical standpoint, we believe these conditions create a healthy state for the bulls. Minor S&P 500 resistance resides at 5325 with support at 5140.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 6/3/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.