Volume Analysis ‘Flash Market Update’ – 5.28.24

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

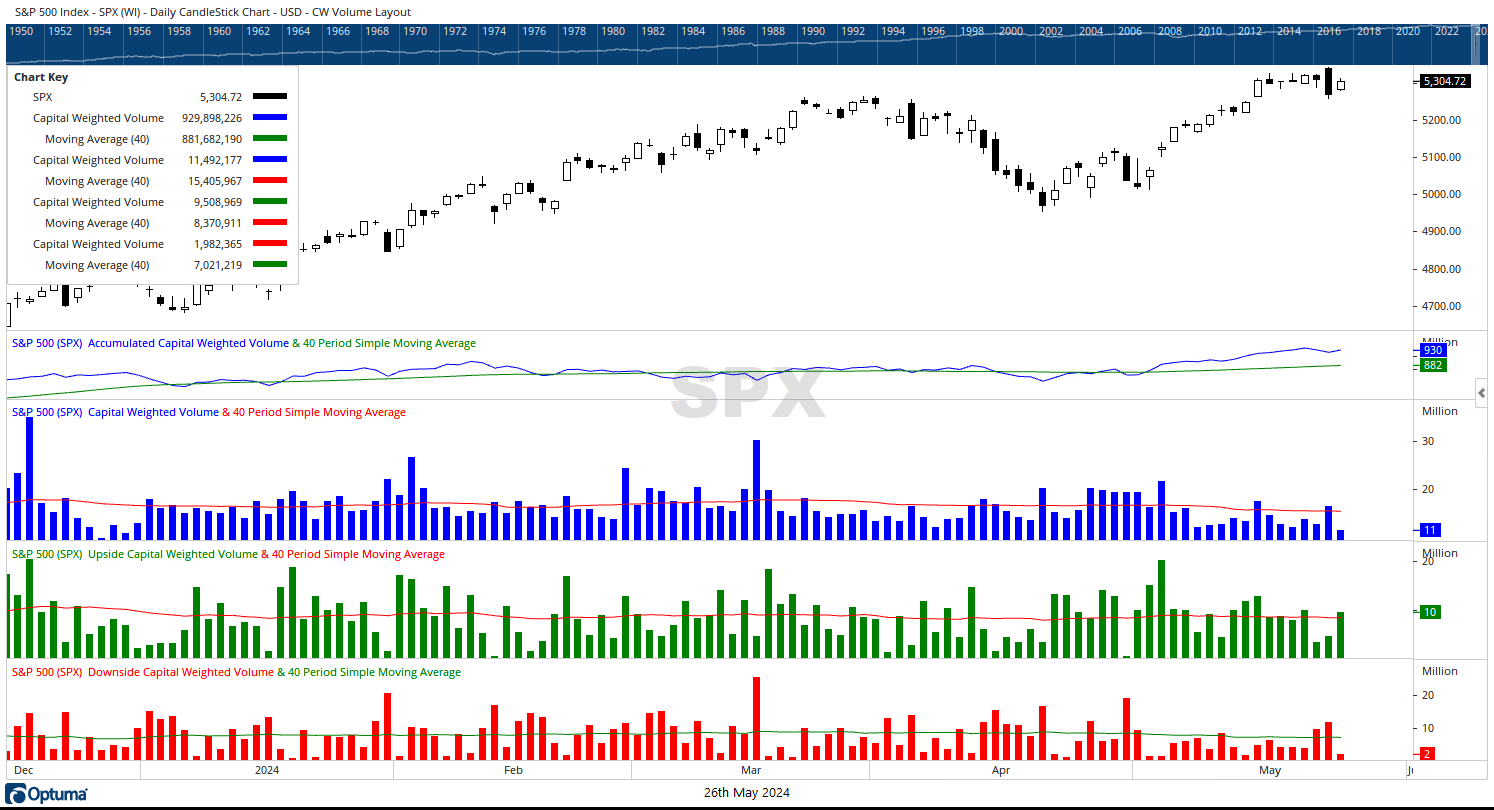

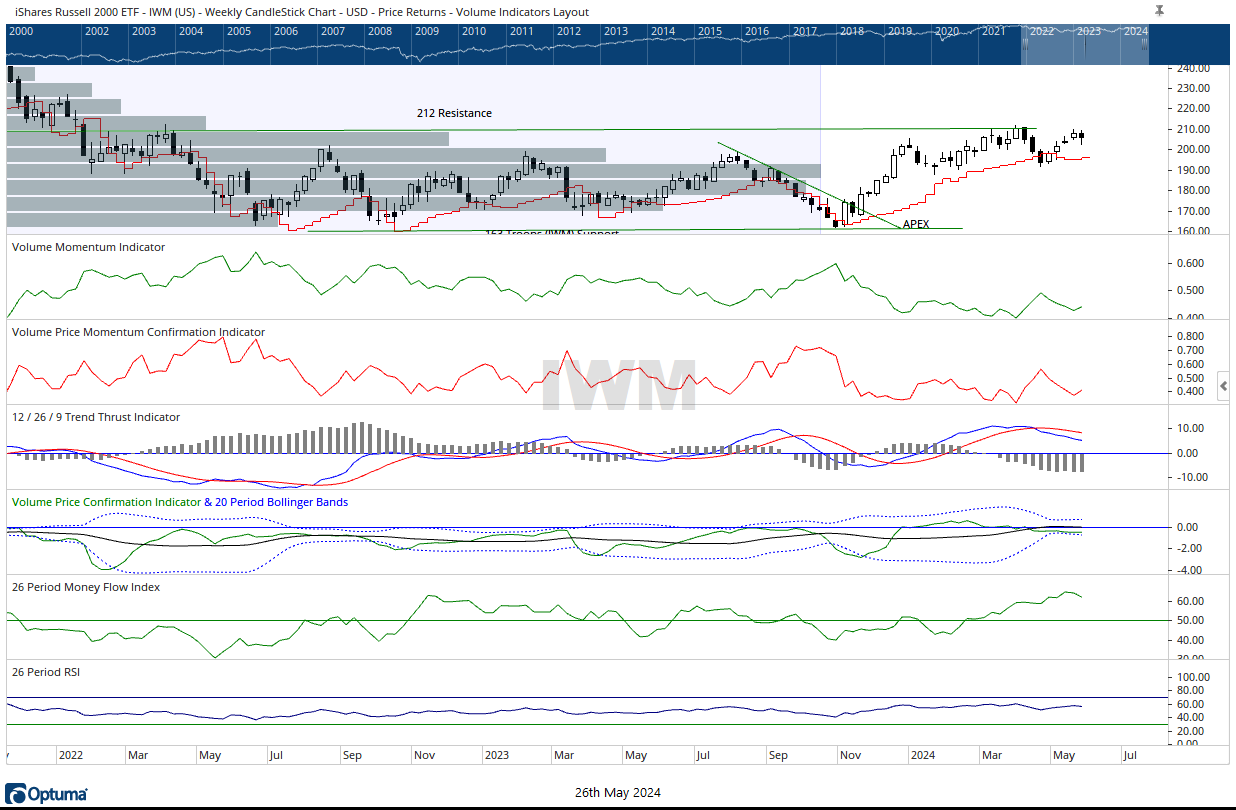

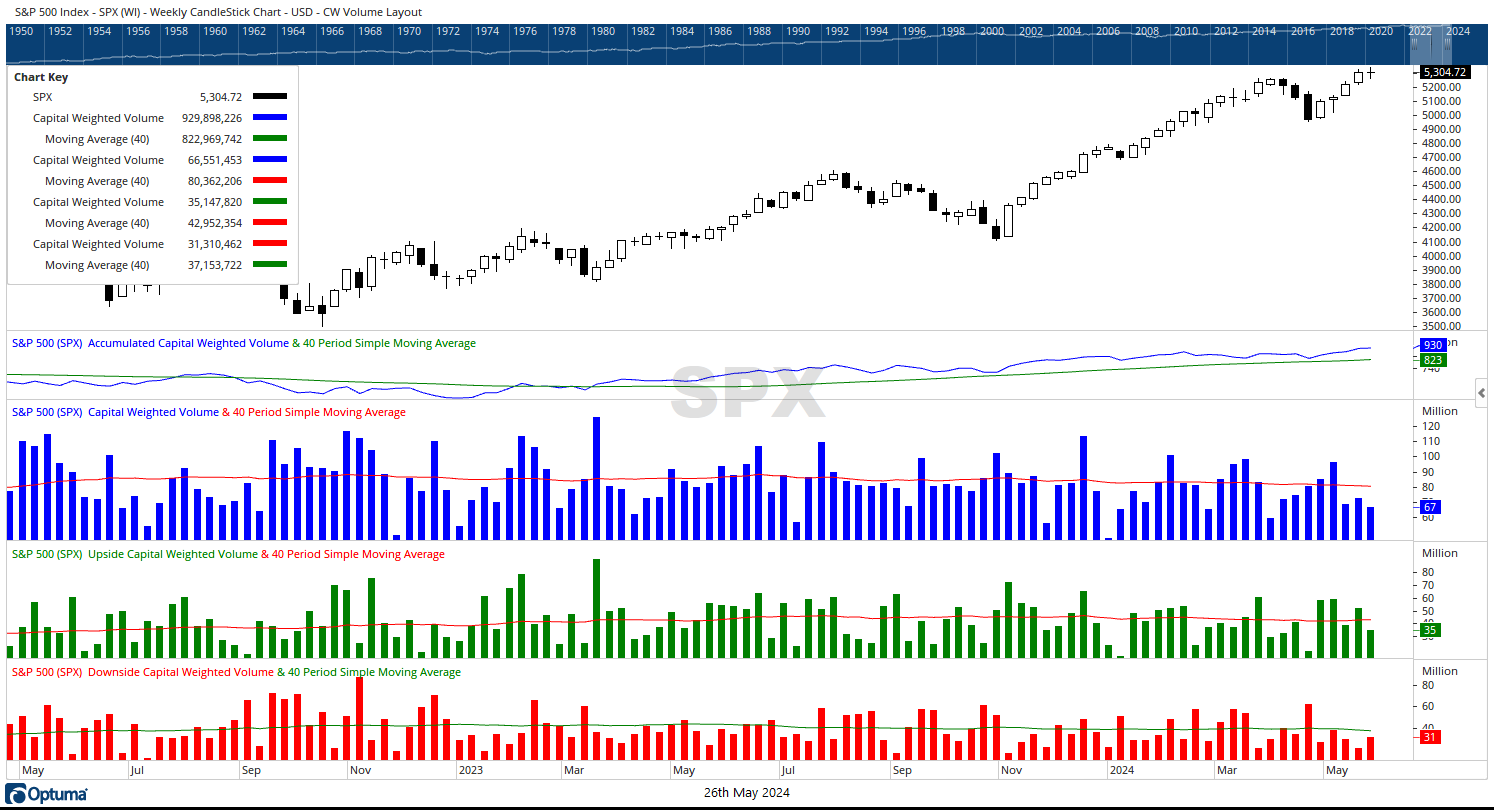

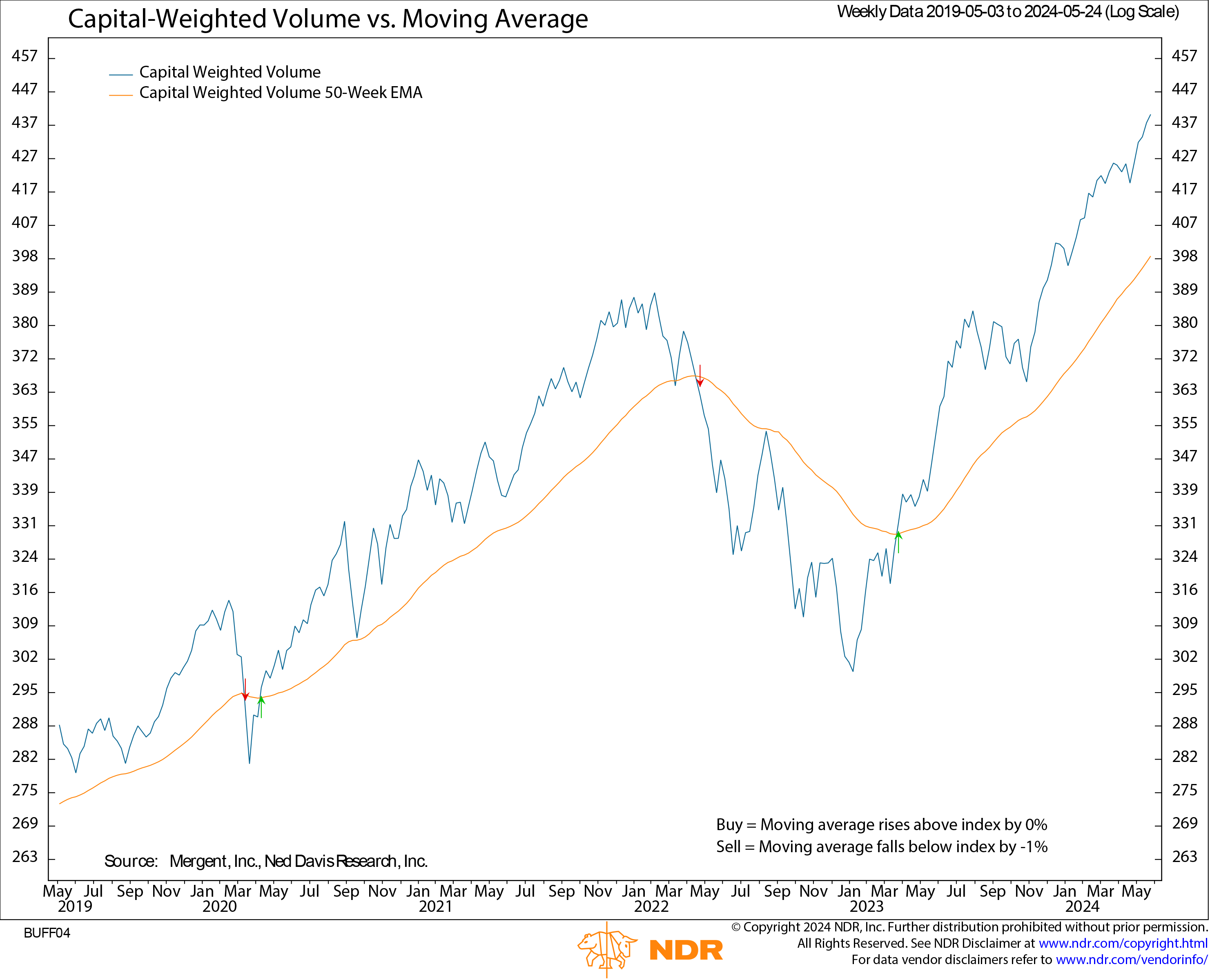

Last week once again highlighted a tale of two markets. This bull market has heard it all too often: the generals (Nasdaq 100) leading with a gain of 1.41%, while the troops (iShares Russell 2000 ETF – IWM) retreated, dropping -1.27%. Meanwhile, the S&P 500 finished the week essentially flat, up just 0.03%, trading within a tight range of less than +/-1% throughout the week and forming another Doji. For context, Doji candlestick patterns often suggest a pause in the primary trend. S&P 500 capital flows were balanced, with $31.3 billion in outflows compared to $35.1 billion in inflows, both below their typical averages. Once again, both Capital Weighted Volume and Capital Weighted Dollar Volume ascended to new weekly all-time highs.

IWM has once again stalled at the 212 resistance level, with the NYSE Advance-Decline line retreating after the previous week’s breakout to new highs. Thursday’s outside day forms the S&P 500’s resistance at 5342 and short-term support at 5246. Meanwhile, bullish sentiment remains elevated, with 47% of individual investors and 94.45% of active managers showing optimism, according to the AAII (American Association of Individual Investors) and NAAIM (National Association of Active Investment Managers). Holistically, this data may suggest that the broad markets could benefit from a pause to refresh during their bullish journey.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 5/28/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.