Portfolio Manager Insights | What Dow 40,000 Means for Consumer Net Worth - 5.22.2024

Click here to download this commentary in PDF format.

The Dow Jones Industrial Average reached 40,000 for the first time recently as markets continue to rebound from a 5% decline earlier this year. While this has felt like a difficult year for many investors due to inflation, high interest rates, and growth concerns, the reality is that the broad market has achieved 23 new all-time highs. Other asset classes, including international stocks, commodities, and even gold, have surged alongside the U.S. stock market as interest rate expectations have fallen.

The health of the economy is perhaps the most important driver of this volatile but strong market performance, and this in turn boils down to robust consumer spending. Recent data show that the financial health of consumers is still remarkably strong despite higher prices for everyday goods and services, layoffs in certain sectors, and diminished savings rates. Since consumer spending makes up over two thirds of GDP, the state of consumer balance sheets, wage gains, and sentiment are critical to both corporate revenues and overall economic growth. What does the financial health of consumers in mid-2024 mean for the broader economy?

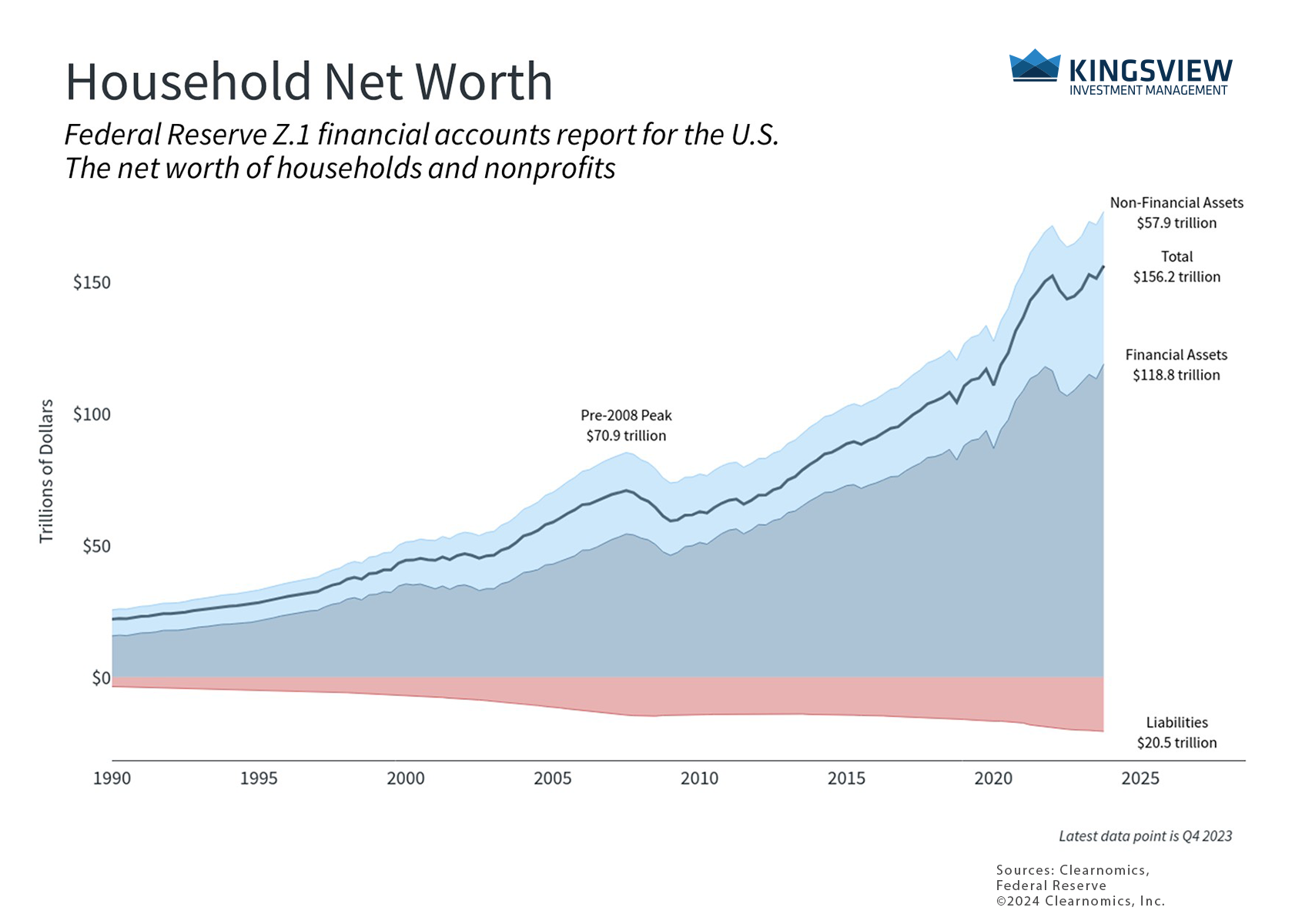

Household net worth is at an all-time high

First, as the accompanying chart shows, household net worth is at an all-time high, eclipsing the previous peak before the 2008 global financial crisis. Household net worth grows with the value of assets such as cash, stocks, bonds and real estate, and it declines with liabilities such as credit card debt and auto loans. The strong economy and bull market have led overall household net worth to more than double since 2007, despite the pandemic and the 2022 bear market.

Rising household net worth can drive consumer spending since the more money people have, the more they feel they can spend – a phenomenon known as the “wealth effect.” When people feel like they are in a good place financially, they tend to spend more which can then drive business profits, higher wages, and ultimately boost stock prices. The wealth effect can occur even when illiquid assets such as homes or retirement investment accounts increase in value.

This increase in net worth has occurred despite high inflation rates over the past couple of years. This is an important reason for investors to hold a portfolio that can grow over time and outpace inflation, rather than holding only cash. History shows that long-term wealth creation is the result of holding the right mix of stocks, bonds, and other asset classes.

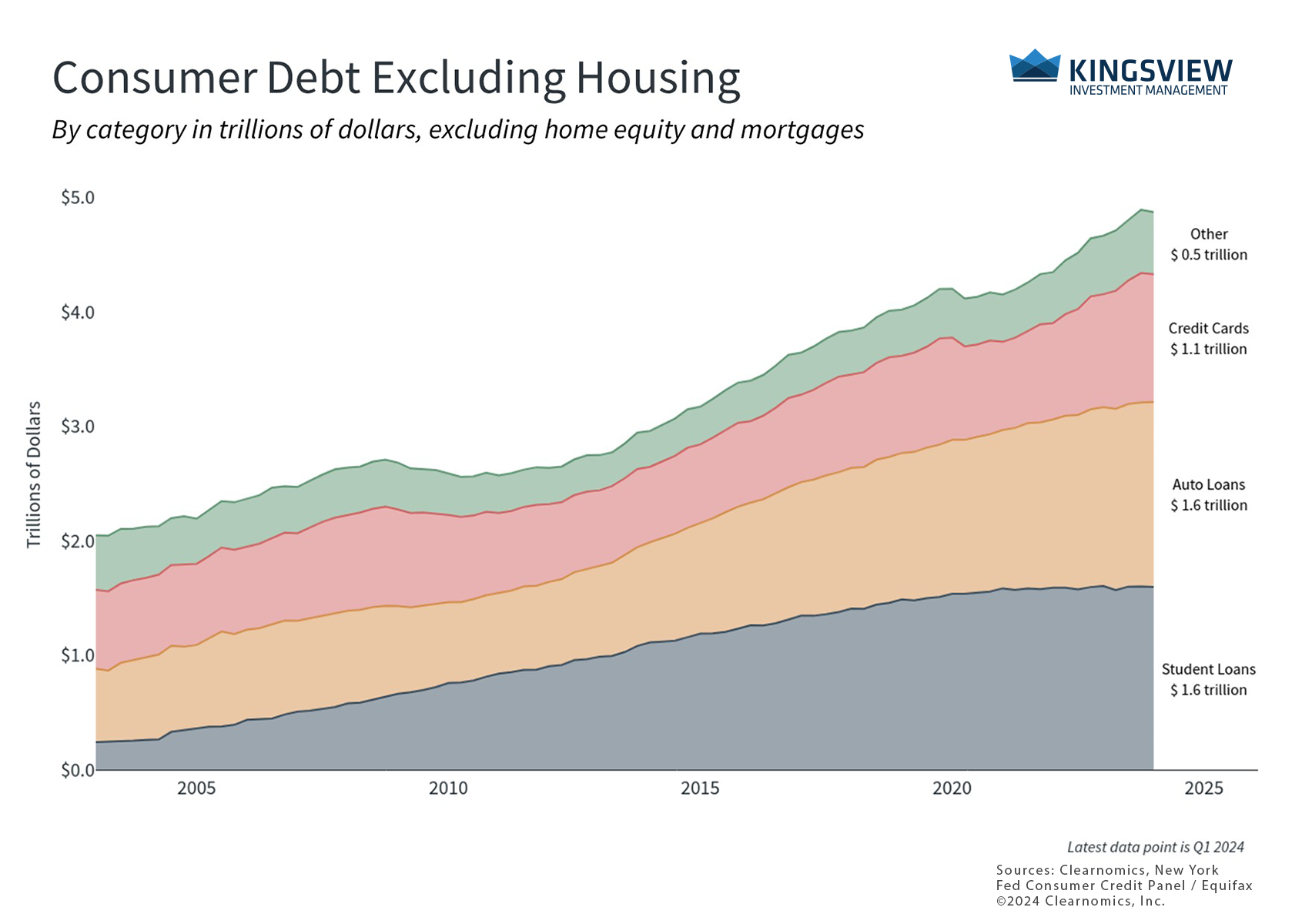

Consumer debts have grown but are still manageable

Second, while consumer balance sheets have grown in aggregate, consumer debt levels are also rising. For some consumers, there are also signs of distress due to the burden of monthly payments. According to the Federal Reserve Bank of New York’s latest Household Debt and Credit report, delinquency rates across all consumer debt levels increased in the first quarter of the year. While mortgage debt, student loan debt, and home equity loan delinquencies remain around their recent trends, credit card and auto loan delinquencies have jumped.

Specifically, 8.9% of credit card balances have become delinquent over the past year as some consumers have struggled with payments, much higher than the 10-year average of only 5.9%. Credit card balances declined slightly in the first quarter of the year but still total $1.1 trillion, 13.1% higher than just a year ago. Similarly, auto loan delinquencies have increased to 7.9% of balances with the total amount of auto loan debt growing 3.5% year-over-year to $1.6 trillion.

Higher interest rates can make servicing these debts difficult. In many ways, this is by design as the Fed attempts to tighten monetary policy and slow economic growth to fight inflation. New debt issuance has indeed slowed since the Fed began raising rates: excluding mortgage debt, the growth rate of debt balances has decelerated from 7.3% a year ago to 4.8% in the first quarter of 2024. While monthly payments will continue to be a challenge for many households, the fact that consumers are adding debt at a slower rate is positive.

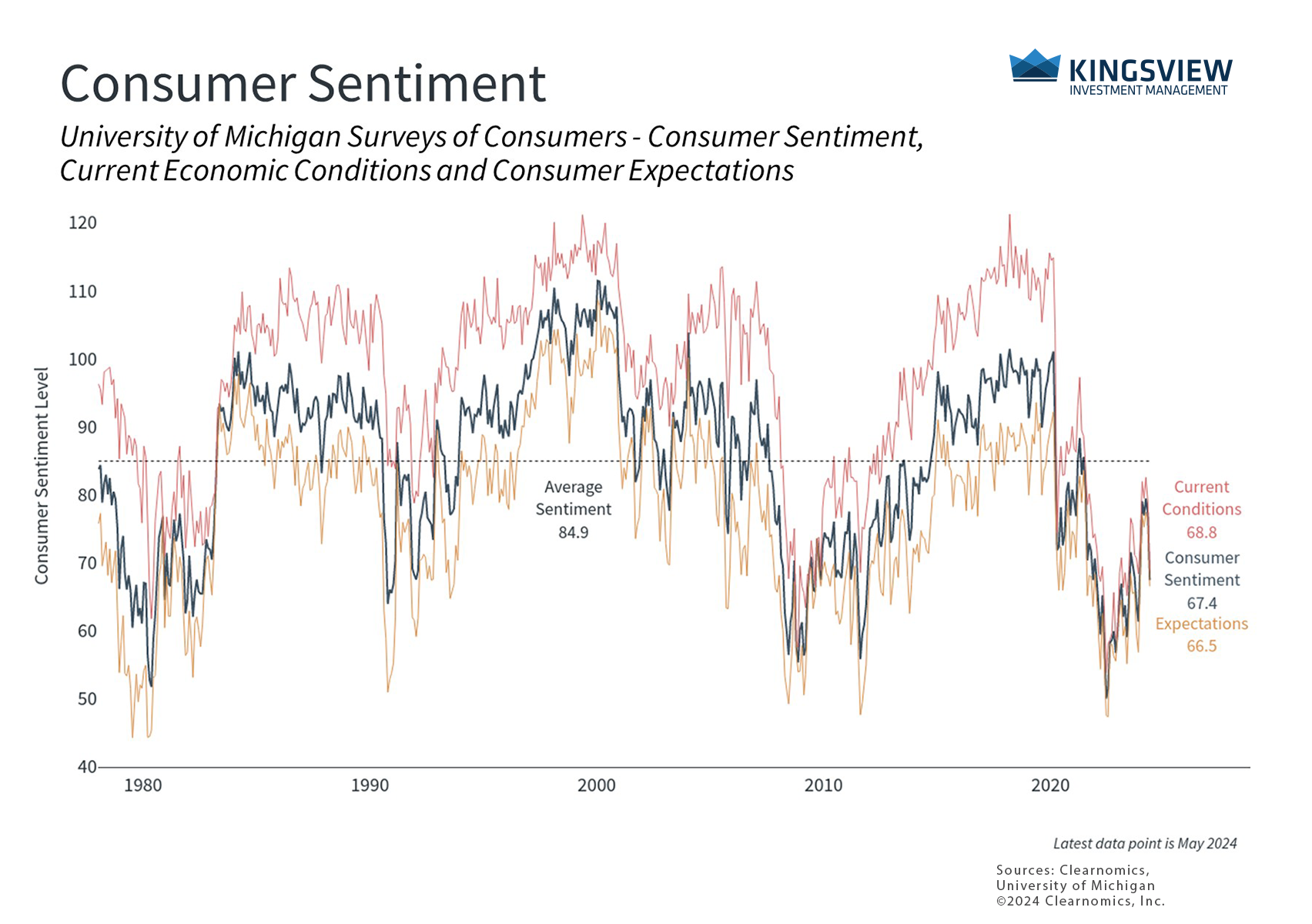

Consumer sentiment has been volatile

Finally, consumer sentiment has fluctuated because of market swings and the uncertain inflation environment. Sentiment tends to improve when inflation is decelerating and the job market is strong, as it was last year. Today, persistent inflation has negatively impacted how everyday consumers view the economy, even though unemployment remains near historic lows.

Fortunately, the trends are gradually moving in the right direction. The latest Consumer Price Index report, for instance, showed a deceleration of inflation with headline and core inflation of 3.4% and 3.6%, respectively, their lowest levels since 2021. These are still well above the Fed’s 2 to 2.5% target and follow several months of higher-than-expected inflation readings. Still, they have been enough for markets to once again expect two Fed rate cuts this year and are a reminder that the data can fluctuate on a monthly basis.

In short, the average U.S. consumer continues to be financially healthy even though inflation, higher interest rates, and growing debt are burdens on many households. This is partly driven by rising asset prices as markets recover from their recent decline. The reverse is also true – the wealth effect drives consumer spending which helps corporate earnings, in turn supporting stock prices. In the long run, the health of consumers and the broader economy is a far more important driver of market performance than day-to-day headlines.

The bottom line? The strong consumer is one reason markets have achieved new all-time highs this year. Investors should focus on these economic trends rather than short-term headlines or individual economic reports.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2024)