Volume Analysis | Flash Market Update - 1.29.24

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

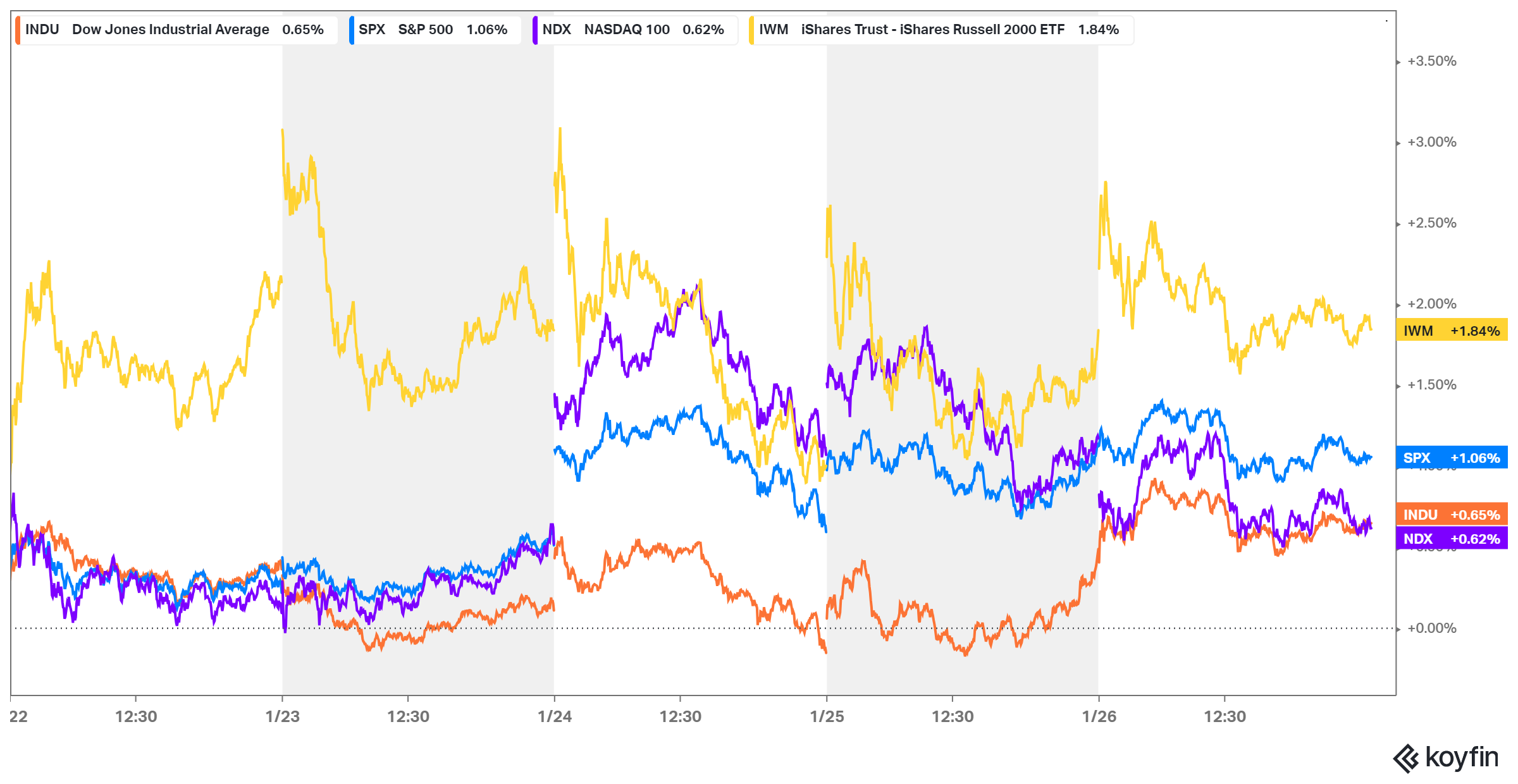

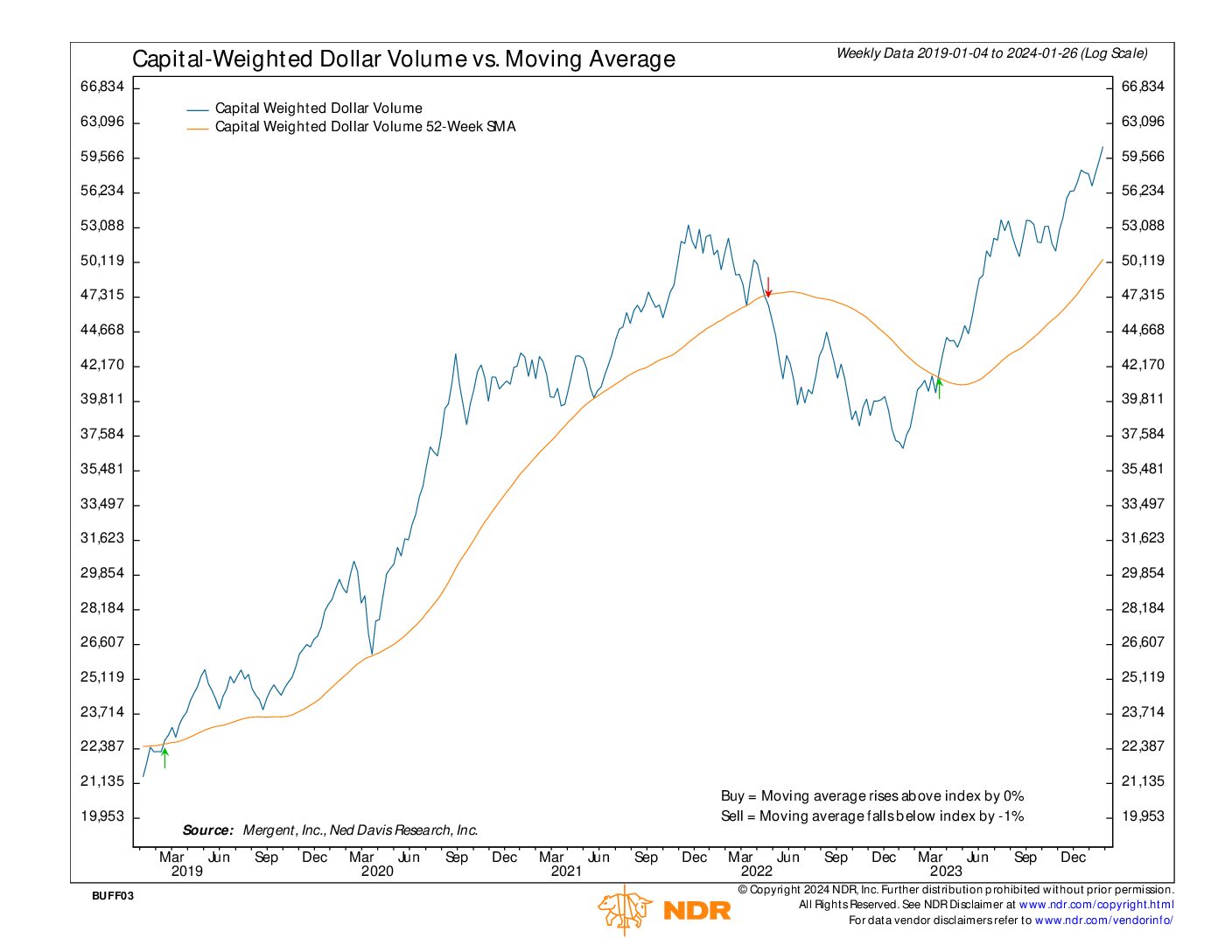

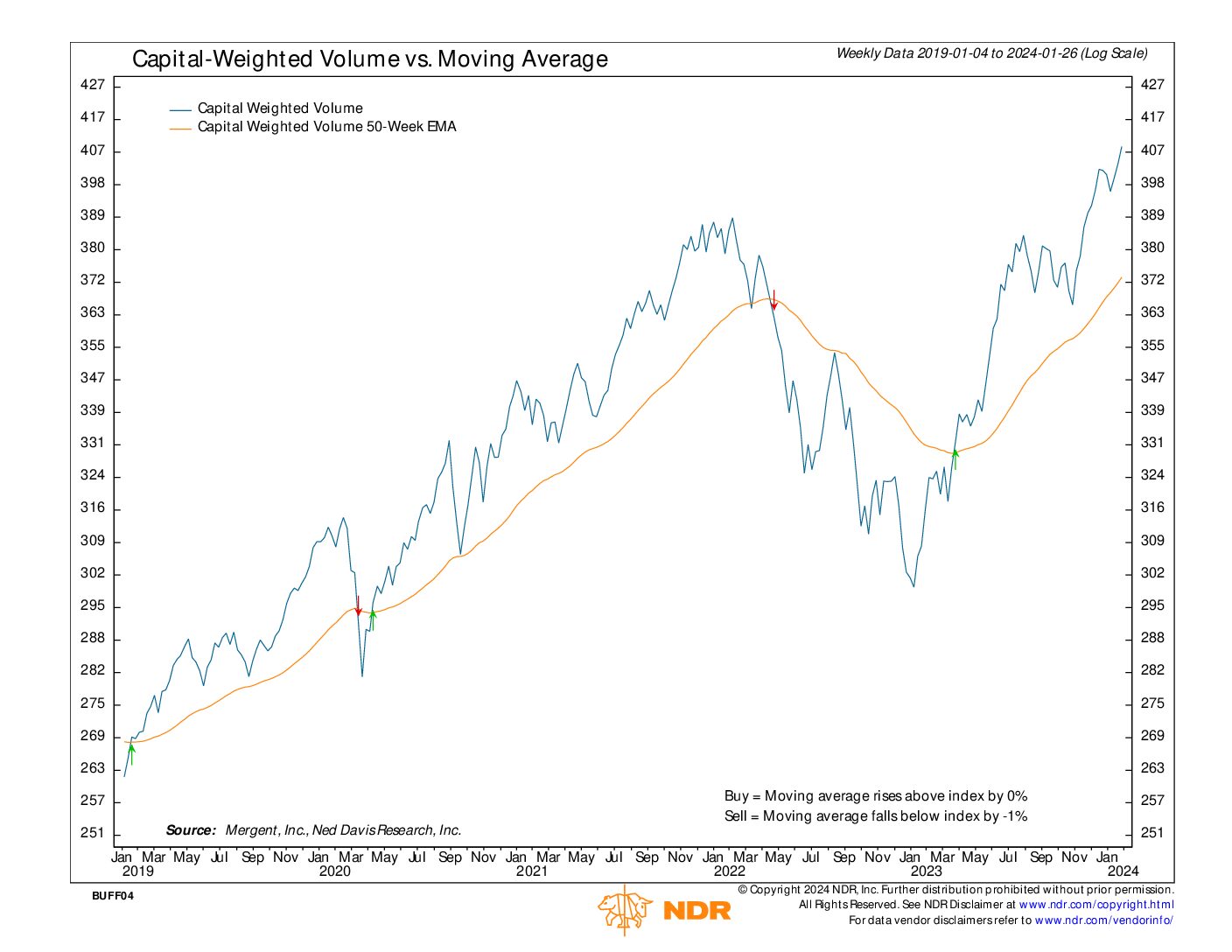

Last week, the S&P 500 maintained its upward trajectory, reaching all-time highs amidst average trading volume. Capital inflows exceeded $50 billion, while outflows amounted to only $32.8 billion. Leading the charge were the troops (iShares Russell 2000 ETF), posting a gain of 1.84% for the week, followed by the S&P 500 with a 1.06% increase, and the formidable generals (NDX 100) with a more modest gain of 0.62%. The market’s advance was widespread, evident in the sharp upward movement of the NYSE Advance-Decline Line. Although the AD Line has retraced from its July peaks, it remains comfortably above trend, signaling potential ongoing strength in the broader market. Overall, upward momentum persists within the broad market.

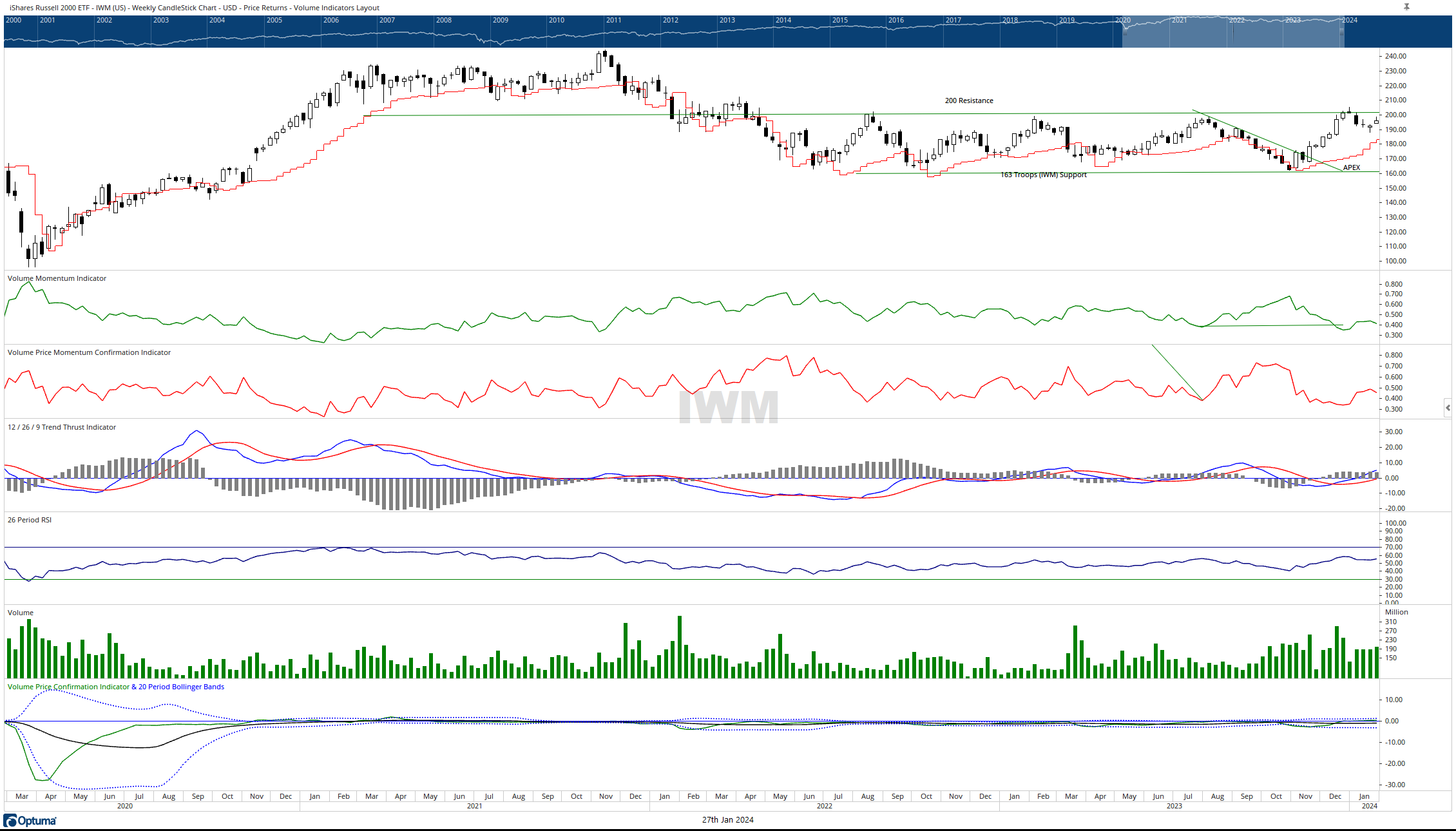

Minor support for the S&P 500 is observed at 4700, with more substantial support at 4635. However, IWM (representing the troops) continues to trade within a range, with resistance at 200 and support at 160, indicating a possible level of consolidation at the higher end of its trading spectrum.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 1/29/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.