Volume Analysis | Flash Market Update - 9.26.22

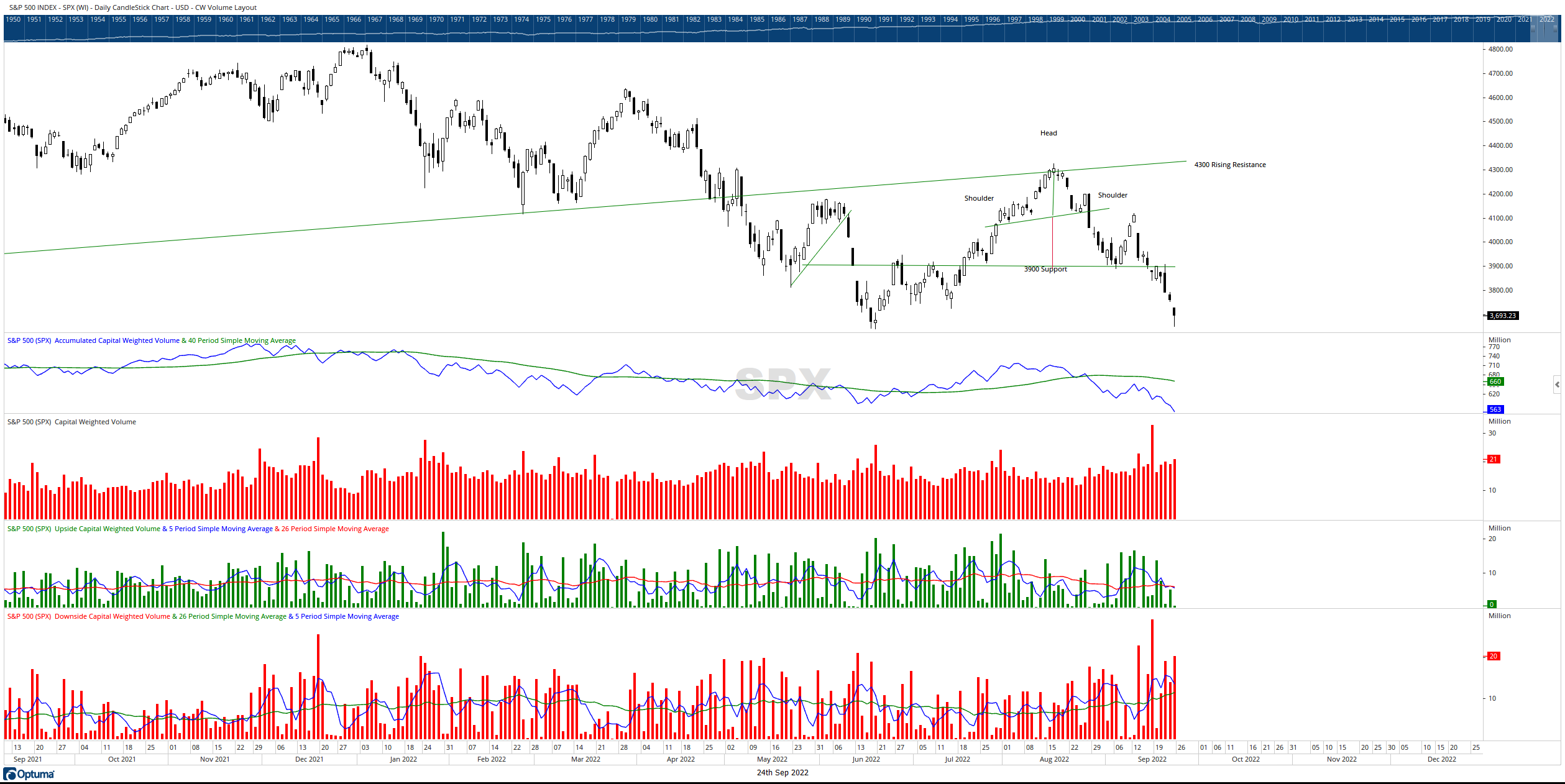

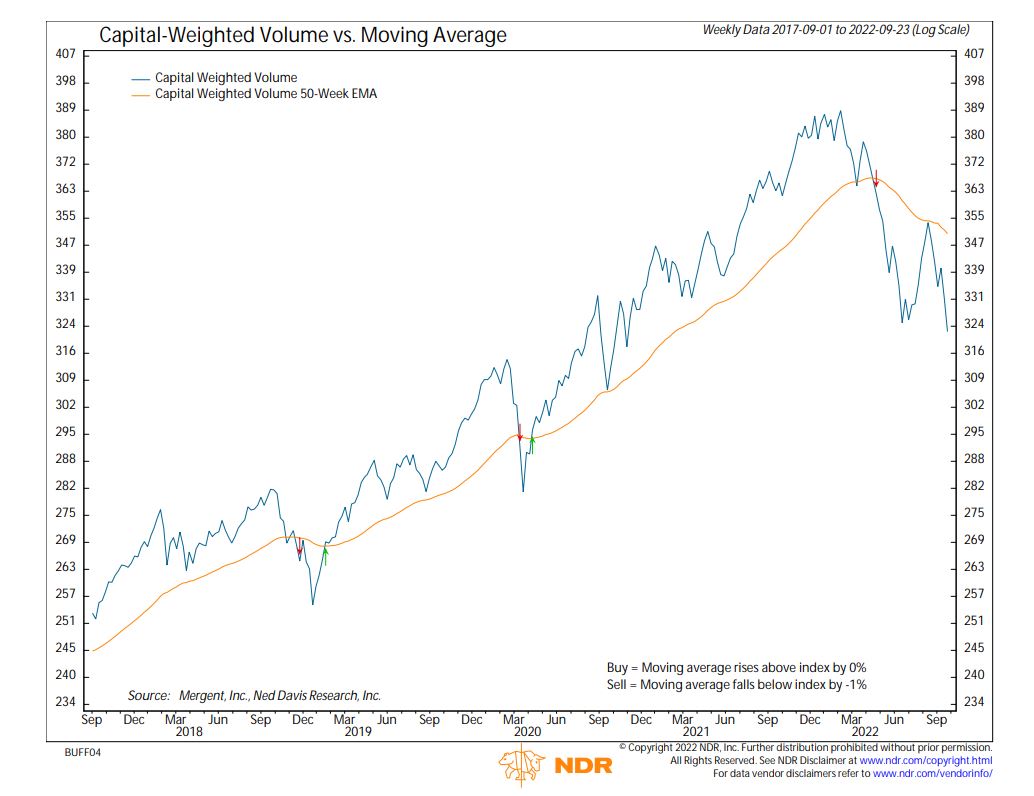

This past week the S&P 500 broke through minor 3820 support like a hot knife through butter, closing just under 3700. This support break was supported and accompanied by strong Capital Weighted Volume. In fact, Capital Weighted Volume broke through our strong 331 support level breaking through its April lows and continuing lower to make a new yearly low. Concurrently, the NYSE Advance – Decline line also broke its April lows to make its own low of the year. Meanwhile the CBOE Volatility Index (VIX) closed just under 30 whereas the March VIX highs exceeded 35, suggesting investors may have yet to capitulate.

3600 is very firm and staunch SPX 500 support. As, I mentioned last week, never has the S&P 500 exceeded its midpoint (4200) and broke through its prior lows (3636) during a bear market. Although it has never happened before, it does not mean it is impossible.

Our leading indicators of Capital Weighted Volume and the NYSE Advance -Decline line are both making new yearly lows, heightening the probability of a 3600 support break. Should the market gather strength at these support levels, look for resistance @ 3830 and strong resistance at 3900. Should the 3600 support level fail, next S&P 500 support is 3550 & 3510, followed by major steadfast support @ 3410.

Risk management is often the path less taken but the steady course leading towards successful long-term financial outcomes.

Wishing you my very best my friends.

Updated: 9/26/2022

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.