Portfolio Manager Insights – Weekly Investor Commentary | June 29, 2022

To download the commentary – click here

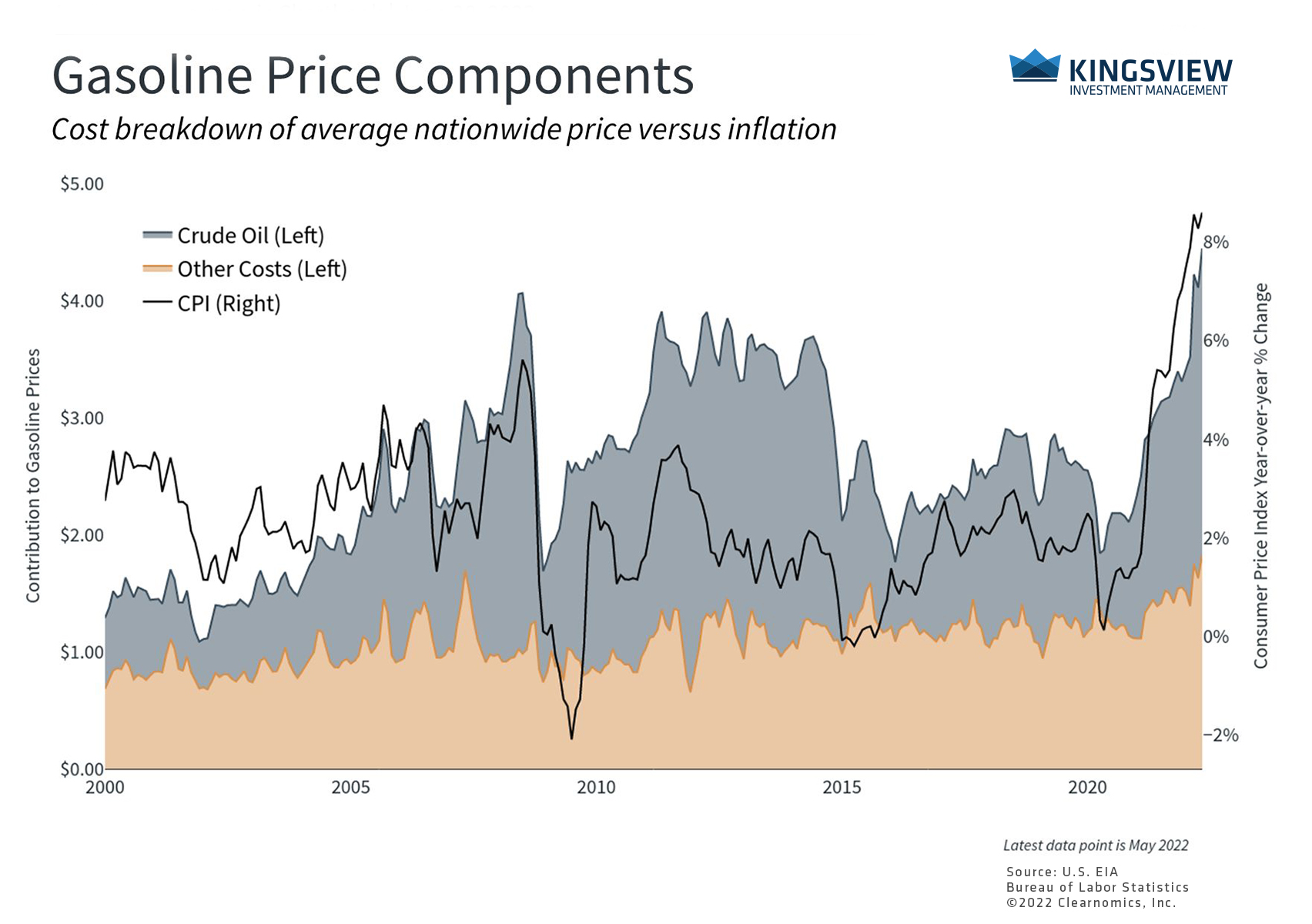

Energy prices have been a major factor driving inflation higher this year. The strong economic recovery and the war in Ukraine have boosted the demand for energy while supplies of oil and natural gas have fallen. Gasoline prices have become a symbol of the burden that inflation places on consumers, and where they go from here will affect consumer spending, Fed policy and stock market returns. What should investors know about energy prices as they position for the next phase of the market cycle?

The challenges in the energy market of the past six months only add to the storylines of the past few years. During the pandemic lockdown, the front-month oil contract fell into negative territory. This had never occurred in history and was due to a collapse in demand made worse by a lack of oil storage capacity. A negative price meant that contract holders were so desperate to not take delivery of oil that they were willing to pay others to take their contracts.

Since then, the oil market has turned around completely as prices first recovered alongside the economy, then spiked this year following geopolitical events, with a few bumps along the way due to growth concerns. Brent crude jumped to nearly $130 a barrel immediately after Russia’s invasion of Ukraine. It has since settled in around $110 a barrel, the same level as in March, but these are still the highest oil prices since 2014.

In this environment, there are at least three major developments for investors to follow. First, energy prices have been a major contributor to rising inflation. Last month’s Consumer Price Index report, for instance, showed that energy prices rose 35% over the previous year and gasoline prices skyrocketed 49% and are now above $5 per gallon on average, a new record.

For this reason, gasoline and oil are perhaps the most important indicators for the path of the economy and markets. To combat higher energy prices, especially at the pump, the U.S. administration has released oil from the Strategic Petroleum Reserve, is negotiating with Saudi Arabia to increase their output, and has floated the idea of a gas tax holiday (although neither party supports this and only amounts to 18.4 cents per gallon).

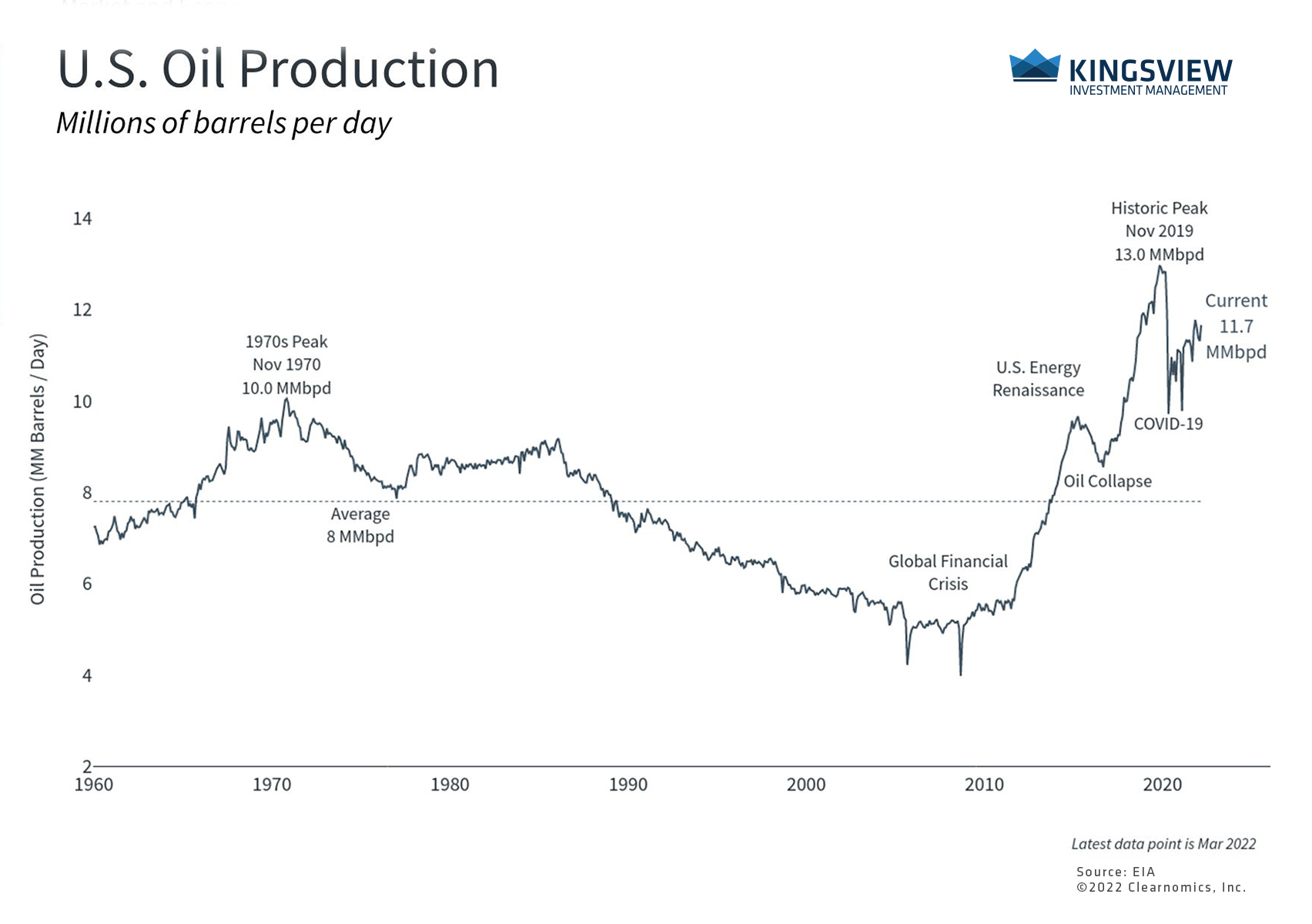

This situation may seem odd given that the U.S. is now the top oil producer in the world due to the U.S. Energy Renaissance of the past decade. However, not only has U.S. oil production not fully recovered, but most U.S. refiners require imported oil to make products like gasoline.

Second, this has unsurprisingly become a contentious political and policy issue since higher gas prices hurt consumer pocketbooks and reduce discretionary income, effectively functioning as a tax. For businesses, higher energy prices boost manufacturing and transportation costs, affecting all products and services.

The Fed has become especially sensitive to the impact of gas prices on headline inflation, even though their policy tools can’t directly fix the disruptions to supply. This has spurred the Fed to raise rates at the fastest pace since the early 1990s. Whether the Fed maintains this pace will be determined by consumer expectations on inflation which are largely driven by energy costs. Steadier oil prices over the past three months are a positive but uncertain sign of where inflation may go from here.

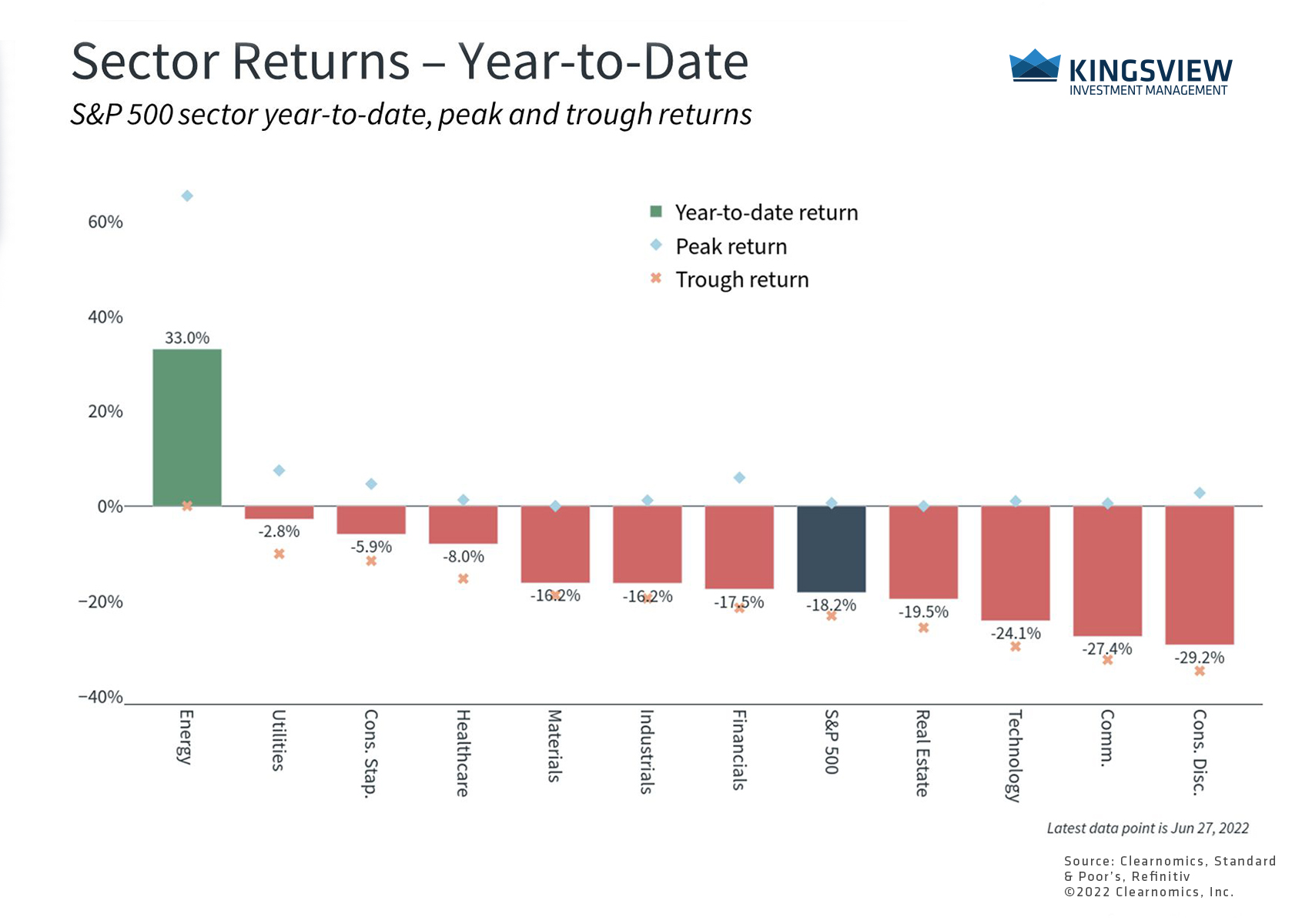

Third, the energy sector of the stock market has benefited from higher prices and is the only sector in the black this year, although its year-to-date gain has been cut to 29% from a peak of 65%. However, for those who are properly diversified, the energy sector accounts for less than 5% of the S&P 500’s market capitalization, even after all other sectors have fallen. The fact that the sector has made these gains emphasizes the importance of investing within and across markets.

The next several months will be challenging for investors as markets continue to adjust to high inflation. However, investors are always faced with potential problems whether it’s financial crises, trade wars, the pandemic, lofty valuations, rising interest rates, geopolitical conflicts, or other challenges. Clearly understanding the key issues while resisting the urge to overreact is still the best approach to achieving long-term financial success.

Gasoline Price Components

Key Takeaways:

- The largest contributor to the record-setting gas prices is simply the jump in crude oil prices.

- Costs associated with refining, distribution and marketing, and taxes have contributed also but to a much smaller degree.

U.S. Oil Production

Key Takeaways:

- With recent geopolitical events, U.S. oil production has bounced from its Covid lows and is spiking near all-time highs from 2019.

- A strong contributor to the production increase within the U.S. has been the administration releasing barrels from the Strategic Petroleum Reserve.

Sector Returns

Key Takeaway:

- Although the energy sector’s year to date gains have been cut in half since its peak, its gains this year demonstrates the importance of why investors should diversify assets throughout sectors and asset classes.

Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser. (2022)