Volume Analysis ‘Flash Market Update’ – 9.2.24

CHIEF TECHNICAL ANALYST, BUFF DORMEIER, CMTⓇ

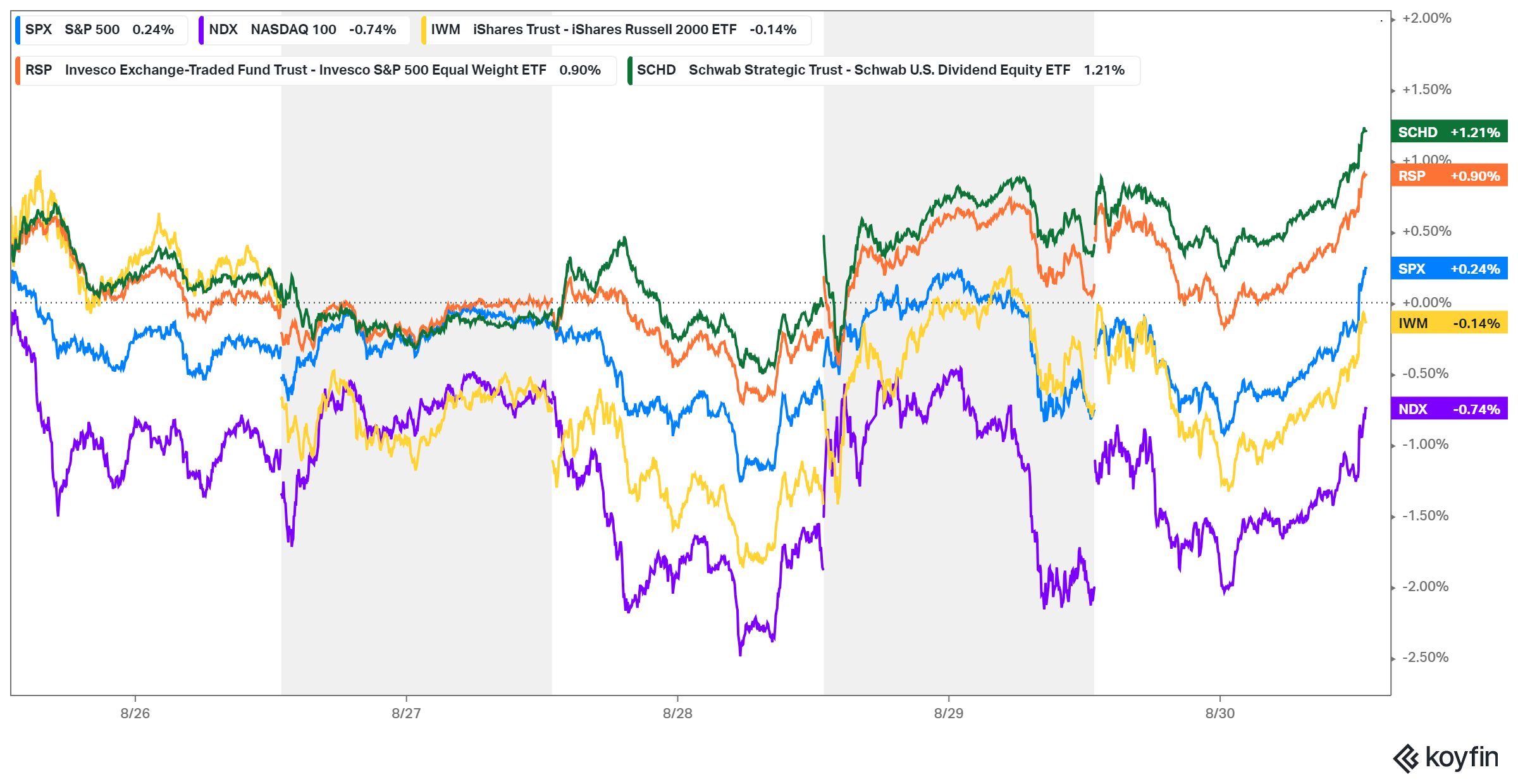

While the S&P 500 managed to eke out a slight gain for the week, with the NYSE AdvanceDecline Line reaching an all-time high, the flow of capital continued to trickle out of the market. Despite the S&P 500’s modest 0.24% rise, there was noticeable divergence among market segments. The troops, represented by the iShares Russell 2000 ETF (IWM), slipped by -0.14%, while the generals, tracked by the NDX 100, dropped -0.74%.

Interestingly, the broadening theme persisted, with the brass commanders leading the charge. The Invesco S&P 500 Equal Weight ETF (RSP) outperformed, climbing 0.90%, and the Schwab U.S. Dividend Equity ETF (SCHD) showed even stronger leadership, advancing by 1.21%.

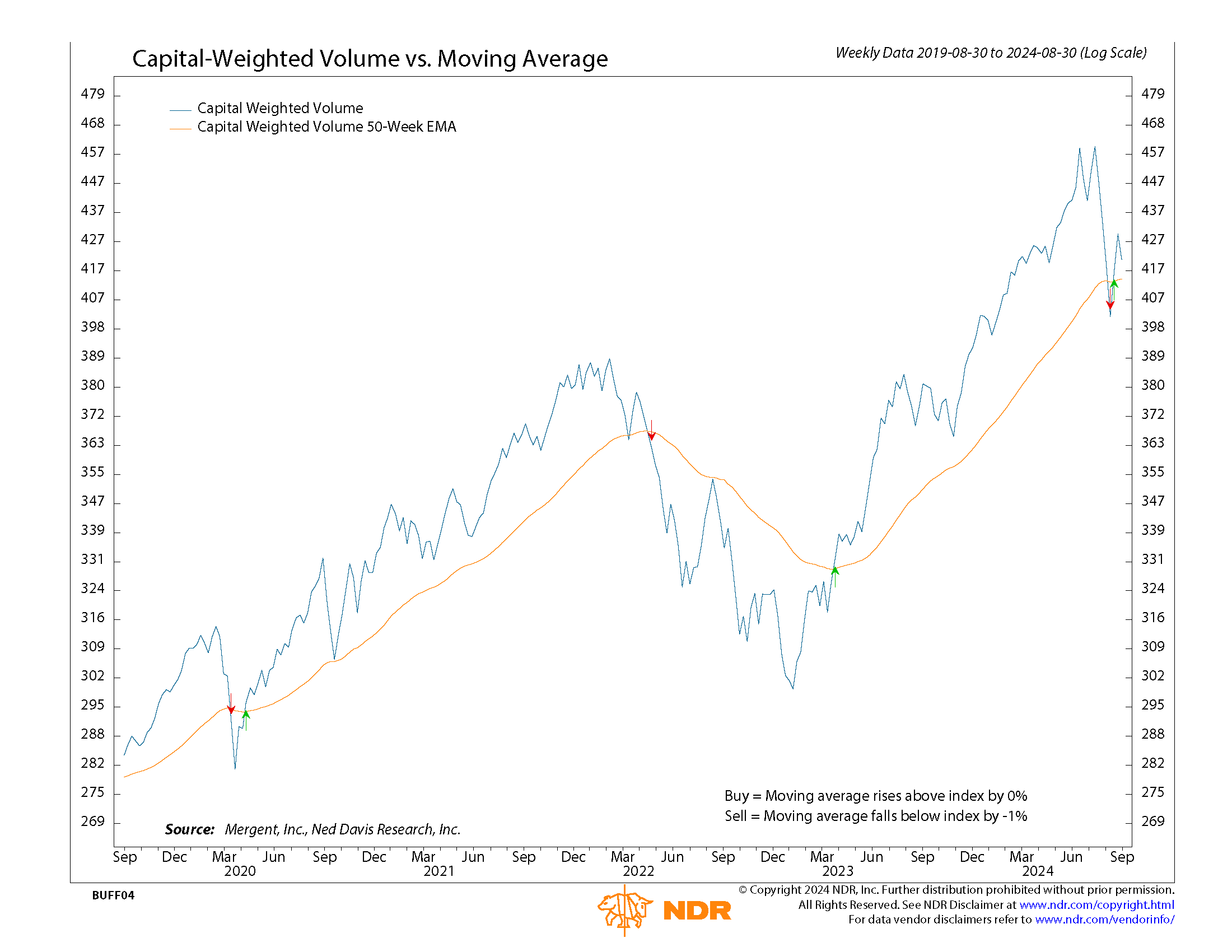

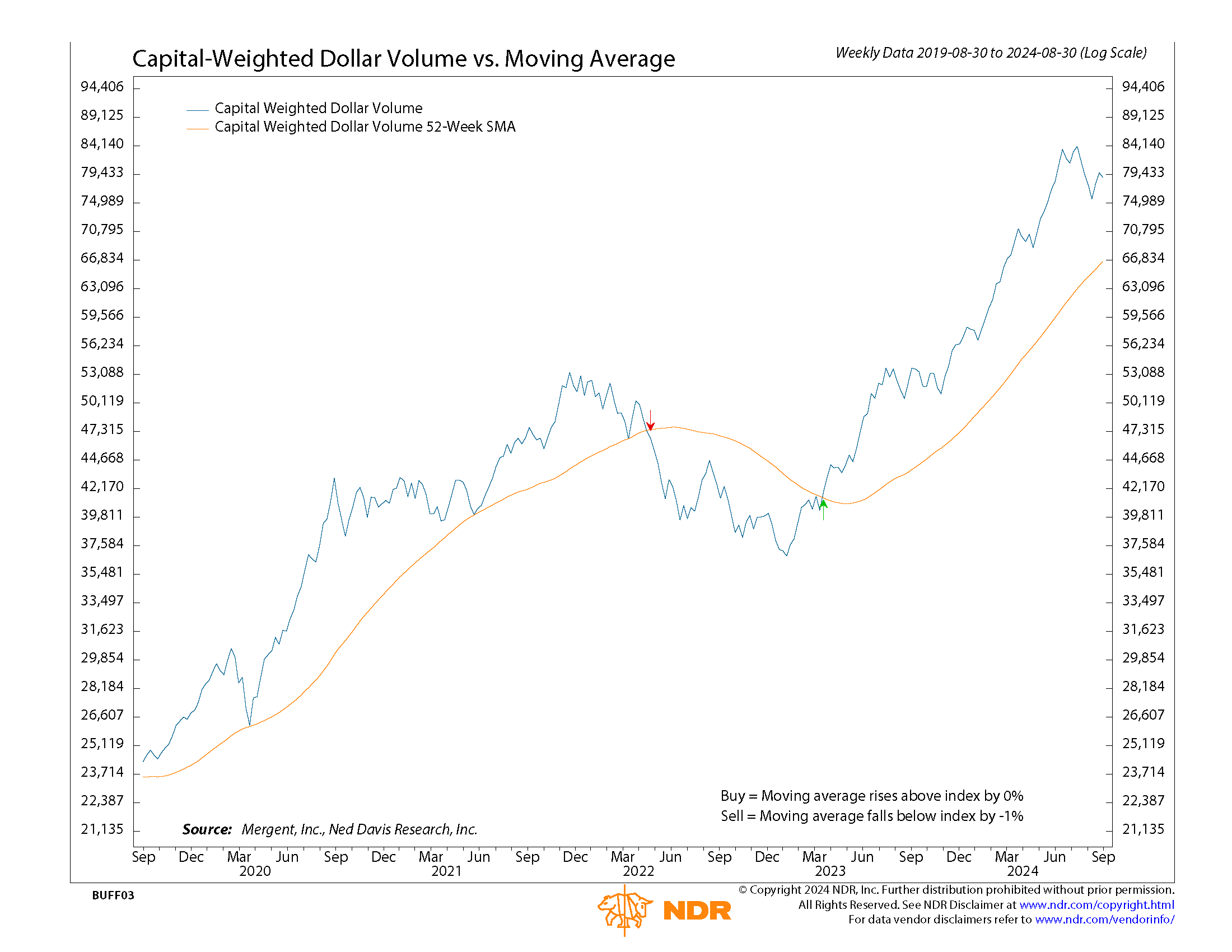

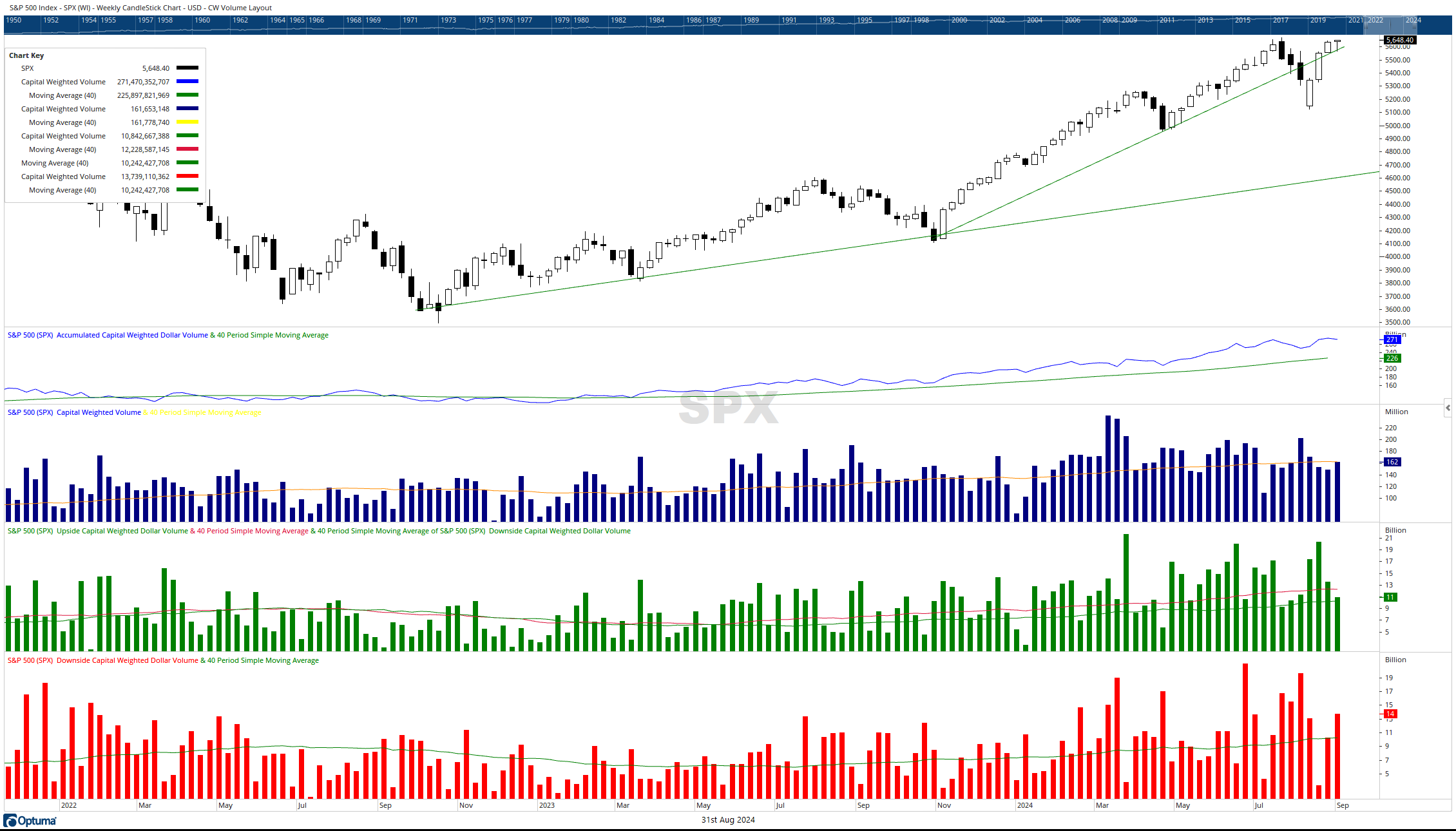

However, beneath the surface, signs of outflows became apparent. Despite the S&P 500’s advance and the record highs in the Advance-Decline Line, both Capital Weighted Volume and Dollar Volume reflected net outflows. Specifically, while $10.8 billion flowed into S&P 500 members, a larger $13.7 billion exited. IWM remains confined within its August 2nd weekly range, with support at 207 and resistance at 229. Meanwhile, the S&P 500 is inching closer to resistance at 5655, with key support resting at 5550.

Grace and peace my friends,

BUFF DORMEIER, CMT®

Updated: 9/2/2024. Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. This material has been prepared by Kingsview Wealth Management, LLC. It is not, and should not, be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed herein are current opinions as of the date appearing in this material only. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate their ability to invest for the long term. Investment advisory services offered through Kingsview Wealth Management, LLC (“KWM”), an SEC Registered Investment Adviser.